Summary:

- PayPal investors have finally enjoyed their winning moments as the stock outperformed its financial sector peers and the S&P 500.

- Recent partnerships with Adyen, Shopify, and Amazon enhance PayPal’s competitiveness against its walled-garden peers.

- Despite improved profitability, PayPal’s topline growth is expected to slow, necessitating a focus on more profitable growth and operating leverage.

- I observed a potentially decisive breakout has likely occurred, validating its bullish thesis.

- I explain why PYPL’s resurgence from its battering is just getting started. Read on to find out more.

Justin Sullivan

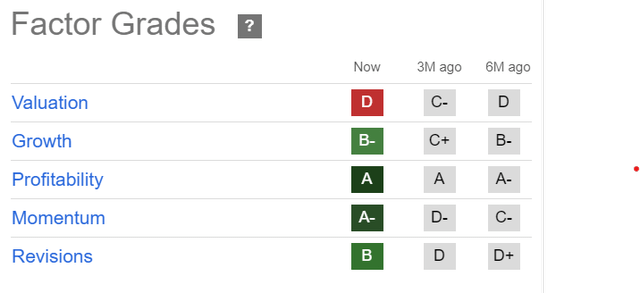

PayPal Holdings, Inc. (NASDAQ:PYPL) investors have benefited from improved buying sentiments over the past six months as PYPL emerged from its worst battering in recent times. As a result, PYPL’s momentum grade improved from “D-” to “A-” over the past three months, corroborating the market’s confidence in its revamped strategies. It has also helped the stock outperform its financial sector (XLF) peers and the S&P 500 (SPX) (SPY), corroborating my observation that the worst is likely over.

In my previous bullish PayPal article in August 2024, I explained why I assessed the stock as having “finally bottomed.” Management executed well, as PayPal demonstrated notable progress in the branded and unbranded space. Therefore, it has likely bolstered the market’s optimism that its execution under CEO Alex Chriss has improved markedly, underscoring its ability to meet its full-year guidance with increased clarity.

I assess PYPL’s bullish reversal as justified, as it has struck several pivotal partnerships with its payment peers. As one of the leading players in the payment processing industry, the company likely recognized the increasingly intense competition as big tech encroaches further on its turf. Given the ecosystem advantages entrenched in the walled gardens of Apple Inc. (AAPL) and Alphabet Inc. (GOOGL) (GOOG), management must move fast to navigate these headwinds.

Therefore, the recent deals with Adyen N.V. (OTCPK:ADYEY), Shopify Inc. (SHOP), and Amazon.com, Inc. (AMZN) have been well-received by investors, as they could improve PayPal’s engagement and help it gain traction outside of its core platform. In addition, Fastlane has also integrated into its partnership with Fiserv, Inc. (FI) and Paydiant, capitalizing on the improved conversion metrics for its guest checkout platform. It has also afforded PayPal the opportunity to “monetize checkout experiences that are not processed on its platform.” Hence, I assess that the partnerships have strengthened its competitiveness against its walled-garden peers, helping the payments leader to compete more effectively.

Recent metrics presented by Mizuho suggest that PayPal’s branded volume growth has performed relatively well, with payment volume “growing 6% over the past 12 months.” Therefore, it should assure investors that the company’s initiatives have started to pan out, although I assess it’s still too early for us to conclude decisively. In addition, the payment landscape is rapidly evolving as banks and big tech vie for a more significant share of the peer-to-peer space through PayPal’s Venmo.

Furthermore, PayPal could face more intense challenges as it adjusts its pricing in its unbranded platform to reflect the value of its offerings better. However, the unbranded space is considered highly competitive, as it also previously diluted PayPal’s profitability growth. Notwithstanding my caution, I assess that the market is likely optimistic about the potential gains made through its recent partnerships. In addition, focusing on more “valuable” opportunities in the unbranded space should help improve the clarity on its margins trajectory, reducing the potential variability moving ahead.

PayPal will release its third-quarter earnings on October 29. Management updated that it remains confident in delivering its full-year revenue guidance of between 10% and 11%. Given PYPL’s recent outperformance, investors are likely not expecting any “unanticipated” surprises as we head toward PayPal’s Q3 earnings release.

