Summary:

- The new ownership structure of Thacker Pass, with Lithium Americas holding 62% and General Motors 38%, is a positive development for the company.

- GM’s $625 million investment, including $430 million in cash and $195 million in letters of credit, provides crucial capital for Thacker Pass.

- Despite asset dilution, the GM partnership and DOE loan will help LAC complete Thacker Pass by 2028, unlocking significant future growth potential.

- Future stock price estimates range from $3-$4 in 2028 to $17-$30 in 2032, reflecting the positive long-term outlook despite short-term adjustments.

peshkov

An update on (NYSE:LAC) is merited given the new ownership structure of Thacker Pass. Let me start off by saying that this is an overall positive for the company. For the past 9 months, low lithium prices have kept a lid on lithium stocks, which has stymied production and development activities. That wind appears to be shifting after the past few weeks of announcements (Arcadium buyout, and new ownership structure for Thacker Pass).

What’s the highlights of the new GM deal?

- The ownership of Thacker Pass, as an asset, will be owner by Lithium Americas (62%) and General Motors (38%)

- The two (2) entities will create a joint venture (JV) to be the owner/operator of Thacker Pass

- GM will contribute $625 Million in capital:

- $430 million in cash

- $195 million in as letters of credit with no interest

- Separate from the deal, LAC announced the DOE Loan is expected to close in a few weeks.

While I don’t love the fact that LAC had to give up some of the ownership of the asset, it was likely the best option considering the share dilution with the previous Tranche 2 (which is no longer applicable) would have been significantly detrimental at current stock price levels and offered more issues in the future given the controlling stake GM would have had.

My previous article highlighted the timeline and economics of the company. For those who are interested in the details, you can reference the link here. Full disclosure, I get a few pennies every time someone clicks on the link. I’ll use the money to buy a case of beer and I promise I won’t ask you to like and subscribe.

The timeline has not changed from my previous article. The economics on the other hand have shifted given the fact LAC is giving up 38% of the asset and hence why I am writing this to update my estimated future price forecast (NOT FINANCIAL ADVICE).

Estimated Timeline and Milestone for Thacker Pass:

|

2024 Q3 |

DOE Loan closes and LAC secures 75% of project funding |

|

2024 Q4 |

GM Tranche 2 closes and LAC issues $330 Million worth of shares |

|

2025 Q1 |

Major construction and procurement starts for Phase 1 |

|

2027 Q4 |

Phase 1 reaches mechanical completion |

|

2028 Q1 |

Phase 1 starts up and operates at 50% capacity for 1 year. |

|

2028 Q4 |

Phase 2 starts engineering and construction efforts. Assume capital costs increase by 25% |

|

2029 Q1 |

Phase 1 reaches 100% capacity |

|

2031 Q1 |

Phase 2 reaches mechanical completion |

|

2031 Q2 |

Phase 2 starts up and operates 50% capacity for remainder of 2031 |

|

2032 Q1 |

Thacker Pass phase 2 reaches 100% production capacity |

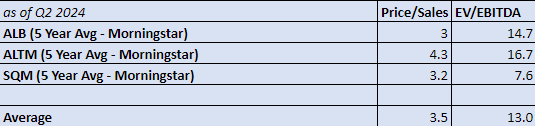

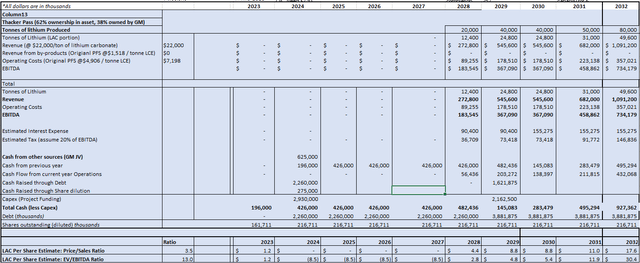

With the same timeline as before, I’ve attempted to forecast the company’s financials based on previous guidance and studies. With this, I’ve attempted to forecast what a realistic stock price may look like based on competitors’ financial ratios. I used the ratios from currently producing competitors (Albemarle (ALB), Sociedad Quimica y Minera de Chile SA (SQM) and Arcadium (ALTM) – soon to be Rio Tinto) in an attempt to understand what (LAC) might look like when they are a lithium producing company. The below graphic shows the ratios used, followed by the second graphic, which provides rough estimates of what a financial picture could look like stepped out to 2032.

Financial Ratios (Self)

Financial Ratios used for Price Analysis (Self)

Economic Forecast (Self)

Future (LAC) Price Estimates

2028 Estimate Price Range: $3 – $4

2029 Estimated Price Range: $5 – $9

2030 Estimated Price Range: $5 – $9

2031 Estimated Price Range: $11 – $12

2032 Estimate Price Range: $17 – $30

Conclusion

While the GM investment does result in an adjustment to the company’s future earnings, it does offer a life raft and a way to clear the current log jam that has plagued not only LAC but other lithium mine developments across the globe. With this new money, and the DOE loan coming through, I would expect LAC to complete Thacker Pass and bring it online in 2028. Future forecasted share prices have decreased from an economic forecasting basis because of the asset dilution. However, the future growth potential is still in the 2-3x range looking out into 2029 and even more as Phase 2 is developed and comes online in the early 2030s. Just remember, 62% of something is greater than 100% of nothing.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.