Summary:

- Amazon has delivered strong long-term performance but has underperformed over the past three years.

- The company enjoys strong competitive advantages due to scale.

- Amazon is poised to benefit from a number of secular growth trends.

- The stock trades at an attractive valuation relative to peers and its own historical valuation range.

- I rate the stock a Strong Buy.

FinkAvenue

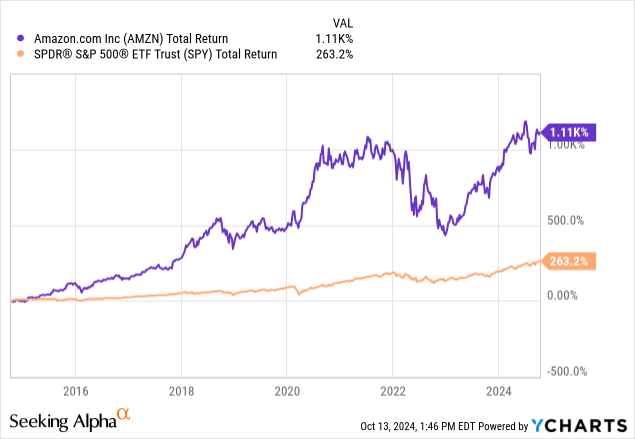

Shares of Amazon (NASDAQ:AMZN) have proved an excellent investment for long-term holders. The stock has delivered a total return of 1,110% over the past decade, while the S&P 500 has delivered a total return of 263%. However, despite trading near all-time high levels, the stock has proved a less exciting investment over the past few years.

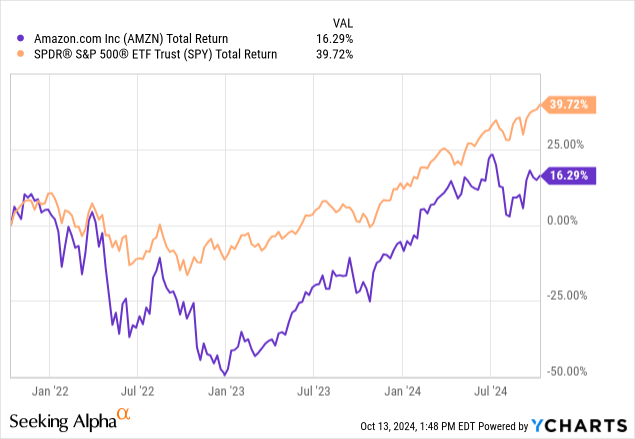

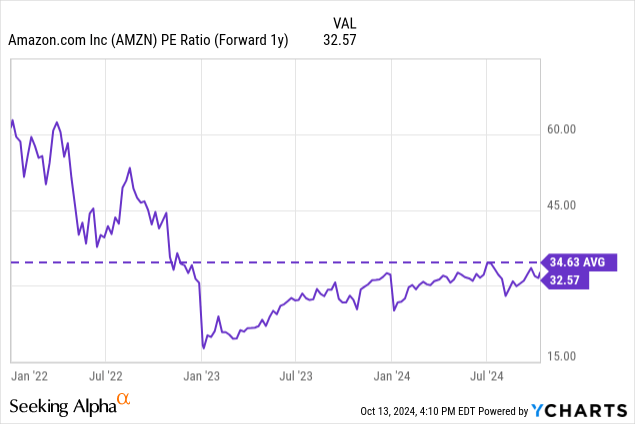

Over the past three years, AMZN shares have delivered a total return of 16% while the S&P 500 has delivered a total return of nearly 40%. This underperformance has come despite the fact that the company has been a significant beneficiary of the AI secular growth theme and significantly grown its highly profitable advertising business. Despite these positives, AMZN shares have experienced significant multiple contraction and are now trading at a valuation discount to historical norms.

