Summary:

- Self-driving vehicles promise to improve road safety and reduce transportation costs.

- While it has been a long road, Waymo has a viable solution that is now being commercially scaled.

- Waymo is the clear market leader and is positioned to begin contributing to Google’s bottom line over the next few years.

- Despite Waymo’s potential value, Google’s large market cap means returns will be dominated by its advertising and cloud businesses.

JasonDoiy

Alphabet Inc.’s (NASDAQ:GOOG) (NASDAQ:GOOGL) patience, deep pockets and technical capabilities are now on the verge of creating real shareholder value through the company’s Waymo subsidiary. Despite large doubts about the technical and financial viability of robotaxis, Waymo is in the process of scaling up its commercial operations and could begin contributing to Google’s bottom line within the next few years.

There is still a large amount of uncertainty regarding what Waymo’s financials will look like long-term, but I think it is reasonable at this point in time to attribute significant value to the company. While this is a positive, it is unlikely to move the needle for existing shareholders due to Google’s enormous market capitalization.

Market

The introduction of self-driving vehicles promises to improve road safety while significantly reducing transportation costs. For example, ride-hailing costs could be reduced to something like $0.50 per mile for service providers, although this will require scale and improvements to the technology. McKinsey analysis suggests that the cost of ride-hailing will fall by more than 50% between 2025 and 2030. Much of this will come from lower sensor and hardware costs as the industry scales. Robotaxi vendors should also benefit from economies of scale and economies of density. As the underlying self-driving technology improves, there will also be less need for support (remote assistants).

By 2030, several million commercial AVs could be deployed for ridesharing, creating roughly a $25 billion robotaxi market. Adoption should be driven by consumer costs, which are expected to fall from around $3 per mile for ridesharing currently to under $1 per mile for robotaxis by 2030 and $0.58 per mile by 2040. Estimates vary significantly though, with Mobileye Global Inc. (MBLY) believing that the robotaxi market will be a $160 billion opportunity by 2030.

Much of this uncertainty stems from estimates of how lower costs will impact demand and how broadly the technology will be deployed. While robotaxis should make mobility more affordable, cost will vary significantly across use cases and geographies, meaning robotaxis may not be commercially viable in smaller cities with lower population densities.

Based on information from Uber’s Head of Economic Research, the price elasticity of demand for ridesharing is around 1.35, meaning a decline in prices should stimulate the growth of the market. Beyond a certain point, demand is likely to prove to be fairly inelastic, though, potentially causing a significant contraction of the overall market.

Technology

Google began developing self-driving technology in 2009, putting it at the forefront of the industry. It has also meant that the company’s path to commercialization has been tortuous, as Google’s self-driving efforts predate much of the technology that now appears to be critical (low-cost lidar, imaging radar, large-scale neural networks, highly performant GPUs/accelerators). Google’s self-driving project was renamed Waymo in 2016 and spun out, although Google retains ownership.

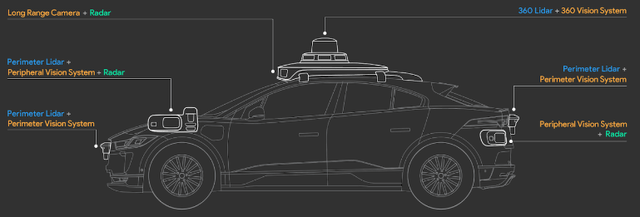

In support of its self-driving efforts, Waymo has developed a range of hardware and software, and is now on its sixth generation of the Waymo Driver. The fifth generation of the Waymo Driver was introduced in 2020, featuring a combination of lidar, cameras, and radar.

A lidar on top of the vehicle provides a 360-degree field of view with up to a 300m range. Short-range perimeter lidars are placed on the sides of the vehicle, helping to detect nearby objects. This is useful for tasks like navigating tight gaps in city traffic and covering blind spots.

