Summary:

- Adobe was one of my earliest investments.

- My investment case relied on its moat, high profitability and capital allocation.

- The Figma acquisition changed a lot about my perception of the company.

- I concluded several learnings from this failed investment into Adobe.

- At this point, I rate Adobe as a hold.

Kimberly White/Getty Images Entertainment

A project post-mortem, also called a project retrospective, is a process for evaluating the success (or failure) of a project’s ability to meet business goals.

Adobe Inc. (NASDAQ:ADBE) has been one of my earlier investments since October 2020 (I started investing in May 2020). Due to its monopoly-Esque market position and cash flows, I considered the company a sleep well at night (SWAN) stock, yet I sold out of the stock in late September 2022. In this article, I want to revisit this decision and reflect on what went wrong, what I could’ve seen coming and what to take away from this mistake.

Why was I invested?

I was invested in Adobe for several reasons:

- Wide Moat: The company has a wide moat due to its large digital design portfolio and workflow tools. An example is its market share in the Graphic Design Software market, according to Slintel. Adobe dominates the top 5 with the #1, #2, #3 and #5 leader for a combined 82% market share. The only competitor in the top 5 is Sketch, with a 9.68% market share.

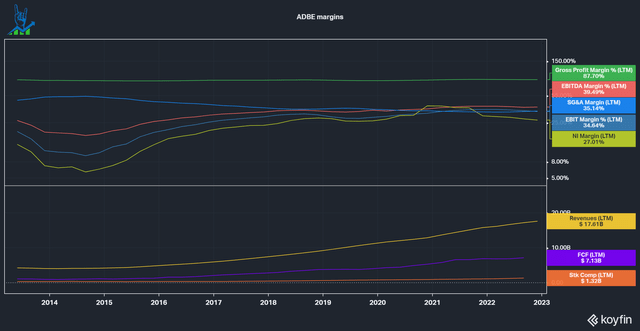

- High profitability: Due to its subscription business model, Adobe enjoys extraordinarily high margins with an 88% gross margin, 40% EBITDA margin and a 27% Net Income margin.

- Capital Allocation: The company has a good track record of deploying capital for acquisitions and buying back shares.

I went deeper into my investment thesis in my prior article.

Where did it go wrong?

Let’s now review the thesis and see where things went wrong.

Is the moat still wide?

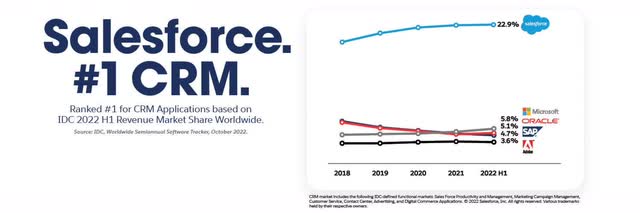

Due to its market share in its core products (digital design software), I had not kept up to date with the company and potential competition. This is evident in other parts of the business, where Adobe is not the leader, for example, the eSignature market, which is dominated by DocuSign (DOCU) with a 75% market share, according to Deloitte. Adobe is also a player in the Enterprise Software market, where they have been unable to expand their market share against competition like Salesforce (CRM).

I started to hear about companies like Figma and Canva, digital collaboration tools with very high usability and mostly usable for free, eating away market share, even in my own workplace! I shouldn’t have been complacent, seen the competition, and not valued Adobe like an unbeatable monopoly.

Will margins remain high?

Adobe has done a great job at improving its margins over the last decade and I believe that Adobe can continue to hold its margins by further decreasing its SG&A margin through efficiencies, especially in a market phase like this one.

The company might encounter margin pressures from increasing competition from competitors and even AI tools like OpenAI’s DALL-E 2, but it still has enough SG&A margin to consolidate. I did not consider Adobe’s large amount of Stock-based compensation: At $1.32 billion in the last twelve months, this accounts for 18.5% of Free cash flows and 7.5% of Revenues. Stock-based compensation is an actual cost for shareholders that is often neglected. It has recently come back into focus after Terry Smith from Fundsmith ranted about it in his annual letter.

Is the Capital Allocation actually good?