Before discussing in more detail why I am now bullish on the stock, I must acknowledge that I had been skeptical of the stock previously, mostly due to its high valuation. I first covered the name in my 2012 piece eBay: A Better Play Than Amazon and also in a 2014 piece How To Trade Alibaba: Long Yahoo, Short Amazon. While my previous skepticism was clearly wrong, I believe the AMZN story today is much different, as the company is in a different place due to improved profitability and increased contributions from its cloud computing business. Additionally, the stock trades at a more reasonable valuation based on traditional metrics such as P/E ratios.

There are seven reasons why I believe the stock is a Strong Buy at current levels:

1. Competitive advantages due to scale and early mover advantage

2. Significant exposure to secular growth trends

3. Advertising business is gaining share

4. Margin expansion opportunities

5. Regulatory risk is manageable

6. Lack of dividend and aggressive share repurchase program

7. Attractive valuation

1. Competitive advantages due to scale and early mover advantage

With roughly $575 billion in annual revenue, AMZN is the second largest U.S. company in terms of revenue, trailing only Walmart (WMT). The company is the largest online retailer with an estimated market share of 38%. Walmart, the second-largest online retailer, has an estimated market share of roughly 6.4%. Similarly, AMZN enjoys a scale advantage with its cloud computing business, Amazon Web Services (“AWS”) as well. AWS is estimated to have 31% market share in the cloud infrastructure business, while its nearest competitors Microsoft and Google have estimated market shares of 25% and 11% respectively. AMZN’s video streaming service Amazon Prime Video, which has more than 200 million subscribers, is the second-largest streaming platform in the world, trailing only Netflix. Additionally, the company has one of the largest advertising platforms in the world, trailing only Alphabet and Meta Platforms.

AMZN has been able to develop such scale in each of its core businesses due in part to its early mover advantage. As an early mover, AMZN was able to develop scale that has made it increasingly difficult for other smaller players to compete. The company’s scale advantage is arguably most important in its core online retail business, as it has allowed the company to build out infrastructure to deliver faster and more reliably compared to other players. Moreover, AMZN’s scale has enabled it to secure the lowest price possible from suppliers. AMZN’s scale advantage also allows it to spread fixed costs such as R&D and marketing over a larger revenue base compared to smaller players. Scale advantages also give AMZN a major competitive advantage in its cloud business, as its large revenue base has enabled the company to generate sufficient cash flow to make the massive capital investment required to support AI enabled computing. The combined scale of AMZN’s retail business and Prime Video streaming businesses allows the company to offer advertisers a differentiated value proposition relative to other online advertising and streaming players such as Netflix, Alphabet, or Meta Platforms which do not have their own online retail business.

AMZN’s advantages due to its scale provide it a competitive edge that cannot be easily replicated by competitors. For this reason, I believe the company is likely to continue to maintain its dominant market position in its key businesses for many years to come.

2. Significant exposure to secular growth trends

AMZN’s key businesses are well positioned to continue benefiting from secular growth trends. In particular, I believe the cloud computing business represents an especially compelling long-term secular growth opportunity. While the company’s AWS business accounts for just 18% of total revenue, it is highly profitable and accounts for over 60% of total company operating income. On the company’s Q2 earnings call, AMZN CEO Andy Jassy noted that roughly 90% of global IT spend today is on-premise. Jassy expects the share of on-premise and off-premise IT spending to flip over the long term. I agree with this characterization, as the growing scale and cost required to operate IT infrastructure (especially to the extent AI becomes a more important tool for companies) will make it even less attractive for companies to continue doing most of their IT spend on-premise. As the largest cloud computing company, AMZN is well positioned to benefit from this secular megatrend in the years to come. Additionally, growth related to this secular theme has only accelerated with AI-driven innovations. As a result, annual revenue growth for the company’s AWS business has accelerated from 17% in Q1 2024 to 19% during Q2 2024.

Another secular trend which AMZN is poised to benefit from is a continued shift away from in store retail in favor of online retailing. The online retail market is expected to grow at an annual rate of 9.9% from 2024 and 2032. I believe AMZN’s market leading position in the online retail business will allow it to significantly benefit from this secular trend, which is likely to continue for many years to come.

