Nikada/E+ via Getty Images

Chip stocks broadly were in recovery mode after this week’s selloff on news surrounding ASML (NASDAQ:ASML), but weakness in tech stocks during October is not out of the norm.

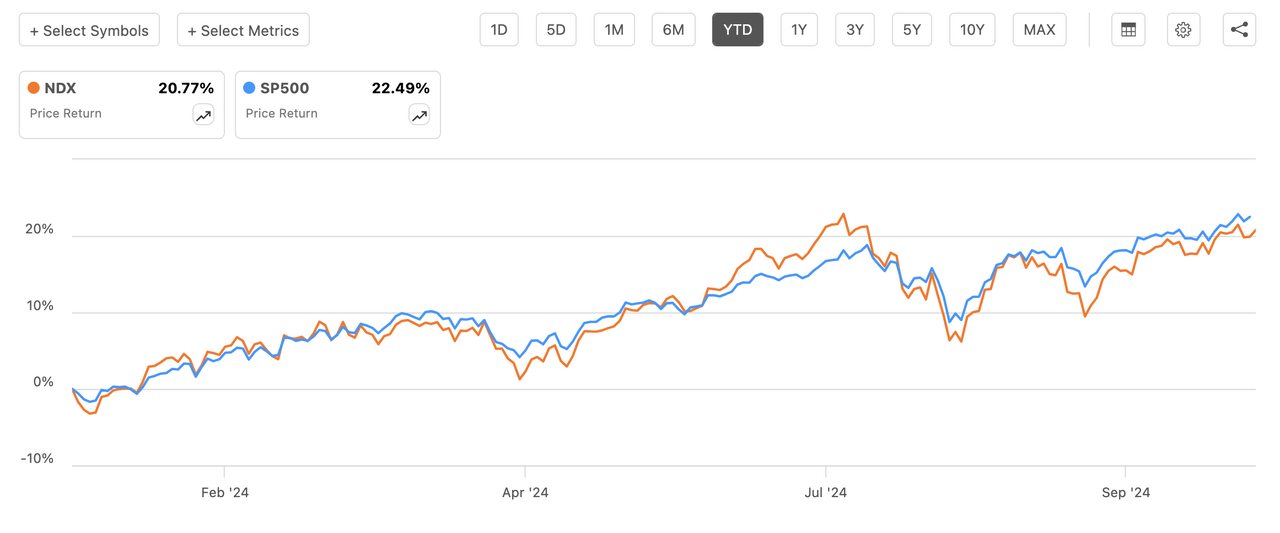

In Thursday’s session, the Nasdaq-100 (NDX) was looking at an all-time high, and the widely watched iShares Semiconductor ETF (SOXX) climbed +2%, with Taiwan Semi (NYSE:TSM) soaring +12% after the world’s largest chipmaker posted third-quarter results and guidance that beat expectations.

But earlier this week, chip stocks were beaten down after ASML’s (ASML) financial update spurred concerns about global chip demand. October has historically been the most volatile month for tech stocks, UBS noted this week. For the Nasdaq-100 (NDX)(NASDAQ:QQQ), the monthly realized volatility over the past 40 years has been 26% in October, compared with a 22% average in other months, UBS said in a CIO update.

“In addition to upcoming company financials, we expect still-elevated geopolitical uncertainty and the risks around export restrictions to also contribute to rising volatility,” UBS said.

ASML’s (ASML) U.S.-listed shares sank 16% on Tuesday, during which other chip stocks including Nvidia (NASDAQ:NVDA), Broadcom (AVGO), and Intel (INTC) were knocked sharply lower. ASML’s (ASML) U.S.-listed shares lost nearly 22% in a two-day rout, and were off modestly Thursday.

The Nasdaq-100 (NDX) on Tuesday fell 1.4%, and the iShares Semiconductor ETF (SOXX) sank 5.2% as ASML (ASML) cut the low end of its 2025 net sales forecast to €30B to €35B. Also, the Dutch computer chip equipment supplier’s Q3 bookings of €2.6B missed expectations.

While ASML sees AI as a key driver of industry recovery, “we see other segments recovering more slowly than anticipated,” ASML CEO Christophe Fouquet said during the company’s earnings call.

UBS said it doesn’t view the “weak start” to tech results as derailing the AI growth story.

“Despite investor concerns about the sustainability of AI-related capex, AI supply chain companies’ investment plans suggest a more constructive multi-year outlook,” the investment firm said, outpointing in part Taiwan Semi’s (TSM) quick expansion in advanced AI-packaging facilities.

“Without taking views on any single names, we continue to see a strong growth outlook for AI semis, and are closely watching managements’ guidance on future demand in the days and weeks ahead,” UBS said.

ASML did say this week it was taking a “more cautious view” on China sales on speculation around export controls. Bloomberg this week reported the U.S. officials have been in talks to cap sales of advanced AI chips from Nvidia (NVDA) and other U.S. companies on a country-specific basis.

Investors can track the Nasdaq through ETFs including (QLD), (TQQQ), and (SQQQ). Semiconductor ETFs include (SMH), (FTXL), (XSD), and (SEMI).