Summary:

- General Motors has significantly improved operational efficiency, leading to healthy free cash flow and expanded operating margins.

- GM’s market share gains in both ICE and EV segments, coupled with disciplined leadership, position it well for sustained growth despite economic uncertainties.

- The company’s strategic approach to EV production and prudent management under Mary Barra, support long-term profitability and market competitiveness.

- GM’s current valuation suggests substantial upside potential, even with zero growth in free cash flow, making it a strong buy.

Wirestock/iStock Editorial via Getty Images

Investment Thesis

General Motors (NYSE:GM) is not the poorly run, fragile company it once was. Fears of its long-term decline may have provided an opportunity to buy a solid business at a cheap price. Operating margins have improved through increased manufacturing efficiency, leading to solid and underappreciated free cash flow generation. Market share gains in both ICE vehicles and EVs support continued free cash flow generation, even as sales may come under pressure during an economic slowdown or normalization in automotive sales. GM’s strong leadership team’s focus on disciplined and efficient growth has positioned it to continue winning in the years to come, even as EVs take a larger share of the automotive market. GM only needs to maintain free cash flow generation to justify solid shareholder returns.

General Motors Is a Free Cash Flow Generating Machine

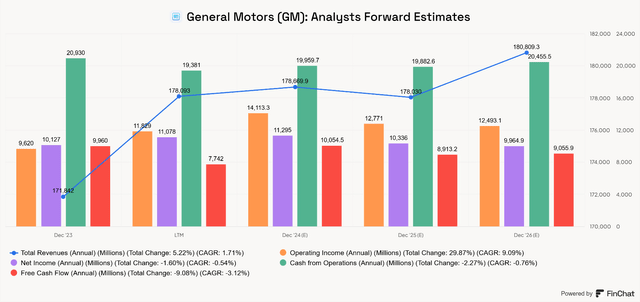

General Motors has made significant operational improvements since 2010, with operating margin expanding from 3.8% to 6.5% during the TTM period.

It all starts with stable revenue growth. GM has grown revenue at an 11.3% CAGR since 2020. Gross profit grew at a 12.8% CAGR, and operating income grew at a 17.1% CAGR during that time. Gross margin has remained healthy, but the real story is GM’s expanding operating margin. I think this is the biggest story to follow for GM, and will continue to be so going forward.

General Motors Revenue and Margins (Author-Generated Chart (data from SEC filings))

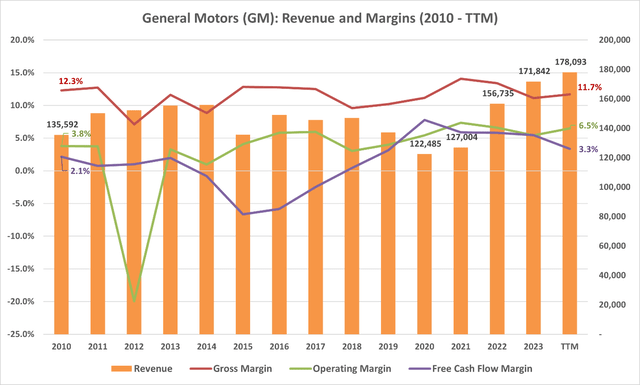

Operating margin has been boosted by improvements further down the income statement. While COGS has grown at roughly the rate of revenue during this time (2.1% COGS CAGR vs. 2.0% Revenue CAGR), GM has prudently managed its SG&A expenses. TTM SG&A expense is more than $2 billion lower than it was in 2010 (-1.5% CAGR) and is still declining. This has more than doubled operating income since 2010, a CAGR of 6.2%. Since 2020, operating income has grown by 17.1% annually.

The chart below shows the divergence in growth between COGS (red line) and SG&A expense (green line), and the growth in operating income.

