Summary:

- Intel’s shares have plummeted over 57% in five years, underperforming the market and risking its spot in the Dow 30 index.

- INTC’s business struggles include revenue growth issues, falling margins, and significant cash burn, with hopes pinned on a 2025 recovery.

- As Intel’s bottom weight in the Dow continues lower, the index which is becoming a little more top heavy could decide to change things up.

Lighthouse Films

One of the worst performing names in recent years has been Intel (NASDAQ:INTC). The chip giant has seen its shares lose more than 57% over the past five years, significantly underperforming US markets that continue to hit new highs. As the company continues to work on a major turnaround, its business and stock price struggles may result in the name losing its spot in a major US index.

Previous coverage of the name

It was back in August that I last took a look at Intel, a little after the company reported disastrous Q2 results. Not only did the company miss estimates for the reporting period, but it gave much weaker guidance for Q3 and announced a major restructuring plan. Shares fell to multi-year lows on the news, as investors questioned whether management could finally get this ongoing turnaround headed in the right direction.

At that time, I was a bit neutral on Intel shares. I thought the restructuring would help in the long run, but near term results were certainly disappointing. As the valuation looked a bit depressed when looking towards 2025, I didn’t think investors should short the name, but I wasn’t ready to buy in yet either. Since that previous article, Intel shares have returned around 10%, but that’s underperformed the S&P 500 by a couple of percentage points.

Intel’s place in the Dow seems shaky

The Dow Jones Industrial Average contains 30 companies, excluding those in the transportation and utilities sector, which are considered to be the most important names on the NYSE and NASDAQ. Many people consider the index’s representation to be a good barometer of the US economy, given how much influence its representation has. Unlike a number of indexes that are based on a company’s market cap, the Dow is price weighted, meaning a stock trading at $200 per share would have double the influence of a stock at $100 per share.

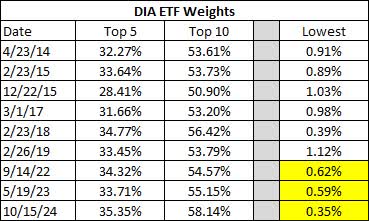

I’ve looked at the Dow’s composition and some of its changes in the past (for example, here and here). At times, the index has simply swapped in new names to replace ones that had very low weights, while at other points things changed due to stock splits or business transactions. We are certainly at an interesting point currently, given how the Dow 30 looks now. In the table below, you can see how certain weightings have changed, using the SPDR Dow Jones Industrial Average ETF Trust (DIA). The table shows the combined weight of the top 5 and 10 holdings at that time, along with the lowest weight in the index. The yellow highlighted cells represent when Intel was the lowest weight.

Dow 30 Weights (DIA Website)

While the dates above are certainly random, the top 5 and 10 both represent their highest combined weights at the points that I’ve tracked them. Based on early Wednesday trading, the top 5 weight has increased a little more, while Intel is heading further lower. Also, Intel’s current weight is the lowest of the low weight points, with the stock only being a little more than half of the next smallest component, which was around 0.67% as of Tuesday.

Intel’s fall from grace

Once the darling of the semiconductor space, Intel’s business struggles have taken their toll in recent years. Revenue growth troubles and falling margins have led to large losses, while significant capital expenditures have helped fuel quite a bit of cash burn. Investors are hoping that 2025 can finally be the first of the rebound years, but there were beliefs that this year could have shown promise too, and that hasn’t worked out so far.

In recent quarters, Intel has been passed on revenues by Nvidia (NVDA), which has seen its Data Center business boom on prospects for an artificial intelligence revolution. In fact, competitor Advanced Micro Devices (AMD), which still only does a fraction of the revenue that Intel does, now has a market cap that is more than 2.5 times that of Intel. In terms of the semis, Intel has fallen to just the 8th largest holding in the iShares Semiconductor ETF (SOXX), and it’s not that far away from falling out of the top ten entirely.

The upcoming Q3 report

Intel will report its quarterly results on Halloween, October 31st, after the bell. Analysts are looking for revenues of just over $13 billion, or a nearly 8% decline from the year ago period. On the bottom line, the street expects an adjusted loss of 3 cents per share, a dramatic shift from the 41 cent per share profit reported in Q3 2023. When it comes to the current quarter, the street is looking for $13.68 billion on the top line, a more than 11% decline, with a more than 85% plunge in adjusted earnings to 8 cents per share.

There are three keys that I’m watching. First, management needs to prove that these revenue declines are ending in Q4, as the street currently expects. I don’t think management will give explicit guidance for next year, but perhaps they could at least provide some color that will give investors an idea of how things are looking for early 2025. Intel needs to get its Data Center group going, which showed a revenue decline in Q2 2024 while Nvidia grew by leaps and bounds.

The second item is gross margins, which have been compressed with declining revenues and need to recover in the medium term. The ongoing restructuring plan will help quite a bit with operating expenses, but the cost of goods sold is the largest expense Intel has each period. Intel’s plan to launch several new nodes over a period of years is important to getting margins back on track, and longer-term revenue troubles can always lead to excess inventory and then product discounting.

Finally, any color we see on how cash flow trends are looking, and whether or not Intel will need to raise capital in the coming quarters due to future cash burn. Getting back to positive cash flow on a yearly basis can definitely improve sentiment in the name. The recent struggles have put Intel into a net debt position of about $18 billion, a headwind that competitors like AMD and Nvidia don’t have to deal with currently.

A look at current valuations

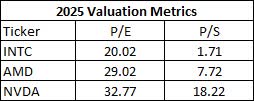

The decline this year has put Intel shares at a valuation that makes them look like a depressed asset in this space. Since we’re almost all of the way through 2024, and now next year is expected to be the first major recovery for Intel revenue and earnings, I wanted to take a look at valuations based on each company’s next fiscal year. For Intel and AMD, that’s December 2025, with Nvidia’s next fiscal period ending in January 2026.

2025 Valuation Metrics (Seeking Alpha)

All three names have rallied since my previous article, so for instance, Intel’s 2025 P/E has jumped by more than 3.5 points. Of course, the current average estimate for Intel’s non-GAAP earnings assumes that Intel will see more than 338% growth next year, albeit off a very low base from this year’s current expectation. Thus, should Intel’s 2025 estimates drop considerably like we saw with 2024 numbers, the P/E could rise exponentially, as the P/E valuation based on this year’s current average stands at nearly 88 times.

Final thoughts

With chip giant Intel’s shares plunging in recent years as the business has struggled, the stock could potentially lose its place in the Dow 30 index. There are certainly a number of larger tech names that could replace it, such as Google parent Alphabet (GOOG) (GOOGL), Meta Platforms (META), or even new chip favorite Nvidia. This would provide a little more balance in the index, being a little top-heavy at the moment, and could provide a chance to adjust the respective sector weights. Since there isn’t a lot of ETFs or mutual fund money tied to the Dow index, it wouldn’t result in a lot of Intel shares being sold right away, but the psychological impact could be more important for investors if Intel loses its blue chip status.

At the moment, I am going to leave my hold rating on the stock. This is only because the valuation isn’t that bad if you start to think about the next couple of years, should this restructuring plan actually result in Intel meeting current expectations. Perhaps the loss of a Dow 30 spot could eventually mark a long-term bottom in sentiment, but the company needs to get the business going for shares to truly head higher moving forward.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.