Summary:

- Algonquin will likely need to accelerate and amplify its capital recycling strategy to complete the Kentucky Power acquisition.

- The most likely asset for the company to divest, is Algonquin’s 44.2% stake in Atlantica.

- The combination of the Atlantica divestment and a 50% cut to the dividend would free up almost $1.5B in the first year.

- While this cash could fund the Kentucky Power deal, it could result in a change in Algonquin’s business mix to have a greater focus on its regulated utilities business at the expense of its renewable business.

- If the business mix moves further towards the regulated side, the company may see a lower valuation multiple going forward.

mdesigner125/iStock via Getty Images

Recent FERC Decision

The latest trouble for embattled utility, Algonquin Power & Utilities Corp. (NYSE:AQN) comes from a recent decision from the Federal Energy Regulatory Commission (FERC) denying Algonquin’s proposed acquisition of Kentucky Power from American Electric Power Company, Inc. (AEP). FERC cited the opinion that the “applicants have failed to show that the Proposed Transaction will not have an adverse effect on rates” as the basis for their decision.

Shares of Algonquin temporarily spiked on December 16, 2022 on the news of the FERC decision, as investors saw a potential off ramp for the transaction. While the ~5% tick up in AQN’s share price implied that the market would like to see the deal die, I think it is still more likely that deal is delayed rather than cancelled.

The FERC decision does give Algonquin some options, and perhaps some breathing room ahead of the April 2023 transaction outside closing date. Algonquin would still need to make reasonable efforts to complete the transaction. Should it not be able to close the transaction, Algonquin would be responsible for a $65M break fee. I would view the FERC decision as a speed bump rather than an off ramp in Algonquin’s plans for Kentucky Power. It is likely to reapply and make appropriate submission modifications to gain regulatory approval.

If Algonquin is permitted to walk away from the deal, it will not be a silver bullet for all the company’s current challenges. The company still has a massive capital plan to fund and an unsustainable payout ratio. With these challenges in mind, Algonquin is likely to proceed with some significant divestments.

Atlantica Sustainable Infrastructure

Between 2017 and 2018, Algonquin acquired its non-controlling ownership interest in Atlantica Sustainable Infrastructure plc (AY) through two large transactions. Algonquin’s first 25% interest was purchased from Abengoa, S.A. (OTC:ABGOF) at a price of $24.25 per share, for a total purchase price of approximately $608M. This was followed by a second transaction for an additional 16.5% equity interest in Atlantica with a total purchase price of approximately $345 million, based on a price of $20.90 per share.

Atlantica Sustainable Infrastructure Plc, formerly Atlantica Yield Co, owns a portfolio of diversified renewable assets throughout North America, South America and Europe. This portfolio includes 41 renewable properties with 2,121 MW of aggregate renewable energy, the majority of which is solar. The company also owns and operates a collection of natural gas power facilities, water desalination projects and a 1,229 miles of electric transmission lines.

Algonquin’s 44.2% ownership stake in Atlantica provides the company exposure to great renewable assets with long-term contracted revenue. Atlantica’s weighted average remaining contract life is approximately 15 years, providing long-term cash flow visibility. Algonquin’s ownership stake in Atlantica entitles it to approximately US$81M in dividends annually, which flows directly to Algonquin’s earnings.

Algonquin’s Options

Algonquin’s significant exposure to floating rate debt has resulted in a looming cash crunch. As noted in my previous analysis of Algonquin, the company’s floating rate debt will balloon from $1.7B currently to over $3B if the Kentucky Power deal closes. Algonquin is exploring all available options to raise the cash needed to close the pending transactions and absorb this additional debt. Algonquin has historically been successful in raising equity capital at the market to fund its capital plan. While this has had a dilutive effect on shares, the strategy has been effective for the company funding in the past. With investor confidence in tatters and the share price halved over the last year, it is unlikely that Algonquin will raise any additional equity in the near future. Management has continued to reiterate the importance of maintaining an investment grade credit rating; therefore, it is also unlikely that the company will look to issue more debt.

This leaves asset sales, shrinking the capital plan and reducing the dividend as the most likely sources of capital. I maintain the view that the dividend will be cut regardless of the FERC decision and the outcome of the Kentucky Power deal. The market has already priced in a cut and investors are expecting it. With a current yield of 10.5%, the firm could cut the dividend by 50% and still provide attractive dividend income relative to other utilities.

Assuming a 50% dividend cut, the company would free up approximately $260M annually. While this is substantial, it does not provide all the company’s cash needs or address funding for the capital plan. Before Algonquin ran into trouble with rising interest rates, asset recycling was already slated to be a core part of the company’s capital plan funding model. The timeline for asset sales will likely need to be accelerated and the divestments more significant than previously considered.

Will Algonquin Sell Atlantica?

The most likely asset for the company to divest, is Algonquin’s stake in Atlantica. The combination of the Atlantica divestment and a 50% cut to the dividend would free up almost $1.5B in the first year. This would enable Algonquin to complete the Kentucky Power transaction and service the additional $400M in variable rate debt that the company would assume with the transaction. According to RBC Dominion Securities Analyst Nelson Ng:

If AQN acquires KP, we believe AQN would need to cut the dividend, accelerate asset sales, and shrink its capital plan to bolster its balance sheet. We believe the obvious asset to divest would be its ~$1.3 billion stake in Atlantica Sustainable Infrastructure (although this has not been specifically discussed by the company it is a relatively passive investment in a publicly listed company with limited strategic value, in our view), which could fund most of the ~$1.4 billion KP equity purchase price.

As Trapping Value pointed out in their recent article “Algonquin And Atlantica Sustainable: Paying The Piper”, Atlantica is less levered than Algonquin as a whole, with Debt/EBITDA of 7.3X vs Algonquin’s 12.9X, so selling this asset won’t help the company’s operational risk profile. It would also see the company forgo its stream of dividend income from Atlantica, worth approximately $0.12 per share of AQN.