Finally, AMZN is also well positioned to benefit from a continued shift away from traditional advertising towards digital advertising. Some estimates call for the total digital advertising market to grow at an annual rate of 15% through 2030. Other estimates call for a growth rate in the high single digits.

3. Advertising business is gaining share

Perhaps one of the most underappreciated parts of the AMZN bull story is its growing advertising business. For 2024, AMZN is expected to capture roughly 22% of the entire U.S. search advertising pie, up from just 10% in 2018. This market share gain has come at the expense of market leader Google, which has seen its U.S. search market advertising share decline from 60% to 48% over the same time period. AMZN’s share of the overall online advertising business, which also includes players such as TikTok and Meta Platforms, has increased to an estimated 13.9% for 2024, up from 10.7% in 2021.

I believe AMZN’s significant growth in market share in online advertising is a major positive, as it suggests the company is able to offer advertising customers a more compelling value proposition than existing players. This is due to the fact that customers often start a purchase search on AMZN and AMZN has vast amounts of customer purchase data, something that Google and Meta do not have. AMZN reported year-over-year advertising revenue growth of 20% during Q2 2024 and I expect this growth rate to continue going forward.

4. Margin expansion opportunities

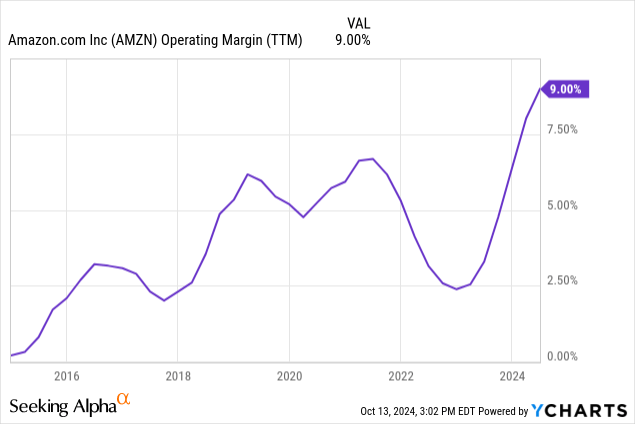

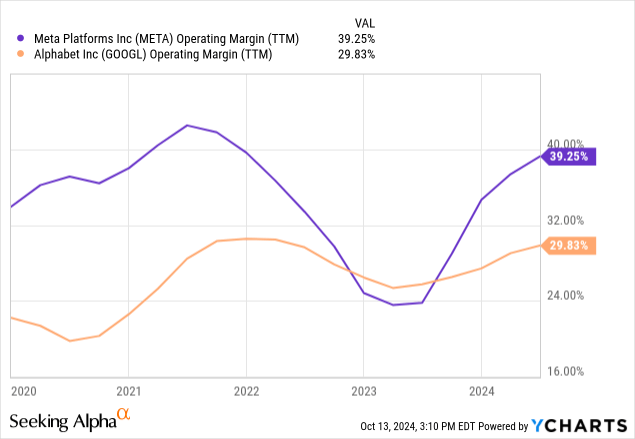

Despite significant margin improvement in recent years, AMZN operating margins remain fairly low at 9%. I believe the company has a solid path to continued margin expansion for a number of reasons. Perhaps the most important driver of margin expansion for AMZN will be a continued shift towards more profitable businesses. AWS has operating margins of 35% and is currently growing at an annualized rate of 19%. While the company does not provide operating margins for its advertising business, a look at peers such as Alphabet and Meta suggests the operating margin for that business is likely around 30%. AMZN’s advertising business is growing at a rate of 20% annually. Thus, both AWS and AMZN’s advertising business are growing much more rapidly than the company’s core online retail business, which is lower margin in nature. As AWS and advertising revenue make up a larger part of AMZN’s total revenue, I expect the company to experience significant margin expansion. Additionally, as the company’s core online retail business grows, I expect margin improvement on that side as well as fixed costs such as warehouses and delivery routes can be shared over a larger revenue base. In particular, I believe the company’s international core online retail business can serve as a margin expansion driver as the company has only recently reached scale required to be profitable and thus further increases in revenue should drive improved margins.

