Summary:

- TSMC’s stock has risen 21.15% since my last buy rating, driven by innovation, industry-leading products, and a loyal client base.

- TSMC’s strong revenue growth, particularly in the AI and smartphone markets, positions it well for long-term growth and value creation for investors.

- DuPont and EVA analyses highlight TSMC’s superior profitability and efficiency compared to Intel, making it a solid investment with strong fundamentals.

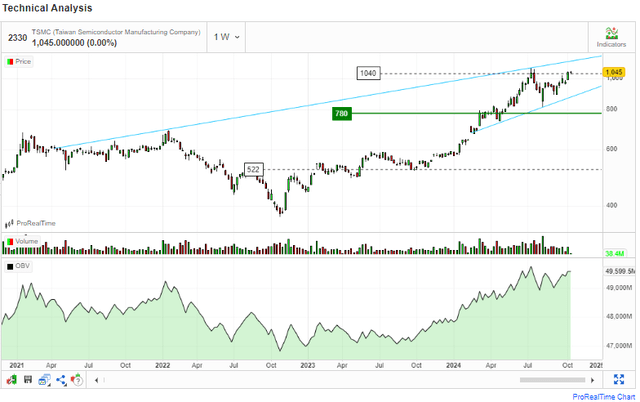

- Technical indicators, including moving averages, MACD, RSI, and OBV, confirm a bullish outlook, justifying a buy decision despite potential risks in the foundry industry.

SweetBunFactory/iStock via Getty Images

Investment Thesis

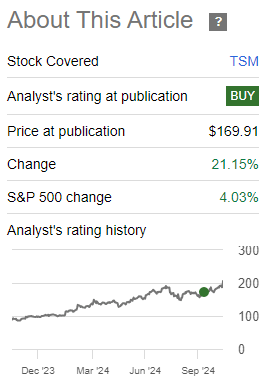

On September 15th, 2024, I published a bullish article on Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) where I reiterated my buy rating for the company. My optimism was based on the company’s innovation and industry-leading products, which serve as its moat, as well as its loyal and broad client base. Since that coverage, the stock has risen by 21.15%, outperforming the S&P 500 gain of 4.03%.

Seeking Alpha

In this updated coverage, I am discussing why I believe TSM will keep leveraging the AI wave to deliver solid growth and create value for investors. The company will benefit from tailwinds such as the surging AI demand, the rebound of the smartphone market, and its expansion in the IoT and automotive sectors. To solidify why TSM is a solid investment, my DuPont and EVA analyses show that this company is creating value for its shareholders multiple times compared to its competitors. From a technical perspective, the stock is in strong upward momentum, which justifies a buy decision in the phase of strong growth levers and solid fundamentals.

Q3 2024: Consistent Revenue Growth Affirms Strong Momentum

TSM’s impressive quarterly performance, with Q2 2024 being a significant turning point in its revenue growth streak, has demonstrated the company’s steady progress. It reported $20.8 billion in revenue for the second quarter of 2024, up 32.8% from the 2023 Q2. Earnings per ADR were $1.48, approximately $0.06 more than anticipated. As indicated in my previous coverage, its consistent revenue growth has been primarily driven by the high demand for its innovative products, particularly the 3-nanometer technology, which accounted for about 15% of its total revenue in Q2 2024.

In Q3 2024, the company maintained its strong revenue growth which began in Q2 2023 when the company reported total revenue of $15.65 billion. Since then, TSM has been growing its revenue QoQ, a trend which has been maintained as depicted by the soaring revenues in the last five quarters from $15.65 billion in Q2 2023 to $23.63 billion in Q3 2024. The company’s strong growth momentum is confirmed by the fact that its MRQ total sales grew 39.88% YoY, the highest quarterly rise in over eight quarters and at least the fifth consecutive quarterly revenue growth.

