Summary:

- Despite a disappointing Q3 report, Elevance Health remains attractive due to its relatively favorable valuation compared to UnitedHealth Group and a total shareholder yield of roughly 3.5%.

- Elevance’s expansion into healthcare services through Carelon and continued strength in Medicare and Medicaid markets support long-term growth, especially given the industry’s demographic tailwinds.

- Though 2024 is a “reset” year, Elevance management’s outlook for 2025 and beyond points to strong potential margin recovery and continued earnings growth.

designer491

UnitedHealth Group Incorporated (NYSE:UNH) and Elevance Health, Inc. (NYSE:ELV) are the two largest health insurers in the United States. While both play major roles in the industry, there are key differences in their business models and growth prospects that, for me, give Elevance an edge looking to the future. Despite UnitedHealth’s stronger performance over much of the past decade, I believe Elevance’s expansion into healthcare services, its strong position in Medicare and Medicaid, and its more attractive valuation make it the more compelling option moving forward.

Comparing Business Models: ELV and UNH

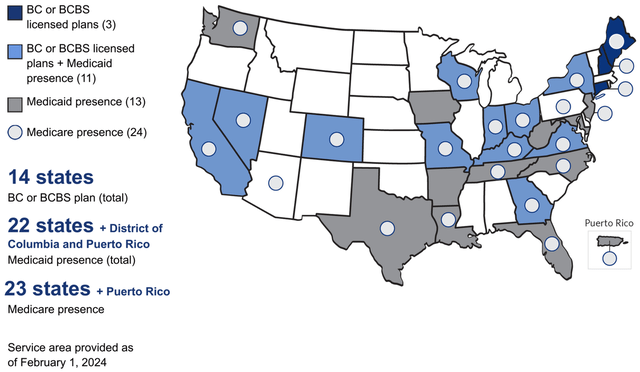

ELV operates under the Blue Cross Blue Shield (BCBS) brand in several states, focusing on both commercial (private) and government-sponsored plans.

Elevance’s Service Area (Elevance 2024 Annual Shareholders’ Report)

Recently, the company has been expanding into healthcare services-a key part of the growth thesis I outline below. ELV thus divides its business into three main segments:

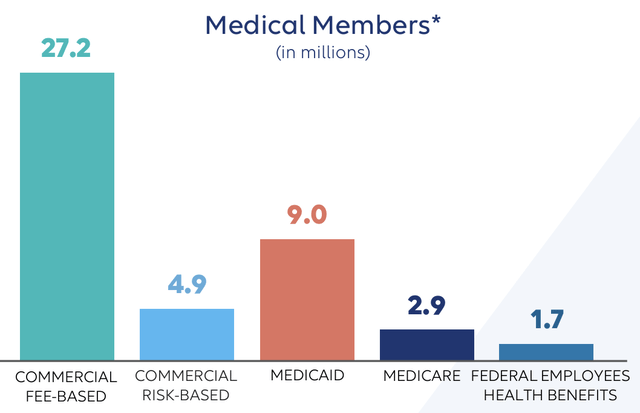

- Health Benefits – Currently accounts for around 86% of revenue and includes commercial insurance, Medicaid, and Medicare Advantage plans. While Medicaid membership has been declining due to eligibility redeterminations, ACA and employer-based plans are growing.

- CarelonRx – The pharmacy benefit management division mainly serves its insurance networks, but also caters to some external clients. Significant investment in infrastructure (e.g., delivery logistics and tech platforms) has driven double-digit revenue growth recently.

- Carelon Services – Focuses on healthcare services and is the company’s fastest-growing division. External revenue growth (from non-ELV customers) jumped by approximately 50% in Q2 2024.

Elevance: Membership by Segment (Elevance 2024 Annual Shareholders’ Report)

In simple terms, the business model centers on diversification, spreading revenue streams across the three segments. Doing so reduces financial risk (vs. being all in one) and supports long-term stability. Central to this strategy are the company’s risk management practices and its deep local/regional relationships through the BCBS brand. By expanding beyond insurance into integrated healthcare, ELV aims to reduce costs and (presumably) improve outcomes, though this shift also introduces new risks given the complex and evolving healthcare landscape.

