Summary:

- ADBE, a beneficiary of an increasing digital transformation and with its services almost indispensable, delivered double-digit growth rates in recent years.

- While the stock seems to be undervalued from a valuation point of view, the technical analysis suggests a probable breakout from its downtrend established since November 2021.

- ADBE’s steady revenue and EPS growth combined with its high profitability and strong market position makes it a potential outperformer in the next bull market.

- Investors should be well-advised to accumulate the stock on weakness.

- However, a sustainable recovery of the stock should be highly dependent on the recovery of the general market.

Jaap2

1. Introduction

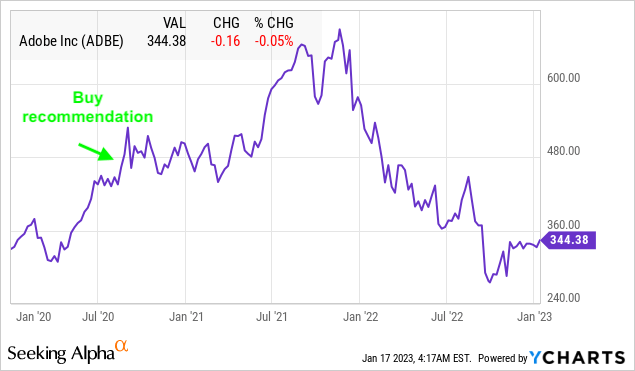

In my article “Why Adobe Could Soar To $800” from August 26, 2020 when Adobe (NASDAQ:ADBE) stock was at $467, I had outlined why ADBE could rise to $800. In the meantime, the stock had peaked as high as $699.54, delivering a performance of around 50% to investors in almost one year, until the bear market has beaten it down (see chart).

ADBE chart since author’s buy recommendation (YCharts)

Due to the now changed market conditions in connection with a more restrictive monetary policy of the central banks as well as concerns about a potential recession, I decided to adapt my former analysis to the current circumstances.

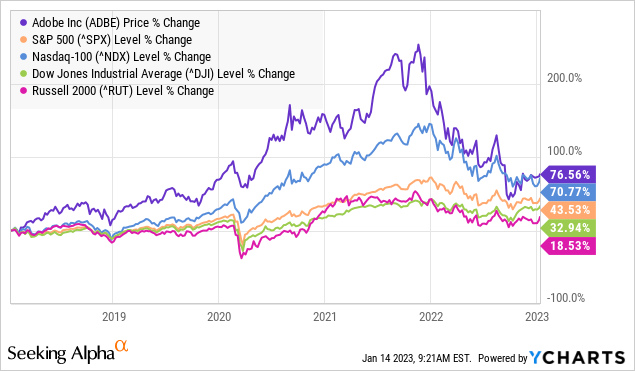

As a preliminary note, it is noteworthy that ADBE is one of the high-flyer stocks delivering investors tremendous returns during the last bull market. Even with the current slump in the stock price, the stock could deliver a slight outperformance of six percentage points relative to the Nasdaq and outperform the Dow Jones and S&P 500 by far in a 5-year period (see chart).

Price % change – ADBE vs major indices (YCharts)

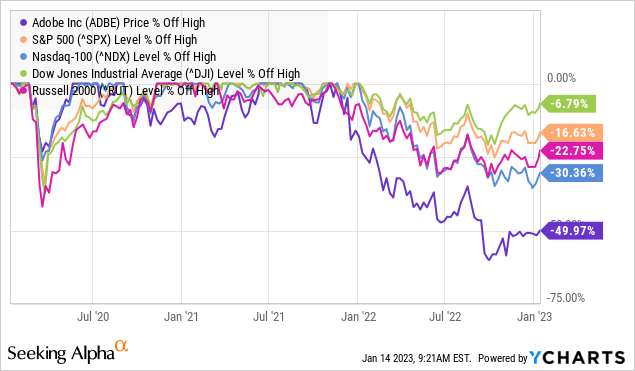

However, the stock has lost around 50% of its value and had briefly fallen all the way back to its COVID lows of around $275 (see chart).

