Summary:

- Streaming services giant Netflix, Inc., has seen a robust 46% rise in its stock in 2023, and it’s unlikely to be done yet.

- The upcoming Q3 2024 results can affirm that there’s more upside to Netflix stock, with expectations of double-digit revenue growth, operating margin expansion and robust EPS increase.

- The stock’s forward P/E still looks attractive too, and with further EPS increases seen in 2025, NFLX’s prospects are positive.

Riska

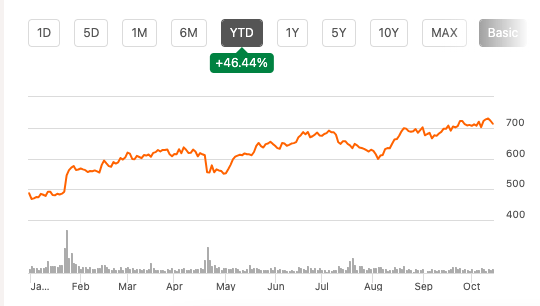

When I last wrote about the streaming services giant. Netflix, Inc. (NASDAQ:NFLX), it was already clear that there was an upside to the stock after it rose by 46% in 2023. This played out. Year-to-date, the stock is already up by as much as in the whole of last year (see chart below). As the company readies for its third quarter results (Q3 2024) later this week, the question to ask is whether they can continue to indicate further stock price upside, or not?

Price Chart (Source: Seeking Alpha)

What to expect from Q3 2024 results

In a year that’s gone rather well for it so far, Netflix’s projections for Q3 2024 continue to be healthy, even as there are pockets of weakness to watch out for. Here are its key projections:

- Double-digit revenue growth expected

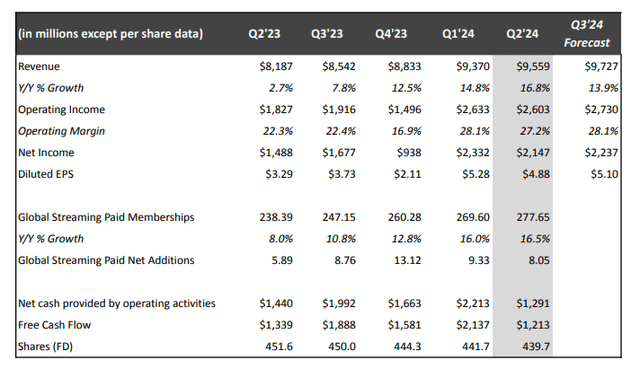

After a slump in revenue growth to mid-single digits in 2022 and 2023, Netflix has seen quite the turnaround in 2024 so far, with revenue showing mid-teens growth in the first two quarters of the year (see table below). It expects a slight come-off in revenue growth to 14% year-on-year (YoY) in Q3 2024.

But this isn’t bad, considering that it’s over a higher base than in H1 2024. Revenue growth had risen to 7.8% YoY in Q3 2023 after coming in at 2.7% YoY in Q2 2023. Furthermore, even with the mildly softer growth projection, it’s still expected to be at the lower end of the company’s target range of 14-15% for the full year 2024, which was revised up from 13-15% earlier.

Financial Summary (Source: Netflix)

- Member additions might not be too bad

Going by Netflix’s expectation for global streaming paid memberships, the figure would be nothing to look forward to. It expects paid net additions to contract YoY, without giving a precise number. This is because of a high base effect, as Q3 2023 saw a big sequential bump up of 48.7% as Netflix started paid sharing, that allows adding more members to the same account at a higher cost.

Even then, though, the paid net additions might still be positive when seen from the perspective of 2024 so far. In Q3 2023, the figure was at 8.76 million, which is higher than the 8.05 million seen last quarter. The point being, that even if the figure declines YoY, there’s a fair chance it can rise sequentially. With a 34% quarterly increase in Netflix’s ad-tier membership last quarter, I’d say it might even surprise on the upside.

- Underwhelming average revenue expected

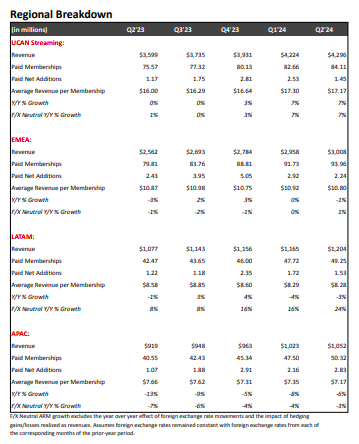

It also expects the average revenue per membership to be “roughly flat year over year in Q3 due to ongoing F/X headwinds and plan and country mix.” This is essentially in line with Netflix’s performance in the past quarter, when it saw a 1% YoY increase on a reported basis, though it did do better on an F/X neutral basis, with a rise of 5% YoY.

Presumably, the regional trend as seen in recent quarters can be expected once again. While revenues from EMEA, LatAm and APAC markets have seen a pullback in reported terms, the big UCAN market has been a stabilizing force (see table below). The UCAN market brought in over 44% of the revenues last quarter, and if the declining trend continues in other markets, it stands to become an even more important one for the company going forward.

Source: Netflix

- Robust operating margin expected

The brightest spot for the upcoming earnings figures is the operating margin. Netflix sees it at 28.1% in Q3 2024, bringing the number back up to the same level as seen in Q1 2024, and after cooling off slightly to 27.2% in Q2 2024.

This is even better than its forecast of a 26% margin, which has already been upped from its earlier projection of 25%. However, the full-year expectation does suggest that the margin can drop in Q4 2024 to around 22%, unless, of course, the company’s forecast is conservative and it outdoes itself. Even if it doesn’t, though, it would be an improvement over the 20.6% levels seen last year. The margin expansion is essentially due to a faster pace of revenue growth, even as the company’s costs continue to inch up.

Is Netflix still a buy?

Now, to answer the big question. The company expects a continued robust increase in diluted EPS in Q3 2024 of 36.73% YoY. This might be lower than the 83.3% YoY increase seen in Q1 2024 and 48.3% YoY in Q2 2024, but on its own, it is still very strong.

Assuming that the EPS grows at the average rate of 54.1% YoY in Q4 2024, which is the expected average increase in the first nine months of the year, Netflix will end 2024 with an EPS of USD 18.5. This indicates a forward P/E of 38.23x, which is even lower than the 38.8x when I last checked. Comparing it to the stock’s five-year average ratio of 46.7x indicates an over 20% upside persists for NFLX.

Further, the outlook for next year is positive too. Analysts’ estimates on Seeking Alpha show another expected 21% increase in the company’s earnings in 2025. This brings the forward P/E to an even lower 30.7x, which is worth considering as we are a hop, skip, and jump from next year.

What next?

The big picture for the streaming services provider continues to be positive. The turnaround in revenue growth is expected to continue, and the margins are expanding. While paid net additions and revenue per member aren’t seeing the best trends (or expected to), and these are indeed figures to look out for in the future, for now, there’s more going for Netflix than not.

Additionally, its earnings are expected to see a robust increase in 2024 and in 2024. Despite the stock’s rise through the year, these support attractive forward P/Es, suggesting that continued double-digit increases in NFLX are still likely. Unless the Q3 2024 results turn out very different from the company’s projections, the upcoming results should only affirm the expected upside.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in NFLX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—