Summary:

- Intel’s current valuation is attractive for near-term investors, with a 50% market cap growth potential in 2025, driven by the 18A node and rising AI demand, despite anticipated Q3 weakness.

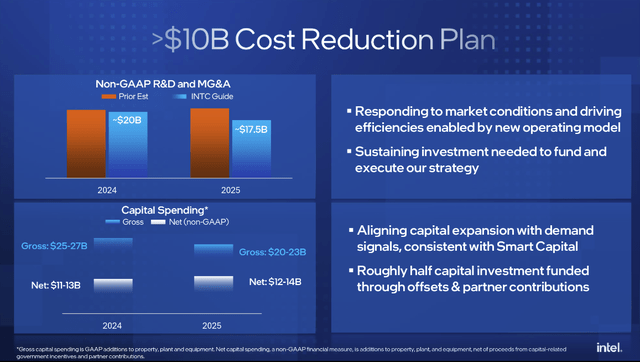

- Management’s cost-reduction plan, including layoffs and dividend suspension, aims to improve free cash flow but may hinder long-term growth against competitors like NVIDIA and TSMC.

- Intel’s Data Center and AI unit struggles due to competition and product delays, necessitating strategic clarity and operational efficiency to regain its market position.

- While INTC may not lead in chip design or foundry services, its role in the global tech ecosystem and current low valuation make it a Buy.

niphon/iStock via Getty Images

I last covered Intel (NASDAQ:INTC) when news broke that Qualcomm (QCOM) was assessing it for acquisition. As time has passed since that analysis, it seems less likely to me that Qualcomm or any other company will be buying aspects of Intel. Therefore, Intel’s market position is largely dependent on its turnaround from its current operational and financial weakness. The company’s much more attractive valuation following its weak Q2 results sets the stage for a long-term value thesis that I currently believe is worth considering. As Q3 results approach, readers should expect weakness, but I don’t think this will last. Despite the reality check that Intel is unlikely to be a leader in either chip design or foundry services moving forward, it can still hold a formidable position in the technology industry. Therefore, the current valuation is appealing, especially in the near term, as the company is likely to achieve high growth in 2025.

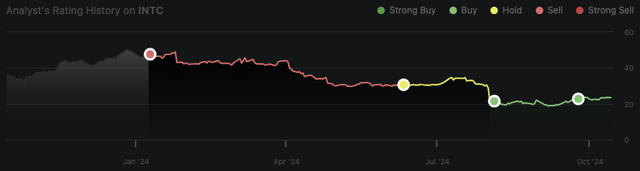

Oliver Rodzianko’s Intel Rating History

Q3 Earnings Preview: Temporary Weakness Before Strength in 2025

For starters, let’s remember how we got here. In Q2, the company reported a $1.6 billion net loss compared to a profit of $1.5 billion in Q2 2023. Additionally, it reported a 1% year-over-year decline in revenue. In response to these financial challenges, management outlined a cost-reduction plan, which includes laying off 15% of its employees and suspending its dividend starting in the fourth quarter of 2024. For Q3, management has provided revenue guidance of $12.5 billion to $13.5 billion, representing a year-over-year decline from the previous year’s Q3 revenue of $15.3 billion. This translates to a decline of between 11.8% and 18.3%. Furthermore, management expects a GAAP loss per share of $0.24 and a non-GAAP loss of $0.03.

One of the core areas of weakness likely to be raised during the Q3 earnings call is Intel’s Data Center and AI (‘DCAI’) unit. Most notably, this segment is struggling due to competition from dominant NVIDIA (NVDA) and the formidable Advanced Micro Devices (AMD). Intel’s DCAI revenues are down by 28% year-to-date, which is a stark contrast to AMD’s 6% decline over the same period. Part of the reason for Intel’s weakness in its DCAI unit is its delays in launching competitive products. Its new processors, Xeon 6 ‘Sierra Forest’ and Gaudi 3 AI accelerators, are strong, but they are entering a market already dominated by well-established competitors. Therefore, management’s recognition of this and its strategy in light of the competition will be a key element to watch for in the Q3 earnings call. For example, Intel is reorganizing its business, including spinning off its Programmable Solutions Group to streamline operations and focus on core competencies.

There’s clearly a lack of operational clarity at Intel right now—partly because I think management has failed to establish clear growth trajectories and may have slightly too lofty ambitions given the competitive climate. Without significant streamlining, an efficiency focus, and clear boundaries between its foundry and design segments to foster positive customer sentiment, it seems NVIDIA and AMD will far outpace Intel in chip design, and Taiwan Semiconductor Manufacturing Company (‘TSMC’) (TSM) will continue to dominate with its foundry monopoly. However, not being the best doesn’t mean it’s not worth continuing. In fact, it can create a better value opportunity for investors, which, I believe, is what we have on our hands with Intel.