5. Regulatory risk is manageable

AMZN, along with other mega cap technology companies, is currently facing elevated regulatory scrutiny. In September 2023, the Federal Trade Commission (“FTC”) sued AMZN, alleging that the company is a monopolist engaging in anticompetitive practices. The case is set to go to trial in October 2026. AMZN has argued that its practices are not anticompetitive and are simply common industry practices.

While the outcome of the trial remains uncertain, the trial start date of October 2026 means that AMZN will have plenty of time to continue operating without the threat of a government forced breakup. Moreover, I believe the company is better positioned to navigate potential litigation because its market share is not on the scale of what would typically be considered a monopoly. Furthermore, AMZN’s relatively low profit margins, especially in the retail business, may make it difficult for the government to argue that consumers have been hurt by AMZN’s practices. Comparably, other technology companies facing regulatory challenges such as Apple, Alphabet, Meta, and Microsoft have much higher profit margins which would make it easier for the government to argue that harm has been done to consumers.

Additionally, the business which is most likely to experience any remedies due to an outcome of the case is the online retail business, which is, in my view, a less important driver of earnings growth compared to the company’s advertising and cloud computing businesses. Even a worse case scenario such as a government forced breakup is manageable for AMZN, as each of its businesses is strong within its own market segment. A breakup may even result in improved profitability as each businesses unit is forced to allocate capital on its own and thus cannot draw on other more profitable business units for funding.

6. Lack of dividend and aggressive share repurchase program

One way in which AMZN stands out from other mega cap technology companies is its lack of a dividend and significant share repurchase activity. Typically, dividends and aggressive share repurchases are viewed as a positive when evaluating a stock. However, when considering a high-growth opportunity, I believe a dividend and aggressive share repurchase activity can indicate that the company’s growth opportunities have become more limited as there are no longer enough good investment opportunities remaining.

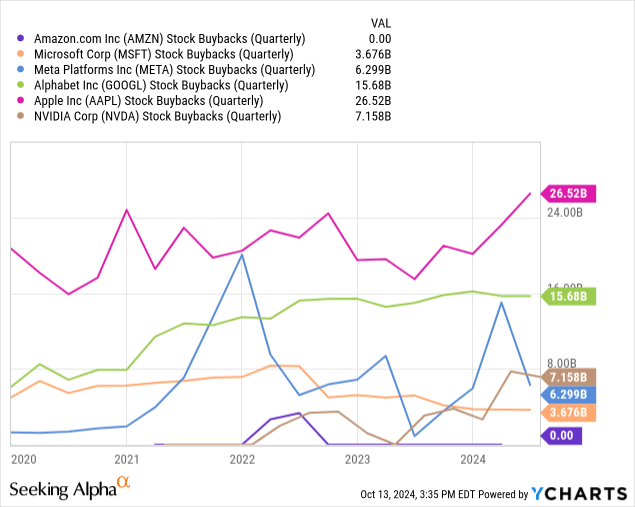

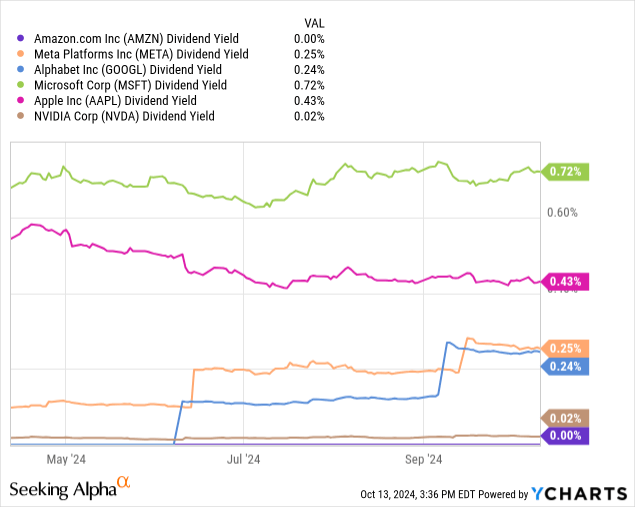

As shown by the charts below, most other mega cap technology companies have initiated a dividend in recent years and have been aggressively repurchasing their own stock. AMZN has not done either of these things, though the company has conducted limited share repurchases and has an outstanding remaining authorization of $6.1 billion.