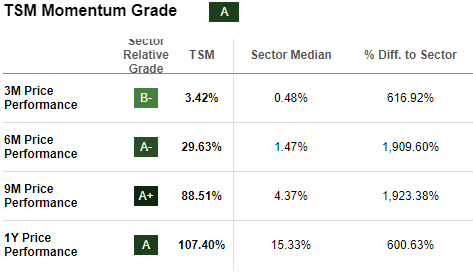

While the company’s revenue growth has been impressive, its stock has responded to this trajectory, as evidenced by its stock momentum being significantly higher than the sector median and receiving a grade A rating from SA.

Seeking Alpha

Although this momentum is attractive to investors, its sustainability is the most important aspect, and that brings me to the growth levers that, I believe, will sustain it in the long-term as discussed in the subsequent sections.

Surging Demand For AI

The surge in demand for AI is one of TSM’s primary long-term growth drivers. The demand for AI chips has increased dramatically globally, particularly for high-performance computing (HPC), which is the company’s area of expertise given its most recent industry-leading inventions including 3-nanometer and 5-nanometer technologies (for more details on these innovations revisit my previous article on TSM). To highlight the market’s long-term growth, BCC research forecasts that the worldwide HPC market will reach $107.8 billion by 2028, up from $46.2 billion in 2022, representing a CAGR of 15.6% between 2022 and 2028.

Given TSM’s industry-leading products and innovative culture, as well as its significant investment in growth areas, as highlighted in my prior coverage, I believe the firm is well-positioned to capitalize on market prospects for long-term growth. Most importantly, TSM has a massive 90% market share of advanced chips, which explains its unshakeable market dominance and provides ample reason to be confident in the company’s ability to grow in the face of rising demand. In terms of market dominance, it is worth noting that the company receives a considerable portion of its revenue from major tech giants, with Apple (AAPL), AMD (AMD), and Nvidia (NVDA) accounting for more than 40% of total revenue.

Considering this significant revenue contribution from giant tech companies, it does not only offer the company revenue visibility for also a reliable revenue stream. For the next two years, Nvidia and AMD have secured TSMC’s advanced packaging capacity for CoWoS and SoIC technologies, indicating that the giant companies are offering TSM a reliable market, something that bodes well for the company’s future revenue growth and stability.

The outlook is extremely positive in light of the strong demand for its market-leading products. Over the next five years, TSMC projects that the CAGR of AI chips will approach 50%, contributing more than 20% of the chip foundry’s revenue by 2028. These projections point out strong future growth which picks up from the current momentum. Given the company’s market dominance and solid projected market growth, I am confident that these estimates are feasible, which is supported by its track record of earnings and revenue surprises.

New Opportunity In The Smartphone Industry

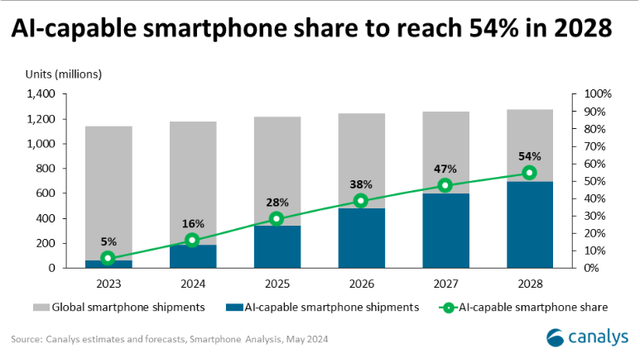

The smartphone market offers a great opportunity for TSMC to leverage its superior AI technologies. The demand for AI-enabled smartphones is growing significantly. By 2028, it is expected that 54% of new smartphones will have generative AI capabilities. This expansion is being driven by breakthroughs in semiconductor technologies and rising consumer desire for smarter, more personalized products.

TSM plays a major role in AI chip manufacturing, something that positions it to be arguably the major beneficiary of this great opportunity. It is a top producer of advanced semiconductor chips, which are essential for applications using artificial intelligence. It supplies chips to well-known AI chip manufacturers like AMD and Nvidia. These chips are crucial for enabling AI features in modern smartphones, like voice assistants, improved camera capabilities, and real-time language translation.

