Summary:

- I cautiously upgraded Advanced Micro Devices, Inc. to “Buy” due to its strong Q2 results, including a 9% YoY revenue increase and an 18% rise in non-GAAP EPS.

- AMD’s data center segment saw a 115% YoY revenue surge, driven by Instinct MI300 GPUs and EPYC CPUs, positioning it well for future growth.

- Despite challenges in gaming and embedded segments, AMD’s focus on AI and data center expansion, including the Silo AI acquisition, supports long-term growth.

- My updated DCF valuation model indicates AMD is undervalued by nearly 15%, making it an attractive investment opportunity at this time.

JHVEPhoto

Intro & Thesis

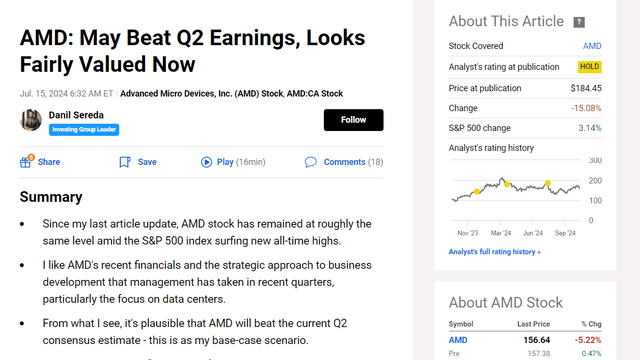

After first writing about Advanced Micro Devices, Inc. (NASDAQ:AMD) stock with a “Sell” rating in August 2023, I admitted my mistake later that year (December 2023) and upgraded AMD to “Neutral.” In March 2024, I updated this rating, noting that the stock would need to fall further before becoming truly attractive to me. In my most recent article published in July, I reiterated my “Hold” thesis based on my observations that AMD appeared to be fairly valued rather than undervalued at the time after the off-high dip we witnessed. The stock needed to go lower to become attractive. I argued that the firm had great chances of beating consensus estimates — and it did beat them — but the stock price started to adjust lower, now being 15% lower compared to the price at which I updated my rating.

Seeking Alpha, my previous article on AMD

After updating my models and considering the key data from the latest earnings report, I have decided to cautiously upgrade AMD to “Buy” this time.

Why Do I Think So?

First off, let me cite the findings of my previous article:

According to my findings, the company has a good chance of beating current Q2 consensus estimates, as expectations haven’t risen significantly in recent months and are closely in line with management’s guidance. Given the increasing demand for AI and chips, AMD is likely to exceed expectations. However, with a slightly more optimistic assumption for my updated DCF model, AMD appears to be fairly valued rather than undervalued, which is disappointing. Despite my initial inclination to upgrade and despite the numerous growth prospects, I feel compelled to maintain a neutral rating for now. I look forward to AMD’s second quarter results to confirm these views.

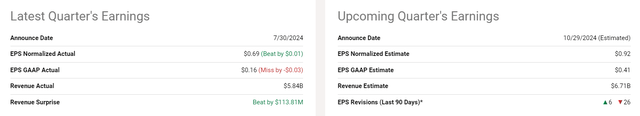

As it turned out, when AMD reported for its fiscal Q2 on July 30, 2024, my expectations regarding an earnings beat came true on both the revenue and EPS sides.

The firm’s revenue of $5.84 billion marked a 9% YoY increase (+7% QoQ rise), primarily driven by strong sales of AMD’s Instinct, Ryzen, and EPYC processors, which are increasingly being adopted by leading cloud and enterprise providers, the press release clarified. The company’s non-GAAP EPS rose to $0.69 (up 18% YoY), reflecting the company’s strategic focus on expanding its AI capabilities and data center offerings, which should bring higher margins for the consolidated business. Unfortunately for AMD investors, the stock didn’t get a sufficient post-earnings boost as Wall Street analysts mostly downgraded their expectations for Q3 FY2024:

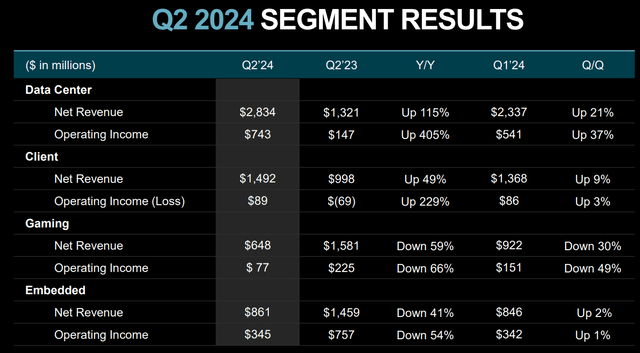

Before getting to the management’s comments on the near future, I propose to take a more detailed look at the segment performance for the second quarter.