Price % off high – ADBE vs major indices (YCharts)

So, which reasons still favor an investment in ADBE?

Since I had already presented ADBE’s business model, growth factors and total addressable market in detail in my above mentioned analysis, I intend to focus only on the main changes in this article.

2. Double-digit growth rates despite macro-economic headwinds

In the most recent quarter, ADBE reported year-over-year revenue growth of 10.2% in Q4 2022. While growth clearly slowed down compared to the previous year’s quarter with revenue growth of 14.4%, partly due to currency fluctuations, the company was still able to deliver double-digit sales growth rates.

In this context, it is also noteworthy that all of its segments delivered double-digit growth rates and thus contributed to the company’s success.

Digital Media segment, which comprises the business areas of Creative Cloud (photo, video, graphic, movie design as well as designing e-learning, training and social media content) and Document Cloud (Acrobat, PDF mobile and web services etc.), grew by 10% year-over-year or 14% in constant currency.

Digital Experience, on the other hand, which focuses on corporate clients and offers product solutions and software offerings in the areas of advertising, marketing, analytics, e-commerce as well as data insights, customer journey and content management, grew by 14% year-over-year or 16% in constant currency.

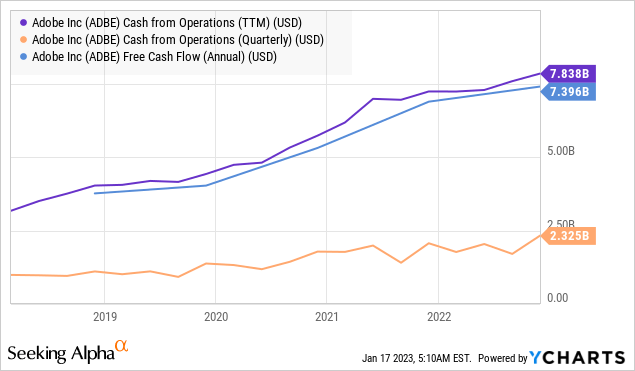

Additionally, the company highlighted that they generated record cash flow from operations of $2.33 billion, which corresponds to an OCF growth of 14% year-over-year. The following figure demonstrates ADBE’s steady OCF and FCF growth for the last five years (see figure).

ADBE OCF and FCF growth – 5 years (YCharts)

Additionally, ADBE repurchased approximately 15.7 million shares during the year, decreasing the outstanding shares by 2% to 466 million from 480 million in the year-ago quarter.

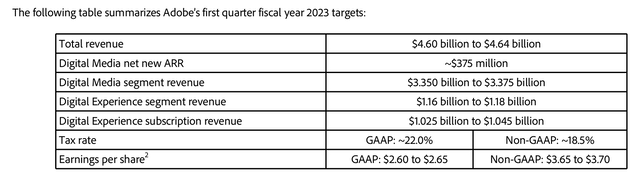

With regard to Q1 2023, the company expects revenues of $4.60 billion to $4.64 billion, forecasting a growth rate of up to 9% to the previous year’s quarter. Considering its double-digit growth rates in the past, this forecast seems to be quite conservative and cautious (see figure).

ADBE’s Q1 2023 targets (Adobe)

3. Market position and future growth catalysts

Alongside the increasing digitization of social life and the work environment, the growing proliferation of social media and digital content, ADBE has a still minimally tapped TAM.

As already presented in my previous article, ADBE has a TAM of $44B with regard to its Digital Media segment as well as $84B with regard to its Digital Experience segment (see figure).

