Summary:

- Adobe reported a solid fiscal 2022 with growth in revenue as well as adjusted earnings per share.

- The company has an economic moat around its business and growth potential in the years to come.

- However, the Figma acquisition doesn’t make much sense as Adobe most likely overpaid.

- The stock could be slightly overvalued already, but it is still a “Hold” in my opinion.

Grafner

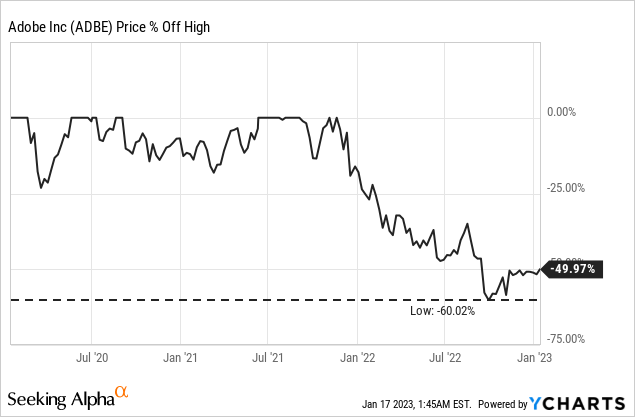

In my last article about Adobe Inc. (NASDAQ:ADBE), I wrote that a 50% decline for the stock is not enough and in the following months the stock continued to decline to a 52-week low of $274. But now the stock is basically trading for the same price again as in June 2022 when my last article was published.

Since the previous all-time highs, Adobe lost 60% in value and is still trading 50% below its previous all-time high and we must ask the question if Adobe is cheap enough. But we all know the answer must depend on the fundamental performance of the business in combination with a calculated intrinsic value – and not just on the percentage points the stock dropped from its previous all-time high.

Annual Results

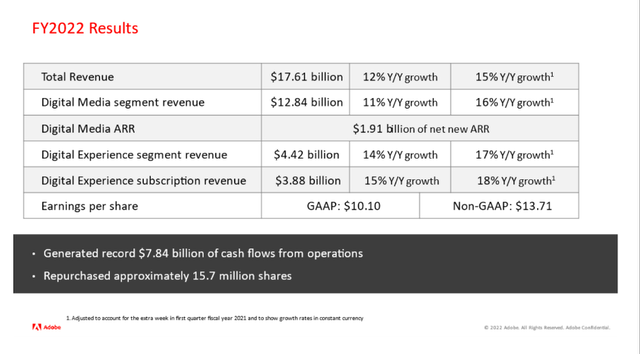

In mid-December, Adobe reported its fourth quarter and full year results for fiscal 2022. And while the company beat earnings per share expectations, it slightly missed on revenue (only by $3 million).

For the full year of fiscal 2022, Adobe reported a revenue of $17,606 million and compared to $15,785 million in the previous year the company was able to grow its top line by 11.5% year-over-year. Operating income also increased 5.1% year-over-year from $5,802 million in FY 21 to $6,098 million in FY 22. And diluted net income per share increased only slightly from $10.02 to $10.08 – resulting in 0.6% year-over-year growth. And when looking at non-GAAP diluted earnings per share, the bottom line increased 9.9% year-over-year from $12.48 to $13.71.

When looking at the different segments, “Publishing and Advertising” (which is only responsible for 2% of total revenue) saw its sales decline 14% to $342 million. However, the other two segments both contributed to growth. “Digital Experience” (which is now responsible for 25% of total revenue) grew 14% year-over-year to $4,422 million and “Digital Media” (which is responsible for 73% of total revenue) grew 11% YoY to $12,842 million.

Adobe Financial Analyst Meeting 2022

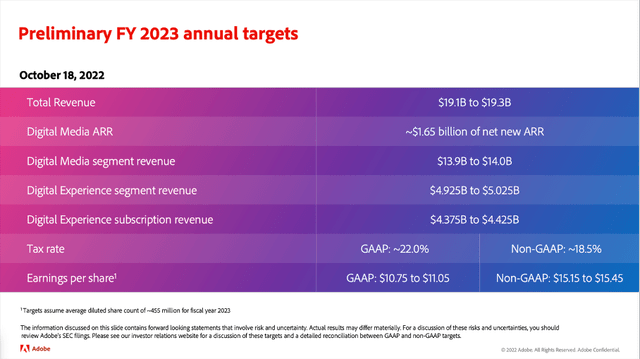

For fiscal 2023, Adobe is now expecting total revenue to be between $19.1 billion and $19.3 billion and GAAP earnings per share are expected to be between $10.75 and $11.05 while non-GAAP earnings per share should be in a range of $15.15 and $15.45. This would result in about 9% growth for the top line and 8.5% growth for the bottom line when taking GAAP numbers and 11.5% when taking non-GAAP numbers.

