Summary:

- Netflix, Inc.’s share price has doubled from its 52-week low as the highly anticipated ad-supported tier is finally released.

- The company’s Q4 results showed muted revenue growth with the bottom line decelerating.

- The current financials do not justify Netflix, Inc.’s elevated valuation, especially when compared to other tech mega caps that are cheaper.

- I rate Netflix, Inc. as a sell.

Mario Tama

Investment Thesis

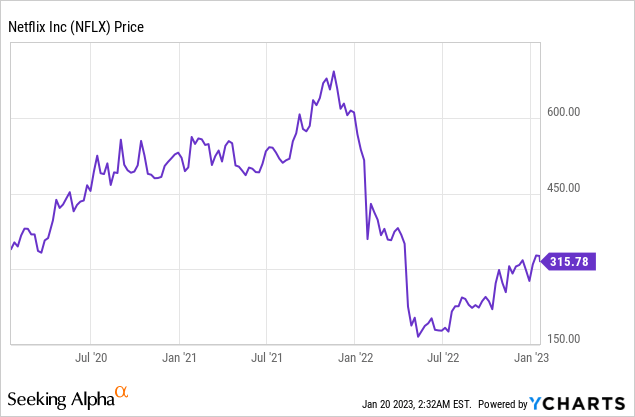

Netflix, Inc. (NASDAQ:NFLX) had a horrific first half in 2022, as the streaming giant reported a surprising loss in subscribers. Since announcing the launch of its ad-supported tier, the company seemed to have turned a corner, with the share price up over 100% from its 52-week low. Its original series Wednesday by producer/director Tim Burton also saw significant traction, which fueled the optimism of the turnaround. However, I do not think the recent NFLX run-up is justified.

The company’s Q4 earnings are very underwhelming, with little top line growth and a weak bottom line. Share price popped over 7% during after-hours due to higher-than-expected subscriber addition, but that’s partly due to hefty marketing spending, which actually hurt the bottom line. The current valuation is also significantly elevated compared to other mega-cap tech companies with better fundamentals and growth. Therefore, I rate Netflix as a sell at the current price.

Q4 Financial Results

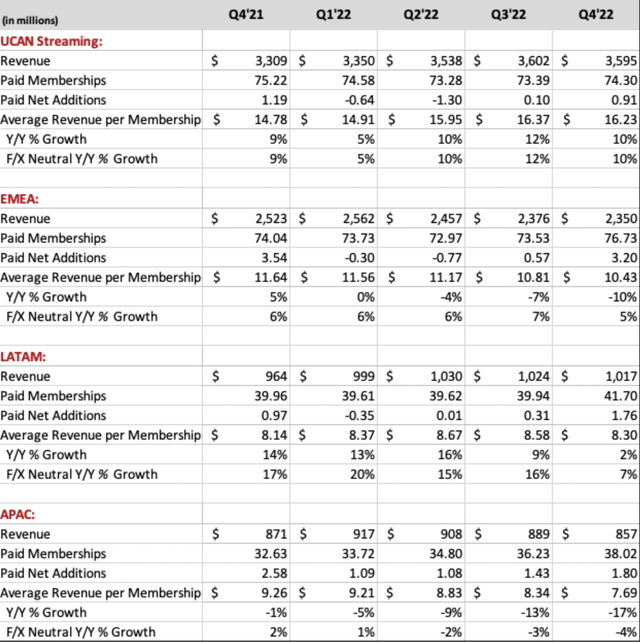

Netflix announced its Q4 earnings on Thursday, and the results are pretty underwhelming, with paid net adds being the only bright spot. Revenue growth is weak, and the bottom line is not looking good, either. The company reported revenue of $7.85 billion, up only 1.9% YoY (year over year) from $7.7 billion. The growth is largely driven by the 4% increase in new paid subscribers, offset by a 2% decline in ARM (average revenue per membership). Due to the company’s global exposure, it was significantly affected by the strong dollar in the past quarter. On an FX-neutral basis, revenue grew 10% while ARM grew 5%. The dollar eased a bit during the past few months, which should take some pressure off but remains a risk as future rate hikes remain uncertain.

The highlight of the quarter for Netflix seems to be the growth in new global paid streaming users, which increased by 7.66 million from 223.09 million to 230.75 million, representing a 4% YoY growth. The number is much higher than the 4.5 million net adds previously expected by the company thanks to the widely popular series Wednesday and the launch of the lower-priced ad-supported tier. EMEA led the increase with 3.2 million net adds, followed by APAC with 1.8 million and LATAM with 1.76 million. UCAN only has 0.91 million new net adds, as the market is getting increasingly saturated.

The better-than-expected net adds also came with a cost as marketing spending increased, which dragged downed the company’s bottom line and margins. Marketing expenses were up 4.9% YoY and 46.4% from the previous quarter. Technology and development expenses also increased 4.7% YoY from $647 million to $674 million. The percentage increase in cost of revenue also outpaced revenue growth as the company spent more on content, which caused the gross profit margin to drop by around 90 basis points.