General Motors Efficiency and Operating Income (Author-Generated Chart (data from SEC filings))

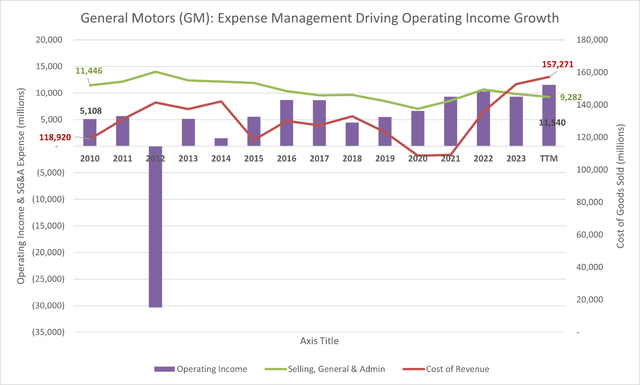

With steady top-line growth, greater expense management, and operating margin improvement, GM has grown free cash flow at a CAGR of 10.6% since 2014, generating $7.74 billion in the TTM period.

General Motors Cash Flows (FinChat)

General Motors Is a Better Company Than The One That Went Bankrupt

Today’s GM is not your father’s or your mother’s GM. GM has accomplished its recent success by dramatically improving its manufacturing efficiency, taking market share in ICE and EV sales while growing sales during a strong automotive market in recent years, and being run by a strong management team.

I’m sure some of you are reading this article thinking, yeah, but wait until GM goes bankrupt the next time a recession hits. That’s a typical comment I hear when I discuss GM. Though that is always possible, given the worst mix of factors similar to what GM faced during the Global Financial Crisis (GFC), the company is superior today and repeat of the GFC is unlikely.

General Motors Operates More Efficiently

Prior to the GFC, the company had significant manufacturing inefficiencies, including overcapacity and the inability to flex its assembly lines to different products. I remember visiting the NUMMI plant in Fremont, CA, as an automotive technician in training. The NUMMI plant was a joint venture between Toyota (“TM”) and GM and was set up to produce two vehicles. It would have taken many months to adapt it to handle different vehicles. Being nimble is important in manufacturing.

GM may have been learning this lesson prior to the GFC, when it rolled out its East Lansing manufacturing plant, but it was unable to achieve company-wide flexible manufacturing capabilities until many years later. During the Q2 earnings call, management spoke about its ability to adapt manufacturing to consumer demand. It said it would take proactive steps to balance EV production if deliveries lag wholesale. In the Q1 call, Mary Barra spoke about the company’s ability to produce either EVs or ICE vehicles at its Spring Hill facility. In Q4 of 2023, CFO Paul Jacobson said the company is prepared to flex between ICE and EV production to balance inventory levels and adapt to shifts in customer demand.

Beyond what happens in the assembly line, GM has improved its design efficiency, eliminating unnecessary parts. Mary Barra has highlighted how the company has eliminated more than 2,400 unique parts on ten vehicles launching in Q1 2025, by implementing smarter contenting and optimizing selectable options in its lineup. This is another example of the company’s push to cut costs.

Nimbleness in production is a major reason that GM has been able to increase its operating margin. The company is better able to shift production to meet consumer demand and limit disruption. While some operating margin pressure may be experienced due to the normalization of pricing, GM’s efficiency improvements are here to stay, meaning the company is unlikely to revert to its past operating margin levels. This supports free cash flow generation as long as demand doesn’t get destroyed. Luckily, GM is still a bestseller in several of its legacy product lines.

Strong Sales and Market Share

GM’s best-selling trucks and SUVs have highlighted the company’s overall sales success in recent years. Its new and refreshed ICE vehicles are expected to continue delivering improved margins over their predecessors, and the company is taking market share in both ICE vehicles and EVs. GM holds a roughly 44% market share in full-size light-duty and heavy-duty trucks and a 64% share in large SUVs. It is also winning a share in the small SUV segment and finding success in entry-level vehicles.

For EVs, GM has worked its way into the #2 position in USA EV sales, surpassing Hyundai (OTCPK:HYMTF) and taking overall market share. According to management, GM now holds a 9.8% market share. This was achieved by winning new customers rather than by cannibalizing ICE sales. 60-67% of EV buyers are new to GM (based on non-GM trade-in data) and are trending younger with higher education levels and incomes. They are also tending to come from coastal markets. These trends are impressive, considering these tend to be weaker areas for GM.