As you might guess, AMD’s Data Center segment was a standout performer, with revenue soaring 115% YoY to a record $2.83 billion, accounting for nearly half of AMD’s total revenue to date, which is significantly more than even a year ago. This surge was fueled by “a significant increase in shipments of the Instinct MI300 GPUs and a strong double-digit growth in EPYC CPU sales.” The data center segment’s EBIT also saw a dramatic increase, rising more than fivefold from the previous year to $743 million, driven by higher top line and improved operating leverage. AMD’s data center products are gaining traction as hyperscalers like Microsoft (MSFT) and Google (GOOGL) (GOOG) increasingly deploy AMD’s 4th-generation EPYC CPUs. I believe it’s likely to continue in the foreseeable future. AMD seems to be poised to capitalize on a significant opportunity in the AI accelerator market due to a shortage of Nvidia’s (NVDA) Blackwell GPUs, which are sold out for the next year. This is the take I recently read in The Asian Investor’s article (another Seeking Alpha analyst). The Asian Investor wrote that AMD’s new AI accelerator (the Instinct MI325X) and also the upcoming Instinct MI350 series are going to drive significant growth in the firm’s Data Center business, which is already growing like crazy, saw a 115%. I can’t agree more, and I share my colleague’s perspective that the introduction of high-margin AI GPUs will likely enhance AMD’s gross margins, potentially pushing them into the mid-50% range, up from 49% last quarter.

Anyway, let’s get back to the factual segment data. In the client segment, AMD’s revenue climbed 49% YoY to $1.49 billion, driven by “strong demand for Ryzen processors and initial shipments of next-generation Zen 5 processors.” This segment returned to profitability with an operating income of $89 million, compared to a loss in the same quarter last year. As we can see, the introduction of Ryzen AI 3000 series processors, which enhance AI capabilities in PCs, has been well-received by the client market, pointing to further strengthening of sales in this area.

However, the gaming and embedded segments faced challenges: It declined 59% YoY to $648 million, primarily due to “a slowdown in semi-custom SoC sales as the console cycle matures.” Despite this, there was an uptick in sales of Radeon 6000 and 7000 series GPUs, so maybe the bad cyclicality is coming to an end soon.

The Embedded segment also saw a 41% drop in revenue to $861 million, as customers continued to adjust their inventory levels; nevertheless, AMD seems to be optimistic about a gradual recovery in embedded revenue in the latter half of the year, supported by strong design win momentum.

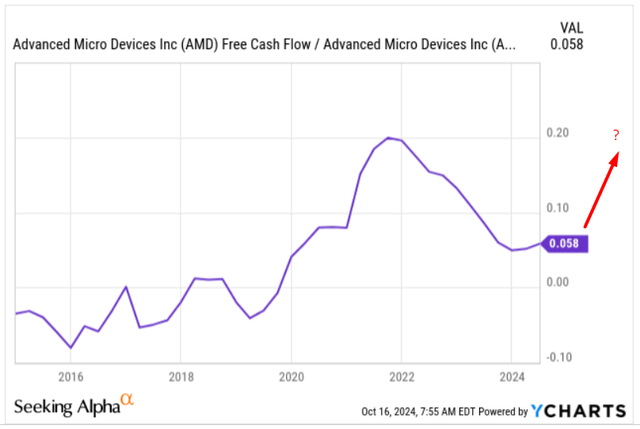

AMD’s segment performance, IR materials

On the balance sheet, we saw that AMD ended the quarter with $5.3 billion in cash and equivalents, after repurchasing $352 million worth of shares and retiring $750 million in debt. Total debt was $1.72 billion as of the end of 2Q FY2024. AMD managed to generate ~$593 million in cash from operations, with free cash flow amounting to $439 million — and that’s amid the inventory levels increasing “to support the ramp-up of data center GPU products,” so the true potential of AMD’s FCF generation capacity should have been even stronger. Now AMD’s FCF is standing at almost 6%, which is not bad but isn’t perfect either — anyway, I expect that as the data center revenue share becomes greater, this metric should climb higher.

