Summary:

- I am downgrading Palantir Technologies stock to Strong Sell due to its extreme overvaluation at $42 per share, driven by AI-related excitement.

- Palantir’s software and database design business is now more overvalued than chip-maker NVIDIA, after weighing higher financial ratios vs. much slower operating growth rates.

- 135x trailing cash-adjusted earnings and 40x sales is too rich for me.

- I now crown Palantir as the most overhyped AI stock in the large-cap sector, with business growth failing to keep pace with stock price gains.

drbimages/E+ via Getty Images

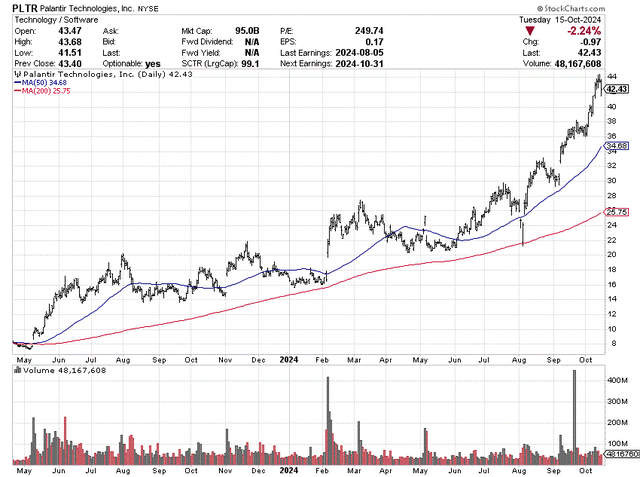

I have not been bullish on Palantir Technologies Inc. (NYSE:PLTR) since the low $20s were reached about a year ago for a share price. My last article discussing valuation issues was published in June here. Fortunately for shareholders, bubbles grow in size until they pop.

Never mind common sense, the valuation and quote have continued to balloon on AI-related excitement. In fact, I now place this stock above NVIDIA (NVDA) for holding the greatest overvaluation vs. likely operating outcomes during 2025-26.

If you will, Palantir may have morphed into the “most” overhyped of all AI names since the summer in the large-cap Big Tech area of the U.S. stock market at $42 per share. As a consequence, I am downgrading my 12-month view to Strong Sell.

StockCharts.com – Palantir, 18 Months of Daily Price & Volume Changes YCharts – Palantir vs. NVIDIA, Total Returns, Since May 8th, 2023

The Business

While NVIDIA makes the basic high-speed computer chips for artificial intelligence datacenters, Palantir is a leading software and database designer for businesses and governments. The bullish argument is massive EPS growth is around the corner on higher profit margins and better returns on equity/assets than even NVIDIA. I am not completely sold on the idea. However, speculative fever what it is, has taken hold and decided PLTR is a must-own for growth portfolios.

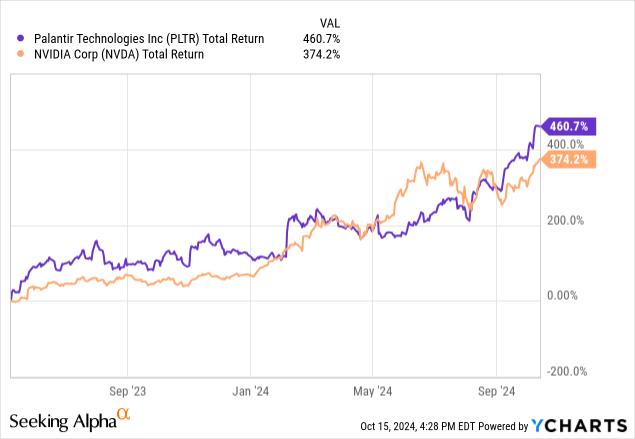

Palantir Website Homepage – Software Awards and Top Rankings, October 15th, 2024

For sure, growth rates have been above average vs. other businesses in America. Yet, in my humble opinion, 20% to 30% annual income increases are not the “amazing” growth story to deserve a valuation of better than 135x trailing after-tax cash earnings (250x GAAP results).

