Summary:

- I was concerned about AMZN stock’s retail segments in my earlier coverage.

- The Prime Day success and margin expansion have dispelled this concern.

- Its valuation ratio is much lower than what’s on the surface when based on owner’s earnings.

- Accounting earnings underestimate Amazon’s true owners’ earnings by ~20% due to its recent growth capex investments (mostly AI related).

Marvin Samuel Tolentino Pineda/iStock Editorial via Getty Images

AMZN stock’s record Prime Day

My last work on Amazon stock (NASDAQ:AMZN) focused on its partnership with Oracle. That article, entitled “Amazon: Oracle Partnership Highlights Margin Expansion Potential,” argued for a buy rating on considerations of its AWS’ leading position and AI opportunities. More specifically, I argued that “AMZN’s recently announced partnership with Oracle highlights AWS’ leading position and AI opportunities. Its AWS segment features a far higher margin than retail (~35% vs. ~4.5% in my estimate), thus offering the potential to both drive rapid EPS growth and also expand margins considerably.”

However, in that article, I also express a concern regarding the uncertainties surrounding its retail segment. Since that writing, a significant event for the company was its recent Prime Big Deal Days. More specifics of the event are quoted below. The success of this event signals to me the recovery of its retail business.

SA news: Amazon said Thursday that its Prime Big Deal Days was the biggest October shopping event for the company as more Prime members shopped compared to last year. The company said Prime members around the world saved more than $1 billion across deals, including on seasonal merchandise and gifts. The company said in the three weeks leading up to Prime Big Deal Days, “a record number of customers” worldwide signed up for Prime compared to last year’s event.

This development has led me to examine the profit of its retail segment and also the stock’s valuation. In the remainder of this article, you will see that my findings are two-fold. First, I see several ongoing catalysts that could first drive up the profitability of the retail segment and also the overall EPS growth for the company. These catalysts have remedied my earlier concern over its retail segment. Second, the current accounting earnings dramatically underestimate its true owners’ earnings (by more than 20% in my estimate) due to the large-growth capex investments made recently. As a result, the stock’s P/E based on owners’ earnings are significantly below that based on accounting earnings.

Based on these considerations, I now rate the stock as a Strong Buy, an upgrade from my earlier Buy rating.

AMZN stock: Retail segment in focus

Let me start with the profitability outlook of the retail segment. I consider the success of its recent Prime Day another demonstration of the convenience and attractive pricing of Amazon’s e-commerce. I expect the retail business continues to do well in future for this well-established edge.

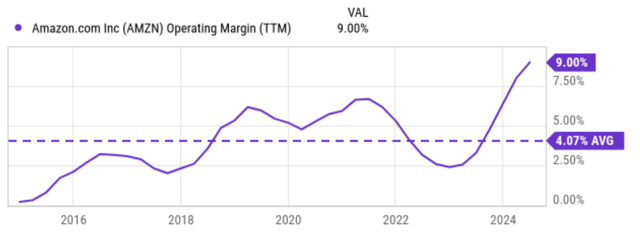

The retail operations have faced some challenges in recent years as elaborated on in my earlier article. The segment went through some major restructuring efforts in recent years to boost profitability and growth in response. These efforts are effective, in my view. As an example, retail operating margins climbed to 5.0% last quarter, helping to drive up the overall margin for the business to the highest level in the past decade (see the next chart below). The segment also expanded many of its key features, such as same-day delivery.

Looking ahead, I continue to see a multitude of opportunities for the company to further improve profitability and achieve growth on this front. A few top catalysts on my list are its ongoing initiatives into healthcare, vehicle sales, and also further cost-saving potential. AMZN recently rolled out its One Medical primary health services for a small fee. Online vehicle sales have also become a new feature starting with Hyundai recently. The company’s investments in recent years to improve its freight and fulfillment efficiencies are most focused on its domestic operations. I see plenty of opportunities to implement these cost-saving actions overseas.

Seeking Alpha

AMZN stock: Growth outlook and valuation

Besides the potential in its established retail segment, the company also enjoys tremendous growth opportunities on the burgeoning cloud and AI front. These opportunities were the focus of my last article, so I won’t further elaborate here anymore.