A number of cameras with high dynamic range and thermal stability provide overlapping fields of view. Waymo’s long-range cameras enable the detection of features like stop signs at a distance of over 500 meters. Waymo has made innovations in areas like custom lenses and optomechanical engineering to enable this level of performance. Waymo’s vehicles also feature a perimeter vision system which helps to provide context to the lidar system.

Radar complements the vision and lidar sensors while also providing a direct velocity measurement and improved performance in adverse weather conditions (rain, fog, and snow).

The sixth generation of Waymo’s driver was released in 2024, which appears to have been a fairly incremental update focused on reducing costs. It also delivers more resolution, range and compute power. The sensor suite features 13 cameras, four lidar, six radar, and an array of external audio receivers. It provides the Waymo Driver with a surround view of the vehicle, overlapping fields of view, and up to 500 meters range.

Figure 1:Waymo Fifth Generation Driver (Source: Waymo)

Waymo hasn’t just installed off-the-shelf hardware in its vehicles and focused its resources on software. The company has made important innovations across the tech stack. While radar provides a distance measurement, a direct velocity measurement through the Doppler effect and insight into objects when there isn’t a direct line of sight, it generally provides low resolution, particularly in the vertical direction. Imaging radar aims to improve resolution (~1 degree versus 5 degrees for traditional radar) creating a point cloud output that is closer to lidar than traditional radar. AI is also used to help understand radar data, including denoising and identifying targets. Imaging radar should help reduce the reliance on lidar, provide an additional source of validation and improve capabilities in inclement weather.

Waymo has also developed its own rotating lidar (Honeycomb), which provides a horizontal field of view of up to 360 degrees and a vertical view of up to 95 degrees. This reduces the number of sensors needed and provides a comprehensive view around the vehicle, including blind spots. The system was introduced in 2017, reducing costs by an estimated 90%, with mass production providing an opportunity for further cost reductions.

It is difficult to know the importance of these internal development efforts, particularly given that companies like Cruise and Mobileye have similar projects. Waymo has suggested that its sensors are orders of magnitude better than what is available from other manufacturers, though.

Waymo has also invested in features like an air-puffer and wiper system to keep its sensors clean. While this isn’t necessarily anything sophisticated, it demonstrates the company’s dedication to creating a highly reliable service.

Little is known about Waymo’s computers, although the company has suggested that its performance is beyond what is currently available off the shelf. It likely involves some combination of CPUs, GPUs and specialized processors/accelerators and utilizes liquid cooling.

Waymo has now used a fairly wide range of vehicles in its self-driving efforts, including:

- Toyota Prius.

- Audi TT.

- Chrysler Pacifica.

- Lexus RX450h.

- Jaguar I-Pace electric SUV.

At one point, Waymo was also developing its own dedicated robotaxi (Firefly). Firefly was a two-door prototype that featured no steering wheel or dashboard. It debuted in 2014 and was manufactured by Google, although was abandoned in 2017. It is not clear why Firefly was cancelled, but it seems likely that Waymo’s losses were considered too large and that the company chose to narrow its focus in the short term as a result. I would not be surprised to see Waymo return to this type of vehicle at some point in the future in an effort to reduce vehicle costs.

Figure 2: Waymo Firefly (Source: Waymo)

Waymo takes a more modular approach to its self-driving technology than companies like Tesla, Inc. (TSLA). While AI is used in the tech stack, Waymo also utilizes a rules-based approach in areas like decision-making. This hybrid approach is in line with companies like Cruise, Mobileye, and Aurora Innovation, Inc. (AUR). There are a number of newer companies pursuing an end-to-end approach, like Wayve, although Tesla is the most prominent example of this approach.

One of the potential weaknesses of Waymo’s approach is that new geographies must be mapped in detail before Waymo can deploy its vehicles. This is because custom 3D maps, along with real-time sensor data, are used to determine the vehicle’s exact location. One thing that is potentially lost in discussions of Waymo’s approach is that detailed 3D maps are valuable in their own right and could be leveraged by Google in products like Google Maps.