Features like multimodal capability, personalization, and improved device connectivity are all part of smartphones’ AI integration. These capabilities are greatly improved by TSMC’s cutting-edge AI technologies, which also make smartphones more intuitive and user-friendly. As a result, TSMC has a high potential to capitalize on the smartphone market opportunity.

As the market for AI GPUs is estimated to expand at a 70% CAGR and reach $400 billion by 2027, TSMC is in a better position to profit from this development. This is because its major customers AMD and Nvidia are at the center of this projected growth. Its advanced processors will be in high demand due to the growing use of AI in smartphones, which alludes to future revenue growth.

DuPont Analysis

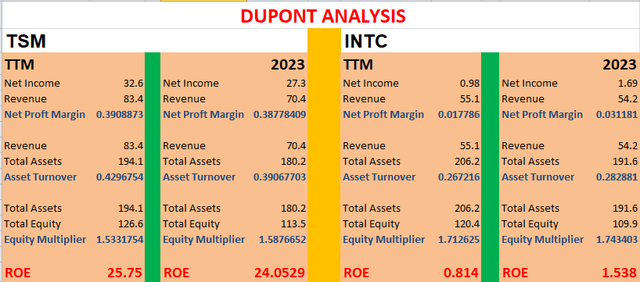

Having discussed this company’s impressive growth, let’s do a DuPont analysis to get a deeper insight into its financial health, as well as getting a holistic view of its performance. DuPont analysis will offer a comprehensive view of the company’s profitability and efficiency. The model has three essential components: the net profit margin, asset turnover, and equity multiplier. For a thorough and candid analysis, I analyzed the 2023 fiscal year and TTM for both TSM and its foundry business competitor, Intel, to determine how their fundamentals are evolving. Given this backdrop, the model output is presented below.

Looking at these results, it appears that TSM’s fundamentals are solid, as seen by its ROE of about 24% in 2023 and around 26% on a TTM basis. In contrast, Intel’s fundamentals are not just weak, but deteriorating, with ROE decreasing to less than one percent. This illustrates that Intel is far from replicating TSM in terms of strong fundamentals and delivering value for investors.

Going on to the three elements of the model, TSM’s extremely high net margin above INTC indicates how profitable it is in comparison to its rival. There could be multiple reasons for this. The first reason might be that TSM’s pure-play foundry business model enables them to concentrate on streamlining their manufacturing procedures and achieving economies of scale. The second reason is its market dominance in the foundry industry, which, among other things, gives it pricing and negotiates long-term contracts with giant customers like AMD and Nvidia that provide a consistent flow of income.

Further, for asset turnover, the INTC ratio has decreased from 0.28 to 0.26, both times being lower than TSM’s, which has increased from 0.39 to 0.43. This means that, in general, the latter is more efficient in using its assets to create sales and is improving, whereas the former is less efficient and is even deteriorating.

The equity multiplier is the last component where TSM has a relatively lower value than INTC. This suggests that, while both companies rely on debt funding, TSM has slightly less leverage than its competitors. While TSM’s debt financing is justified by its growth and excellent ROE, INTC’s use of debt has resulted in lower profit margins and weaker returns, which are unappealing to investors.

In conclusion, TSM has stronger fundamentals than its competitor with its strength being in its profitability and efficiency, hence a good investment opportunity with higher value for investors.

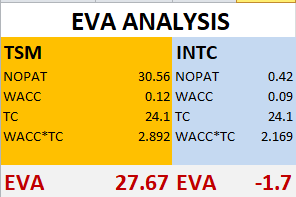

EVA Analysis

To supplement the DuPont analysis, I carried out an Economic Value Added analysis to determine how well these two competitors make profits from their invested capital. EVA measures the true economic profit of a company by considering both equity and debt capital. The formula is as follows:

EVA = NOPAT – (Invested Capital*WACC)

Where:

NOPAT is net operating profit after taxes.