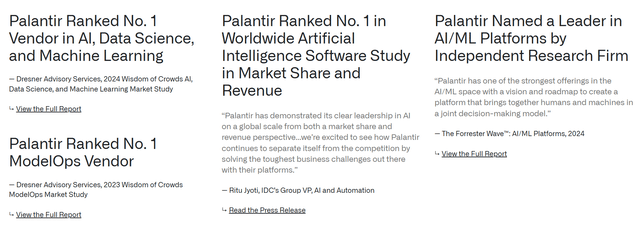

Palantir – Q2 2024 Growth Rate Table

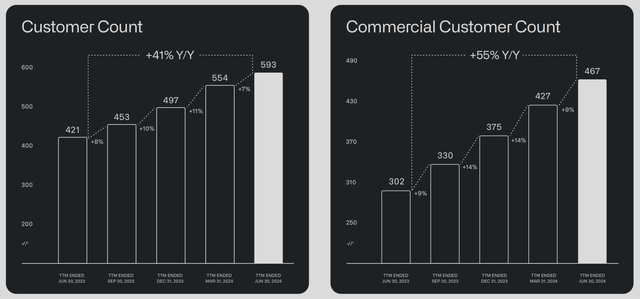

The Q2 Earnings Presentation highlighted lots of good news in terms of new customer additions, rising sales, and much improved income generation. I don’t have anything bearish to say about operations or management. The problem is what investors are paying upfront to own a piece of the business.

Palantir – Q2 2024 Earnings Presentation, Customer Testimonials Palantir – Q2 2024 Earnings Presentation, Customer Growth

Palantir – Q2 2024 Earnings Presentation, Guidance

Bubble Valuation Story

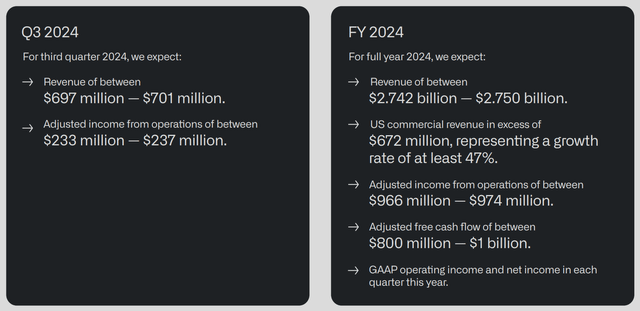

In the olden days before the internet took off during the early 1990s, growth-stock valuations were typically considered high at 10x “trailing” sales and 50x EPS. However, the AI darlings of today (huge corporations, mind you), are priced well outside of this usual box. Believe it or not, the Palantir share price to sales ratio on the latest 12-month operating total is 40x, while the standard valuation comparison on GAAP earnings is a whopping 250x!

YCharts – Palantir, Price to Trailing Earnings & Sales, Since May 2023

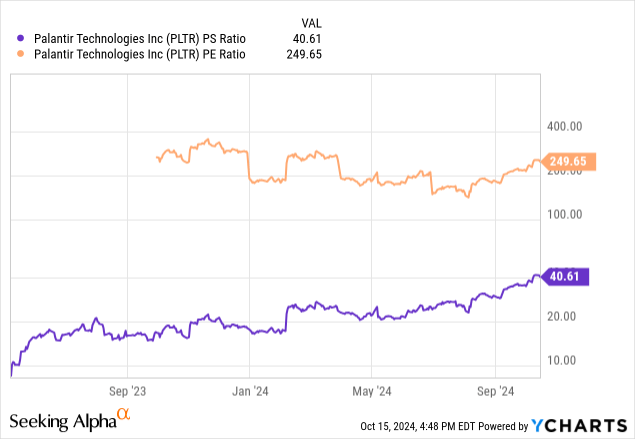

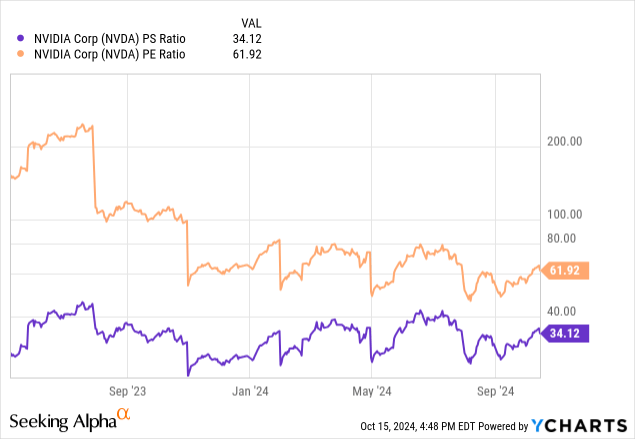

NVIDIA’s setup is much cheaper on these traditional yardsticks of equity worth. A valuation of 34x trailing sales and 62x earnings is still crazy high, especially for a company with a $3 trillion market capitalization. However, it makes stronger mathematical sense than Palantir’s lower growth-rate background.

