Summary:

- The potential Qualcomm acquisition of Intel has emerged as a key upside catalyst for the stock.

- This development has prompted me to upgrade my rating from Sell to Hold.

- However, investors need to be prepared to hold the stock as a standalone company in the case of no deal.

- My view is that Intel is in a very weakened competitive position, judging by its latest inventory data.

THEPALMER

INTC stock and potential QCOM acquisition

I last covered Intel Corporation stock (NASDAQ:INTC) a bit more than one month ago. In an article entitled “Intel: Foundry Spinoff Won’t Stop Sell Pressure”, I analyzed a critical development surrounding INTC’s future: The potential spinoff of its foundry division. Overall, my outlook for this potential outlook is quite negative and my rating on the stock was a Sell for the following considerations:

Finding a suitable buyer at a reasonable price seems to me unlikely under current conditions. Even if the spinoff materializes, it’s only a way to cut losses. I expect the company to continue to have trouble competing with fabless rivals such as ADM and NVDA.

Since that writing, another key catalyst started brewing and kept developing: The potential for QUALCOMM Incorporated (QCOM) to acquire INTC. At this point, my view is that this catalyst has materialized sufficiently to a degree that calls for a reexamination of the stock. More specifically, according to the following Wall Street Journal report:

WSJ report (Sept. 20, 2024): Qualcomm approached Intel about a takeover. Chip giant Qualcomm made a takeover approach to rival Intel in recent days, according to people familiar with the matter, in what would be one of the largest and most consequential deals in recent years.

At that time, a deal was a very remote possibility and there were not too many specifics in the report in my view. However, QCOM has kept pursuing this ideal since then. According to a more recent report from Seeking Alpha, over the past month, QCOM has contacted Chinese antitrust regulators about this potential deal and plans to wait until after the US presidential election before it decides whether to make an offer or not. Given that the election is coming up in a month, I think an acquisition by QCOM has become a possibility that investors need to include in their INTC consideration. If an acquisition does materialize, I think most likely the acquisition will be at a premium over the market stock price, thus offering an opportunity for a sizable gain in the near term for potential investors.

However, there’s always the chance of no deal. As such, potential investors also need to consider if the stock is worth holding in the long term as a standalone business. My view here is quite gloomy, and I will elaborate more on INTC’s competitive position based on its latest inventory data in the next section.

Given the above two potential outcomes, I am upgrading my rating from Sell to Hold. In a nutshell, the QCOM acquisition potential has provided a key upside catalyst not considered in my earlier thesis. This potential helps to counterbalance the negatives surrounding INTC as a standalone company.

INTC stock: Latest inventory data reveal competitive pressure

Readers following my writing know that my investment approach is heavily influenced by the thinking of Peter Lynch. I especially benefited from his wisdom on picking turnaround stocks and also on the use of inventory data. Thus, in the case of INTC, I feel Lynch’s wisdom is doubly relevant. For example, I found his following insights on inventory very timely for INTC under the current conditions:

To start, unlike many other financial data that are more open to interpretation, inventory is one of the less ambiguous financial data. Lynch also explained why inventory levels can be a telltale sign of business cycles. Especially for cyclical businesses, inventory buildup is a warning sign, which indicates the company (or sector) might be overproducing while the demand is already softening. Conversely, depleting inventory is a sign of strong demand.

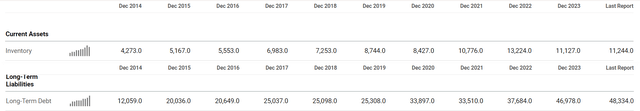

As you can see from its latest balance sheet below, there has been a general upward trend in INTC’s inventory levels in the past. For instance, in December 2014, inventory stood at $4,273M, while by the latest report, it had increased to $11,244M. Of course, a growing inventory could be a positive sign that suggests a growing business with growing demand and growing production capacity (which was the case for INTC in the first half of the past decade).

