Summary:

- Netflix’s stock is undeservedly popping up after a mixed quarterly report.

- In this note, we will analyze Netflix’s Q4 report.

- Furthermore, we will review its valuation and technical chart.

- At ~50x forward P/FCF and 2023 revenue growth of ~10-15%, Netflix is grossly overvalued! I rate Netflix a “Sell/Avoid” at $338.

Marvin Samuel Tolentino Pineda

Reviewing Netflix’s Q4 Earnings Report

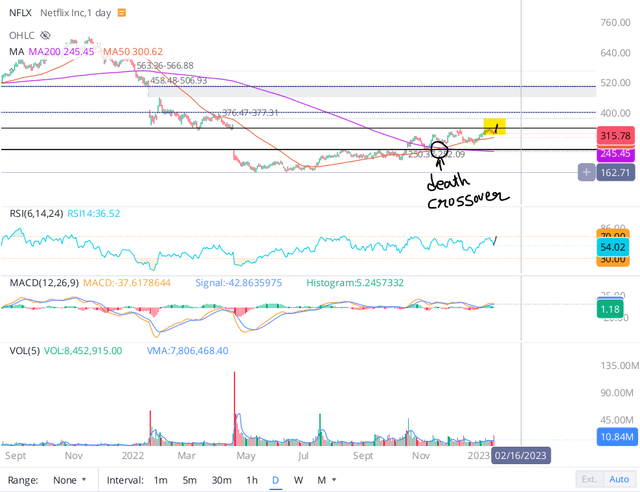

Yesterday, Netflix (NASDAQ:NFLX) released its Q4 2022 earnings report, which, in my view, was somewhat of a mixed bag. For Q4, Netflix’s revenue of $7.85B met street expectations, whilst EPS of 12 cents (-91% y/y) came in far lower than the projected EPS of 45 cents (due to a non-cash unrealized loss on Netflix’s $5B euro-denominated debt).

Despite a glaring earnings miss, Netflix’s stock rallied by ~7% to close at $338.25 per share in the after-hours session. As I see it, this pop in Netflix’s stock is driven by a significant beat in net subscriber adds of +7.66M (vs. est. of +4.57M) and growing investor confidence in Netflix’s growth re-acceleration story.

Netflix Q4 2022 Shareholder Letter

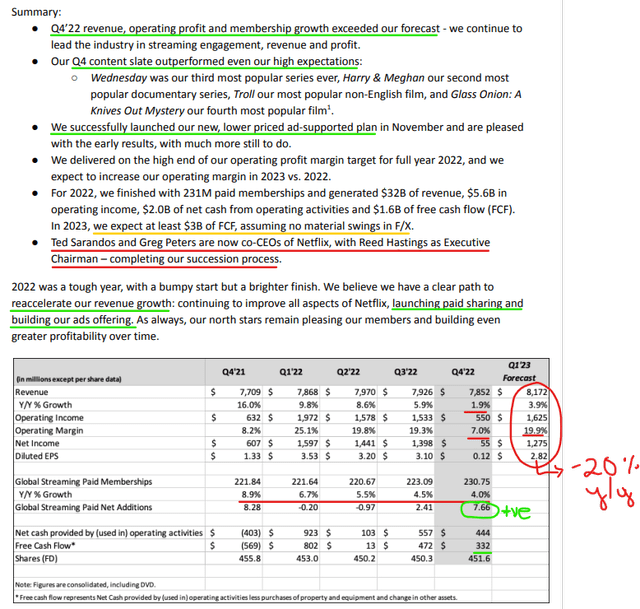

As you may know already, Netflix is hoping to re-accelerate sales by venturing into the world of connected TV advertising [with its “Basic plus Ads” plan] and by cracking down on password sharing (& offering paid sharing). While I believe that this plan will work, I am unhappy to learn that Reed Hastings, Netflix’s legendary CEO and co-founder, is leaving his role as co-CEO to move into the role of Executive Chairman. Yes, Reed will still be around; however, Reed not being hands-on is still a big loss for Netflix.

