Microsoft Stock: Q1 FY2025 Earnings Will Likely Surprise You

Summary:

- I am upgrading Microsoft to “Buy” due to its more favorable valuation and strategic focus on AI and cloud. I believe MSFT should beat Q1 FY2025 consensus figures in 2weeks.

- In Q4, Microsoft’s Intelligent Cloud revenue rose 19%, driven by AI integration, while Productivity and Business Processes and More Personal Computing also showed strong growth.

- Despite increased capital spending, Microsoft’s robust balance sheet and cash flow ensure sustainable investments, with potential for higher buybacks post-Activision acquisition.

- Risks include fluctuating PC demand, macroeconomic pressures, and regulatory scrutiny, but Microsoft’s AI and cloud focus positions it well for future growth and potential earnings beats.

- Microsoft’s AI and cloud services focus, supported by strong Q4 FY2024 earnings, indicates potential for future growth and momentum in Q1 FY2025 and beyond. I think it is time to raise my rating to “Buy”.

HJBC

Intro & Thesis

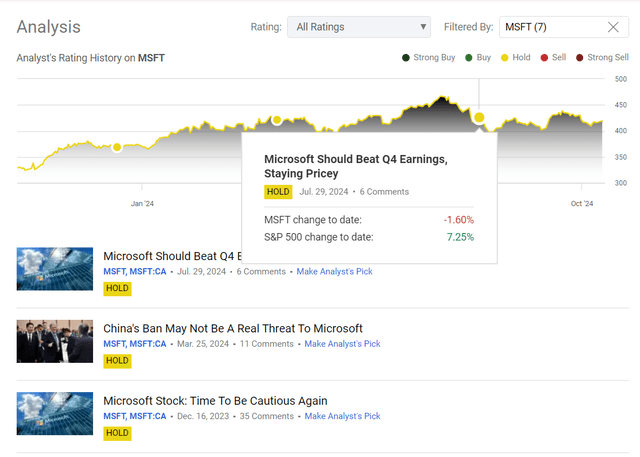

There will be a number of critical Q3 reports by the end of October – the market is mainly waiting for the big tech companies, including Microsoft Corporation (NASDAQ:MSFT), which I have been writing about regularly on Seeking Alpha since December 2022. My last 4 ratings on MSFT were neutral – I urged caution as the stock seemed overvalued to me based on various valuation methods. The last time I updated my thesis was in July – right before MSFT’s Q4 came out. Since then, the stock has been virtually unchanged, and due to its consolidation, it has underperformed the broad market quite meaningfully:

Seeking Alpha, the author’s coverage of MSFT stock

Today I have decided to raise my rating back to “Buy” as Microsoft is likely to outperform again, in my view – this time at a more favorable valuation and seemingly less negative market reaction to a potentially conservative investment outlook.

Why Do I Think So?

First off, let’s take a quick look at how the company reported for its fiscal Q4 FY2024.

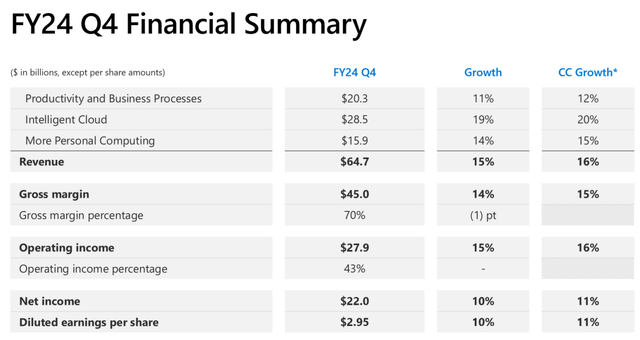

Microsoft’s Q4 FY2024 results look encouraging to me with consolidated revenue of $64.7 billion, up 15% year-on-year (+16% YoY in CC), boosted by “strong demand for its cloud and AI offerings”, with Microsoft Cloud revenues up 21% to $36.8 billion. We see this strategic reorientation of investments in AI and cloud infrastructure since they remain the core source of revenue and efficiencies. But the gross margin in the cloud vertical did narrow down to 69% due “to a mix change in sales from Azure to AI and the growth of AI systems”, which I consider quite high anyway.