In my opinion, GM may is likely to gain new customers thanks to its differentiated lineup of both ICE vehicles and EVs. Considering GM’s high loyalty scores and customer satisfaction, this might bode very well for sustained growth and may be a major reason that GM has not had to rely on increased incentives for EVs or had to discount its ICE vehicle prices excessively, unlike other automakers.

As we head into an uncertain time for vehicle sales and economic growth, this may be very important for the company to help it maintain both pricing power and volume in the near-term and for long-term growth through new customer acquisition.

Looking ahead, management came off very optimistic about its 2025 outlook during its investor day presentation. GM expects its 2025 financial performance to be similar to 2024, with Capex roughly in-line YoY, and sales pressured on price but supported by efficiency improvement and potentially by volume. The company will release updated and more detailed guidance when it reports Q3 earnings in late October.

One concern with General Motors is the threat of losing share to EVs, but the company appears primed to be one of the eventual winners in this market, and its share gains underpin its potential going forward.

EVs Are GM’s Future

GM is working to catch up in the EV market. So far, the results look pretty solid, as GM is taking EV market share. It may be from a low base right now, but it reported a 40% YoY increase in EV deliveries during Q2, outpacing the 11% EV market growth. This has management confident that they are on the right track. In the U.S., GM’s EV deliveries increased by 34% sequentially, driven by the Chevy Blazer EV and Cadillac LYRIQ. As mentioned, 60% – 67% of its EV customers are new to General Motors. Its lineup is well differentiated from some of its competitors, meaning it can carve out a strong position in this market by offering more than just a few models like Tesla or other new companies like Rivian (RIVN), Lucid (LCID), and others. Taking market share is a sign that its products are landing better with customers than its legacy rivals like Ford (F), Stellantis (STLA), Toyota, and Nissan (OTCPK:NSANY).

GM’s EV Gains (GM Q2 2024 Investor Presentation)

GM’s Ultium platform is designed to be an efficient way of scaling its battery EV production line. Ultium is an architectural platform designed to be highly modular, scalable, and efficient. The system uses a common base, allowing a flexible battery and drive unit set-up and compatibility for various trucks, SUVs, crossovers, cars, and commercial vehicles. The common Ultium architecture, battery technology, and drive unit is part of GM’s efficiency gains, which have allowed for the reduction of unique parts and production costs. The Ultium platform also underpins Honda’s Prologue crossover.

During the investor day presentation, management highlighted how it is moving away from the term Ultium to reflect the variation in battery package designs that it is going to be shifting towards. This move will allow for a wider range of EVs and better products.

With greater scale, the company is approaching profitability in its EV division. GM aims to achieve variable cost profitability in Q4 of this year, meaning the company will be profitable after excluding fixed costs. Increased production scale, improved manufacturing efficiencies, and reduced materials costs are the key drivers behind this push toward profitability. This is an important step, considering GM aims to produce and wholesale 200,000 EVs in 2024. If EV sales pick up and GM continues to take market share, the push toward EBIT profitability will come faster. The company is on track to reduce fixed costs by $2 billion since 2022, and to continue reducing costs incrementally in the years ahead.

EV Market Share Growth Has Slowed, Providing a Great Opportunity for GM’s EVs

In my first article on GM, my thesis revolved around the company’s opportunity to continue generating loads of free cash flow as the EV market growth rate stalled. I shared my take on the normalization of the EV market share growth. The reports calling for EVs to follow the S-curve and take 80% of the auto sales market were being brushed aside in favor of the articles explaining why BEV demand is softening. I also pointed out that EVs remain the future of auto sales but that the future is being pushed out a little further than many people expected.