Due to higher costs and overall expenses, Netflix operating income actually decreased by 12.9% from $632 million to $550 million. The operating margin was also down 120 basis points from 8.2% to 7.0%. The bottom line took a further hit due to unrealized loss from FX re-measurement on its euro-denominated debt, which amounted to $462 million. This alongside the increased expense caused a significant drop in net income, which was down 90.9% from $607 million to $55.3 million. This resulted in a diluted EPS of only $0.12 compared to $1.37 in the prior year and $3.1 in the prior quarter.

Despite planning to roll out paid sharing more broadly later in the first quarter to tackle account sharing, the company guided revenue to be only $8.2 billion for the next quarter, which translates to a mere growth of 3.9%. The management team expects revenue growth to improve throughout the year but single-digit revenue growth is just way too low in my opinion considering its lofty valuation.

Spence Neumann, CFO, on the Netflix growth outlook:

But throughout the course of the year, we would expect to see accelerating revenue growth as we roll out page sharing broadly across our business and then obviously, scale adds throughout the year, which is a more gradual build.

Valuation

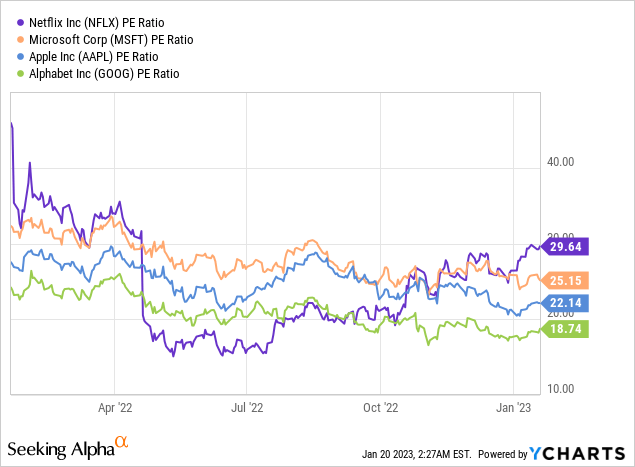

The run-up in NFLX share price during the past 6 months almost doubled Netflix’s valuation, and the company is now back in overvalued territory. The company is currently trading at a P/E ratio of 29.6x, with a decelerating bottom line and quarterly revenue growth of only 1.8% (around 6.4% growth for the fiscal year). From the first chart below, you can see that the current valuation is much higher than other tech mega-caps such as Apple (AAPL), Microsoft (MSFT), and Google (GOOGL). The average P/E ratio for the three companies is around 22x, or a 25.7% discount compared to Netflix. In the latest shareholder letter, Netflix guided at least $3B of free cash flow (“FCF”) for 2023 (assuming no material swings in FX). Using the current market cap, this still translates to a price-to-FCF ratio of 46.8x, which is extremely pricey.

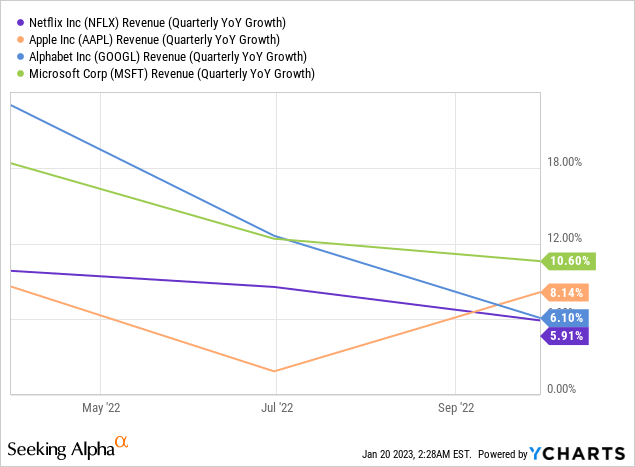

Yet from the second chart, you can see that other companies are all posting higher revenue growth rates, which average around 8.3% compared to just 1.9% from Netflix (the 5.9% shown below is from the prior fiscal quarter as YCharts haven’t been updated yet). Not to mention all these companies have better fundamentals with better tailwinds. For example, Microsoft’s Azure and Google Cloud continue to see strong momentum thanks to increasing cloud spending. They also have much more diversified revenue streams with better operating leverage. I can’t think of why Netflix should be trading at a higher multiple when its fundamentals and growth are trailing behind.

Takeaway

I do not think the recent quarterly earnings are good enough to support Netflix, Inc.’s extremely elevated valuation. The company’s revenue growth rate is very low and the bottom line is struggling due to higher spending and FX headwinds.

Yes, the increase in new net adds is impressive, but this is sort of expected due to the launch of a lower-priced tier. The success of Wednesday is also one of a kind (third most popular series ever) and will be hard to replicate. The current Netflix valuation is absurd when comparing its multiple to other high-quality tech mega caps.

It made sense last June when Netflix, Inc. was trading at mid-teens P/E, but definitely not now. There is no way Netflix deserves a 26% premium to peers when it has inferior fundamentals and growth. Therefore, I rate Netflix, Inc. as a sell.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.