Breakdown of Adobe’s TAM in the different segments (Adobe)

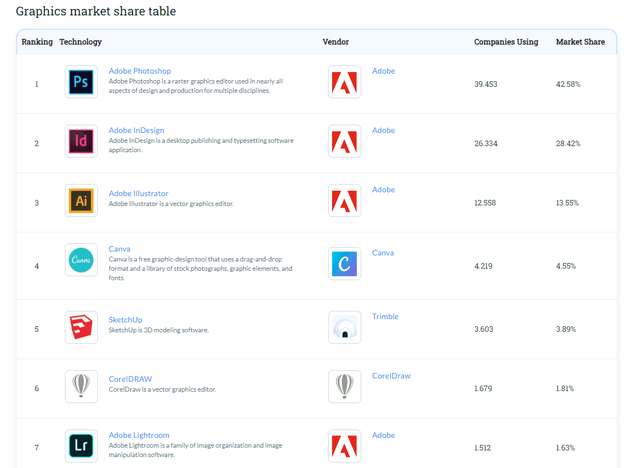

With regard to the graphics software market share, ADBE is the undisputed market leader with a market share of over 86%, according to Datanyze (see figure below).

Graphics software market share (Datanyze)

In order to further enhance growth and expand its service offerings, ADBE has announced the acquisition of Figma, a collaborative design platform, in a half-cash half-stock deal worth around $20 billion, on September 15, 2022. This takeover would bring ADBE in direct competition to Atlassian (NASDAQ: TEAM) and Slack, recently acquired by Salesforce (NYSE: CRM).

Figma, established in 2012, grew to a $400 million in annual recurring revenue from 2017 to 2022, when the company actually started to monetize its offerings. Consequently, ADBE paid 50 times Figma’s annual recurring revenue for this deal. However, Adobe senior vice president of digital media, Ashley Still, seems to be pretty confident concerning Figma’s takeover as she told the media.

Considering ADBE’s revenue of $17.61 billion in 2022, the Figma acquisition alone, which is still subject of the approval of regulators, would push ADBE’s revenue by more than 2% in FY 2023 with constant revenues.

4. Valuation

In terms of valuation, I have chosen three valuation models to substantiate my investment thesis:

- The first valuation method is based on a DCF calculation.

- The second valuation method is based on an earnings-per-share calculation.

- The third valuation method is based on the rule of 40 by using the revenue growth rate and EBITDA margin, which is mainly used for evaluating growth stocks.

In any case, I have chosen a conservative approach by using a discount rate of 12% due to the monetary tightening phase of central banks on a global scale and the related rapidly rising interest rate environment. Other factors favoring a conservative approach include the uncertain macroeconomic and political environment and rising recession risks, which have probably not yet been fully priced in.

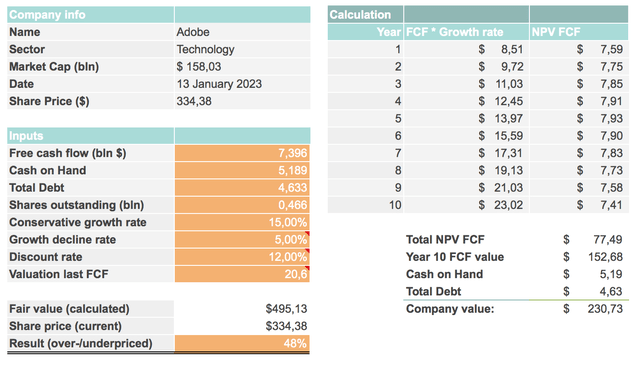

4.1 The valuation method based on a DCF calculation

ADBE managed to grow its FCF by around 30% or more since FY 2017 (exception: FY 2019 with only 7%), according to Morningstar. Analysts’ consensus predict an FCF growth of 8% in FY 2024 and 14% in FY 2025, according to MarketScreener.

In order to do a proper assessment of past developments and to take into account future forecasts as well as a potential economic downturn, I have chosen a conservative growth rate of 15% per year and a growth decline rate of 5% in terms of the free cash flow (FCF) with regard to the valuation method based on a DCF calculation.