While Waymo’s approach isn’t as data-intensive as Tesla’s, the company has performed extensive testing and continues to scale up its fleet. Waymo had performed a total of 20 million self-driven miles on public roads by 2020 and over 10 billion simulated miles. I would not be surprised if the company’s total real-world miles were approaching 100 million by the end of 2024. This pales in comparison to Tesla’s 1.5+ billion FSD miles, though. Testing has been performed in 13 states, including Michigan, New York, Washington, California, Arizona, and Florida. While Waymo has driven a relatively small number of miles, one of the advantages of its approach is that its safety drivers document each disengagement, which is useful for training purposes.

Waymo’s software is also tested on private test tracks, where complex scenarios can be staged. Waymo has completed over 40,000 unique scenarios in closed course environments.

Waymo also makes extensive use of simulation and has performed a total of 10 billion simulated miles by 2020. Simulation can be used to accrue more miles, prepare for rare events, train new models and validate changes to the software. This approach is not without its faults, though. Sensor simulators often leverage game engines, which are labor-intensive and fail to produce realistic approximations of camera, lidar, and radar data without significant additional work. Simulation can also be compute-intensive and is likely a complement to real-world miles rather than a replacement.

Waymo has developed software called SimulationCity for this purpose. To do this, Waymo leveraged real-world data, and Google’s technical infrastructure and made advances in areas like sensor simulation and machine learning. As a result, Waymo can simulate details like solar glare, dimming light, and the impact of raindrops on sensors. Waymo also has the technology to efficiently reconstruct the scene from an initial vehicle pass, making its approach far less labor-intensive.

Performance

In terms of performance, autonomous vehicle companies must be able to offer a safe service which makes riders feel comfortable and is commercially viable. This is difficult to assess from public data, but Waymo’s service appears to be safe, and early consumer feedback is generally positive. Waymo’s primary challenge at this point therefore appears to be widening the operating envelope of its technology and reducing its reliance on remote assistants.

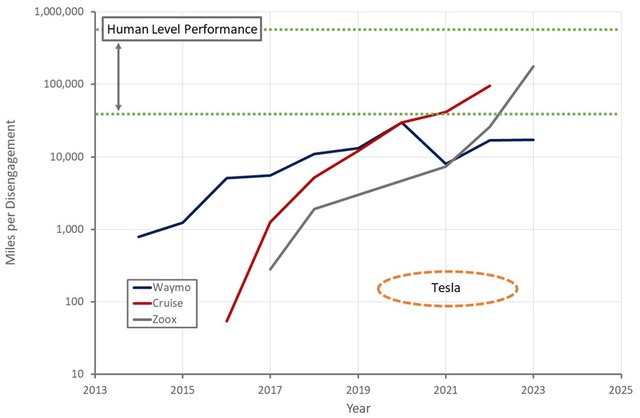

Self-driving data is reported in California, but disengagement in this data is specifically related to disengagements for safety reasons. Waymo has stated that safety incidents represent a tiny fraction of all disengagements. As a result, miles per disengagement in this dataset far exceeds real-world performance. For example, Cruise’s remote assistants reportedly have to intervene around every 5 miles. Assistants cannot actually operate Waymo’s vehicles though, instead, they answer questions which help Waymo’s vehicles to navigate complex situations.

The miles in disengagement data are also not necessarily comparable. For example, Waymo has tested its vehicles on freeways (with safety drivers) for more than a decade but still doesn’t allow its robotaxis to utilize freeways. Cruise also appears to avoid operating its vehicles under more difficult conditions.

Figure 3: Autonomous Vehicle Miles per Disengagement (Source: Created by author using data from the California DMV)

Waymo has released data indicating that its vehicles improve safety, although this is complicated by the fact that a substantial portion of the miles driven were likely under supervision. Waymo attempts to resolve this situation by simulating the behavior of its vehicles in cases where there are safety interventions to determine whether the vehicle would actually have crashed or not.