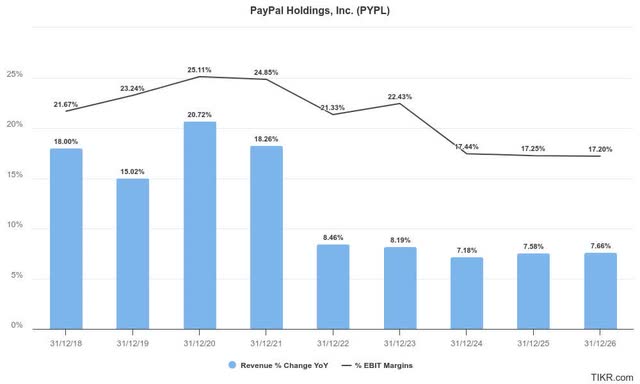

However, investors must be cautious about expecting a sharp valuation re-rating in PYPL. Wall Street’s revisions to PYPL estimates are mixed, suggesting an improvement in profitability but a decline in topline growth. In addition, analysts don’t expect PayPal to return to its high-growth phase (as seen in the chart above) recorded earlier.

Coupled with the company’s focus on more profitable growth prospects, PayPal investors must contend with a markedly slower topline growth profile while assessing the opportunities to gain operating leverage. PayPal’s adjusted operating margins are expected to remain stable, corroborating the market’s confidence in the potential success of its recent partnerships.

PYPL Quant Grades (Seeking Alpha)

PYPL’s valuation has worsened over the past three months, downgraded from a “C-” to a “D” grade. Given its relative outperformance, I urge investors to consider the valuation re-rating as constructive, even as it trades at a relative premium.

As seen above, PYPL is assessed as a growth stock (“B-” growth grade) compared to its financial sector peers. In addition, its commitment to delivering more profitable growth opportunities for investors should bolster the clarity in its “A” profitability grade. Unless management telegraphs a much lower-than-anticipated outlook for its upcoming Q3 release, I’m confident in the sustainability of its robust buying momentum.

However, PYPL’s forward adjusted PEG ratio of 1.6 is more than 15% over its sector median. Therefore, investors deciding to add exposure at the current levels must assess the results and developments of its recent initiatives on its branded platform TPV. As PayPal potentially lowers its TPV growth opportunities in the unbranded space to improve its margins, it needs to strengthen the branded aspect of its business further.

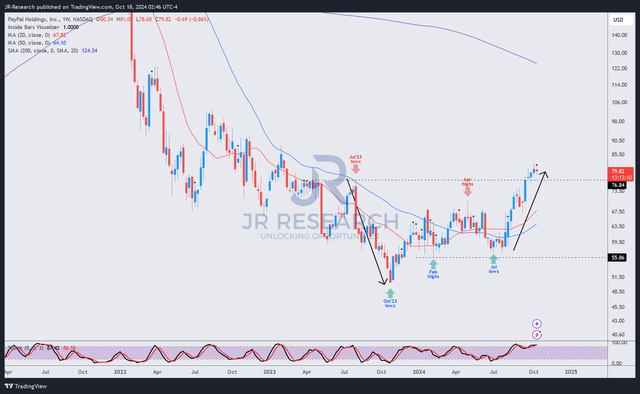

PYPL price chart (weekly, medium-term) (TradingView)

As seen above, PYPL has surged above its July 2023 highs, with no signs of a bull trap yet. It marks a pivotal moment for PYPL bulls to celebrate, as it could validate a decisive breakout in its buying momentum.

A series of constructive higher lows and higher highs have lent credence to my bullish thesis, bolstered by its robust momentum grade (as highlighted earlier). Therefore, I’m increasingly confident that we are still in the earlier stages of PYPL’s recovery, as it remains far below its 2021 highs.

Notwithstanding my optimism, investors must be cautious about expecting a significant valuation re-rating in PYPL. As competition in the payments space has become more intense, PayPal could have more significant limitations with its pricing levers, as it needs to maintain its competitiveness. In addition, while consumer spending has remained resilient, the uncertainty in the cadence of interest rate reductions through 2025 could continue to weigh on consumers, potentially impacting PYPL.

Rating: Maintain Buy.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, GOOGL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!