Summary:

- Taiwan Semiconductor reported strong Q3 FY24 results, driven by “insane” AI demand, with sales growing 36% y/y, beating expectations.

- Management expects continued robust AI and smartphone demand, projecting Q4 revenues between $26.1 billion and $26.9 billion, a 35% y/y increase.

- Taiwan Semi’s strong margin profile, with gross margins at 57.8% and operating margins at 47.5%, supports an earnings growth estimate of ~26% for 2025.

- I recommend a Buy rating on Taiwan Semi due to its strong demand environment, promising capex investments, and potential for further earnings growth.

luza studios

Investment Thesis

After the bloodbath that ASML Holdings (ASML) started in the semiconductor market this week due to its early earnings release, the Q3 FY24 earnings report from semiconductor fab giant Taiwan Semiconductor (NYSE:TSM) righted the route for the semiconductor industry by delivering blowout results.

The highlight of Taiwan Semi’s Q3 results was the “insane” AI demand that the company’s management continues to see in its horizon, which is keeping Taiwan Semi extremely busy as it ships out more semiconductor chips than ever.

The “insane” demand that Taiwan Semi’s management talked about was seen in the company’s sales, which still grow in excess of 30%, with official guidance projecting similar growth rates as it closes out FY24 through the next quarter.

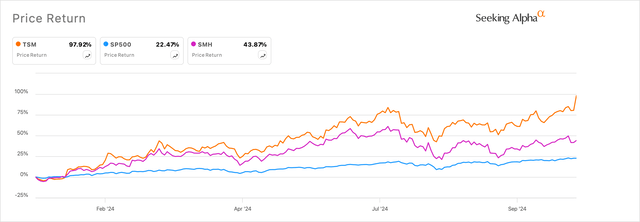

The strong results from Taiwan Semi encouraged investors to bid up the company’s stock as well as the entire semiconductor space, as shown in Exhibit A.

Exhibit A: Taiwan Semiconductor’s stock is up almost 100% this year. (Company filings)

Such strong results are an affirmation of the strong outlook that I expect in 2025, and I recommend a Buy rating on Taiwan Semi.

Smartphones and AI demand strengthen Taiwan Semi’s outlook

In the recent Q3 FY24 quarter, Taiwan Semi reported consolidated sales worth NTM 760 billion, or $23.5 billion, beating street expectations of $23.3 billion. The Taiwan-based fab giant’s sales grew 36% y/y well above the ~20% CAGR target growth rates it had issued in 2021.

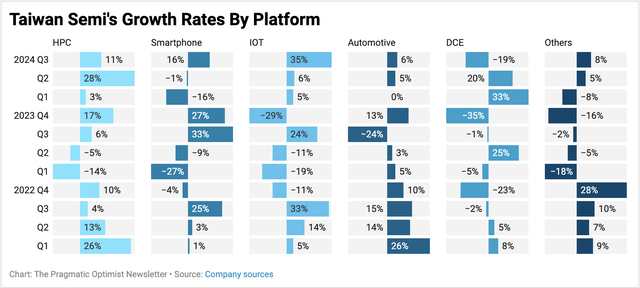

TSM’s management said their “business was supported by strong smartphone and AI-related demand for our industry-leading 3-nanometer and 5-nanometer technologies.” AI-related demand which Taiwan Semi categorizes as the HPC or High Performance Computing segment continued to grow in double digits along with the Smartphone segment as well. Both HPC and Smartphone segments account for 85% of Taiwan Semi’s revenue, with the HPC segment now accounting for 51% of Taiwan Semi’s revenue versus 42% share a year ago.

Exhibit B: Taiwan Semiconductor’s segment revenue growth rates (Company filings)

Taiwan Semi dominates the market for fabrication of advanced chips with a 90% share, and the Q3 results manifested the strength of its market dominance, with the HPC segment continuing to grow.

On the call to discuss earnings, management mentioned that during conversations with one of its key customers, they noted that “[AI] demand right now is insane” and explained how demand for advanced chips that it manufactures is nowhere near peak demand yet points to a significant runway for further growth.

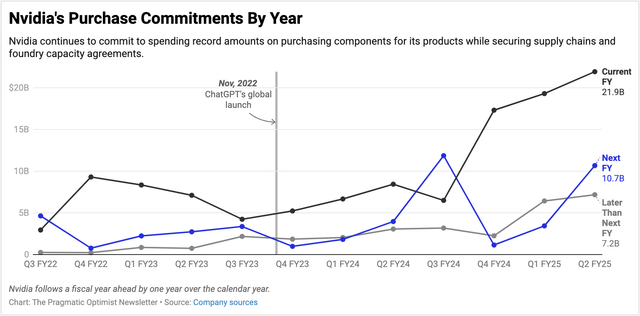

I had pointed this out in one of my previous coverages on Nvidia (NVDA), a key customer for Taiwan Semi, who had been ramping up commitments for manufacturing capacity with its manufacturing partners, such as Taiwan Semi, as illustrated in Exhibit C.