In terms of Price/Cash flow multiple, I have chosen a multiple of 20.6 for the last FCF, which represents the current multiple of ADBE. This Price/Cash flow multiple is well below V’s 5-year-average of 35.36 but higher than the S&P 500 multiple of 14.60, according to Morningstar.

In the first valuation method based on a DCF calculation, the fair value is $495.13, which corresponds to a current undervaluation of 48% (see figure below).

ADBE fair value calculation based on DCF (Author’s calculation)

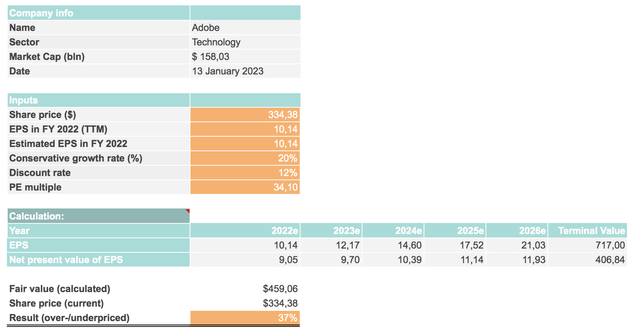

4.2 The valuation method based on an earnings-per-share calculation

The 5-year average EPS growth rate was 33.99% and the 3-year average EPS growth rate was 24.44, according to the latest indications on Morningstar.

In order to choose a conservative approach and take into consideration a potential economic downturn, I have chosen a growth rate of 20% per year in terms of EPS growth. This also corresponds to the 10-year average for the financial years 2019-2021, according to Morningstar, and should better reflect economic cycles.

In terms of P/E multiple, I have chosen a multiple of 34.1, which represents the current multiple of ADBE. This P/E multiple is well below ADBE’s 5-year-average of 50.71 but higher than the S&P 500 multiple of 19.23, according to Morningstar.

In the second valuation method the fair value is $459.06, which corresponds to an undervaluation of 37% (see figure below).

ADBE fair value calculation based on EPS (Author’s calculation)

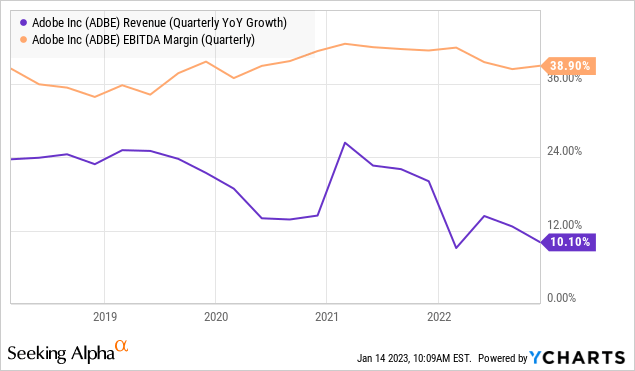

4.3 The valuation method based on the rule of 40

With regard to the rule of 40 and a revenue growth rate of around 10% in the most recent quarter, it can be stated that the ratio of 49 (38.90 plus 10.10) demonstrates an attractive valuation, despite the fact that the revenue growth rate is highly volatile since COVID.

However, the company was able to hold its EBITDA margin, which suggests that the ADBE is able to keep its profitability despite near-term headwinds and probably increase it if the market environment improves.

According to the rule of 40, a promising investment should have a ratio of 40 or more. The more this ratio exceeds 40, the better.