Safety should also be the first metric where self-driving cars begin to demonstrate greater than human performance. This is because most accidents are the result of human error. Self-driving cars have superhuman sensing capabilities and cannot become distracted. Long before a fully autonomous solution is viable, self-driving cars should be able to avoid most accidents and stop in a safe location when unsure what to do.

Waymo’s data indicates that relative to humans in the cities where it operates, its vehicles are involved in:

- 84% fewer airbag deployment crashes.

- 73% fewer injury-causing crashes.

- 48% fewer police-reported crashes.

Waymo’s safety performance was fairly similar across Phoenix and San Francisco.

Waymo has also suggested that its vehicles cause injuries at a 6x lower rate than human drivers based on data from its first 7.1 million miles of fully driverless operations in Arizona and California. Human-driven cars are also more than twice as likely to get into a crash that is reported to the police.

A separate Swiss Re study based on 3.8 million miles of driving in Phoenix and San Francisco indicated that human-driven vehicles got into crashes involving property damage at 4x the rate of Waymo vehicles.

From a safety perspective, it is also worthwhile considering that the majority of incidents involve more than one vehicle, meaning that even an extremely safe driver will eventually be involved in an accident due to mistakes by other vehicles. A significant number of the crashes that Waymo has been involved in have been due to other vehicles running into the rear end of a stationary Waymo vehicle. Cruise’s data suggests that its vehicles were the primary contributor in only 10% of crashes.

Ride-Hailing

Waymo is currently commercializing its self-driving technology through a ride-hailing service. Waymo One was launched in 2018, providing 1,000-2,000 rides per week, with 5-10% of those being entirely autonomous. At the time, Waymo planned on purchasing 20,000 I-Pace sedans from Jaguar and 62,000 Pacifica minivans from Chrysler. The fact that Waymo is still nowhere near operating at this type of scale is indicative of the difficulty of the self-driving problem.

Waymo’s sixth-generation vehicle was initially going to be based on a body from Zeekr. This would have been a custom-built van with a flat floor for more accessible entry and low step-in height. The vehicle also wouldn’t have featured a steering wheel or pedals. The Biden administration has proposed a 100% tariff on EVs from China though, up from 25%, making this plan infeasible. As a result, Waymo has pivoted to using Hyundai’s Ioniq 5 EVs.

Waymo has partnered with Magna for the final assembly of its vehicles. Magna has operated a factory in Detroit since 2019 and the companies have partnered to open a second assembly facility in Arizona. It is unknown what type of scale this enables, but it seems unlikely that manufacturing will be a bottleneck in the near term due to the volumes involved.

Waymo’s service is offered through the Waymo One App and is now available 24/7 in Phoenix and San Francisco. Waymo also has expansion plans for LA, Austin, and Atlanta.

While Waymo has its own app, it is walking back on this initiative as it expands. Waymo recently announced that it is partnering with Uber Technologies, Inc. (UBER) for its Austin and Atlanta expansion. Waymo’s service will be available through the Uber app, beginning in early 2025, and Waymo will transition its users from the Waymo One app.

Uber will provide fleet management services including vehicle cleaning, repair, and other general depot operations. Waymo will continue to be responsible for the testing and operation of the Waymo Driver, including roadside assistance and certain rider support functions.

The economics of this arrangement are not clear, but it is possible that Uber will be able to maintain a reasonably high take rate by assuming much of the responsibilities for operating the service, allowing Waymo to focus on scaling up its service and improving the performance of its self-driving technology. In the long term, I tend to think that Waymo will want control of the customer relationship through its own app.

Autonomous Trucking

Waymo has also sought to apply its self-driving technology to logistics, trialing its technology in Class 8 trucks in 2017 and launching Waymo Via in 2020. While autonomous trucking will likely be a large market in its own right, and Waymo was well positioned to be a market leader, the company paused its development efforts in 2023. The decision was likely due to resource constraints and concerns about Waymo’s losses. I think that Waymo will probably come back to autonomous trucking in the next few years, after its ride-hailing business is profitable and scaling smoothly.

