Summary:

- I reiterate a ‘Strong Buy’ rating for Netflix with a fair value of $830 per share, driven by robust subscriber growth and an emerging advertising business.

- Netflix’s in-house advertising platform, set to launch by FY25, will enhance monetization and user experience, despite near-term operating expense increases.

- Q3 results showed 15% revenue growth and 35% quarter-over-quarter growth in ads memberships, highlighting the potential of Netflix’s advertising business.

- Key risk: Disney’s bundling strategy with Disney+, ESPN, and Hulu could challenge Netflix’s market position; investors should monitor Disney’s performance closely.

Riska

I assigned a ‘Strong Buy’ rating to Netflix (NASDAQ:NFLX) in my previous article published in July 2024, highlighting the company’s progress and growth in ads-tier memberships. Netflix posted a strong result in Q3 with more than 5 million new subscribers. I favor their efforts to build an in-house advertising platform, which could potentially turn Netflix into an advertising technology company. Therefore, I reiterate a ‘Strong Buy’ rating with a fair value of $830 per share.

Launching In-house Advertising Platform by FY25

In 2022, Netflix announced to utilize Microsoft’s (MSFT) global advertising technology and sales partner in expanding their advertising business. However, in 2024, Netflix decided to develop their in-house advertising platform, with plans to launch by the end of 2025. By having its own platform, Netflix will likely enable marketers to fully access their subscriber base without relying on intermediary platforms. As such, Netflix could potentially provide better user experience for these marketers, and further monetize Netflix’s growing subscriber base.

On the downside, Netflix will need to invest heavily in developing their own digital advertising IT infrastructure, which may add more operating expenses for their advertising business in the near term.

On August 20th, Netflix closed deals with all major holding companies as well as independent agencies with 150%+ increase in upfront ad sales commitments over 2023. In addition, Netflix has partnered with major programmatic advertising platforms including The Trade Desk (TTD), Google Display & Video 360 and Xandr. With these ongoing investments and efforts, I anticipate Netflix is on its way to becoming a major player in the advertising technology industry.

Q3 Result and Outlook

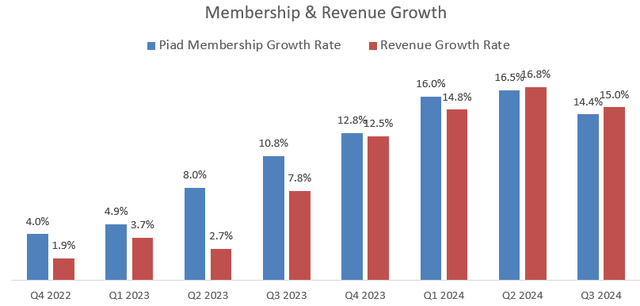

Netflix released their Q3 result on October 17th after the market closes, reporting 15% revenue growth and 14.4% paid membership growth with beating market expectations, as illustrated in the chart below.

My biggest impression for the quarter is their 35% quarter-over-quarter growth in ads membership, which highlights the potential of the advertising business to attract more subscribers and accelerate revenue growth. The management emphasized that their in-house ads tech platform is on track to launch in Canada in Q4 and more broadly in 2025.

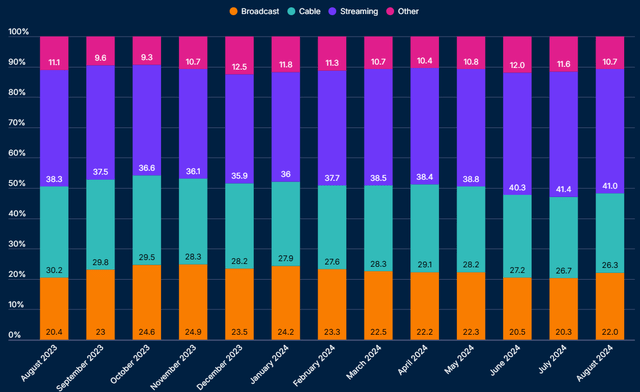

Netflix’s growth will be driven by the overall increase in streaming penetration as well as their market share gains. As depicted in the chart below, the streaming market continues to capture market share from cable market. I am confident that more people will cut the cable and switch to online streaming in the near future.

Netflix has experienced strong subscriber growth thanks to their crackdown on password sharing and expansions into international markets. In addition, I anticipate Netflix will grow their advertising business in the future, particularly with the launch of its own advertising technology platform in FY25. The advertising business could provide additional growth opportunities and expand the total addressable market.

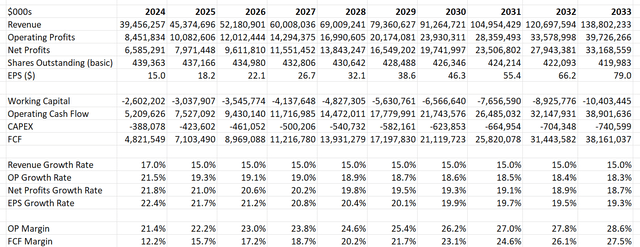

For Netflix’s normalized growth, I continue to anticipate their revenue will grow by 15% annually, driven by 8% subscriber growth, 2% price growth and 5% advertising market growth. The subscriber and price growth are aligned with their recent trends. I assume their in-house advertising platform could further accelerate their advertising business, as it will enable marketers to more effectively access Netflix’s subscriber base for targeted marketing.

As discussed in my previous article, Netflix has already passed the peak of content investments. The company spent $17.7 billion on contents in FY21, $16.8 billion in FY22, then reduced to $12.5 billion in FY23. I project 80bps margin expansion, driven by 10bps from gross profits, 10bps from SG&A leverage and 60bps from decrease in content cost as a percentage of total revenue.

The WACC is calculated to be 10.2% assuming risk free rate 3.6%; beta 1.55; cost of debt 5%; equity risk premium 7%; equity $20.5 billion; debt $14.5 billion; tax rate 15%. The DCF can be summarized as follows:

Discounting all the free cash flow, the fair value is calculated to be $830 per share, as per my estimates.

Key Risks

I think the biggest risk for Netflix comes from Disney (DIS). Disney has been bundling their Disney+ with ESPN and Hulu. With the multiple sources of contents, Disney is able to provide a broad range of subscription choices for their customers. With these bundles, subscribers can potentially achieve more value from the streaming services. I recommend Netflix’s investors to closely monitor Disney’s performance.

End Note

Netflix is becoming an advertising technology company while maintaining their core streaming business. The in-house technology platform will enable Netflix to further monetize their growing subscriber base, in my view. I reiterate a ‘Strong Buy’ rating with a fair value of $830 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.