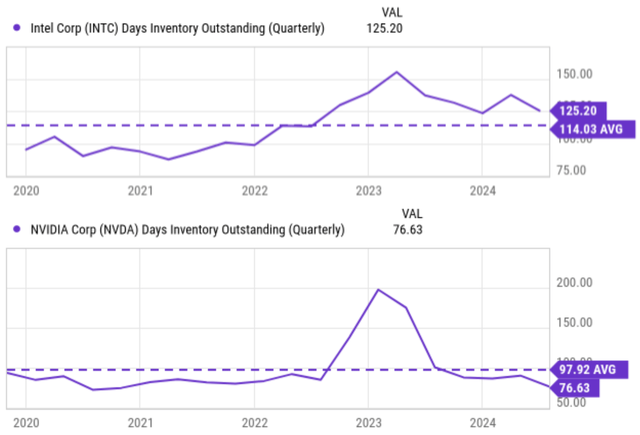

However, inventory growth becomes a cause for concern if it outpaces the growth of the business. In this case, growing inventory becomes a sign of weakened competitiveness and market positioning – which is the situation facing INTC now, in my view. The next chart below helps to illustrate my argument. This chart shows a comparison of days of inventory outstanding (“DIO”) INTC and NVIDIA Corporation (NVDA) in the past five years from 2020 to 2024. DIO is a metric that measures the average number of days it takes a company to sell its inventory.

As seen, both for INTC and NVDA, their DIO has fluctuated quite dramatically over the years. In particular, both companies suffered a large surge in 2023 in the wake of the COVID-19 pandemic, due to disrupted global logistics. With the aftermath of the disruption fading, both companies have enjoyed a recovery (i.e., decline) in their DIO. However, the contrast in the degree of recovery is stark. As seen, INTC’s reached a peak of over 150 days in 2023. INTC has managed to reduce the DIO to the current 125 days, a moderate reduction. The current level is still noticeably above its historical average of 114 days. In contrast, NVDA’s DIO surged to a peak of over 200 days in 2023. Then it rapidly declined to the current level of 76 days only, not only below its four-year average of 97.9 days but also near the lowest levels in at least four years as seen. Looking ahead, I anticipate INTC to face more competitive pressure as rivals like NVDA and AMD ramp up their next-generation chips (especially NVDA’s Blackwell chips). I urge potential investors to closely monitor the inventory data as a sign of the competitive dynamics for the reasons mentioned here.

INTC stock: Valuation

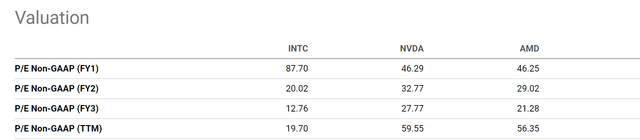

Given the inventory buildup at INTC and its weakened competitive position, I find it difficult to justify INTC’s current valuation multiples. More specifically, the provided chart presents a comparison of the P/E ratios for INTC, NVDA, and AMD. Here I want to focus on the comparison based on non-GAAP earnings estimates for fiscal years FY1 through FY3. As seen, for FY1, INTC is currently trading with the highest P/E ratio of 87.7, almost double the multiples of NVDA and AMD (which are at 46.29 and 46.25, respectively).

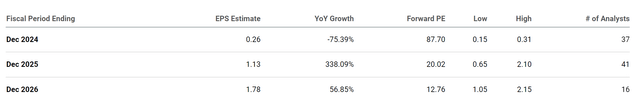

Admittedly, the picture changes somewhat when looking at subsequent years further down the road. For example, in FY2, NVDA’s implied P/E ratio is expected to be the highest at 32.77, vs. INTC’s 20.02 and AMD’s 29.02. However, I want to point out the huge variation in INTC’s earnings uncertainty going forward. As you can see from the next chart below, consensus estimates for INTC’s EPS in FY 2024 vary from a low of $0.15 to a high of $0.31 (i.e., by more than twofold) and vary from a low of $0.65 to a high of $2.1 (i.e., by almost fourfold). Given such large uncertainties, I don’t think investors should place too much weight on the FWD P/E ratio too far into the future.

Other risks and final thoughts

Besides the inventory issues and valuation risks, INTC faces a few more specific risks additionally. Current INTC’s product lineup has a large exposure to certain product segments (such as PC) which are facing potential market saturation, in my view. INTC also derives a large portion of its sales from China. With the trade tension between the U.S. and China, its China exposure represents a large geopolitical risk. These factors could limit INTC’s ability to adapt to technological advancements and changing geopolitical dynamics.

To recap, compared to the conditions in my last writing, the potential of a QCOM acquisition is a new key upside catalyst. My view on the business itself remains gloomy judging by the latest inventory data. However, the acquisition catalyst offsets the downsides to a degree, thus leading to an upgraded rating of Hold from my earlier Sell rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.