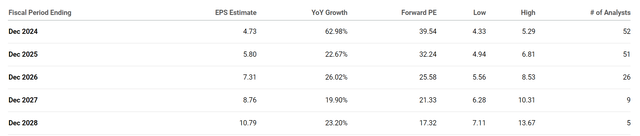

The profitability and growth potential in both is retail and cloud segments adds to a rapid growth curve ahead, as reflected in the following consensus EPS estimates. According to the estimates, AMZN’s EPS is expected to increase from $4.73 in FY 2024 to 10.79 in five years (i.e., FY 2028). This represents a compound annual growth rate of almost 22%.

The forward P/E ratios for AMZN stock are expected to decline in tandem over the next few years. The current FWD P/E is estimated to be 39.54 based on the consensus EPS. This figure is expected to decrease to 32 next year and to about 25x only in two years.

Next, I will explain why the stock is considerably cheaper than such accounting P/E suggests.

Seeking Alpha

AMZN stock: Accounting EPS vs. owners earnings

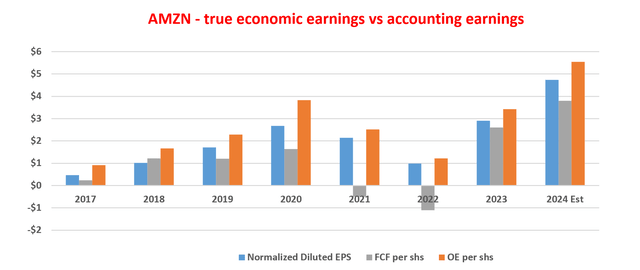

As aforementioned, due to the large growth capex investments AMZN made recently (largely in AI-related projects), its accounting earnings are an underestimate of its owners earnings.

The analysis of the owners earnings requires us A) to split its capex into maintenance and growth capex, and B) then add the growth part back into earnings because this part is optional. In my analysis here, I used the following approach described in Greenwald’s book entitled Value Investing. I highly recommend the book for readers interested in this topic and here I will quote the gist for ease of reference:

The growth part should actually be considered part of the owners’ earnings because it can be returned to the owners if the owners decide not to grow the business anymore – a key insight that investors like Buffett have recognized. The maintenance capex and growth capex in this work is estimated in these steps. First, calculate the ratio of PPE (properties, plants, and equipment) to sales for each of the five prior years and find the average. We use this to indicate the dollars of PPE it takes to support each dollar of sales. We then multiply this ratio by the growth (or decrease) in sales dollars the company has achieved in the current year. The result of that calculation is growth capex. We then subtract it from total capex to arrive at maintenance capex.

Following this approach, the next chart shows my estimates of AMZN’s owners earnings in recent years. As seen, its owners earnings have consistently exceeded both its accounting EPS and also free cash flow (“FCF”) in the past, a hallmark of a growth stock. In 2024, due to the large growth-oriented capex, my estimate is that its owners earnings are about 20% above its accounting EPS.

Thus, AMZN’s valuation is not as high as on the surface. Based on my estimates of its owners earnings, its FY1 P/E is about 32.9x, vs. about 40x in terms of accounting P/E.

Author

Other risks and final thoughts

In terms of downside risks, AMZN’s AI initiatives are in an early stage. Investors’ clamoring for the “all things AI” scenario could take a pause and cause temporary stock price corrections. As an example, in the past earnings season, many analysts questioned the potential returns on the industry’s massive AI investments (including AMZN’s). I’m optimistic of the long-term potential of AI-related technologies to boost productivity (they are already boosting my productivity now). However, I’m fully aware that these investments face uncertainties and could cause short-term profit headwinds.

On the retail front, AMZN faces intense competition from other retail giants like Walmart (WMT) and Target (TGT) as well as recent entrants like PDD’s (PDD) TEMU. In particular, TEMU could be a disruptive force in several ways. TEMU features ultra-low pricing. TEMU’s business model, which involves direct sourcing from manufacturers and minimal markups, allows it to offer products at significantly lower prices than Amazon. This is particularly appealing to budget-conscious consumers. TEMU’s gamified shopping experience also integrates shopping and social features in an effective way, potentially driving higher customer loyalty and retention.

All told, my overall conclusion is that the positives are the prevailing force in the next few years and make AMZN a compelling investment under current conditions. To recap, my early Buy rating was largely due to the concern of its retail uncertainties. However, recent developments, especially the Prime day success and margin expansion, have dispelled that concern. A closer look at its capex and earnings also reveals that its valuation multiples to be significantly lower than what’s on the surface. These developments have led me to upgrade my rating to Strong Buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.