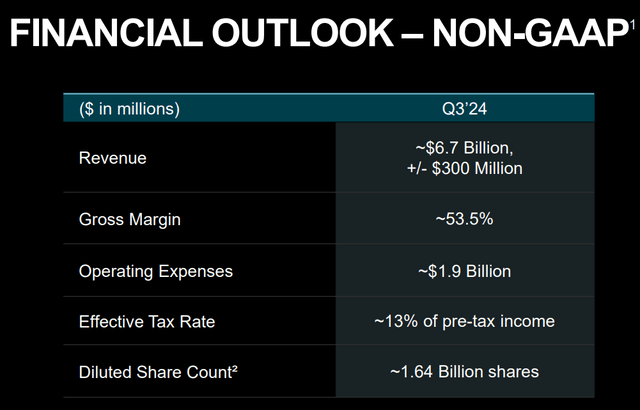

Now a few words on the forwarding guidance from the management. As I can see from the latest earnings call commentary, AMD’s executives sound optimistic about the growth prospects — again, particularly in the data center and client segments. There, they are expecting Q3 FY2024 sales to be ~$6.7 billion, driven by continued strength in these two areas. AMD is also expanding its AI capabilities, with plans to launch the MI325X accelerator later this year and the MI350 series in 2025 (which is what I mentioned above already) — which promises a significant performance boost over current offerings. The battle against NVDA will look more competitive in 1–2 years — in AMD’s favor if you ask me, as they’ll have a lower starting point.

Furthermore, the recent acquisition of Silo AI — Europe’s largest private AI lab — should enhance AMD’s AI capabilities and support its long-term growth strategy. Few people are writing about it, but it’s important to know that these guys from Silo have served big customers like Allianz, Philips, Rolls-Royce and Unilever. Since they’re controlled by AMD, I think they’ll expand their customer base and help AMD penetrate data centers even faster.

Overall, I view AMD’s strong second-quarter results as quite successful, as the execution of the company’s strategic initiatives in the data center and AI markets continues to progress smoothly. While challenges remain in the gaming and embedded segments, the company is well positioned for future growth through its focus on innovation and expanding its product portfolio. It has a robust pipeline of new products and strategic investments in AI, so I believe AMD shall be positioned to deliver significant revenue growth and margin expansion in the coming years.

Now let’s talk about AMD’s valuation — I’m going to use a classical DCF method to find the stock’s fair value.

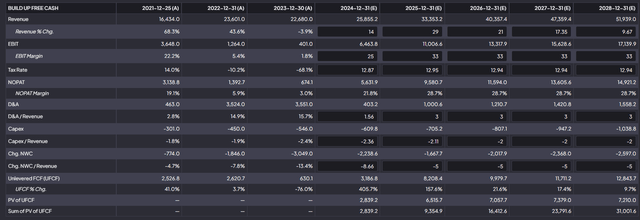

As last time, I take the current consensus revenue forecasts (which are now slightly different from those I used last time) and add a growth premium of about 1% annually. This is in line with the relatively consistent history of AMD surpassing the market expectations to the upside recently. Moreover, I still expect AMD’s EBIT margin to gradually reach 33% in FY2025 and remain constant until the last forecast year (FY2028). I suggest assuming that D&A accounts for ~3% of the company’s revenue in all forecast years; in my view, AMD’s CapEx should increase, but this growth will also be fully offset by sales growth, so CAPEX-to-sales will have to remain at about the current level of 2%. Here are my key operating model assumptions:

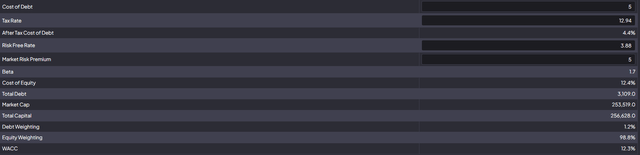

I propose assuming a potential cost of debt of 5% for AMD, as the risk-free rate is now ~3.88%, so there should be a reasonable market spread. Assessing an MRP of 5% and considering AMD’s tax rate of ~13%, we arrive at a WACC of ~12.6%. While this may seem a little high, it’s ~30 bps lower than I had in my previous model, and I think it represents a conservative approach and ensures that my model reflects reality more closely.

