Summary:

- Bank of America reported strong 3Q24 results, driven by higher investment banking fees and trading revenues, despite increased loan losses affecting its credit profile.

- The bank’s net interest income grew QoQ, with a positive outlook for mortgage and auto loans, though YoY growth was impacted by higher deposit costs.

- Technically, the stock is bullish, breaking above key moving averages, and remains undervalued compared to peers, suggesting potential for further upside.

- Despite rising credit losses, the robust U.S. economy and job market support a positive investment thesis, with an intrinsic value target of $48-49 per share.

ProArtWork

Bank of America Corporation (NYSE:BAC) reported better-than-expected results for its third quarter thanks to higher investment banking fees and trading revenues.

With that said, there is also a potential cause for concern as the bank suffered an increase in loan losses, resulting in a somewhat softer credit profile.

With inflation moderating and the U.S. economy being arguably in resilient shape, I think that Bank of America has a lot of potential to deliver positive surprises if credit issues remain under control.

The stock showed an inclination for an upside breakout after 3Q24 earnings, and the technical chart profile looks compelling as well.

My Rating History

My last stock classification for Bank of America’s stock was Buy in no small part because the bank profited from a higher-for-longer rate environment.

Moreover, Bank of America’s net interest income margin was healthy, and the bank guided for growth in its net interest income in 2024, despite the expectation of lower benchmark interest rates.

Trading and investment banking did particularly well in the third quarter and Bank of America once again produced billions of profits for shareholders.

Robust 3Q24 Profits, But Loan Quality Potentially An Issue

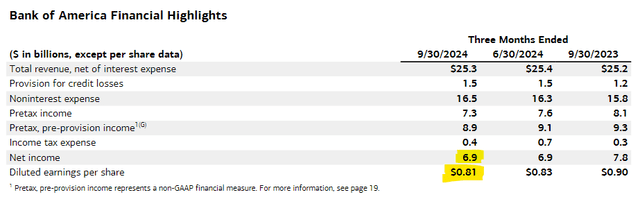

Bank of America’s total sales, net of interest expenses, were up 1% YoY to $25.3 billion in 3Q24. Helpful in the third quarter were primarily higher investment banking revenues and asset management fees which aided Bank of America’s 3Q24 results: The bank produced $6.9 billion in profits in the third quarter which was the same amount earned in the prior quarter.

Asset management fees rose 14% compared to the year ago period amid market strength which is also what helped the bank log 18% higher investment banking fees in the third quarter.

Still, profits declined 12% YoY and a major factor here were higher credit losses which went up $300 million compared to the same period a year ago to $1.5 billion. Credit provisions thus increased 25% YoY while net-charge offs increased 65% YoY. Total net-charge offs were also $1.5 billion, about the same as they were in 2Q24, but investors definitely want to keep an eye here on how the trend develops moving forward.

Higher credit losses are a potential cause for concern if the U.S. economy slips into a recession which I don’t consider to be a realistic near-term scenario. The jobs report in September showed healthy job growth, with the U.S. economy adding 254K new jobs, beating the consensus of 150K jobs by a mile.

Financial Highlights (ank of America)

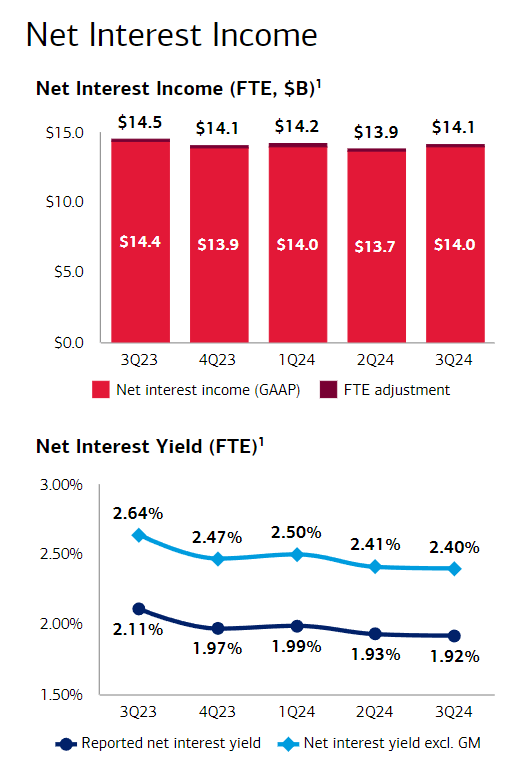

In 3Q24, Bank of America also earned $14.1 billion in net interest income, reflecting an increase of $200 million QoQ. The bank forecasted to grow its net interest income to $14.5 billion by 4Q24, primarily because of a positive growth outlook for mortgage and auto loans.