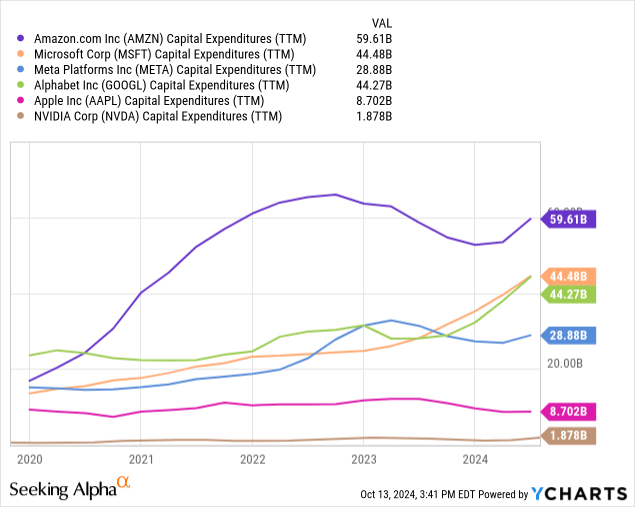

Instead of returning capital to investors, AMZN has been reinvesting in its business. As shown by the chart below, AMZN has spent significantly more than peers on Capex over the past few years. I view this use of capital as the correct choice for AMZN, given the long runway of growth opportunities in each of its core businesses. Additionally, I believe AMZN’s capital allocation decision speaks to the confidence that management has in the future of AMZN’s businesses.

7. Attractive valuation

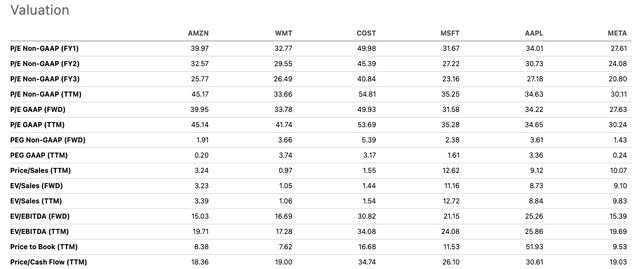

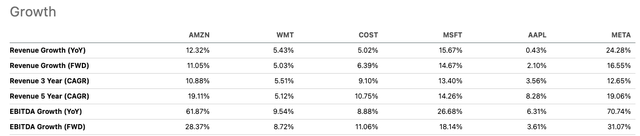

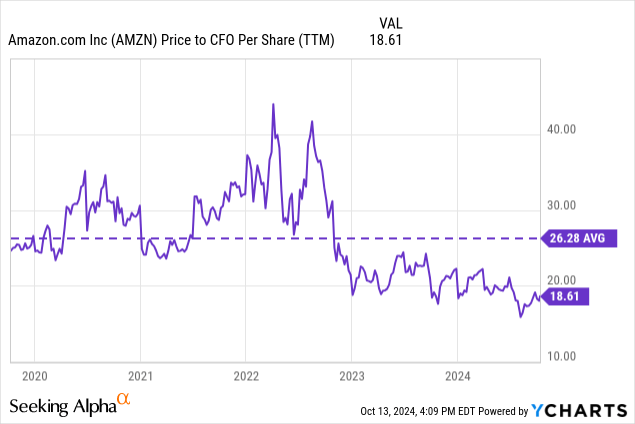

Traditionally, AMZN has been valued base on metrics such as price to CFO per share due to significant reinvestment of capital, which has made metrics such as P/E ratios less useful. However, given recent margin improvement and expected margin improvement from current levels, P/E ratios are now more useful. Currently, the stock trades at 32.5x consensus FY 2025 EPS. While this is significantly higher than the 23.7x forward P/E ratio that the S&P 500 trades at, the company has far superior growth prospects than the broader market.