Netflix Q4 2022 Shareholder Letter

Since a succession plan has been in place for a few years now, I hope the C-suite transition at Netflix is smooth sailing. Going forward, Ted Sarandos (co-CEO) and Greg Peters (new co-CEO) will be calling the shots at Netflix, and their No. 1 job right now is to get Netflix’s growth train back on track!

Fortunately, Ted and Greg have been at Netflix for 15+ years now, and they already have a solid plan to execute for 2023. With user growth slowing down drastically in the post-pandemic world amid a flurry of deep-pocketed rivals entering the streaming space, Netflix is embracing advertising and cracking down on password sharing to derive incremental revenue.

Netflix Q4 2022 Shareholder Letter Netflix Q4 2022 Shareholder Letter

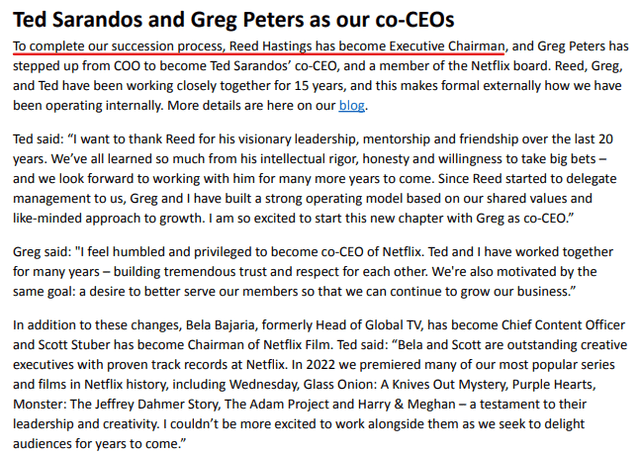

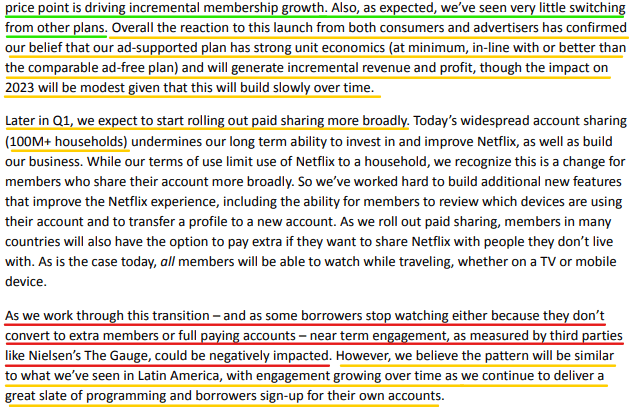

In relation to the ads business, Netflix’s management gave away little details this quarter, and I think that’s understandable given the fact that the partially ad-supported tiers went live only in November. That said, Netflix’s management seems excited about the impact of the Ad plan:

Engagement from Ads plan users is comparable to non-ad plans. That’s a promising indication that we’re delivering a solid experience & this is better than we modeled. Ad plan take rate is solid & largely due to incremental subscribers coming into the platform. We aren’t seeing much plan switching from premium plans to the ads plan which means unit economics remain good.”

Source: Greg Peters, co-CEO, Netflix

This statement from Greg about unit economics remaining good due to limited plan switching from users – contradicts their own claim that the ad-supported plan has strong unit economics (at minimum, in-line or better than the comparable ad-supported plan).

In a recessionary environment, a good quantum of Netflix’s subscribers could look to cut back on subscriptions, and having a lower-priced offering should help alleviate some potential churn at Netflix. Overall, I think Netflix’s Ads business can successfully serve the purpose of garnering incremental revenues.