Exhibit C: Nvidia is ramping up its purchase commitments and supply chain obligations through CY25 (Nvidia’s report filings)

While referencing its semiconductor nodes, Taiwan Semi’s management said:

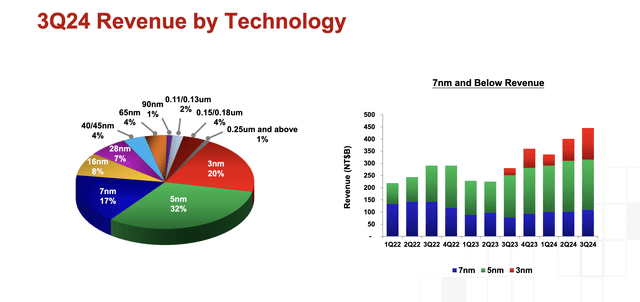

Moving into the fourth quarter, we expect our business to continue to be supported by strong demand for our leading-edge process technologies. We continue to observe extremely robust AI-related demand from our customers throughout the second half of 2024, leading to an increasing overall capacity utilization rate for our leading-edge 3-nanometer [N3] and 5-nanometer [N5] process technologies.

I expect the ramp from N3 technology will boost its outlook in 2025. Management also said they plan to advance some of their customers from the N5 node to the N3 node as demand for manufacturing chips on more advanced nodes intensifies. Other catalysts for the next 1–2 years include N2 ramps as well as Taiwan Semi’s CoWoS advanced chip packaging technology. CoWoS, in particular, is expected to be “growing faster than the corporate average” within the next five years, according to management. And at the center of it all is demand for manufacturing advanced chips on the leading edge.

Exhibit D: Taiwan Semi’s revenues by node technology (Company presentation)

Looking forward, management expects Q4 revenues to be “between $26.1 billion and $26.9 billion, which represents a 13% sequential increase or a 35% year-over-year increase at the midpoint.” While the company’s capex guidance for 2024 looks to be about the same as 2023, what could be very exciting for the company’s outlook next year is how management characterized its investments for 2025 by saying:

Next year looks to be a healthy year. So it is very likely that our CapEx next year will be higher than this year. And we will provide you more updates in the January conference.

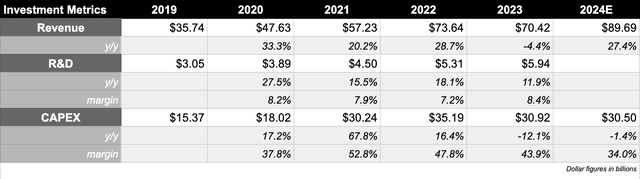

For now, I have added the company’s revenue and investment metrics in Exhibit E below, but management’s forward-looking commentary regarding investments and capacity expansion is very promising, in my opinion.

Exhibit E: Taiwan Semiconductor’s R&D and Capex versus Revenue in 2024 in contrast to previous years. (Company filings)

Taiwan Semiconductor’s Strong Margin Profile Boosts Its 2025 Outlook

With the robust growth that the company continues to post, I expect Taiwan Semi to deliver at least ~25% growth next year. Again, this is going to be well above the ~20% growth targets that the company had previously issued.

In terms of earnings, Taiwan Semi’s earnings will grow even faster than its revenue, growing ~26% per my estimates. My basis for this earnings expectation is the robust margin expansion that Taiwan Semi has been delivering over the past few quarters. Robust demand has allowed the company to expand gross margins by 357 bp in Q3 to 57.8% and GAAP operating margins expanded even faster by 578 bp to 47.5%. Given the high-demand environment, management expects further expansion into next year as well.

However, with electricity costs rising, management mentioned it will experience a 1% headwind to its margins next year. Still, the margin expansion the company is seeing sets Taiwan Semi apart as one of the few companies in the semiconductor supply chain operating at a GAAP operating margin in excess of 40%.

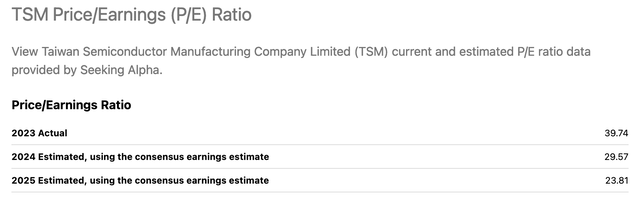

Such a strong margin profile and earnings growth indicate the company should continue to warrant an earnings multiple of ~28x in 2025, which implies ~18% further upside.

Exhibit F: Taiwan Semi’s earnings multiples through 2025 (Seeking Alpha)

Risks & Other Factors To Look For

Taiwan Semi’s outlook is already assuming robust industry demand for the advanced AI chips it manufactures. Some of the world’s leading technology companies, such as Apple (AAPL), Nvidia (NVDA) along with hyperscalers, count as Taiwan Semi’s customers directly and indirectly. The upcoming earnings report from all these companies should attest to Taiwan Semi’s “insane” AI demand outlook. But any signs of demand diluting will impact Taiwan Semi.

Takeaway

Taiwan Semi continues to trade at reasonable valuations due to the strong demand environment it operates in that allows the company to expand margins and grow earnings. Management hinted at further capex investments next year, which usually is a strong indication of demand continuing to buoy Taiwan Semi’s growth rates.

I recommend a Buy rating on Taiwan Semi.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.