Rule of 40 – ADBE quarterly revenue growth rates and EBIDTA margin (YCharts)

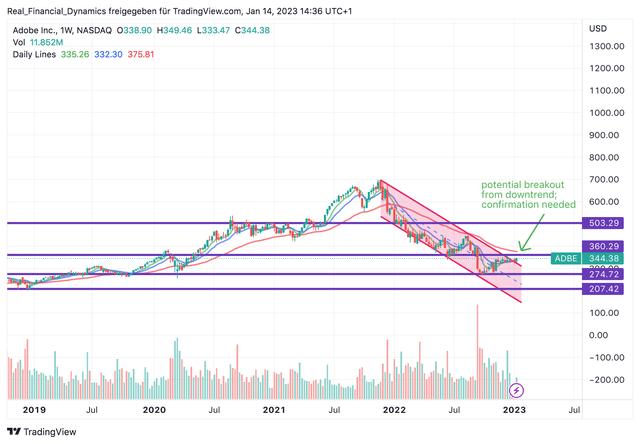

5. Technical Analysis

From a technical point of view, there is a promising development concerning ADBE. The stock made a breakout attempt in the last two trading weeks out of its downtrend started in November 2021 and moves towards its 200-day Moving Average at around $375 (see chart).

However, I assume that the stock has to breach the resistance at around $360 and surpass its 200-day Moving Average with high volume in order to establish a sustainable uptrend. Additionally, the stock’s recovery has to be supported by a general stock market recovery.

If a general stock market recovery fails to materialize or the stock is not able to establish a sustainable uptrend, it could retest its lows at around $275 or fall even lower (see purple line in the chart).

On the upside, if the market is supportive, the stock could rise to around $500 in the short term (see purple line in the chart).

In the short term, ADBE’s performance should be highly dependent on the general stock market’s development.

ADBE chart – breakout attempt (TradingView)

6. Risks and potential threat to ADBE’s market position and future growth

I have identified four major risk factors for ADBE’s further growth and the performance of its stock.

First, ADBE faces macroeconomic headwinds, just like any other company at the moment. On the one hand, the strong U.S. dollar is putting pressure on sales and profits. On the other hand, the Fed is raising interest rates very quickly and very sharply in its fight against inflation in order to reduce growth. A slowdown in economic growth could lead companies to reduce their investments and spending, which could negatively impact ADBE’s Digital Experience segment in particular, as it is primarily focused on corporate clients.

Second, ADBE paid around 50 times annual recurring revenue for its most recent acquisition of Figma. ADBE needs to integrate this acquisition into the business and ensure that the company’s growth potential can be realized to ensure a return on investment, which is one of the most expensive takeovers in the tech industry, according to Protocol.

Third, I have noticed that ADBE has been making more acquisitions lately, such as the recent acquisitions of Magento and Marketo. This could be very costly in the long run and become an obstacle to growth if the integrations of these acquisitions do not succeed. As an investor, I would also like to see organic innovation, which can drive growth in the future. Organic innovation seems to have taken a hit in recent years.

Fourth, ADBE has a broad range of competitors from different sectors and business areas. Competitors from different sectors and business areas are for example Autodesk (NYSE: ADSK), DocuSign (NASDAQ: DOCU), Canva, Salesforce (NYSE: CRM), Avid and Corel. On the one hand, they have to be careful not to lose market share when competing with rivals. On the other hand, ADBE must focus on its strengths and gain additional market share to further expand its competitive position, for example outside of graphics software.

7. Conclusion

ADBE has a strong market position in its own niche highlighted by its double-digit growth rates as well as margins over the past years.

However, there are also several threats and risks, which could threaten ADBE’s market position as well as growth, for example, intense competition in certain niches and product offerings, decreasing demand to an economic downturn as well as pressure from regulators.

My conservative fair value calculations signal at least double-digit returns for investors. My fair value calculation based on a DCF method shows an undervaluation of the stock of 48% and my fair value calculation based on an EPS method indicates an undervaluation of around 37%.

Additionally, the rule of 40, which is an indicator mainly used for growth stocks, indicates an attractive ratio of 49.

From a technical standpoint, the stock is trying to break out from its downtrend established since November 2021. However, in the short term, the stock should be dependent on a general market recovery.

The recovery of the general market, on the other hand, will depend on various factors, such as the Fed’s monetary policy and the economic growth outlook.

In summary, investors should be well-advised to accumulate ADBE on weakness and not miss out on at least double-digit returns in the upcoming bull market.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.