Summary:

- I’m maintaining my buy on Netflix post 3Q24 earnings after the company beat on subscriber growth and showed solid footing for next year.

- I believe the anticipated price hikes will better position the company to drive top-line growth throughout FY25.

- I think management’s focus on improving core film and series offerings and other growth catalysts like games and live will enhance engagement, boosting the top line in the longer term.

- I share my positive sentiment on Netflix here and why I see more upside in FY25.

Five Buck Photos/iStock via Getty Images

Investment thesis:

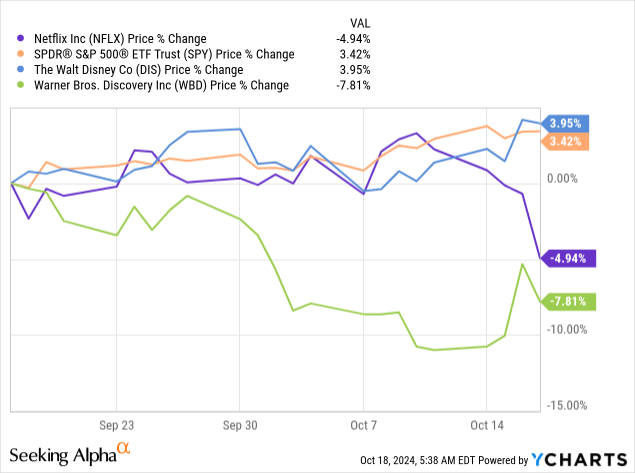

Netflix (NASDAQ:NFLX) reported 3Q24 earnings Thursday and beat on the top and bottom lines. I last wrote on Netflix post 2Q24 earnings reiterating my buy in July, since which the stock is up 6.2%. I see more upside ahead for Netflix and expect the anticipated price hikes to drive top-line growth by FY25. The stock is down ~4.9% on the 1-month chart, as seen below, underperforming both the S&P500, up 3.4%, and rival Walt Disney (DIS), up 3.9%, but outperforming Warner Bros. Discovery Inc. (WBD), down 7.8%. While the 1-month chart will change at market open Friday with the stock up around 6% in pre-trading, I continue to think Netflix is attractive at current levels for the potential upside that higher pricing, combined with more engagement efforts from management, can provide.

Netflix has been on a roll this year, and the fact that the company reports before its peers gives the market an idea about consumer spend in the streaming industry. The company remains on top of its game against the peer group as the king of streaming, and I don’t expect this to change anytime soon.

In my last note, I expected that Netflix was “better positioned to outperform in 2H24 as it leaves the threats of seasonality behind. All in all, Netflix is gaining momentum in the ever-expanding SVoD market. I see Netflix having yet another impressive next quarter, mainly driven by its original content and the “hyper-focus” on engagement.” The company’s co-CEO Greg Peters confirmed management’s priority remains “improving our core film and series offering.” I maintain my sentiment even more after this quarter’s results and management’s commentary on the call. With the recent rate cuts and more anticipated rate cuts by the end of the year, I think the momentum for Netflix will augment as consumer discretionary spend rebounds.

YCharts

Expectations versus reality: this quarter’s results and price hikes

For 3Q24, management forecasted revenue of $9.73 billion, lower than consensus estimates at $9.83 billion, and EPS of $5.10, above consensus of $4.74. I discussed this in my last note and pointed out a trend I’ve been eying for the last three quarters: Management has guided lower than consensus for Q1 and Q2 but beat on revenue and EPS in both. And what do you know? Netflix did it again, and this quarter’s results are a testament. Revenue came in at $9.82 billion and was up 15% year over year, beating estimates by $50 million. GAAP EPS came in at 5.4% and beat expectations by $0.28. Netflix added 5.07 million paid memberships this quarter, and its total subscribers currently stand at 282.72 million.

For the next quarter, management expects revenue growth of 15%, up from 14%, and raised its full-year 2024 operating margin forecast to 27%, up from the previously forecasted 26%. Netflix is also expecting a higher influx of paid additions to its platform in Q4 quarter over quarter due to stronger seasonality and content slate. As for the advertising business, ad membership was up 35% quarter over quarter, and the ad tech platform will be launched in Canada by Q4 and 2025.