Now let’s assess each of Microsoft’s business units in more detail to see where the main momentum is taking place.

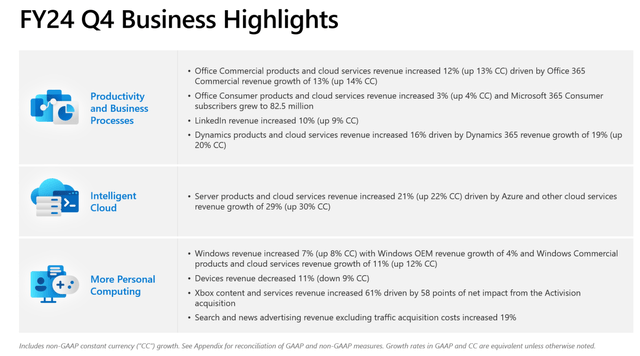

Last fiscal year (Q2/Q2 2023-2024), the Intelligent Cloud business stood out as its revenue increased by 19% to $28.5 billion. Azure and other cloud services jumped by 29% YoY with AI service offerings contributing 8 percentage points – such expansion is a testament to Microsoft’s ability to incorporate AI into its cloud services successfully, in my opinion, which has proved a big attraction to customers. And with an enterprise mobility and security installed base of over 281 million seats up 10% from last year, the company has further increased its cloud ecosystem.

Productivity and Business Processes were also up in a strong manner as revenues increased 11% to $20.3 billion. Office 365 Commercial revenue increased 13% with high adoption of E5 and Microsoft 365 Copilot. The paid Office 365 commercial seats were up 7% with Microsoft scaling its user base across multiple segments. LinkedIn and Dynamics also drove the success of this category with LinkedIn revenue increasing 10% and Dynamics revenue increasing 16%.

More Personal Computing posted revenue up 14% at $15.9 billion thanks to Activision’s acquisition – revenues for games jumped by 44% YoY, led by an increase in Xbox content and services revenue by 61% YoY. But Xbox hardware revenue decreased by 42%, suggesting a shift toward content and services. Anyway, the gross margin of the segment rose 3 points reflecting a strategic move towards high-margin businesses.

Among all the segments Microsoft operates, the cloud is the most promising one. Judge for yourself: Take different market research reports as a reference, and you’ll find that the cloud computing market, the video game market, and the desktop OS market are projected to register 20.3%, 13.4%, and 1.9% CAGRs for the next few years, respectively. The management appears to be well aware that with the development of Linux, its share of operating systems will gradually decline. In order to continue to grow, the main focus must therefore be on the cloud and the integration of different offerings into a single (ideally) ecosystem.

So it’s no wonder that Microsoft has put AI as a strategic focus in its products and services. It has already introduced AI across the platforms from Azure AI to Copilot for Microsoft 365 and witnessed significant adoption and revenue growth, as we can see from fiscal Q4 financials and key operating metrics. Microsoft’s AI focus places the company well for the future, as it continues to ramp up its capabilities and infrastructure to service a growing customer base. But why didn’t the stock really move after strong Q4 figures? I believe it’s because of fears regarding huge spending ahead: The company said it would increase its infrastructure spending in FY2025 in line with the increasing demand, and the capital spending will outpace FY2024. Management forecasts double-digit revenue and operating income growth, powered by innovation and customer interest. The effective tax rate is expected to remain around 19% while operating margins are likely to shrink a bit on higher investments.

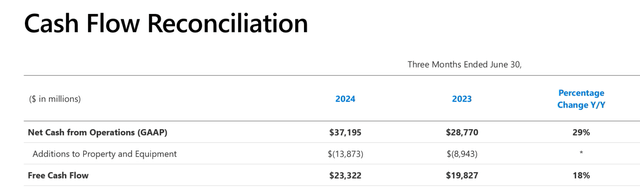

The most important thing is that these enormous investments bring a sufficient ROI. However, we can already see from the growth of the top and bottom lines that the past initiatives are gradually leading to good growth. At the same time, the company has a very solid balance sheet with ~$75.5 billion in cash and cash equivalents and total debt of only $45 billion, meaning that its capital expenditure including finance leases of $19 billion (including cloud and AI infrastructure) doesn’t pose a major risk in the medium term. Also, MSFT’s operating cash flow of $37.2 billion keeps going up (+29% YoY) based on strong cloud billings and collections. Free cash flow climbed 18% YoY to $23.3 billion, covering capital spending quite well.

