Summary:

- Nikola Corporation has shown some progress with record truck sales, but profitability remains a distant dream due to high production costs and cash burn.

- The company continues to face commercialization challenges, inefficient cost management, and a lack of necessary infrastructure for FCEVs, making it uninvestable.

- Despite the comparative advantages of FCEVs over BEVs, the expensive production and limited hydrogen refueling infrastructure hinder Nikola’s potential success.

- Investors should avoid Nikola stock as the company struggles financially and operationally, with little hope of turning profitable in the foreseeable future.

onurdongel

Nikola Corporation (NASDAQ:NKLA) does not fail to keep investors interested despite having very little to show from a financial performance perspective. Just over a year ago, I thought Nikola would burn investors, and it has. The stock is down 90% since then. My bearish thesis for Nikola was centered on the commercialization challenges of the fuel cell technology, Nikola’s self-inflicted damages to its brand value, and the ominous cash position of the company. Last July, I reaffirmed my bearish stance on NKLA given that operating inefficiencies were eliminating any chance of Nikola turning profitable in the foreseeable future.

Amid all the negative developments, Nikola stock rallied earlier this month after the company disclosed it had wholesaled 88 Class 8 hydrogen fuel cell trucks in the third quarter, a record high for the company. Although there’s no denying that this is a positive development, unfortunately, Nikola needs to scale exponentially from here to even think about profitability. Given the continued challenges the company is facing to commercialize its technology and the lack of infrastructure to trigger meaningful demand for FCEVs, I believe Nikola is going nowhere. To make matters worse, the company is likely to dilute shareholders to stay afloat. I strongly believe that Nikola is as uninvestable today as it was a year ago despite some encouraging developments.

Good News Masks The Bad News

Let’s start with the recent good news. In Q3 2024, Nikola sold 88 Class 8 hydrogen-fueled trucks, marking a 22% improvement from Q2, within the guidance range of 80 to 100 units. Even though the improvement was less than the 80% increase experienced in the last quarter, it marks a significant success for the company, especially in the context of its historical nature of failing to deliver set targets repeatedly.

Nikola CEO Steve Girsky was happy with the Q3 performance. It is the best-performing quarter in terms of truck sales for Nikola and the company also added the first-ever U.S. dealer-based HYLA modular refueling station. The CEO said:

Despite overall market headwinds, Nikola remains focused on our mission to pioneer solutions for a zero-emission world, and we’re doing it one truck at a time.

Despite the record deliveries as well as the expanding customer base for hydrogen trucks, Nikola is still in turmoil. So far, the company has only handed over 235 trucks and is losing cash at high rates, requiring new equity to be issued at regular intervals to raise money. Although Q3 deliveries boosted investor sentiment, the soft demand for FCEVs, inefficient cost management related to production, and operational challenges make profitability a distant dream.

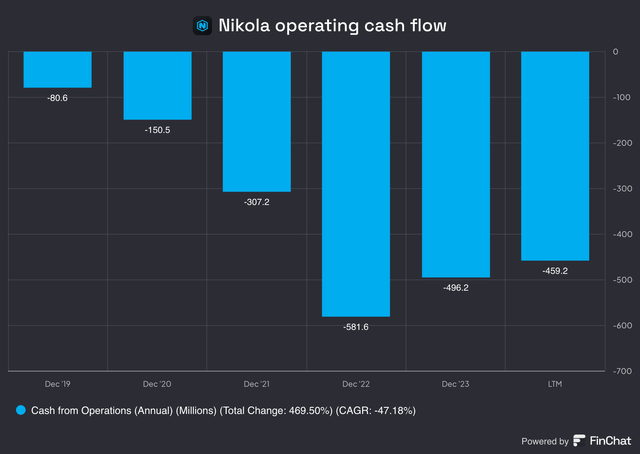

Exhibit 1: Nikola operating cash flows

FinChat

The substantial cash burn of the company amid non-existent earnings has forced Nikola to dilute shareholders ever since its SPAC merger in March 2020 which valued the company at $3.3 billion (today, Nikola is valued at just $220 million). Nikola’s total number of shares outstanding has ballooned from just 13 million in 2020 to more than 50 million today, which is a clear indication of how the company has resorted to new equity issuance to avoid a catastrophic end. Although I am not always against this strategy, in Nikola’s case, I believe this only adds to investor worries given that the company may never see light at the end of the tunnel.

