Summary:

- Tesla’s ‘We, Robot’ unveiling on 10/10 was a historic milestone in the company’s robotics legacy.

- Tesla’s Q3 production and delivery numbers missed the consensus, reinforcing my lower expectations for near-term revenue growth.

- However, in the medium to long term, Tesla could achieve a revenue CAGR of 22.5% to over 30%, based on successful Cybercab and Optimus execution.

- Despite near-term slower growth, Tesla’s market cap could reach $920 billion within the next twelve months.

gremlin/E+ via Getty Images

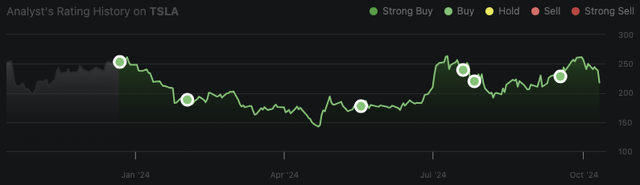

My ratings for Tesla (NASDAQ:TSLA) thus far have all been Buy ratings, founded on the premise that Elon Musk is likely to be successful in executing Tesla’s pivot from EVs to autonomous taxis and humanoid robots. Since my last analysis, the stock has lost 4.5% in price, with a pullback following the Cybercab unveiling on 10/10, called ‘We, Robot’. Leading up to Q3 earnings on 10/23, I reiterate my Buy rating despite lower-than-consensus vehicle delivery and production numbers (which signify short-term challenges) as elements of the autonomous taxi thesis are becoming actualized (which signify long-term growth).

Oliver Rodzianko’s Tesla Rating History

Readers of this thesis should expect a long-term-oriented outlook. Any Tesla investment thesis is subject to near-term and medium-term volatility, primarily due to the high stock price and valuation multiples, which at this time is largely sustained by sentiment surrounding Tesla’s future direction in autonomous taxis and humanoid robots even though the company is currently reporting contractions in its fundamental growth rates.

‘We, Robot’ Was a Success Despite the Price Pullback and a Slow Q3

Based on my perception and analysis, the ‘We, Robot’ event was a success. Not only does it show Tesla investors and customers that the company’s plans have a substantial grounding, but the company should be commended for how quickly it embraced a full pivot to autonomous taxis. Although Musk previously announced that Tesla’s robotaxis would be on the road by 2020, this doesn’t diminish the groundbreaking achievement of being able to showcase a fully autonomous driving experience in 2024 in a state-of-the-art vehicle design. This development is the result of immense hard work, both in innovation and strategy from Musk himself and great execution from the Tesla team. Based on my perception, a technology like this should not be taken for granted by the public; it is akin to the design and technological progress offered by the iPhone in 2007. However, the patience needed before we see it produced at scale means there is less initial consumer hysteria. While Tesla has a reputation for being fast and scrappy, I foresee that the next era of Tesla’s life cycle will be much more of a slow burn. The sentiment from the Cybercab and Optimus (Tesla’s humanoid robot) is likely to take decades to really be experienced at its peak. For an investor with a very long allocation horizon like myself, I have no issue with this. Despite Musk’s optimistic timeframes, as an analyst and a Tesla shareholder, I am in this for the long term; I encourage other investors to consider taking this approach, too. An 8% pullback in price is inconsequential in the grand scheme of what Tesla can accomplish over the next few decades.

Tesla’s Cybercab & Cybervan (Author’s Montage with Images Sourced from ‘Car and Driver’)

Tesla’s event showed three core signals of material progress toward future growth drivers. The first was the Cybercab; the second was the Cybervan (a larger autonomous vehicle capable of transporting goods or up to 20 people); the third was the Optimus bots, which performed as hosts.

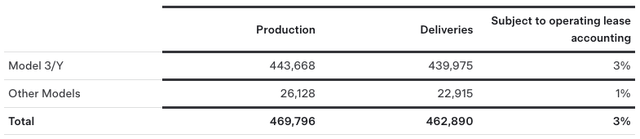

Looking more closely at Tesla’s current financial and operational position, we’ve already had results for Tesla’s Q3 vehicle deliveries and production numbers:

Its deliveries underperformed the average expectation of 463,310 from analysts. However, I mentioned several times in my coverage of Tesla that this is a short-term to medium-term trend that investors should expect. This is especially true given the significant pressure macro-economically right now (including a high interest rate environment affecting car sales on finance, which is only recently abating), as well as Tesla’s broader strategic redirection toward autonomous ride-hailing and humanoid robots. Such an immense strategy shift is likely to show periods of contraction in its traditional EV deliveries and production numbers. I mentioned in my last analysis of Tesla that its energy segment is likely to provide much-needed support during its strategic redirection. The company deployed 6.9 GWh of energy storage in Q3, up 72.5% from 4 GWh in Q3 2023, showing that strength in this segment continues to perform exceptionally well, as I expected.