The firm also returned ~$8.4 billion to its shareholders in dividends and share repurchases last quarter as an expression of shareholder value creation. In fact, Microsoft repurchased ~$17.25 billion of its stock in FY2024 – indeed, that was way lower than last year (~$22.25 billion in FY2023), but the Activision acquisition was a drain on cash, so I expect the buyback volume to go up again in FY2025 despite huge CapEx.

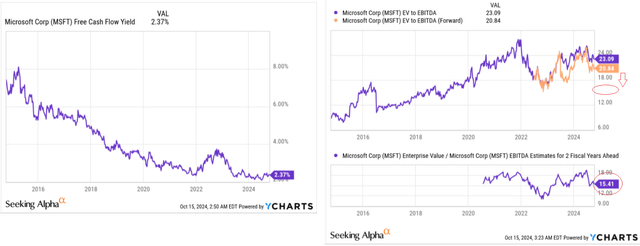

Last time I wrote that despite strong fundamentals and high odds of beating Q4 consensus (which is what happened), Microsoft stock seemed overvalued, with a limited margin of safety.

I don’t think you can call Microsoft an undervalued stock to buy right now – its FCF yield continues to shrink and is now below 3%. However, given the company’s potential growth over the next few years, I think MSFT can grow out of its high multiples – look at EV/EBITDA in two years, it’s about 15.4x, about the 10-year average and well below the next year’s 20.8x:

I think MSFT will maintain its premium a) due to its dominance in certain tech sub-sectors on a global level and b) due to increased buybacks no longer hampered by the Activision deal as was the case in FY2024.

As for the report for the first quarter of fiscal 2025, which the company will publish on October 30, 2024 (in about 2 weeks), it seems to me that the operational momentum Microsoft has gained in recent quarters is likely to continue. If I am correct, the quarterly EPS consensus cuts over the last six months will provide fertile ground for another earnings beat:

Also, an important aspect will be how management addresses its plans to increase capital spending on artificial intelligence. I believe that much of the market’s perceived negativity has already been addressed in previous quarters, and going forward the company will likely build on this foundation. The company can be expected to continue to invest significant resources in this area. Consequently, I expect at least neutral comments from management and a similarly neutral reaction from the market. Against this backdrop, Microsoft has a good chance of rising on a potential beat. That’s why I decided to upgrade to “Buy”.

Where Can I Be Wrong?

My bullish view of Microsoft isn’t free from various risks that should be taken seriously.

First, global PC demand fluctuates, impacting MSFT’s Windows operations, and macroeconomic pressures may make companies curtail technology investments, reducing revenue from Bing and LinkedIn that are ad-sensitive. Even with an elusive “soft landing”, the economic outlook is still far from firm, in my view, so advertising income can be a high-stakes gamble.

Second, Microsoft is being investigated by antitrust regulators in the US, the EU, and the UK for its cloud offerings and its OpenAI relationship, which could get it sued. A copyright infringement case against OpenAI’s ChatGPT in court with The New York Times shows the tensions between copyright law and AI. Also, Microsoft’s exit from the smartphone market leaves it open to challengers, and Amazon.com, Inc.’s (AMZN) cloud offerings are up against it for market share.

Third, my assumption is that Microsoft’s stock will retain its premium valuation due to its strength in some technology segments and higher buybacks could come wrong in case general market conditions shift.

The Bottom Line

And yet, despite the risk, I believe that Microsoft’s focus on AI and cloud services puts it nicely on track for future growth, backed up by solid earnings in Q4 FY2024 – I think that momentum will carry over into Q1 FY2025 and beyond. The company’s capability to offer AI has helped to generate strong revenue in its Intelligent Cloud and Productivity and Business Processes lines. Microsoft has a healthy balance sheet and solid cash reserves, so it is well-placed to keep adding infrastructure to serve the increasing demand. The stock has been flat since my last update, but it’s at a better price now, and with the potential for another earnings beat the price may react nicely to Q1 data. I think it is time to raise my rating to “Buy”.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MSFT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!