The Mounting Challenges

Things have not been easy for Nikola as it has failed to deliver on many of its promises. The company made bold claims that it would be making mass orders of both BEVs and FCEVs but has never done anything of the sort. The company managed to deliver only 79 BEVs by 2023 despite its much flashier promises, and even out of those delivered, many were recalled due to incidents of battery fire. The company’s FCEV segment has also failed to deliver the promises, with only 35 units delivered in 2023 compared to earlier forecasts for 2,000 trucks, eroding investor confidence.

The heavy cash burn is the main reason behind Nikola’s failure to make progress toward profitability. In Q4 2023, the company’s truck cost about $679,000 to produce, while the average selling price hovered around $351,000, making each unit sold a burden on the company’s financial performance. Even though average selling prices went up to $381,000 in the first quarter of 2024, this was still inadequate to cover production costs. For Nikola to succeed, the company has to scale in multiples from here but at these price points, Nikola is very unlikely to see demand growth.

In addition to these problems, there is intensifying competition from the electric truck segment. For instance, Daimler Truck is aggressively promoting its Freightliner eCascadia trucks to major corporate customers such as United Parcel Services (UPS), Walmart, Inc. (WMT), and Sysco Corporation (SYY) while Tesla, Inc. (TSLA) is preparing for the commencement of mass production of the semi-truck in 2025. In addition, Mercedes and MAN are also preparing new models of electric trucks.

Will FCEVs Save Nikola?

In long-haul trucking, FCEVs have comparative advantages over BEVs since the heavy weight of lithium-ion batteries makes BEVs less efficient. FCEVs typically last longer and refuel quicker than BEVs. These are very important for industries that need to operate long-distance vehicles with very few stops for recharging batteries. Fuel cell trucks are anticipated to account for 19% of all zero-emission trucks by 2044, which is a very encouraging prediction. For Nikola, this expected growth in FCEV trucks presents an opportunity, and the company aims to establish 60 hydrogen refueling stations by 2026 in partnership with Voltera to build the necessary infrastructure to support this growth.

Comparatively, FCEV technology is considered to be more versatile in terms of mileage and output than BEVs. Fuel cells have a longer service life and can be produced more efficiently as demand increases. FCEVs are expected to come on par or less in cost compared to internal combustion engines by 2030. Moreover, FCEVs are quick to recharge compared to other EVs available in the market, making them appealing.

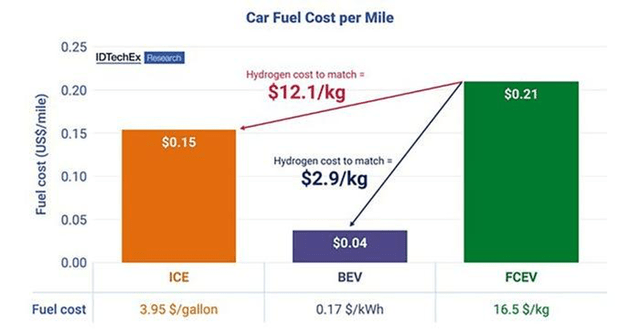

Exhibit 2: Cost per mile comparison

Battery Tech Online

However, there are serious challenges limiting the success of FCEVs. One of the major challenges is the expensive nature of FCEV production and the capital intensity of developing hydrogen refueling infrastructure. Though Nikola’s HYLA refueling system has greatly improved, investments are proving to be a burden on the company as they add to its severe cash burn. Attending these issues is far more complicated because this infrastructure is still very scarce and does not compare to the expansive charging infrastructure for BEVs. Currently, there are less than 100 hydrogen fuel refilling stations in the U.S., mostly concentrated in California, compared to the 76,772 locations of EV charging spots across the country. In addition, hydrogen is way more expensive than its substitutes, driving potential customers away.

Exhibit 3: Hydrogen fueling stations in the U.S.

Alternative Fuels Data Center

On paper, FCEVs offer many benefits for the trucking industry compared to BEVs. However, as I have pointed out above and in my previous articles, commercialization of this technology is still at the infant stage, and I doubt whether Nikola may even survive before FCEVs go mainstream, if at all. Investors, in my opinion, should remind themselves that the success of an industry does not always guarantee the success of a company representing that industry, even if that company proves to be the frontrunner at any given point in time.

Takeaway

To sum up, profitability seems unlikely for Nikola, at least in the foreseeable future. Even with some progress made in truck deliveries and the growth of its hydrogen infrastructure, the company is still struggling in terms of finances and operations. Keeping in mind that the production cost of trucks is nearly double the selling price, Nikola needs a miracle to turn things around in the next few years. Betting on Nikola stock to gain exposure to the FCEV market is not a prudent investment decision, and I believe Nikola will continue to inflict pain on long-term investors for a long period of time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.