The company’s efforts appear to have been focused on Class 8 trucks, but there were also plans for things like delivery vans. Class 8 trucks present a number of challenges due to their size, weight, and the fact that the cab can move a meaningful amount relative to the chassis, complicating sensor measurements.

The maturity of Waymo’s logistics business isn’t really clear from public data. The company has also been testing its cars on freeways for a number of years but still doesn’t offer this functionality to riders. Whether this is due to performance issues or conservatism is unknown.

Waymo’s autonomous trucking efforts centered around the Freightliner Cascadia truck. Waymo’s trucks use the same sensors as its cars, just configured differently. This includes both short and long-range lidar and imaging radar, enabling Waymo to detect objects up to 1 km away in a range of conditions.

Waymo has a partnership with Daimler to develop an autonomous truck platform that will continue, despite the logistics business being shut down. The company also had partnerships with UPS and JB Hunt, although these have now ended.

Aurora Innovation is potentially the leader in this market currently, with its market capitalization currently sitting at around $10 billion. Aurora Innovation is set to commercialize its autonomous trucking technology in the coming months, focusing initially on transportation between Dallas and Houston.

I believe that Waymo remains well-placed though as competition will be based on technological capabilities and there is unlikely to be a first-mover advantage. Even if competition heats up, the market is likely to be highly attractive while autonomous trucks aren’t setting the market price.

Financial Analysis

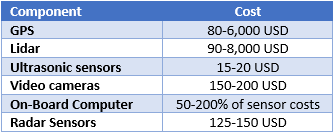

Much of the concern around Waymo’s business revolves around the cost of its sensor suite. For example, Waymo’s vehicles reportedly had around $150,000 of equipment in 2012, including a $70,000 lidar system. Technology costs have dropped significantly since then though and will continue to drop at a rapid pace as the industry scales. By 2019 the cost of Waymo’s Honeycomb lidar was already down to around $7,500. As a result, concerns over the cost of Waymo’s vehicles are misplaced.

Waymo recently suggested that if it equipped a Chrysler Pacifica Van or Jaguar I-Pace with its hardware, it would cost around the same as a moderately equipped Mercedes S-Class (~180,000 USD). This suggests that Waymo’s Driver costs upwards of $100,000, although this estimate was prior to the sixth-generation release and likely doesn’t factor in economies of scale.

Alternative estimates put hardware/sensor costs in the $10,000-$30,000 range, depending on setup. An important cost driver will be the introduction and scale-up of solid-state lidars, with companies like Luminar Technologies, Inc. (LAZR) targeting sub $1,000 pricing.

Table 1: Estimated Self-Driving Technology Costs (Source: Created by author using data from BCG)

Waymo is now going to use Hyundai’s Ioniq 5, which is roughly a $40,000 vehicle. Longer-term, there is also the possibility of introducing a dedicated two-seater to help lower costs. This option seems likely given that 80% of trips have two or less people. As a result, I think it is feasible that the cost of Waymo’s vehicles ends up approaching $50,000 USD. In comparison, Baidu’s robotaxi will reportedly cost $28,000.

Waymo has suggested that the cost of its vehicles will come to around $0.30 per mile, excluding maintenance and service costs. Other cost estimates are in the $0.60-$0.90 per mile range, although some estimates are as low as $0.35 per mile. I estimate variable costs of around $0.32 per mile and depreciation costs of around $0.20 per mile.

As a result, I can see Waymo having operating profit margins exceeding 30% at scale. This assumes that a competitive market doesn’t form, creating a race to the bottom on pricing. Initial margins will look far different though due to Waymo’s lack of scale and the high initial cost of things like remote operators.