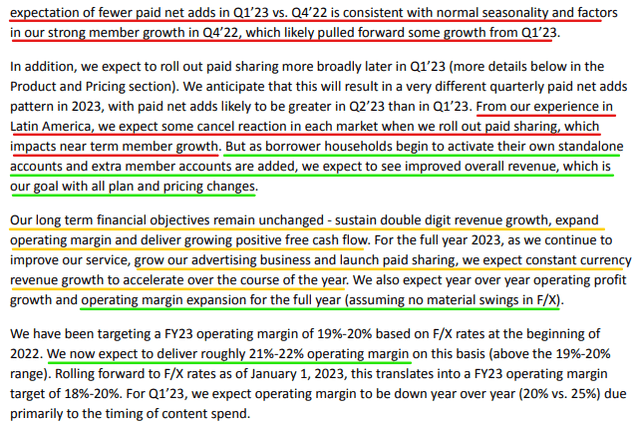

On password sharing, Netflix suggests that 100M+ households share passwords within and outside their household. While Netflix is cracking down on password sharing, it is set to introduce paid sharing feature for its members in Q1 2023. The confidence or belief in Netflix’s management related to the long-term potential impact of paid sharing is based on LATAM.

Netflix Q4 2022 Shareholder Letter

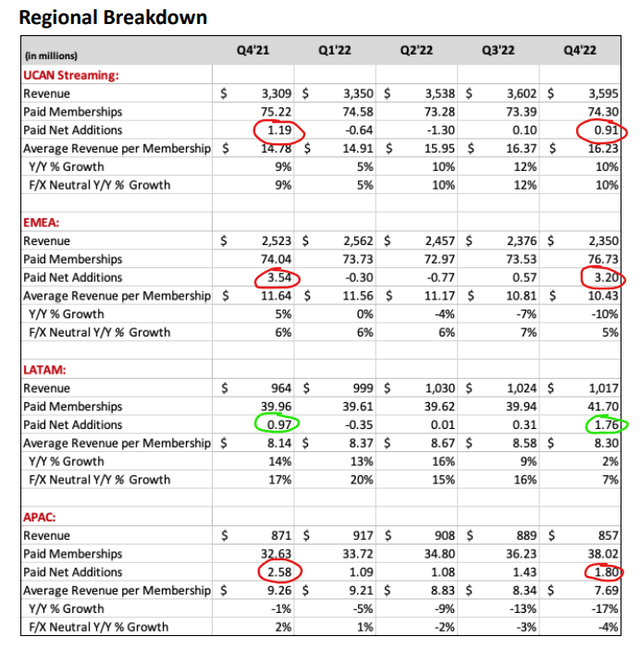

As you can see above, LATAM is the only market where Netflix had positive y/y growth in “Paid Net Additions”; and since LATAM is the only market where Netflix has tested its paid sharing plans, I think this is what the management is basing their commentary on at this point in time.

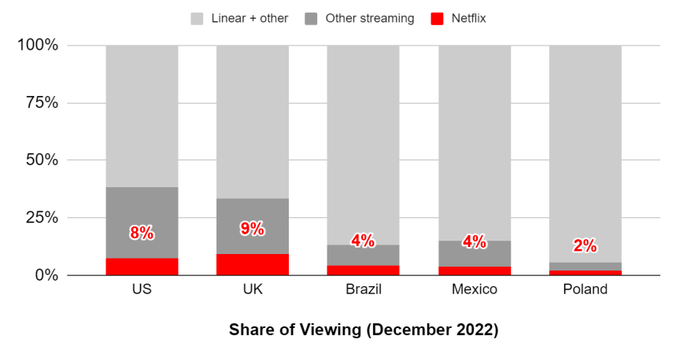

While Netflix is making some big strategic changes to its business this year, we should remember that its total addressable market opportunity, i.e., streaming, still has a long growth runway.