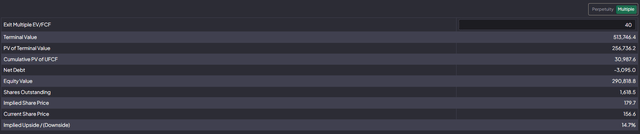

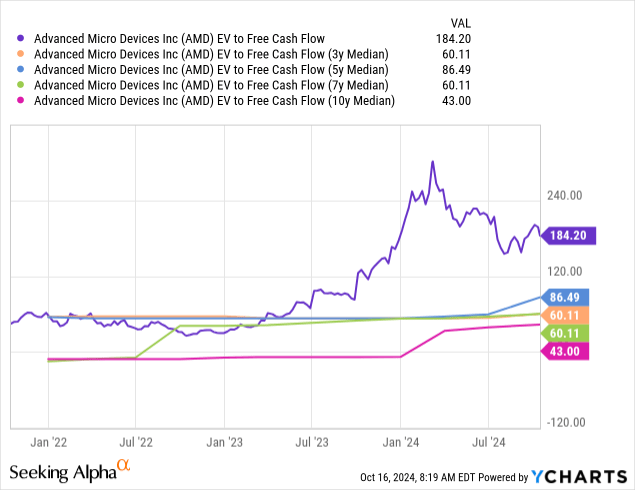

As my DCF models utilize the EV/FCF ratio rather than the traditional EV/EBITDA for terminal value calculation, it brings some modeling difficulties. Currently, AMD’s EV/FCF ratio is around 184x, which is well above the 10-year median of ~43x. I’ll take that long-term historical median and adjust it slightly lower — to around 40x, which I think shall be a reasonable assumption considering the business maturity in 5 years from now.

As a result, I get an output saying that AMD is undervalued by almost 15% after its prolonged dip:

Based on all that, I cautiously decided to upgrade AMD stock to “Buy” today.

Where Can I Be Wrong?

I should say that I recognize that my bullish view about AMD’s prospects could be overly influenced by recent positives (the launch of new AI accelerators and the strategic acquisition of Silo AI, among other things). While these factors certainly bolster AMD’s position in the data center and AI markets, I might be underestimating the competitive pressures from Nvidia and other players, who are also aggressively expanding their AI capabilities.

My assumption that AMD will continue to gain market share and improve its margins might not fully account for potential setbacks, such as supply chain disruptions or technological challenges that could hinder the rollout of new products.

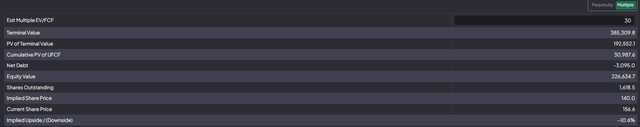

Additionally, my valuation approach, which relies heavily on a simple DCF model, may turn out to be overly optimistic. My assumptions about AMD’s future revenue growth and margin expansion are based on the current market trends/expectations, which are far from certain in reality when we try to forecast them for the next few years. Take a look at my assumption regarding the EV/FCF ratio for terminal value calculation — if only it goes down from 40x to 30x, the stock will get overvalued:

Also, it’s important to keep in mind, that the tech and semis industry is notoriously volatile, so any unforeseen changes in consumer demand, the regulatory environment, or macro conditions could adversely affect AMD’s prospective financials. So my expectation of a 33% EBIT margin by FY2025 may be too aggressive as well, especially if AMD faces increased costs or competitive pricing pressures that could theoretically erode marginality.

Finally, my decision to upgrade AMD to “Buy” this time may be premature given the broader market context. I mean that while AMD’s recent earnings growth and strategic initiatives are promising, the stock’s valuation still reflects significant expectations for future growth. Thus, in case the market sentiment changes or AMD fails to meet these high expectations, the stock could come under downward pressure.

The Bottom Line

Despite the above-mentioned risks, my main takeaway today is that Advanced Micro Devices presents a promising investment opportunity, driven by its strong performance in the data center and AI markets. After initially rating the stock as “Sell” and later “Neutral,” I’ve now upgraded AMD to “Buy” based on its impressive fiscal Q2 results, which saw a 9% YoY revenue increase and an 18% rise in non-GAAP EPS with a considerable shift to data center sales. The company’s strategic focus on expanding its AI capabilities and data center offerings, highlighted by the success of its Instinct, Ryzen, and EPYC processors, positions it well for future growth, in my view.

Despite challenges in the gaming and embedded segments, AMD’s robust pipeline of new products and strategic investments, such as the acquisition of Silo AI, support its long-term growth strategy. At the same time, my updated DCF valuation model suggests that AMD is undervalued by nearly 15%, making it an attractive “Buy” at this time.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMD over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!