Acquisition of Figma

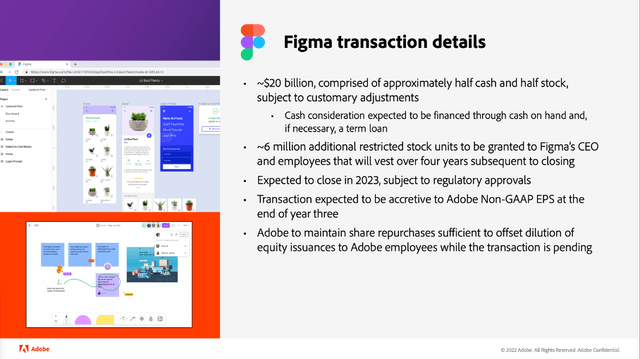

One of the major news stories in the last few months was certainly the intended acquisition of Figma. In September 2022, Adobe announced it is planning to acquire Figma for $20 billion (about half in cash and half in stocks). In my opinion (which seems to be in-line with the market consensus as the stock tanked more than 20% in the days following the news), Adobe is overpaying for the acquisition as Figma was expected to surpass “only” $400 million in ARR at the end of fiscal 2020 and Adobe is paying 50 times the amount and 6 million additional stocks are granted to Figma’s CEO and employees over the next few years (at current stock prices this is another $2.1 billion). Hence, Adobe is paying more than 50 times sales for the acquisition – and that is absurd in my opinion.

Adobe Figma Acquisition Presentation

Figma was founded in 2012 and has about 850 employees today. The company offers a web application for interface design. It focuses on user interface and user experience design and although the addressable market will be $16.5 billion by 2025 I don’t see what Adobe management (hopefully) sees in Figma. A gross margin of 90% is great and a young company being able to generate positive operating cash flows is also great. During its third quarter earnings call, David Wadhwani explained the deal:

“Figma’s web-based, multi-player platform can accelerate the delivery of Adobe’s Creative Cloud technologies on the web, making the creative process accessible to more people. This will dramatically increase Adobe’s reach and addressable market opportunity.”

And during the same earnings call, David Durn stated:

“The combination will accelerate top-line growth for both Adobe and Figma based on three primary drivers; one, we extend Figma’s reach to our customers and through our global go-to-market footprint; two, Figma accelerates the delivery of new Adobe offerings on the web to the next generation of users; and three, we jointly introduce new offerings to market as we unlock the possibilities of collaborative creativity.”

Of course, we should not forget that there have been great acquisitions in the past and when a company is recognizing early on what potential a competitor might have it could make sense to pay a huge premium to acquire a competitor. Facebook paying $1 billion for Instagram at an early stage of the business (no revenue, no profit) is a good example. However, paying $20 billion for Figma is hard to justify.

And when considering that Adobe must pay $10 billion in cash with “only” $4,236 million in cash and cash equivalents and $1,860 million in short-term investments on the balance sheet we must see if Adobe will generate enough free cash flow in fiscal 2023 to pay for the acquisition or if the company must take on a loan to finance the deal. For shareholders, the number of outstanding shares will certainly increase, and I will also assume that Adobe won’t repurchase shares in the next few quarters (in fiscal 2022, Adobe repurchased about 15 million shares).

Recession

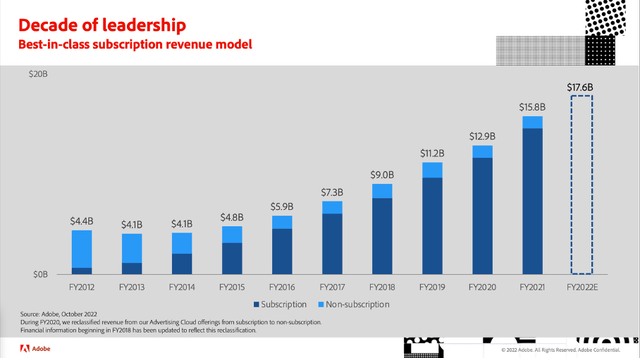

In my last article about Microsoft (MSFT), I argued that the switch to a subscription model might have made Microsoft more recession resilient. And while Microsoft has switched to a subscription model for several of its products, Adobe would be one of the best examples for a subscription-based business model as it is generating almost all revenue by subscriptions. We can see that during the last ten years, Adobe transformed from generating most of its revenue via non-subscription products to a business which was generating $16,388 million in revenue from subscriptions in 2022 (93% of total revenue).

Adobe Financial Analyst Meeting 2022

Compared to one-time sales, subscription models are rather sticky and even in economic challenging times businesses will continue their subscriptions. While companies might not purchase new software during recessions (assuming non-subscription software) they probably won’t terminate the subscriptions. In a non-subscription world, a company could for example use an older version of the software. But in a subscription world, the company must either continue to pay or can’t use the software anymore – which is usually not an option.