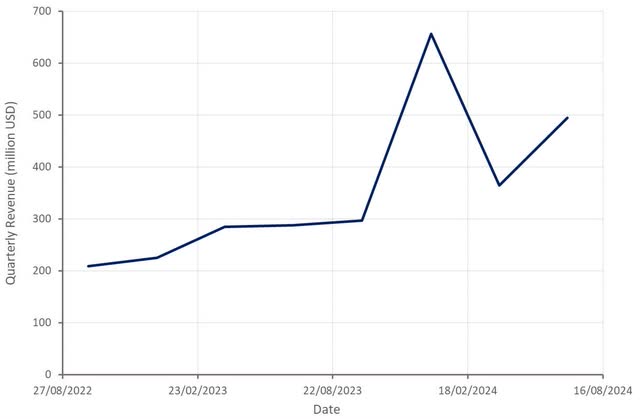

Waymo is now providing 100,000 rides per week, up from 50,000 earlier in the year. This is an enormous increase given that Waymo only provided around 700,000 rides in 2023. Waymo’s revenue, as inferred from Alphabet’s “Other Bets” also appears to be ramping. I think Waymo could be generating something like $50 billion annually by 2040, although this is basically a guess that depends on competition, pricing, and technological progress. My expectation is that the service will remain relatively geographically constrained for the foreseeable future though, resulting in less revenue.

Figure 4: Google “Other Bets” Quarterly Revenue (Source: Created by author using data from Alphabet)

Waymo could achieve breakeven in the next 2-3 years and may incur something like $5 billion in losses on the way. This estimate is heavily dependent on how quickly Waymo’s revenue ramps, though.

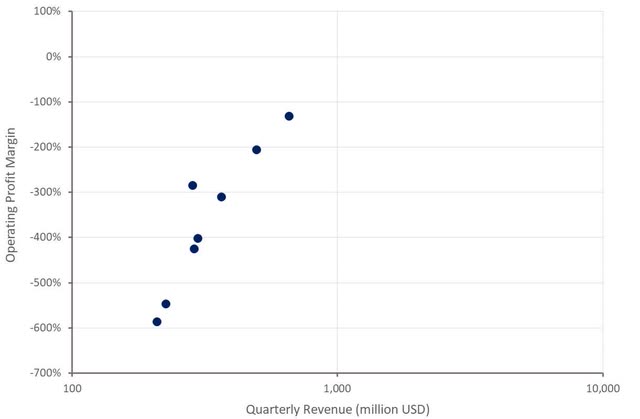

Figure 5: Google “Other Bets” Operating Margin (Source: Created by author using data from Alphabet)

Valuation

Morgan Stanley previously estimated that Waymo was worth approximately $175 billion, with $80 billion attributed to the ride-hailing service, $90 billion to logistics, and $7 billion to licensing. This calculation assumed an average price of ~$0.90 per mile, with Waymo capturing ~4% of global miles ex-China and achieving a 12% margin. I tend to think that this estimate is optimistic on market share and pessimistic on margins, though. I believe Waymo’s ride-hailing business could be worth something like $100 billion, though.

Conclusion

While there is a lot of noise about competitors pursuing a camera-only end-to-end approach, Waymo is currently the clear leader in the self-driving space. Even if competition increases over the next few years, it is difficult to see the market transitioning to price-based competition any time soon, as self-driving vehicles will only represent a fraction of the market in most geographies.

If the scale-up of Waymo’s operations goes well, the company could reach breakeven over the next few years, although it will be some time before Google recoups the enormous investment it has made in self-driving technology. Particularly given the large capital investment that will be required to build a large fleet. Google’s deep pockets will come in handy in this regard, with Alphabet recently reconfirming its commitment by investing an additional $5 billion in Waymo.

Across licensing, ride-hailing, and logistics, an argument could be made that Waymo should be worth several hundred billion dollars. While the market doesn’t appear to be attributing Waymo anything like this type of value currently, it will be difficult for investors to capitalize on the situation. Google’s $2 trillion market capitalization means that the returns generated by an investment in Google will be dominated by the performance of its advertising and cloud businesses, rather than Waymo.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MBLY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.