Summary:

- A recent study shows over 80% of AI projects fail, with only 14% of companies ready to adopt AI, which suggests that the Gen AI could be a flop.

- However, Microsoft is heavily dependent on Gen AI success, given the capex of over $44 billion over the last year.

- Thus, Microsoft is vulnerable, especially given the current high valuation multiples.

FinkAvenue

The Gen AI capex race

Microsoft (NASDAQ:MSFT) started the unfolding Gen AI revolution when it invested in Open AI in late 2022. This was during the bear market slump, when Microsoft decided to directly attack Google Search, which triggered a massive Gen AI capex cycle.

Alphabet (GOOG) (GOOGL) panicked to defend itself and boosted the Gen AI spending, and other mega-caps rushed in due to the fear of being left behind, such as Meta (META) and Amazon (AMZN). As a result, massive amounts have been spent on Gen AI capex – but it seems like the rate of return on this spending is unknown.

The analysts are starting to question what the ROR is on this massive spending, but the best answer is by Alphabet CEO, when he said that the risk of underspending is higher than the risk of overspending. In fact, in my opinion, this statement started the process of the Gen AI bubble burst.

This confirms the thesis that the benefits of Gen AI are unknown, but if it does work, the early movers will be the winners, while the rest could be left behind. Thus, for the tech firms, this is really an existential issue, which suggests that the fear is fueling the race in Gen AI capex.

The practical implication is that if the Gen AI does not really work, or in other words, if the companies are slow to adapt the Gen AI apps, the Gen AI capex will be completely wasted. In this case, the heavy spenders on Gen AI, like Microsoft, could be in a bubble, and facing a major bust.

Microsoft is vulnerable

So, let’s look at Microsoft.

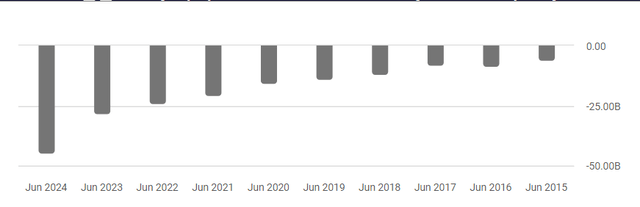

Looking at the cash flow statement, over the last 12 months, Microsoft’s capital expenditures were $44 billion, which is around 50% of net income, or 38% of operating cash flow. That’s a heavy investment. It’s about double from the 2022 levels, before the Gen AI cycle.

Seeking Alpha

Thus, Microsoft is vulnerable to a deep selloff if the Gen AI capex proves to be a wasted investment.

Note, Microsoft is also overvalued with the PE ratio around 35 and the PS ratio over 12. The recent price move has been associated with the PS and PE multiple expansion – thus, it’s a speculative investment, heavily dependent on the broad adoption of Gen AI.

In fact, Microsoft has been downgraded recently partially due to the heavy losses at Open AI, which is expected to lose over $44 billion before turning profitable in 2029.

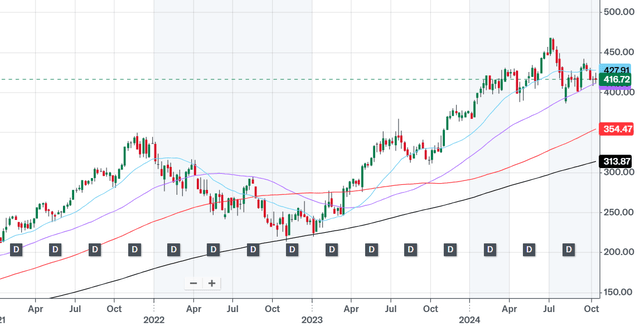

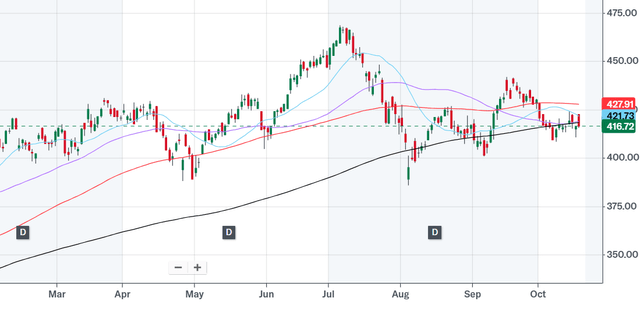

Technically, Microsoft is also vulnerable. Currently, Microsoft is sitting at the key 50wma on the 5Y chart, which is actually the key 200dma support on the 1Y chart. In fact, it looks like the price is forming the head-and-shoulders pattern. If the key support is broken, the price could drop significantly.