On the earnings call, I’ll be looking for Musk’s mention of specific financial strategies that indicate a tangible roadmap to autonomous taxi production and Optimus at scale. While I respect that Tesla’s business agility means that management mentioning specific details might be counterproductive, noting elements of strategic reallocation of resources could provide investors with a more concrete understanding of the long-term financial viability of the company’s current strategic roadmap. This is especially true given we had scarce mention of this at the ‘We, Robot’ event. The biggest concern with the current plan remains getting regulatory approval for fully autonomous transport across the world. However, Tesla should not be underestimated because while it might be experiencing some delays in obtaining regulatory approval compared to competitors like Waymo, it is more technically advanced. Tesla is expected to clear key regulatory hurdles in China in 2025, which would be a significant stride in the right direction.

Valuation Analysis: An Excellent Entry Point

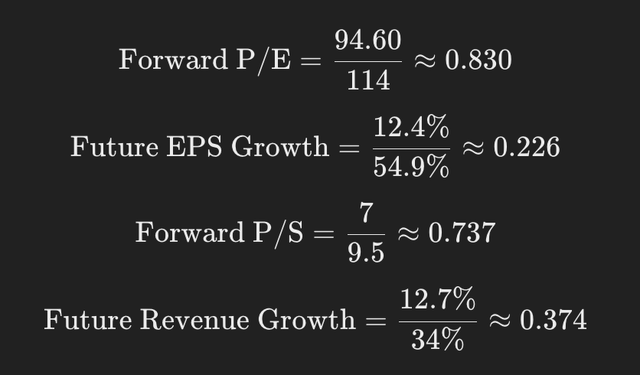

In my last analysis of Tesla, I outlined that the stock could achieve a five-year revenue CAGR of 22.5% and a 10-year revenue CAGR of 30%+, primarily related to autonomous taxi and Optimus developments, but also supported by success in the Megapack and Powerwall. There are some core metrics that I believe investors should keep in mind at the moment, which show vulnerability in the current stock price (a vulnerability which I believe should be capitalized on):

| Forward P/E non-GAAP ratio | 94.60 |

| Historical forward P/E non-GAAP ratio five-year average | 114 |

| Forward EPS long-term growth (three-to-five-year CAGR) | 12.4% |

| Historical forward EPS long-term growth (three-to-five-year CAGR) five-year average | 54.9% |

| Forward P/S ratio | 7 |

| Historical forward P/S ratio five-year average | 9.5 |

| Forward revenue growth | 12.7% |

| Historical forward revenue growth five-year average | 34% |

These ratios present a significantly overvalued stock based on historical growth rates and valuation ratios compared to current and future levels and estimates. That presents a reason for caution in the size of the allocation, but it also means that this is a perfect time to build a long-term position in the company if one believes in the next era of Tesla’s lifecycle, as in that case, the stock could still be selling at a discount given the future growth potential.

Investors may be wondering where I think Tesla stock could be in terms of price in 12 months. To be clear, I do not expect a significant upside in this timeframe. The high CAGRs are likely to take time to manifest, with sideways movement and periods of volatility based on sentiment shifts as the company navigates a successful long-term execution. Patience is certainly required here. I anticipate that due to structural changes made within Tesla, the near-term revenue growth of the company will be weaker than the current consensus. My independent prediction is that Tesla will achieve revenue growth of approximately 15% for FY25, with total revenue of approximately $115 billion for the year. I also think the P/S ratio will stay approximately at the current level (potentially with some expansion) as the company will still be navigating through uncertain terrain. The reason I believe the P/S ratio will not contract further is that the company is likely to have a strong year on an earnings front; likely deployments in FSD, full-scale production of the Cybertruck, and a lower interest rate environment support this. Investors should not forget the energy segment; while smaller, it is a key part of Tesla’s strength in profitability. At a P/S ratio of 8, the company will have a market cap of $920 billion in 12 months, given my predictions.

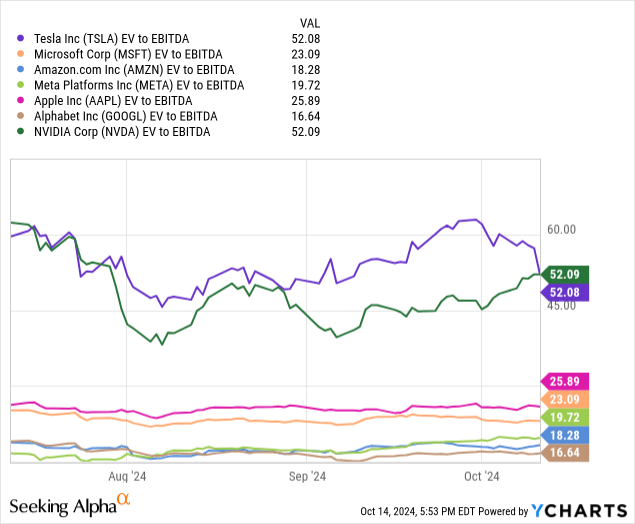

Tesla is currently tied with NVIDIA (NVDA) as the most highly-valued stock based on EV to EBITDA—which shows the company’s total acquisition valuation (market cap + debt – cash) relative to its core operating income—in the Magnificent Seven. This does present a vulnerable environment for Tesla investors. However, some context might be useful. I only own three stocks in the Magnificent Seven. The first is Google (GOOGL) (GOOG), which I consider the best-valued, lowest-risk of the cohort. The second is Amazon (AMZN), which I own for its business quality, high growth and moat. The third is Tesla, which I own because I see it as a high-growth, risk-on investment that could generate very high alpha over the next few decades if Musk successfully executes his autonomy and sustainable energy long-term roadmap.

