Summary:

- Reed Hastings, co-founder and now former CEO of Netflix, does not scare easily. He has steered the company through multiple body blows and executed many nimble pivots.

- Hastings just stepped upstairs to let the kids run the show. He remains as Executive Chairman but the day-to-day brickbats and kudos will now rain on others.

- A look at the financials together with the stock chart shines a light on his timing. The selloff was overdone and the partial recovery has been rapid.

- Now come the hard yards.

Jerod Harris

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Time To Roll Up The Sleeves

As everyone knows, Netflix (NASDAQ:NFLX) was on fire during the Covid crisis period and has since worsened as a business. Which is why the stock dumped so convincingly from late 2021 through the first half of 2022. And also as everyone knows, the business is now doing better having introduced ads and starting to crack down on unlicensed account sharing, and so the stock has rebounded a fair bit since the lows.

This is a great narrative. The trouble is, it’s not true.

Netflix stock moved up hugely following the Covid crisis, but that was more out of sentiment than actual financial fundamental performance. The stock moved up in anticipation of subscriber growth delivering earnings and cashflow growth; when the inevitable return to something-like-normality came and folks were dragged by their earlobes back to the office, less subscriber growth, general doom and gloom about streaming economics (Disney, anyone?), the Curse of Ackman, and hey presto, you’re at the 786.

The 786?

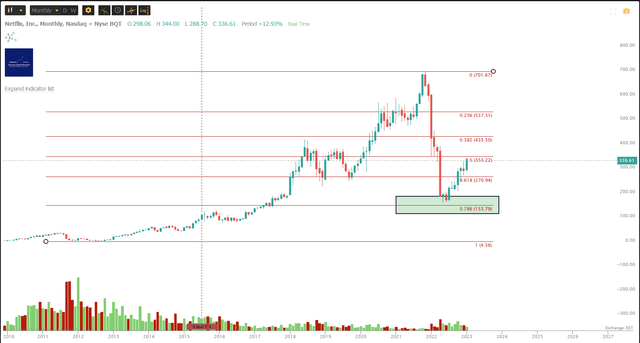

Yup. Netflix joined Meta Platforms in selling off so hard that it hit the mythical .786 Fibonacci retracement of its whole move up from the post IPO lows. Amongst normal folk that technical retracement is known as a Dumpster Fire In An Ammunition Yard. Just look! (You can open a full page chart, here).

NFLX Chart I (TrendSpider, Cestrian Analysis)

As you know, NFLX has now set out its stall as an earnings- and cashflow-growth play; based on capturing lost revenue by stopping account sharing and based on adding a new revenue line from ads. And as we will see in a moment, the early signs of success are there to see. Unlevered pretax free cashflow margins are trending up and of course the valuation multiples are much reduced, tempting buyers back in. You can see the impact of that above – the stock has very nearly doubled up off the lows.

The thing is, improvement in fundamentals is lagging the stock; that’s normal, but Hastings stepping upstairs doesn’t fill us with confidence. Let’s take a look at the numbers.

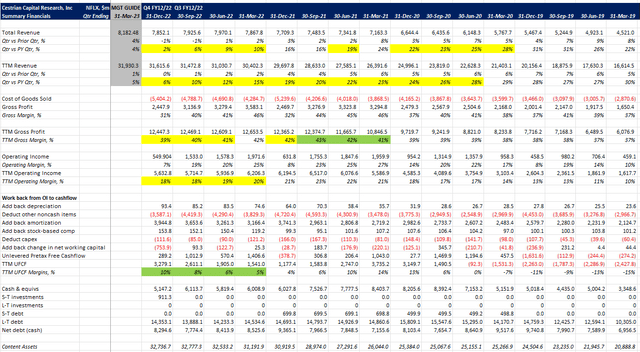

NFLX Fundamentals (Company SEC filings, YCharts.com, Cestrian Analysis)

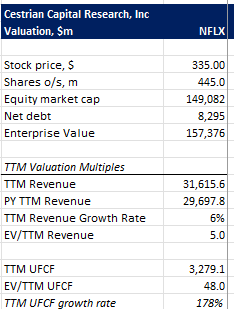

Here’s the valuation by the way.

NFLX Valuation (Company SEC filings, YCharts.com, Cestrian Analysis)

The decline in NFLX’s rate of revenue growth began in March 2020. Yes it did. At the start of the pandemic period, not when the crisis eased. It’s been a one-way ticket down since then. All that happened to the stock was that it went a little lockdown-crazy. Q4 just reported also shows a declining growth rate – just +2% since Q4 2021 and down to +6% vs prior year on a TTM basis. As we noted above, cashflow margins are climbing from the 4% struck in Q4 2021 to 10% in the quarter just closed, all on a TTM basis.

On the revenue guide front, Mr. Hastings left a nice parting gift for his successors – the company has said it will deliver the first acceleration in growth since the March 2021 period (which was a one-time anomaly – really, we haven’t seen growth accelerate since 2019). So it’s on the new folks to deliver that.

On a pure technical basis you would expect to see NFLX stock give a little back now, even as part of a continued move up. Perhaps the Q1 report will be the catalyst. CEO handovers of this nature are rarely smooth – witness Amazon of late – and if there was a rocket ship ahead you would think Hastings would keep the big chair in order to grab the glory (and also the appreciation in his stock comp).

Here’s how we think it may play out. The move up off the lows we can call a Wave One – in the chart below we assume it terminates soon (why else would Hastings exit stage left?) then retraces, maybe a Wave Two 61.8% pullback, before moving up once more when the new team get a hold of the company. So, near term, down, then a Wave Three up to hit $415 or (much) better.

NFLX Daily Stock Chart (TrendSpider, Cestrian Analysis)

Generally speaking we think the future will keep improving for Netflix; we own the stock in staff personal accounts and plan to hold it for some time; but for now we think the stock warrants just holding it, not adding to it and not selling (if you have a multi-year timeframe – if you bought at the lows and doubled your money already, consider taking some gains and/or putting a stop under your position to lock in those gains already marked up). If it does drop and the metrics keep improving under the new team? The parameters above can help you time an add. For now, we’re just sitting on our hands.

Cestrian Capital Research, Inc – 20 January 2023.

Disclosure: I/we have a beneficial long position in the shares of NFLX, DIS either through stock ownership, options, or other derivatives. Business relationship disclosure: See disclaimer text at the top of this article.

Additional disclosure: Cestrian Capital Research, Inc staff personal accounts hold long positions in, inter alia, NFLX and DIS