Netflix Q4 2022 Shareholder Letter

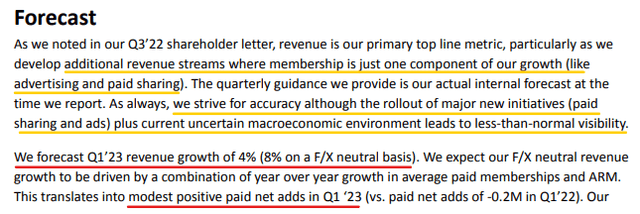

Based on the trends they have seen so far, Netflix’s management provided the following forecast:

Netflix Q4 2022 Shareholder Letter Netflix Q4 2022 Shareholder Letter

In my view, Netflix’s Q1 guide is weak, or probably it’s just the management team being too conservative at a time when an uncertain macroeconomic environment is leading to less-than-normal visibility. Despite plenty of competition entering the streaming space in recent years, Netflix continues to remain the “King of content and streaming”.

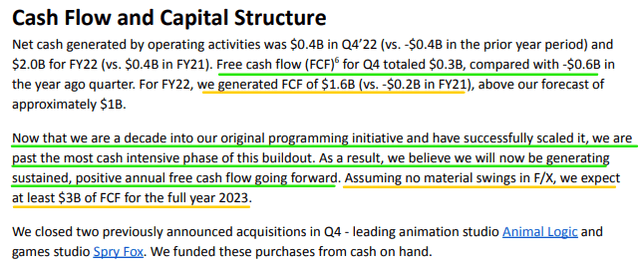

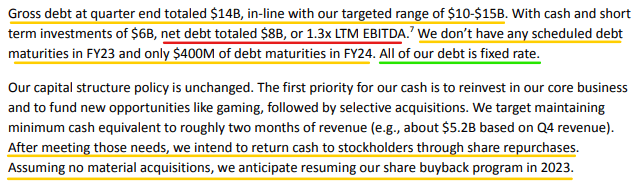

As of the end of Q4, Netflix had a liquidity cushion of $6B (cash + short-term investments), against total debt of $14B. Since Netflix has no scheduled debt maturities in 2023, I am not too worried about Netflix’s liquidity profile. As the only profitable streamer in the market, Netflix could be a big consolidator in this space over the next 12-24 months.

Netflix Q4 2022 Shareholder Letter Netflix Q4 2022 Shareholder Letter

And I think M&A is the right way to go here because the alternate plan from the management is to deploy Netflix’s FCF via share buybacks. At its current price (~$338 per share or ~$150B), Netflix is trading at a P/FCF multiple of ~95x (forward P/FCF of ~50x). Considering the fact that Netflix is struggling to deliver double-digit growth, I think such a high multiple is absolutely ridiculous. Netflix is a media company in a mature growth stage, and unfortunately, it is being priced like a technology company in hypergrowth.

In my view, buying back stock at ~50x 2023 P/FCF is imprudent (especially in the face of a recessionary environment). I hope Netflix’s management decides to preserve its cash flows for a rainy day or chooses to utilize them for driving inorganic growth via M&A.

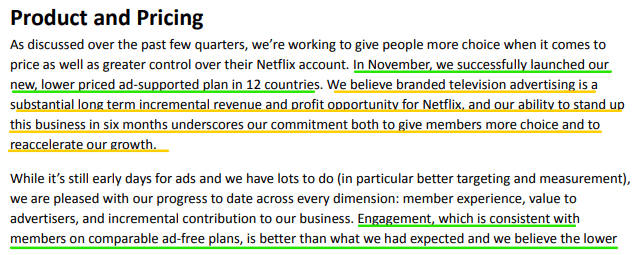

Technical Gap Has Been Filled, NFLX Could Go Either Way From Here

After reporting its Q1 earnings on 19th April 2022, Netflix’s stock plunged by ~36% in a single trading session. And now, that entire gap on Netflix’s technical chart has been filled with a ~7% jump in yesterday’s after-hours session.

From a capitulatory bottom in the summer of 2022, Netflix’s stock price has climbed more than 100%, with the 50-DMA acting as support throughout this rally. However, now that Netflix has filled out this technical gap, the stock could see some correction from here. On the chart, I see a bearish death crossover pattern formed in November, and I think a re-test of the $250-260 level (200-DMA) is possible in the next couple of quarters.