The slowing growth rate of EV adoption is a perfect opportunity for GM to catch up without being forced to decide between price destruction and taking market share. The company has its Ultium platform ready, its plants are operating more efficiently, its EVs will soon be profitable, and as it ramps up its capacity and its lineup of EVs, GM will still be generating free cash flows from its strong lineup of ICE vehicles, which are still taking market share, led by its dominant position in North American Large Trucks, SUVs, and Mid-size Trucks.

CEO Mary Barra summed it up perfectly when discussing EVs in General Motors’ Q2 2024 earnings call:

“As excited as we are about our portfolio, we are committed to growing responsibly and profitably in any demand environment. Over the next few years, third-party forecasters now see the EV market growing steadily, but more slowly than it did over the last few years. As a result, we are adjusting our spending plans to make sure we’re capital efficient and moving in lockstep with customers.”

Leadership isn’t going to rush the EV transition, and the market has given GM the gift of slowing it down, providing the company with an opportunity to make up for lost time and remain profitable while doing it.

General Motors Has Better Leadership

Flexibility and adaptability are common refrains among management, which speaks to the company’s disciplined leadership and operational prudence. Mary Barra is renowned for her excellence as Ulta Beauty’s (ULTA) CEO and appears to be leading GM in the right direction within a challenging industry. Since Barra was named CEO in 2014, the company has made strides in the right direction, which is evident in its financial performance. I believe the company is well-positioned to benefit from the slowing shift to EVs and has an opportunity to benefit from autonomous vehicles and “robo-taxis” through its investment in Cruise. Given that the company still holds a large share of ICE vehicle sales, GM appears to be set to continue holding a large share of overall vehicle sales in the coming years. This is a reflection of leadership.

Risks

With GM’s efficiency and wide and popular vehicle lineup, it doesn’t have to keep this growth rate up, which we will see when we get to the valuation section. That’s good for shareholders because the auto industry faces potential headwinds in the coming quarters.

Near-term risks include slowing automotive sales, pressuring revenue, and cash flow generation for automakers, as pointed out by S&P Global. There are indications that GM’s and other automakers’ profitability picture will be pressured in the coming months; however, this contradicts what GM management implies in its commentary.

Prices of new automobiles have been maintained at relatively high levels because inventory levels are not yet exceeding demand. This can change quickly; any economic downturn or a normalization of buying trends could cause sales to deteriorate through lower volume and/or lower selling prices. We have seen shrinking dealer margins in recent months, which has not impacted GM much. However, at some point, lower selling prices would eventually cut into GM’s manufacturing margins.

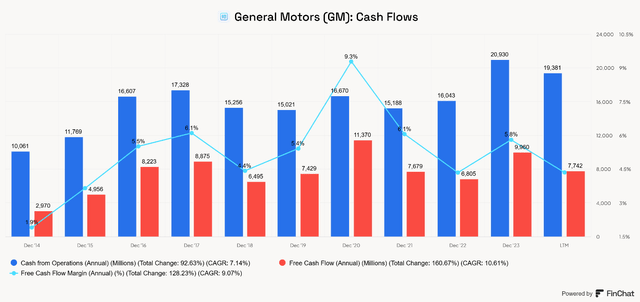

Analysts expect GM’s total revenue and free cash flow to decline in 2025 and operating and net income to decline in the next two fiscal years. We will have to wait and see what management says next week when it reports Q3. Any upward revision to guidance or improvement above what analysts expect could provide a catalyst for more stock momentum.

Long-term risks include disruption to the automotive market and GM being unable to keep up with the adoption of EVs and falling behind more innovative companies. Robotaxis could pose another long-term threat to the company, as a decreasing need for owning a vehicle due to the availability of autonomous ride-sharing options will lower the overall need for car ownership and punish all automakers who are not benefitting from robotaxi sales.

However, I have pointed out how adept GM has become at producing EVs efficiently and taking market share, which counters this argument.