I don’t expect much upside from the ad business yet, but I am watching it for sure. For 2025, the company is expecting revenue of $43 billion-$44 billion, higher than the consensus of $38.73 billion and 11%- 13% up from 2024 full-year revenue guidance at $38.9 billion. This is backed by a forecasted increase in paid memberships and ARM. Operating margin for 2025 is expected at 28% versus 2025 guidance of 27%.

Why I think price hikes are coming:

All in all, I think Netflix, with its continued investments in new legs of growth through games, sports, and original content, is well-positioned to keep outperforming the peer group and come out on top. According to the company CFO Spencer Neumann, Netflix is planning to further invest in core film and TV offerings, “improving our product discovery, expanding into new areas like live and ads and games.” I’m a fan of management’s thought process in price hikes; according to Peters, the company’s core theory is that they won’t raise prices without delivering more and more value to customers every quarter.

Did we do a good job there? Have we actually delivered on that promise of more value?

These are some questions that come to the table when discussing price hikes. Needless to say, the answer is yes. Netflix is investing in several new offerings, like live events, Tyson Paul, NFL, Christmas Day, and Games. On a related note, I’m most excited about games based on Netflix’s IPs like the coming Squid game, The Ultimatum, Monument Valley 3, and a Virgin River Christmas, and I think that’ll be a hot spot for consumers, too.

So far, Netflix has raised prices in a couple of countries: Europe, Scandinavia, and Japan. The results have been in line with expectations. Knowing Netflix, churn rates as a result of price hikes are not very common, and I expect the same to continue into current price hikes, especially in a more friendly rate-cut environment. As per management’s announcement, the company is planning for additional price hikes in Spain and Italy. One case study is Netflix’s recent LatAm price hikes that stagnated revenue growth at a 9% increase year over year and 10% year to date, which is in line with the 9% in 2023. However, the currency headwinds in 2024 are significantly higher than in 2023, which is why the stagnation is more of a slight acceleration in retrospect. The decrease in Q3 membership in Latin America is due to the price changes in the company’s “bigger LatAm markets, which always dampens near-term growth.” However, as we’re in the early innings of Q4, the company has already seen a nice rebound in terms of membership growth, which is not uncommon, considering Netflix’s customer base has proved resilient and loyal.

Although management doesn’t decide on a price based on the streaming peer group pricing or its pricing power, I think these could come as a positive. I said it once, and I’ll say it again: Netflix walked so that everyone could run. Starting off with a pass-crackdown to price hikes that opened the door for others in the streaming industry, like Disney, to also follow in its footsteps. I expect other streaming businesses to also follow suit on Netflix’s shift away from subscriber numbers to engagement and revenue down the line.

Valuation:

Netflix has a market cap of $297.45 billion and an enterprise value of $311.14 billion. The stock has a beta of 1.26, meaning its price volatility is higher than that of the market average. The stock is up over 92% over the last 52 weeks, and I expect more upside over the coming 52-weeks. According to data from Refinitiv, the market sentiment on Netflix is positive, with over 20% of Street analysts giving the stock a strong buy, with over 47% giving it a buy; around 27% of Street analysts give Netflix a hold, and only 4.2% give it a sell. The PT median and mean both have an upward trajectory, further supporting the optimistic sentiment on the stock. The PT median was $682.5 in mid-July, went up to $708 in August, down ~$2 in September at $706.3, but is currently at $727.5. The PT mean was $670.8 in July and surged up to $692.6 in August and continued going up in September at $694.9 and is currently at $718.8.

Netflix is fairly valued at current levels due to its growth catalysts in the mid-to-long term. I might even dare say it’s edging cheap. Netflix currently has a P/E ratio of 35.5 for CY 2024, higher than the streaming peer group average of 28.8 and its biggest competitor, Disney, at 19.3. Netflix’s EV/Sales is 7.4 for CY 2024, higher than the peer group average of 4.1 and its competitor Disney at 2.4. I think Netflix has the growth catalysts and a sound footing in the streaming industry. I don’t see why next quarter would be any different in terms of outperformance, as the three recent quarters proved this as possible.

What’s next?

I think Netflix has a lot going for it in terms of initiatives that will play out in the mid to long-term. Such initiatives take time, and along with its already highly profitable core business, I think Netflix’s position in the streaming industry is intact. The company currently has over $600 billion in consumer spend in the countries it’s operating in, and it’s only been capturing roughly 6% to 7% of that. I think the odds are in Netflix’s favor, and the go-to-market strategy is working. I see more upside in 4Q24 and into 2025.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.