Selling Atlantica Relative to other Assets

Algonquin had $17B in assets as of Q3 2022, giving it optionality on how best to pursue capital recycling. If a large asset sale is required to repair the balance sheet and complete the Kentucky Power deal, these assets are likely to disproportionally come from the renewable side, rather than the regulated side of the business.

Atlantica is a collection of 41 renewable generation assets and some transmission assets in Europe and the Americas. These are great properties, however they are peripheral to Algonquin’s core regulated business and are not integrated into Alqonquin’s (Liberty) operations. In short, while this is a nice to have, the company’s Atlantica ownership is not a crown jewel.

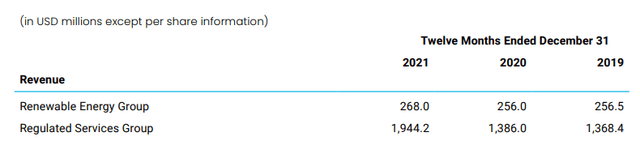

Algonquin’s regulated business is 7X larger than its renewable division by revenue. Since 2019, revenues from the renewable business have grown by 4.4%, whereas revenue from the regulated business has increased 42% over the same period.

AQN Business Revenue Mix (Algonquin)

Source: Algonquin

This growth pattern highlights that Algonquin’s priority is to continue its focused growth strategy in its regulated business. By selling Atlantica rather than a regulated asset, Alqonquin can maintain the broad direction of strategic growth it has pursued in recent years, rather than spook investors further by doing a strategic about-face.

This trend of targeting renewable assets for disposition has been highlighted in the firm’s recent capital recycling activities. In October, 2022 Algonquin announced the results of its inaugural asset recycling transaction that included the sale of a 49% ownership interest in three operating wind facilities in the United States totaling 551 MW and an 80% ownership interest in a 175 MW operating wind facility in Canada. The total cash proceeds from these dispositions were approximately $277M for the U.S. wind farms and approximately C$107 million for the Blue Hill Wind Facility. These divestments were a follow through on the company’s 2021 Investor Day commitment to utilize asset recycling to fund and execute Algonquin’s $12.4B capital plan.

Existing Buyer Interest for Atlantica

In November 2022, Seeking Alpha reported that shares of Atlantica traded higher “following a report that the renewable energy company may have received a takeover bid”. This news release goes on to say that the Atlantica may be evaluating conducting a strategic review after receiving interest from an unidentified party. Should Atlantica be a takeover candidate, Algonquin could potentially see a premium over the current market price for their ownership of AY. This could make the decision to divest Atlantica more attractive relative to other assets at the moment.

Algonquin’s stake in Atlantica is easy to value as Atlantica is a publicly traded company. As the Atlantica renewable assets are geographically distributed and have attractive long-term power purchase agreements in place, it could be a bolt-on acquisition for a broad array of firms or asset managers looking to diversify or add scale to an existing energy portfolio.

January 12th Investor Update

Following the last earning release on November 11, 2022 where AQN cut its 2022 EPS guidance, shares of AQN have dropped almost 40%. Management has made some minor attempts to quell uncertainty by releasing a letter on November 17,2022 highlighting some insider buying and a commitment to providing investors with additional updates at an Investor Day in early 2023. On January 12 at 8:00am ET Algonquin Power & Utilities President and CEO Arun Banskota and CFO Darren Myers will host an investor call to provide a business update. You can join the webcast of the call here.

I believe many investors including myself are in a holding pattern awaiting a coherent plan on January 12, 2023 that will speak to:

- the pending $2.6B Kentucky Power acquisition and how the recent FERC decision impacts management’s commitment to the transaction,

- commentary about potential asset sales and accelerated capital recycling, specifically for AY

- an indication about the level of dividend to be paid going forward

- to what extent the balance sheet will be prioritized with respect to maintaining an investment grade credit rating

With the business update being offered in lieu of an investor day, we may have to wait for more details about the company’s capital plan and revised 5-year growth plan.

Lowered Valuation

One of the likely outcomes from the next phase of Algonquin’s reorganization is to change its business mix to have a greater focus on its regulated utilities business at the expense of its renewable business. If the business mix moves further towards the regulated side, the company may see a lower valuation multiple going forward.

The estimated 2022 EV/EBITDA and P/E for a basket of regulated Canadian utilities [Algonquin, Canadian Utilities Limited (CU:CA), Emera Incorporated (EMA:CA), Fortis Inc. (FTS) and Hydro One Limited (H:CA): averaging 93% regulated revenue] was 11.8X and 18.2X respectively. This compares to estimated 2022 EV/EBITDA and P/E of 16.4X and 23.5X respectively for a basket of diversified utilities [Black Hills Corp (BKH), CenterPoint Energy, Inc. (CNP), Chesapeake Utilities Corp. (CPK), Dominion Energy, Inc (D), NextEra Energy, Inc. (NEE), Public Service Enterprise Group (PEG) and Sempra (SRE): averaging 72% regulated revenue] with a similar mix of regulated and non-regulated revenue (approximately 70/30%). While this evolution may see decreased volatility going forward, it could also see Algonquin ascribed a lower multiple over the long-term.

What’s Next for Algonquin?

I expect the company will likely need to reduce its capital program, divest assets and reduce its dividend. Divesting Algonquin’s 44.2% stake in Atlantica is the most expedient and concrete action the company can take to convince the markets that pursuing the Kentucky Power deal won’t destroy any more shareholder value. Even if the Kentucky Power deal is completed, a less ambitious capital plan and a greater focus on regulated earnings could result in a lower valuation for Algonquin going forward.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of AQN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.