The GFC Is Unlikely To Be Repeated Soon

I won’t get too deep into macroeconomics because it’s a waste of time to focus on, beyond looking at the big picture and understanding that there are too many factors to account for. The big picture, to me, is that the housing market is nowhere near as distressed as it was in the run-up to the GFC, and that should make a huge difference in the event of a recession. Any reduction in home values in certain markets today probably has more to do with normalization than with distressed borrowers who are highly over-levered. Statistically speaking, recessions of that magnitude don’t happen very frequently. Therefore, I am not concerned about a GFC-like recession occurring unless things change. Without a massive mortgage crisis, I don’t see any reason to think GM will suffer the same kind of distress in any potential recession in the coming years.

Valuation

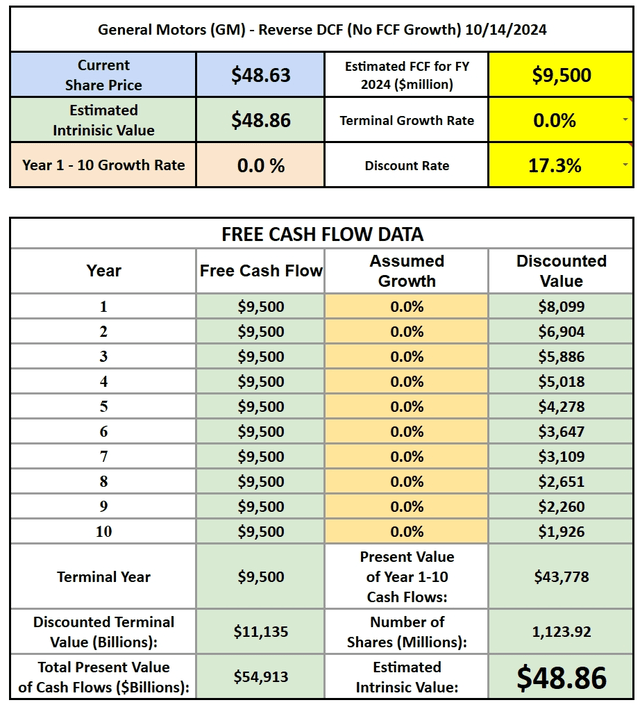

As I mentioned in my investment thesis, GM doesn’t even need to grow free cash flow to justify solid shareholder returns. I’m going to keep this as simple as possible by running a reverse DCF model using GM’s guidance for free cash flow as a starting point. The company is guiding to an FY 2024 adjusted automotive free cash flow amount of $10.5 billion. CFO Paul Jacobson mentioned that GM expects to realize EV valuation adjustment credits totaling roughly $1 billion for the year, which will positively impact free cash flow. Because these are likely one-time in nature and boost free cash flow, I have adjusted GM’s guide to a midpoint of $9.5 billion.

Using $9.5 billion as my model’s base free cash flow, I assumed zero growth in free cash flow during the calculation and terminal growth periods, with a discount/hurdle rate of 17.3%. The result is that even with zero growth in FCF, GM could return roughly 17.3% annually, as the intrinsic estimate matches the current share price.

General Motors Reverse DCF (Author-Generated Reverse DCF Model)

The risk to this valuation estimate is that GM must maintain its current free cash flow levels. However, because I am factoring in zero growth, this appears to provide an ample margin of safety for my investment thesis and supports my assumption that General Motors might be significantly undervalued, with the main risk being the business being in an inevitable state of decline and disruption that would cause free cash to deteriorate significantly in future years.

Conclusion

General Motors is no longer the fragile, poorly run company it used to be. Management’s purposeful shift towards operations efficiency and strong sales has turned GM into a free cash flow generating machine. The company has gained both ICE and EV market share, while expanding operating margin. The company’s leadership, especially Mary Barra, has shown they’re not rushing the EV transition but are taking smart, calculated steps. While there are risks, such as slowing sales, and ICE vehicle market disruption, GM’s operational flexibility and ability to adjust to consumer demand should allow it to continue generating strong cash flows. The current valuation shows that even with zero free cash flow growth, GM has plenty of upside potential. All in all, it looks like the market is undervaluing what could be a very solid long-term play. I consider GM a strong buy and one of my strongest value stock ideas. I plan on adding to my position one week after publication of this article.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 14. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GM, ULTA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.