YCharts – NVIDIA, Price to Trailing Earnings & Sales, Since May 2023

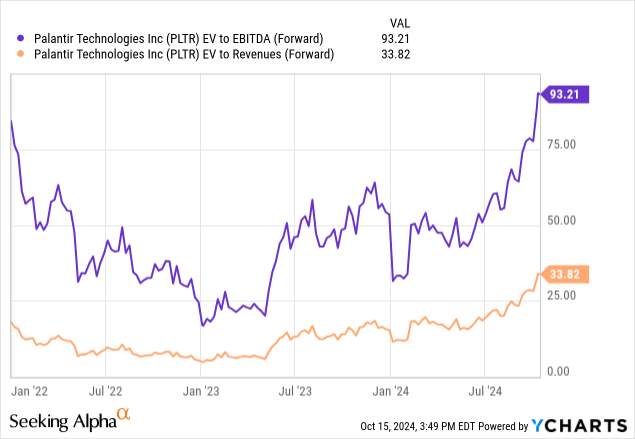

Other eye-popping valuation datasets for Palantir include an enterprise valuation (equity + debt – cash) on “forward” sales of 33x and EBITDA of 93x.

YCharts – Palantir, EV to EBITDA & Revenues, Since January 2022

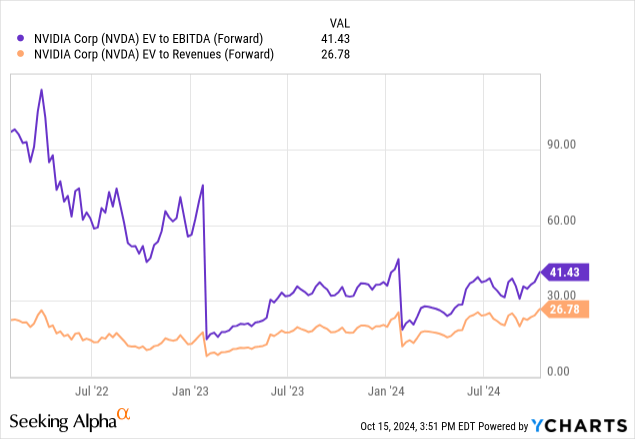

In fact, NVIDIA is again valued far cheaper using enterprise valuation ratio analysis, sitting at an EV to forward revenue number of 27x and EBITDA of 41x.

YCharts – NVIDIA, EV to EBITDA & Revenues, Since January 2022

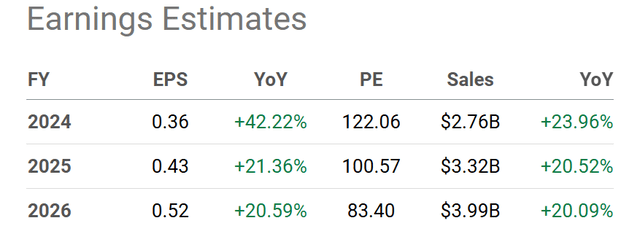

Really, for me, the problem lies in the growth forecast for Palantir. It is excellent, but not overly stupendous. If sales were expanding 30%+ annually, and earnings closer to 50% per annum, you could make a reasonable case for the current valuation stats. But, Wall Street analysts are projecting closer to 20% sales growth yearly, alongside a similar EPS rate of expansion after 2024 is complete.

Seeking Alpha Table – Palantir, Wall Street Analyst Estimates for 2024-26, Made October 14th, 2024

