Summary:

- Wells Fargo’s Q3 earnings exceeded bottom-line expectations, with a notable 7% sequential rise in EPS and a strong performance in non-interest income.

- Despite a seventh consecutive quarter of declining net interest income and net interest margin, optimism remains for a near-term NII trend reversal.

- My “buy” rating on Wells Fargo remains intact, supported by positive momentum in non-interest income and an improving funding mix.

Roman Tiraspolsky

Bank branches in the US were closed on Monday due to the Columbus Day. Nonetheless, this week is crucial as several money center banks, such as Citigroup (C) and Bank of America (BAC), will report on Tuesday.

Wells Fargo (NYSE:WFC), on the other hand, reported on Friday, and in this analysis, I will review their Q3 earnings and current landscape to analyze whether I need to update my current “buy” rating on America’s third-largest bank.

Seeking Alpha

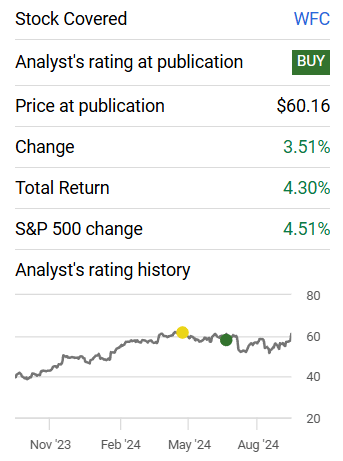

Since my last “buy” rating in mid-July, Wells Fargo’s stock has been down in volatility and has accumulated a total return of 4.30%, closely matching the S&P 500’s performance of 4.51%. Yet, in one year, the stock has accumulated a fascinating performance of 58.22%, outperforming the S&P 500 by 23.94% and the NASDAQ KBW Nasdaq Bank Index (BKX) by 2.66% on a total return basis.

Wells Fargo Exceeded Bottom-Line Expectations

On Friday’s close, the markets reacted optimistically to the Q3 earnings reported, as on that day, the stock gained a whopping 5.61% on a single trading day. This was justified by beating GAAP EPS by 18.08%, return on tangible common equity by 100 bps, and credit provision by $270 million.

Nonetheless, other key metric estimates, such as net interest income, total loans, and NIM, were missed, coupled with slightly less favorable guidance on the end-of-year NII front.

WFC’s Q3 – NIM and NIM Keep Contracting

For the preceding six quarters, Wells Fargo’s net interest income has been declining sequentially. Unfortunately, Q3 of 2024 wasn’t the exception, marking the seventh consecutive quarter of NII decline. The trend hasn’t been able to revert for both net interest income and net interest margin, which sat at $11.690 billion and 2.67%, respectively, for the most recent quarter.

In Q3, the YoY NII decline was -11%, and the guidance for the FY 24 drop was adjusted slightly higher at ~9% from a previous range of ~8-9%. During the latest earnings call, management announced their sweep deposits interest rise, which substantially affected Q3’s NII as it explained 55% of the sequential drop. On the other hand, the net interest margin is 43 bps lower than a year ago, with no guidance provided.

Wells Fargo: Non-Interest Income Remains Strong

Yet, when it rains in some places, it clears up in others. In this case, it’s income not related to interest that was up 12% from a year ago, helping to counter the ongoing headwinds of net interest income. Here, with particular strength in Investment Advisory (11% YoY), Trading Activities (14% YoY), Investment Banking (37% YoY), and Mortgage Banking (45% YoY). In addition, non-interest expenses were relatively constant compared to a year ago.

This diversification among revenues from interest and those that aren’t is an appealing characteristic of diversified banks. As of Q3, the split of WFC was 63% NII and 37% non-NII, making the NII more critical in the pondering, resulting in a revenue slowdown of -2.4%. Yet, if non-interest income remained intact, the revenue decline would’ve been -6.9% YoY.

WFC Q3’s EPS and Key Bank Ratios

Moving to the bottom line, a substantial reduction of -11% in provisions for credit losses, constant non-interest expenses, and approximately $18.1 billion of TTM share repurchases brought the diluted earnings per share to $1.42, representing a -4% YoY decline, but an appealing 7% sequential rise. This was partially offset by a realized debt securities loss, resulting in an EPS reduction of $0.10, but with the intention of reinvesting the proceeds at 130 bps higher and gaining more interest income going forward.

With this, Wells Fargo obtained a ROTCE of 13.9% and an efficiency ratio of 64 in Q3, the former deteriorating from a year but both improving sequentially. Finally, the Common Equity Tier 1 ratio sat at 11.3% (9.8% required), with a slight YoY improvement due to lower risk-weighted assets.

WFC: Optimism in NII Trend Reversal

As commented above, net interest income has been the critical factor affecting top-line growth. Yet, during the Q3 earnings call, CFO Mike Santomassimo appeared optimistic that the bank is close to the NII trough. This is reflected by the monetary policy outlook and the bank’s financial trends, such as a slowdown in funding cost growth and NII declines.

At the same time, the CFO mentioned that the bank has been agile in reducing deposit pricing in response to the FED’s most recent actions and that customer migration to higher-yielding deposits has decelerated even further. Simultaneously, the funding mix has improved. Although average deposits were down for the quarter, the decline was mainly due to reductions in corporate treasury deposits, but with a solid rise in lower-costing customer deposits.

Despite short-term rates falling in the last month of the quarter, average loans continued to decline. This was mainly due to weak commercial loan demand as corporations await lower rates in the future and economic landing uncertainty to ease. Nonetheless, credit card loans have continued to increase for the 13th consecutive quarter while reducing net charge-offs and starting two co-branded credit cards with Expedia (EXPE).

Wells Fargo’s Outlook

Overall, the bank is set to benefit from the monetary policy course, as the market is currently pricing 100 bps in cuts by the end of Q1. This would help them improve their funding mix and potentially drive up weak loan demand, positively changing the net interest income trajectory. Currently, they have a conservative average loan-to-deposit ratio of 67.8%. However, considering their asset cap of approximately $2 trillion imposed in 2018, the room for asset and deposit growth is limited. Therefore, non-interest income and cheaper funding costs are crucial to their success.

Multiples Valuation of WFC

In Q3, Wells Fargo achieved a tangible book value per common share of $41.76 and trailing earnings per share of $4.84. With this, the multiples stand at 1.5x price-to-tangible book value and 13.0x price-to-earnings based on a closing price of $62.16. Considering the average of the past three years, the stock looks arguably fairly valued from a tangible book value perspective, with the average sitting at 1.4x. Yet, on the PE front, the current multiple is 17.1% higher than the 11.1x average.

Risks to Loan Demand

Besides the asset cap, another risk for Wells Fargo is that the 10-Year Treasury Yield (US10Y) has actually gone up 38 bps since the September rate cut. Although a bull steepener is ideal for a bank (borrow lower, lend higher), these higher long-term yields would make loan demand more challenging than anticipated, partly due to less aggressive expectations of year-end cuts of 25 bps in each of the two meetings remaining.

At the same time, credit spreads are tight due to a resilient economy and expectations of a soft landing, making it harder for them to contract further and offer cheaper yields that appeal to clients’ borrowings.

Bottom-line

To conclude, my previous “buy” rating in Wells Fargo remains intact, even more so now that the slowdown in net interest income drops has further materialized, and it seems that it is just a matter of one or two more quarters for NII growth to pick up again. Furthermore, the bank showed substantial progress in its funding mix, and with an outlook of lower short-term rates, it is positioned for cheaper funding in money market instruments and higher non-interest-bearing liabilities. This in addition to their positive momentum in non-interest income activities and enhanced asset quality.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of C either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.