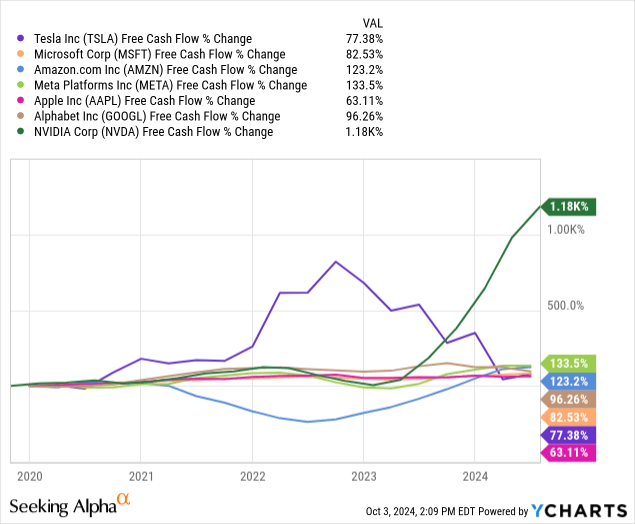

Furthermore, the above chart shows a significant contraction in Tesla’s free cash flow in recent years compared to NVIDIA’s meteoric rise in this area over the past two years. However, I expect that this trend may reverse over the coming five to 10 years as demand reduces for GPUs and more focus is placed by investors on inference capabilities, particularly related to AI-enabled robotics. This is an area where Tesla is much better positioned to succeed than NVIDIA. Tesla’s focus is on hardware like autonomous taxis and humanoid robots, which have much longer-term revenue growth capabilities compared to the recent demand for semiconductors related to data centers powering AI. NVIDIA’s meteoric growth rates recently are hinged on the initial AI infrastructure build-out, a trend unlikely to last for several more years.

Risk Analysis: Long-Term Headwinds and Recent Cybertruck Recall

As I have mentioned previously, the greatest risk to the long-term thesis for Tesla at the moment is related to execution. With the historic autonomous taxi event on the horizon, this is likely to boost sentiment in the stock market. However, I do see challenges ahead for Tesla, not only with regulation but also with market adoption, public perception, and the effects on the macroeconomy of its business model. To my mind, too much domination from Tesla in the ride-hailing markets could increase regulatory delays and scrutiny, including several antitrust cases related to monopoly. I consider it vital for Tesla to focus on partnerships and inclusivity in its ride-hailing and autonomous ecosystem that it is developing. As likely the largest player at the robotics table, Tesla will need to show responsibility, dignity, and justice in its approach to other players to facilitate a fair and competitive robotics market. A failure to do this could result in a weak macroeconomic environment and facilitate a lack of opportunity in the human labor market. The future environment must be navigated carefully, as based on my analysis, a failure of cooperation from government and private entities to navigate autonomous technologies over the next 20 to 30 years could cause significant economic hardships.

In addition, while I do expect 2025 to be a strong year for Tesla with regard to the Cybertruck potentially being at full-scale production, there have been recent challenges with the product. Management recently issued a recall for over 27,000 Cybertrucks due to a software problem affecting the rearview camera display. The company plans to address the issue with a free, over-the-air software update. While an OTA update is impressive and shows the hallmark advancements in cloud technology within automobiles that Tesla is known for, this is the fifth recall for the Cybertruck since it was first released at the end of 2023. There have been rumors that insurers will withdraw coverage for the Cybertrucks due to repeated recalls and safety issues, but this is only speculation from the media. What I think this highlights is that Tesla could benefit from a more meticulous and disciplined approach, underpinned by the value of patience, in order to garner strong regulatory approval (especially as it relates to its autonomous vehicles) by proving it produces to the highest standard possible. In other words, Tesla needs to be less scrappy moving forward to truly evolve into the dominant robotics and AI company it could be.

Conclusion

Tesla’s ‘We, Robot’ event was a pivotal moment in the company’s legacy. Largely, it set the foundation for what investors and customers can expect from Tesla in the next stage of its life. My long-term-oriented analysis shows evidence that the stock is likely to deliver strong growth over the next few decades. Furthermore, despite a slower year ahead than what will likely be achieved over time, Tesla could reach a market cap of $920 billion in 12 months based on my forecasts. Due to the high valuation and execution risk inherent in Tesla stock, my rating is a Buy rather than a Strong Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, GOOGL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.