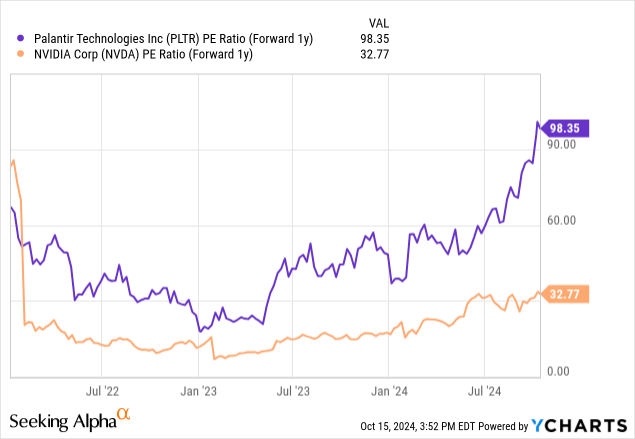

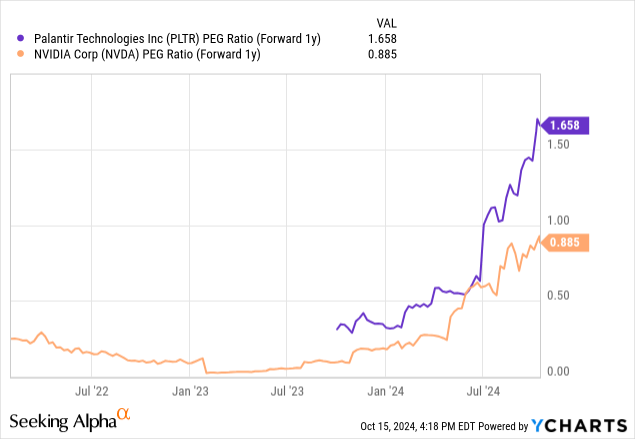

This is what forward 1-year guidance looks like for the two AI winners, using a P/E ratio measurement. Given current 2025 estimates, Palantir is valued at 3x the equivalent metric for NVIDIA (98x vs. 33x)!

YCharts – Palantir vs. NVIDIA, Price to Forward 1-Year Earnings Estimates, Since January 2022

Then, when we cross Palantir’s greater valuation setup with a slower expected growth rate for earnings, forward PEG Ratio comparisons (price to earnings divided by earnings growth rate) tell investors exactly what they need to know. The bottom line is, new buyers are paying TWICE the growth-adjusted valuation for Palantir as NVIDIA (which itself is a Sell idea in my research). This is a far cry from the nearly equal setup in June.

YCharts – Palantir vs. NVIDIA, Forward 1-Year PEG Ratio, Since January 2022

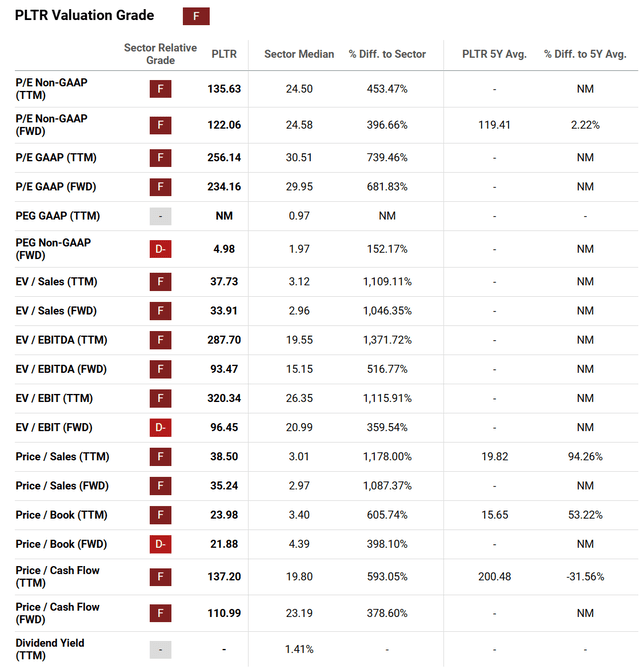

Don’t trust what I am saying? Seeking Alpha’s Quant Rating system gives PLTR shares an “F” for a Valuation Grade. At this stage of nuttiness, I would give it an “F-” if possible.

Palantir’s valuation stats are screaming this stock’s price future is too good to be true. We’re talking about “overvaluation” datapoints in the 100s to 1,000s of a percent higher vs. regular computer software and SaaS businesses.

Seeking Alpha Table – Palantir, Quant Valuation Grade, October 15th, 2024

Final Thoughts

With $4 billion in cash and no debt, you would think the company has a terrific backstop for shareholder worth on the balance sheet. Yes and No. Against $97 billion in equity market capitalization, you are only getting 5 cents on the dollar in equivalent cash holdings.