Sensible Capital Allocation was part of my original investment thesis. For Adobe, this mainly consisted of small Bolt-on acquisitions to increase its portfolio and enter new markets. In the recent past, these acquisitions were relatively small compared to Adobe’s size:

| Company name | Year | Price | Description |

| TubeMogul | 2017 | $560 million | Video Advertising platform |

| Magento | 2018 | $1.64 billion | E-Commerce Hosting platform |

| Marketo | 2018 | $4.7 billion |

B2B marketing software |

| Frame.io | 2021 | $1.275 billion | Video collaboration platform |

| ContentCal | 2021 | $1.2 billion | Social Media planning and publishing |

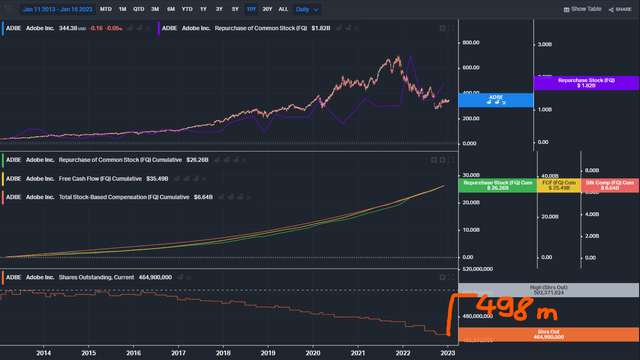

These are all acquisitions of relatively small size and paid in cash. Then in 2022, Adobe announced the acquisition of Figma, a web-first collaborative design platform, for $20 billion in cash and stock. At the time of the acquisition, Figma expected to end 2022 at $400 million in ARR with 150% net-dollar retention and 90% gross margins. There is no argument that Figma is a lousy company, quite the opposite. The problem with this deal is the price, how it was paid and the implications of this deal. Adobe officially paid 50 times revenue at a time when valuation multiples across high-growth technology stocks (including Adobe’s own shares) were already down significantly. Paying 50 times revenue is outrageous in itself, but the cost to long-term shareholders was closer to 80 times! Let me explain: In the picture below, you can see a history of Adobe’s share repurchases over the last decade. The company generated $35.5 billion in Free Cash Flow, repurchased shares for $26.26 billion and gave out $6.64 billion in stock-based compensation. All of this reduced the share count by around 38 million. Now the company wants to issue about 27 million shares (around half of the purchase price) and an additional 6 million restricted stock units for the CEO and employees to vest over four years. So the company basically spent $26 billion to offset dilution and purchase these 33 million shares, to reissue them valued at $10-12 billion (depending if you count the restricted stock units or not) to buy a company at 50-80 times sales, while tech multiples across the board are down.

Adobe’s buyback history (Koyfin)

If we look at Adobe’s Proxy statement, we can see that all directors and executives own just 0.2% of the company. Now we can ask ourselves if an owner-operator, with significant skin in the game, would have diluted shareholders in the same way. Overall this deal, in my opinion, shows us two things:

- Adobe does not have as strong of a competitive position as I thought because otherwise, it would not have acquired a fast-growing competitor at this valuation. It seemed like an “at all cost” deal to eliminate a competitor before it could take significant market share.

- Adobe’s management has destroyed over $10 billion in shareholder capital with its repurchase and reissue strategy.

Adobe still is a decent company, but I don’t want to own it

I conclude that Adobe is still a good company with a favorable market position, immense profitability and operating in growing markets. The company trades at a fair multiple after the valuation compressed through the bear market and as a reaction to the Figma acquisition. Yet I do not want to own a company where management does not have significant skin in the game, and that dilutes shareholders to this extent, especially if it is by reissuing shares that were repurchased at much higher prices. Generally, a strategy of dollar cost averaging buybacks is not favorable because you purchase when cash flows are high and the market rewards it with a higher multiple. Once the multiple is low, it is often due to low cash flows, leaving the company unable to use this opportunity. This can also be observed now: This would be a prime opportunity to repurchase shares instead of diluting shareholders.

To sum my learnings up:

- assessing moats is hard, especially in fast-moving technology markets

- management without significant skin in the game might not act in the interest of shareholders

- be more critical about buyback strategies, especially combined with high stock-based compensation

I hope you can take something away from my mistakes with Adobe.

Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advise.