Based on AMZN’s diverse business mix, I believe it makes sense to consider a number of comparable companies, including retailers such as Walmart and Costco as well as tech companies such as Microsoft, Apple, and Meta. One thing that stands out is the fact that AMZN currently trades at a significant valuation discount to Costco and only a modest premium to Walmart. These companies are growing earnings at a much slower pace than AMZN, which, in my view, suggests AMZN is significantly undervalued on a relative basis compared to these companies. AMZN’s biggest competitor in the cloud business is Microsoft, which trades at a moderate discount to AMZN based on FY 2025 earnings estimates. I believe AMZN should trade at a more significant premium to Microsoft as the company has a more diverse set of growth drivers (cloud, advertising, and online retail) while the Microsoft earnings growth story is more driven by its cloud business.

Another striking peer valuation is Apple, which trades at 31x forward earnings, which compares to 32.5x for AMZN. While AMZN is expected to grow earnings by more than 20% over the next two years, Apple is expected to grow earnings at low double digits rates over the same period.

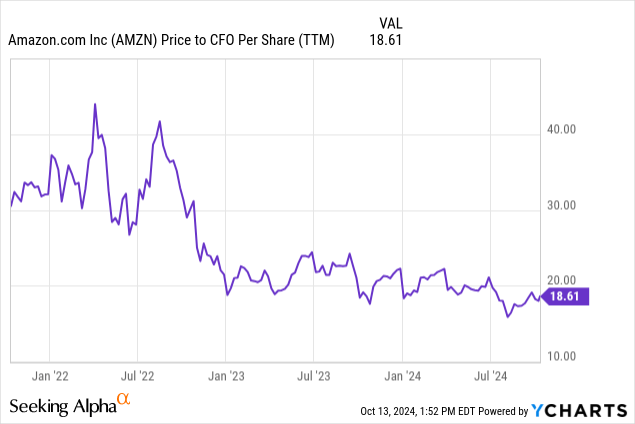

Perhaps the most compelling part of the AMZN valuation story is the stock’s current valuation relative to historical norms. Prior to the onset of COVID-19 in 2020, AMZN had traded at a price to free cash flow multiple of roughly 25x and today trades at a multiple of just 18.6x based on the same metric. This decline in valuation comes after a boom in the online retail market which has only strengthened AMZN’s core business as well as new positives such as the emergence of AI and market share gains in the advertising business. The stock also trades at a discount to recent historical norms based on forward P/E ratios as well.

Seeking Alpha Seeking Alpha Seeking Alpha

Risks to consider

One risk to consider is that AMZN’s recently announced return to office plan backfires and results in significant departures of key employees and lower employee morale. I believe a significant outflow of talent is unlikely given the strong culture that the company has along with a fairly tight job market for tech companies.

Another key risk to consider is that Microsoft’s partnership with OpenAI and integration with its Azure platform makes AWS a less compelling option and results in market share losses. I view this risk as more limited in the near-term as both AWS and Azure continue to report strong growth thus far. Additionally, the FTC is currently investigating the business relationship between Microsoft and OpenAI, which could result in pressure for OpenAI to allow better integration with AWS to ensure more market competition.

Finally, an economic slowdown also represents a key risk for AMZN, as the company is highly exposed to consumer and business spending. While I do not believe we will see an economic slowdown in the near-term, I would view any macro induced share price headwinds as a long-term buying opportunity.

Conclusion

AMZN is a high-quality company with strong competitive advantages due to its scale. The company is poised to benefit from a number of secular growth opportunities which are likely to play out over the coming decade. These growth opportunities are likely to result in margin expansion over time, as faster growing businesses offer better margin prospects compared to the company’s core online retail business. While the company has some regulatory risk, I view these risks as fairly manageable in the near-term. The stock trades at a compelling valuation relative to peers and its own historical norms.

For these reasons, I believe AMZN represents a compelling investment opportunity at current levels.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, MSFT, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.