WACC is the weighted average cost of capital.

Below is the model output given the above formula.

Author Computation

In the above calculation, I used the TTM values. From this output, TSM has an economic value added of $27.67 billion TTM from an invested capital of $24.1 billion [CapEx] compared to a negative economic added value of $1.7 billion TTM for INTC. This implies that TSM is generating value above its cost of capital when its competitor is generating losses for its invested capital. This implies that TSM is creating a significant value for its shareholders, something which instills confidence in investors because TSM is not only profitable but also creates value for its shareholders.

Technical Take

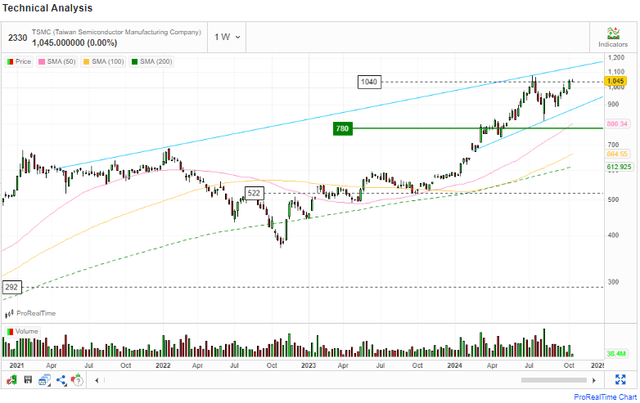

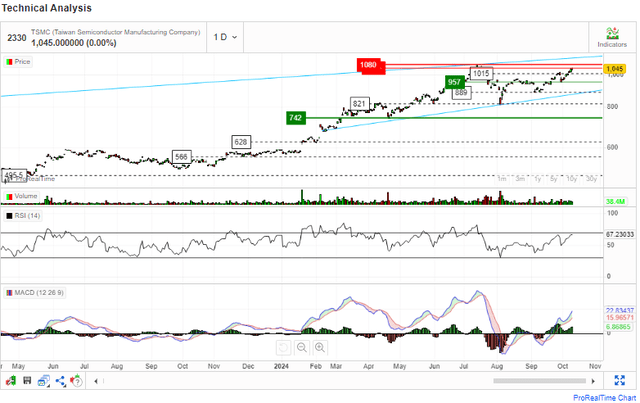

While I maintain my estimated price target of $295.19 in my previous coverage based on the regression model, I will use technical indicators to support my bullish stance on this stock. To begin, the stock price is above the 50-day, 100-day, and 200-day moving averages, indicating that the stock is bullish over the short, medium, and long term. Most importantly, in mid-November, the 50-day MA rose above the 100-day MA, resulting in the golden cross, which confirms a long-term bullish trend.

In addition, the MACD and RSI are pointing to a strong bullish momentum. The MACD is above the signal line, both of which are above the zero line and trending upward indicating a strong bullish trajectory. Further, the RSI is currently in an apparent upward movement, which further confirms the bullish outlook.

Above all, the OBV has been rising consistently, indicating an increasing buying pressure. This signifies that more volumes are being traded on up days than on down days, which is a bullish signal.

In a nutshell, TSM is in a dominant and strong bullish trajectory which justifies a buy decision, especially given the golden cross that occurred last month.

Risks

Although I am optimistic about this stock, investors should be aware of one key risk before buying. The major risk of investing in TSM is the narrow business model, which is completely foundry-based. If the foundry industry experiences a disruption or supply chain disturbance, this company’s financial health would be severely impacted, perhaps resulting in significant losses for investors.

Conclusion

In conclusion, TSMC’s growth momentum remains driven by increased AI demand, particularly in high-performance computers and smartphones. With major players such as Nvidia and AMD dependent on TSMC’s advanced processors, the company is well-positioned to benefit from the AI revolution. Given its high ROE and EVA, TSM generates value for its shareholders, making it an attractive investment prospect. Given this backdrop and the bullish outlook based on technical analysis, I recommend buying this stock

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.