In the past, Adobe was certainly not “recession-proof” as I wrote in my last article:

When looking at Adobe’s performance during the last recessions, we can see revenue as well as earnings per share to decline in the quarters following a recession. We can also see that Adobe could recover again within a few quarters, but I would not call the business recession-proof.

But Adobe might perform better in the next recession and Adobe’s guidance for fiscal 2023 might be a hint. I assume that Adobe’s management is aware of the possibility for a recession and economic slowdown in 2023 (although it did not mention recession once during the Q4/22 earnings call) but it still appears optimistic, expecting solid growth rates for revenue as well as earnings per share in fiscal 2023.

Growth

While we must see how Adobe will perform during the next recession and if the subscription model can minimize drawdowns for revenue as well as earnings per share, we should be rather optimistic about the company’s growth potential over the long run (or the next 5 to 10 years).

And we can see that there is an increasing demand for programs and software to produce audio and video content with social media still on the rise and video becoming the dominant form of content on many different platforms. And I already mentioned in my last article that Adobe has in theory a huge addressable market. The TAM for Creative Cloud is expected to be around $63 billion in 2024, the TAM for Document Cloud is expected to be around $32 billion and the Experience Cloud TAM is expected to be around $110 billion.

Even if Adobe should not be able to increase the number of new users significantly, it might be able to grow its revenue by increasing prices annually and due to the stickiness of the products and the steep learning curve that leads to switching costs, it probably won’t lose any customers. In my last article I already explained in more detail why Adobe has a wide economic moat around its business.

Intrinsic Value Calculation

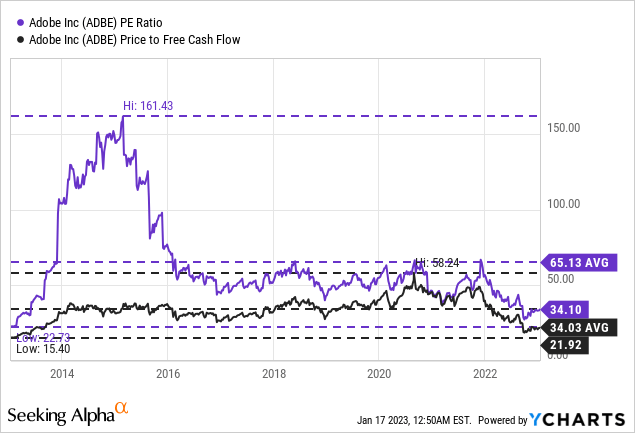

Without any doubt, Adobe is a great business with growth potential in the years to come but I am still not sure if Adobe is also a great investment. When looking at the P/E ratio, Adobe is trading for one of the lowest valuation multiples in the last 8 to 9 years. The P/E ratio peaked at 150 in 2015 and then fluctuated around 50 for several years. The average P/E ratio during the last ten years was 65.13 and when comparing the current P/E ratio of 34 to these numbers, it seems like Adobe is cheap.

But instead of looking at the price-earnings ratio, we should rather focus on the price-free-cash-flow ratio, which is the better metric in my opinion. And Adobe is also trading for one of the lowest P/FCF ratios in the last ten years and a current valuation multiple of 22 is not only below the 10-year average of 34.03 but can be called reasonable for a company growing with a rather high pace.

And when trying to calculate an intrinsic value by using a discount cash flow calculation, we can also come to the conclusion that Adobe is at least fairly valued. Like always, we use our typical assumptions – the current number of outstanding shares (466 million) and a 10% discount rate and the free cash flow of the last four quarters, which is around $7 billion. In order to be fairly valued right now, Adobe has to grow between 5% and 6% from now till perpetuity.

Now, there are several problems or reasons why this calculation might be too optimistic. First, the number of outstanding shares will increase due to the Figma acquisition. It will increase probably about 30 million, but that is not the major problem. Second, the world is most likely headed towards a recession. And although the company is switching to a subscription-based model, we don’t know how solid Adobe will perform during a recession. Third, free cash flow is much higher than net income and I don’t know how sustainable these high amounts of free cash flow actually are.

Instead of the free cash flow we can also take the net income (according to GAAP) as basis in our calculation. When calculating with $4,756 million (fiscal 2022), Adobe must grow slightly above 10% in the next ten years followed by 6% growth till perpetuity to be fairly valued right now. And while that growth rate is not accounting for a potential recession, it is also not completely unrealistic.

Conclusion

While Adobe might be fairly valued at this point, I still see the risk for lower stock prices and would still be a bit cautious about an investment. To be honest, I am a little more bullish about Adobe than I was when my last article was published. Nevertheless, I personally would not invest in Adobe at this point. And I really don’t like the idea of Adobe acquiring Figma for $20 billion as I have extreme trouble in seeing Adobe achieving any meaningful return on this investment in the foreseeable future. For now, I will remain to the sidelines.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.