It is likely that Microsoft will stay within the current range, until the earnings report on 10/30. If the earnings report is negative, with respect to actual earnings or the guidance, a technical support breakdown is likely. I discuss my earnings projections in the section below.

5Y MSFT (Yahoo)

1Y MSFT (Yahoo)

More than 80% of AI projects fail

The key to Microsoft success is the wide adoption of Gen AI projects, beyond just the tech. This would ensure that the massive investments in AI data center infrastructure would pay off.

However, it looks like the adoption of Gen AI is very low and very slow, with no progress in sight. Some previous studies, like Lucidworks, have found the Gen AI is expensive to implement, and that:

Only 63% of companies are planning to increase AI investments in the next 12 months (compared to 93% in 2023). The slowdown is driven by growing concerns around implementation costs, data security, and accuracy of AI-generated outputs.

But the recent study by RAND corporation finds that more than 80% of AI projects fail, which is more than double the tech projects excluding AI. The study points to the “five leading root causes of the failure of AI projects were identified”:

First, industry stakeholders often misunderstand — or miscommunicate — what problem needs to be solved using AI.

Second, many AI projects fail because the organization lacks the necessary data to adequately train an effective AI model.

Third, in some cases, AI projects fail because the organization focuses more on using the latest and greatest technology than on solving real problems for their intended users.

Fourth, organizations might not have adequate infrastructure to manage their data and deploy completed AI models, which increases the likelihood of project failure.

Finally, in some cases, AI projects fail because the technology is applied to problems that are too difficult for AI to solve.

The study also finds that “only 14 percent of organizations responded that they were fully ready to adopt AI, even though 84 percent of business leaders reported that they believe that AI will have a significant impact on their business”.

Thus, it seems like the businesses believe in the promise (or hype) of the AI; however, they don’t know how to implement it, they don’t have the data, or the infrastructure, or the people to manage it.

But the last finding is the most important, “AI projects fail because the technology is applied to problems that are too difficult for AI to solve”. This means that AI is limited in solving real-life problems – and that’s basically where the hype ends.

Implications

Microsoft is heavily investing in Gen AI, with capex at over $44 billion over the last 12 months, which is 50% of net income. The Open AI is losing massive amounts, and the losses are expected to accelerate. Currently, Microsoft stock price is caught in the Gen AI mania, and the valuations are very expensive.

Thus, Microsoft is heavily dependent on the Gen AI success. However, it seems like Gen AI is just hype, without the ability to solve real-life business problems. The recent study shows that only 14% of companies are ready to adapt AI, which is not surprising given that more than 80% of AI projects fail.

The question is when will companies like Microsoft start confirming the Gen AI failure, as the referenced studies show. The problem is that the guidance and the outlook from Microsoft and other key Gen AI players don’t consider the findings of these studies.

Thus, analysts continue to raise the projections. In my opinion, this is inflating the bubble. However, if the referenced studies are correct, the earnings will have to eventually reflect the Gen AI reality, and in my opinion, the Gen AI bubble will burst. I don’t expect that Microsoft will miss the earnings estimates for the last quarter, but any mention of the uncertain Gen AI capex RoR or the Gen AI wider adoption could burst the bubble – and in my opinion, that’s likely, given the referenced studies.

My negative outlook for Microsoft would change if the Gen AI adoption shows a wider adoption beyond the tech sector, which eventually improves productivity, and thus the GDP growth outlook. That’s what the Gen AI bulls believe in. Unfortunately, there is no evidence of that – yet.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.