Bank of America’s net interest income decreased $400 million YoY, however, in light of higher deposit costs that made a bigger impact than incrementally higher asset yields.

Net Interest Income (Bank of America)

Technical Chart Profile

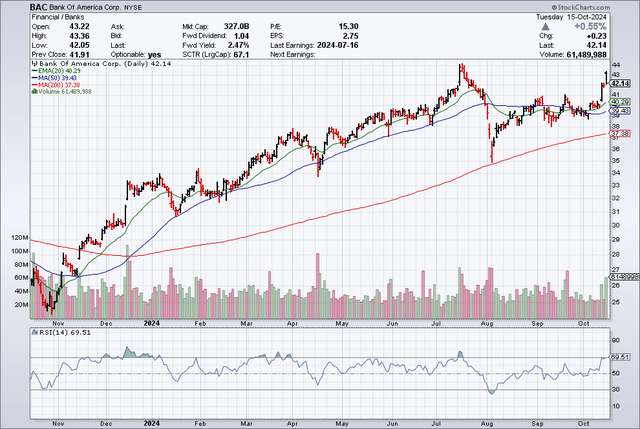

Technically, Bank of America is in a long-term up-channel with the stock breaking out above the 200-day moving average line in November of last year.

Since then, BAC has remained above this trendline and completed a textbook bounce-off in early August when the stock market temporarily melted down.

Just now, with the help of the bank’s 3Q24 results, Bank of America also broke out above the 20-day and 50-day moving average lines which are short-term oriented trend indicators. The technical picture here is very bullish, and I would not be surprised to see new highs being achieved imminently.

Moving Averages (StockCharts.com)

Still Cheap, Possible Upside

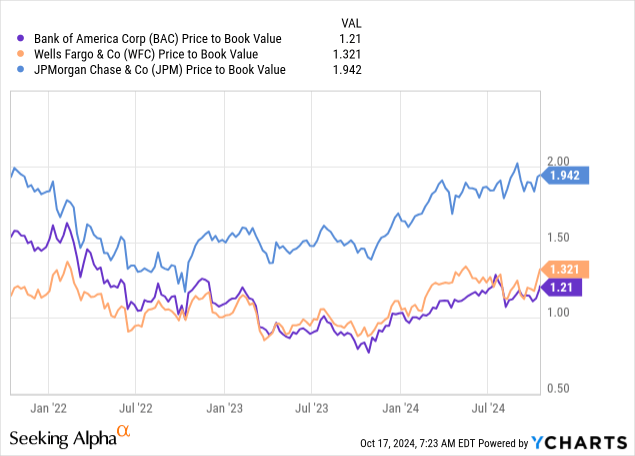

Bank of America’s book value as of September 30, 2024, was $35.37 per share, up 8.3% YoY thanks to robust growth across the bank’s businesses, particularly consumer and investment banking.

Bank of America’s stock is thus selling for a 21% premium to book value whereas Wells Fargo & Company (WFC) is selling for a 32% premium. JPMorgan Chase & Co. (JPM) is selling for a 94% premium for book value.

Because Bank of America is still so enormously profitable and growing its book value easily, I think the bank has ongoing rerating potential: Taking into account the cyclical support that Bank of America has from a robust labor market and a growing U.S. economy, I think a 30% premium to book value remains an appropriate mark-up for the bank.

By the end of the year, based on present growth rates, Bank of America could have a book of $37-38 per share which equates to an intrinsic value of $48-49.

Why The Investment Thesis Might Not Pan Out

Bank of America owns a considerable amount of floating-rate assets (loans) on its balance sheet that in the long run are poised to produce lower interest income for the bank if we go along with the assumption that the central bank will slash benchmark interest rates in 2024 and particularly in 2025.

That said, Bank of America is broadly positioned with its multiservice bank model, serving both consumers and corporations.

I think it would be a good idea to pay some attention to the credit profile moving forward, as any evolving weakness in the U.S. economy would probably show up here early.

My Conclusion

Bank of America had a robust third quarter: The bank was widely profitable, profited from momentum in investment banking and asset management, and managed to grow its net interest income and book value.

There were some minor issues regarding rising credit losses (higher provisions) as well, but I think that the earnings release in its entirety remained favorable for Bank of America.

The stock has just broken out above the 20-day and 50-day moving average lines, on growing volumes, indicating a positive change in sentiment that, in my view, could last as long as the U.S. economy adds jobs and inflation retreats. Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.