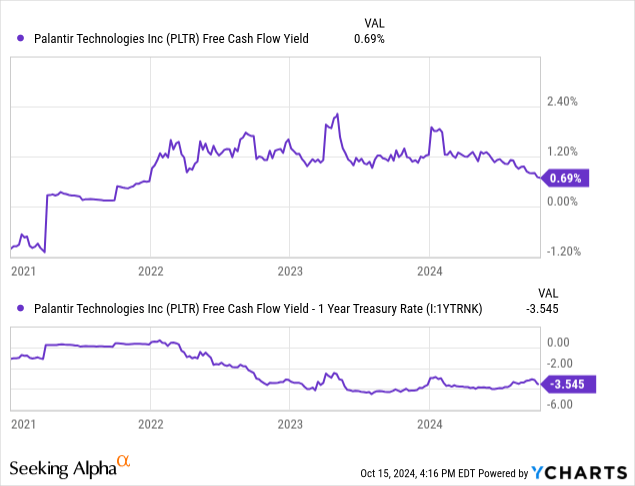

In addition, roughly $700 million in trailing free cash flow generation ($800 million to $1 billion on forward management guidance) annually sounds like something to cheer. Not so fast. It only creates a free cash flow yield of 0.7% for owners! Why not just invest in T-Bills yielding 4.5% annually, with zero risk to your upfront investment? At a theoretical 20% long-term EPS growth rate, it will take a full decade (10 years) just to match the risk-free cash yields available today! At 25%, it would take eight years. And with no dividend yield from Palantir, you may lose out on 40% to 45% (with compounding) in cash dividend gains owning Treasuries as an alternative.

YCharts – Palantir FCF Yield vs. 1-Year Treasury Rate, Since 2021

However you slice it, the free cash flow “goal” of owning any business looks closer to a total failure in mathematical terms for Palantir shareholders. One of my valuation imperatives is to own a business with high free cash flow yield, definitely better than prevailing cash investment yields.

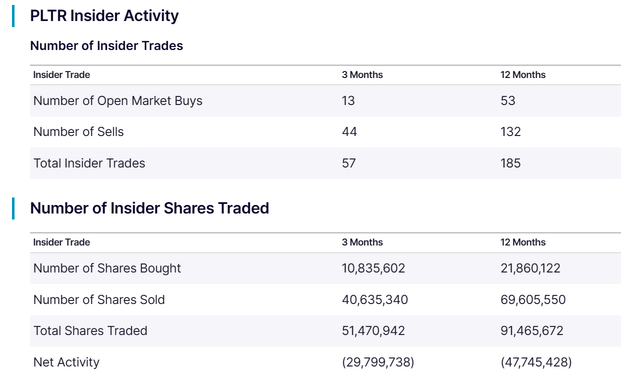

Insider/management sales have also been increasing in 2024, from the likes of Co-Founder Peter Thiel and CEO/Founder Alex Karp. Around $1.5 billion in net value has been sold over the past 12 months.

Nasdaq.com – Palantir, Insider Trading Activity, 12 Months

Like other Big Tech names in October 2024, those committing capital to PLTR today are counting on the Greater Fool Theory of new investors coming to the rescue to bid the quote ever higher, with little underlying value supporting your buy decision at $42. You are counting on the boom in AI equities growing even larger. You are betting valuations no longer matter for investment decision making, where the fear of missing out (FOMO) on stock appreciation overrides all rational analysis. It’s the same thought process, part and parcel of every bubble situation.

What could save the stock quote from falling hard soon? I would say growth rates have to pick up for sales and earnings. Huge expansion at NVIDIA has helped the stock quote to double and triple, despite a super-extended valuation a year ago. If Palantir growth rates at the operating business expand from the 20% to 30% YoY range above 40%+ in coming quarters, I can see the share price trading between $35 and $50 in 2025.

How can Palantir achieve stronger growth rates? Management understands it must expand its customer base from mostly government entities to big business to accelerate growth. Palantir’s AI Bootcamps are an interesting sales angle in this regard. Thousands of companies have taken a look at what Palantir’s database experience and software code can do to help efficiency and profit levels. So, closely watch the level of sales outside of U.S. government accounts (representing about 50% of sales), including the number of new clients/customers brought to the table in the Q3 earnings release due November 4th, 2024.

The flip side of this equation is growth rates could just as easily stall in a recession scenario. What if future growth rates are being overstated? What if Palantir actually only grows 15% a year? With today’s massive overvaluation, there would be hell to pay. A stock implosion to $20 or even $15 would be quite easy, as investors rerate the stock with a more typical and sustainable technology valuation.

So, you have a risk-reward balance of potentially gaining +15% to +20% for an investment return, offset by -50% to -65% of theoretical downside. My conclusion: outside of a “Goldilocks” scenario for both the economy and AI leaders (including a strengthening economy with sliding inflation/interest rates), I am projecting Palantir will be an oversized investment loser over the next 12 months.

I am moving my PLTR rating from Sell to Strong Sell. When the AI bust appears (and it will eventually), I believe Palantir will be a leader to the downside. If price trades back to $20, we can reevaluate the investment picture and outlook.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.