These issues are further compounded over the long term by the fact that management has decided to slash capital expenditures by 20% as part of its restructuring efforts. While this is likely to support its near-term free cash flow, it is also likely to inhibit its long-term growth, giving more room for NVIDIA, AMD, and TSMC to dominate. Management will need to be transparent about its market position with shareholders in the Q3 earnings call to provide investors with a realistic outline of what they can expect from the company moving forward. Doing so could engender positive sentiment in the market because the stock’s current valuation is appealing, and with proper execution from management, I expect many investors will buy Intel shares at the current depressed prices.

Q3 is expected to remain challenging, and given the operational factors above, I believe its total revenue for the quarter will come in at the lower end of management’s guidance—my estimate is $12.75 billion. Additionally, I estimate its normalized EPS loss will be $0.04. Given the poor quarter we’ve just had, it seems quite reasonable to assess management as prone to overpromising—a quality I believe the company needs to address moving forward, as the 18A strategy to leapfrog TSMC in manufacturing technology has not delivered. Remember, I am bullish on Intel for the long term, but Q3 is likely to generate further near-term negative sentiment. That being said, with a valuation this low, the outlook for 2025 presents an opportunity for substantial 12-month and medium-term returns.

Valuation Update: An Excellent Near-Term Value Investment

While Intel’s Q3 results are important to monitor as they continue to outline the challenges the company faces and how these affect its competitive market position, I prefer to focus on 2025 to evaluate how Intel can currently serve as a successful value investment.

At the moment, I have a 6% revenue growth estimate for the company in 2025. This is lower than the consensus of 8%, primarily because I believe the company’s operational challenges are severe. I also believe dominant players NVIDIA and TSMC will continue to compound their market positions over Intel in 2025, reducing demand. Moreover, I estimate the company will achieve year-over-year normalized earnings per share growth of 300% in 2025, which is also significantly below the consensus of 340%.

Given my estimates, Intel is cheap at a forward price-to-sales ratio of 1.9 and a forward EV-to-EBITDA ratio of 12.6. Consider the following data:

| Intel | NVIDIA | TSMC | |

| Forward price-to-sales ratio | 1.9 | 27 | 9.6 |

| 2025 revenue growth estimate |

6% (independent) |

41% (consensus) | 24.3% (consensus) |

| Forward EV-to-EBITDA ratio | 12.6 | 41.4 | 13.7 |

| 2025 normalized EPS growth estimate | 300% (independent) | 41.3% (consensus) | 26.3% (consensus) |

Now, evidently, Intel is lagging in terms of revenue growth, but it’s likely to have a strong year in 2025 due to the ramp-up of its 18A node and increased demand related to AI at the moment. This is supported by its recent capacity expansion, including $20 billion invested into fabs located at Intel’s Ocotillo campus in Chandler, Arizona, which are expected to be fully operational in 2025. With a period of investment coming to an end, 2025 is a time for Intel to reap the rewards in profitability. Despite the recent setbacks, the likelihood of a successful 2025 is still high. Therefore, irrespective of the long-term challenges the company might face, this is a short-term value investment worth considering.

My current estimate is that the company will trade at a P/S ratio of 2.75 in 2025 (the company’s 10-year median P/S ratio is 2.94, and its 10-year revenue growth rate is 4.7%). With 6% revenue growth in 2025 and full-year revenues of $55.5 billion, the company will have a market cap of $152.6 billion. This represents an increase of over 50% from the current market cap of $100.23 billion.

Risks Review

- To clarify, I see it as highly unlikely that Intel will be a leader in either chip design or foundry services moving forward. That being said, I believe its position in both of these markets is important for the global technology ecosystem, especially in supporting the West’s role in manufacturing. I believe that as management focuses on cost-cutting, it will lose the long-term growth advantage to TSMC, NVIDIA, and AMD. I’m fine with this, as Intel is now a value investment, not a growth allocation.

- Despite a near-term value thesis that suggests we could see a 50% increase in the stock price, I’m less convinced that Intel will stand the test of time. I am currently considering buying shares in Intel, but I could also see myself selling at the end of 2025 if the company shows little sign of operational and financial sustainability moving into 2026 and 2027. This is contrary to my usual long-term, buy-and-hold strategy, but some near-term investments are too good to pass up.

- With the current geopolitical climate, any escalations could prove destabilizing for Intel. However, this macroeconomic concern affects all major technology stakeholders, so it is not a reason to ignore opportunities in the sector at this time. Instead, it presents a reason to be cautious in the size and concentration of allocations. I find it prudent to begin looking at global diversification to hedge against current geopolitical risks and macroeconomic weakness in the West. However, I also think present tensions will ease, so this is likely a short-term strategy to consider rather than a permanent solution.

Conclusion

Intel is likely to report weak Q3 results, but I do not believe this will be a lasting phenomenon. Looking ahead to 2025, I expect robust growth from the company, driven by the 18A node and increased capacity amid high AI demand. Therefore, at the current low valuation multiples, Intel is a Buy. Over the next 12 months, I estimate its market cap will increase by more than 50%. I will continue to review the company throughout the year, as its long-term prospects are somewhat less certain than its near-term alpha potential.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.