We also have another technical gap to fill on the upside from the $410 to the $500 level. Can Netflix rally up to $500?

Considering Netflix’s TTM P/FCF of ~95x, I don’t know how the stock will rally higher from here. In fact, I think Netflix should be trading much lower. At current levels, Netflix is uninvestable.

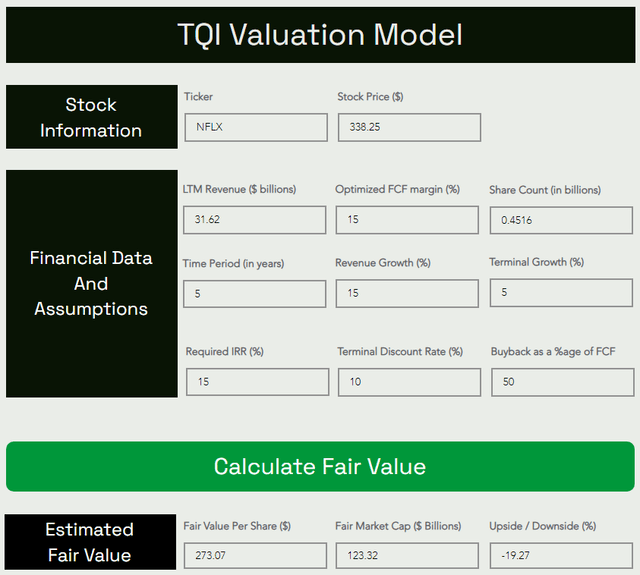

In this note, we’ve already discussed Netflix’s trading multiples. On a relative basis, Netflix is grossly overvalued. However, let us determine its absolute valuation to make an informed decision.

Netflix Fair Value And Expected Returns

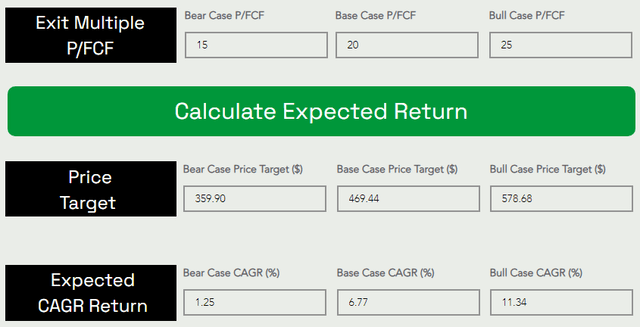

TQI Valuation Model (TQIG.org) TQI Valuation Model (TQIG.org)

Final Thoughts

Netflix looks set to improve its financial performance over the next 12-24 months; however, in the current environment, its price tag of ~50x 2023 P/FCF is absolutely ridiculous! After all, Netflix is a media company in mature growth phase.

Despite using generous assumptions for margins and revenue growth in our model, Netflix still came out to be overvalued by ~20%. Furthermore, Netflix’s expected 5-yr CAGR return of ~6.77% falls well short of my investment hurdle rate of 15%. Hence, I can’t fathom the idea of buying Netflix at $338.

The post-earnings pop in Netflix’s stock is undeserved, and if I had a long position, I would be a seller here. If you are looking at Netflix for a fresh investment, I suggest you look elsewhere.

Key Takeaway: I rate Netflix a “Sell/Avoid” at ~$338.

If you are willing to deploy capital into any business at such a high valuation, I suggest you look into Snowflake (SNOW):

Twitter

Here’s my latest coverage on Snowflake from earlier this week:

- Snowflake Stock: Don’t Speculate, Just Accumulate (Slowly)

Thank you for reading, and happy investing! Please share any questions, thoughts, and/or concerns in the comments section below or DM me.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in NFLX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why I tailored my marketplace service – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

TQI’s core idea is to generate wealth sustainably through tailored portfolio strategies that meet investor needs across different investor lifecycle stages. Each of our five model portfolios comes with thoroughly vetted investment ideas, embedded risk management, and specialized financial engineering for alpha generation.