ELV and UNH both generate substantial revenue from health insurance, but they differ significantly in terms of diversification and scale. UnitedHealthcare (UNH’s insurance arm) and ELV’s Health Benefits segment both focus on commercial insurance, Medicaid, and Medicare Advantage. However, UNH’s Optum division encompasses healthcare services, pharmacy benefits management, data analytics, and telemedicine platforms. This is divided into two segments for ELV (CarelonRx and Carelon Services) but operates on a much larger scale for UNH.

Moreover, UNH has a more global presence with operations in Latin America (notably in Brazil, Chile, and Colombia) while ELV operates domestically through its BCBS network. The integration between UNH’s two segments is arguably more developed, while ELV is still building toward that level of integration. Overall, UNH is more diversified whereas ELV, at least for now, relies more heavily on its core insurance operations, with healthcare services playing a growing but smaller role.

Two other peers to note are Cigna (CI) and Humana (HUM), both smaller than ELV but sharing some similarities. CI has also expanded beyond commercial insurance into healthcare through its Evernorth division, which includes pharmacy management, behavioral health, and data analytics. This somewhat parallels ELV’s Carelon Services, though CI’s focus on large employer plans and other health systems is more specialized. HUM by contrast is more concentrated in Medicare Advantage while ELV has a more balanced portfolio, as described above.

Comparing Fundamentals: ELV and UNH

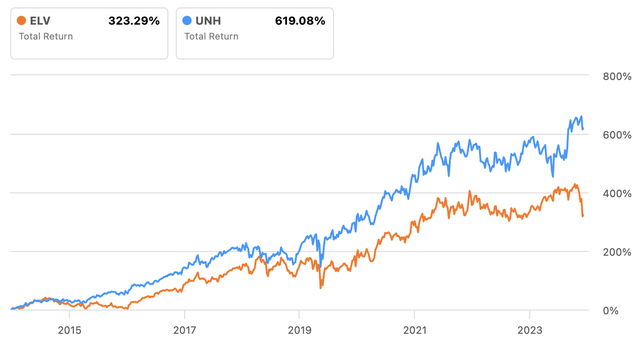

There’s no debating that UNH has delivered better total returns for investors over the past decade, magnified by ELV’s recent and steep decline:

UNH vs. ELV: 10Y Total Return (Seeking Alpha)

However, when comparing growth and profitability metrics, the picture is more mixed. UNH has achieved superior and more consistent revenue growth, but ELV has outpaced its larger peer in EPS growth over the past decade. While UNH maintains a higher average operating margin since 2019, it has trended downward, whereas ELV’s has modestly improved. In terms of net income, ELV has performed better, with significantly stronger growth than UNH.

|

ELV |

UNH |

|

|

Revenue 10Y CAGR |

9.1% |

11.9% |

|

Revenue 5Y CAGR |

12.2% |

10.5% |

|

Revenue YoY |

3.6% |

9.4% |

|

EPS 10Y CAGR |

14.2% |

10.7% |

|

EPS 5Y CAGR |

13.0% |

2.3% |

|

EPS YoY |

8.6% |

-33.2% |

|

Oper. Margin |

5.6% |

5.3% |

|

Oper. Margin 5Y Avg |

5.2% |

7.4% |

|

Net Income 10Y CAGR |

11.6% |

10.0% |

|

Net Income 5Y CAGR |

10.4% |

1.4% |

|

Net Income YoY |

6.1% |

-34.0% |

As the next table illustrates, the two companies are nearly identical in terms of their dividend yield, CAGR, and growth streaks. ELV does have a lower payout ratio, though both have plenty of room to grow.

|

ELV |

UNH |

|

|

Yield FWD |

1.47% |

1.48% |

|

5Y CAGR |

15.1% |

15.0% |

|

Years of Growth |

12 |

14 |

|

Payout Ratio TTM |

18.3% |

29.5% |

However, ELV has a clear advantage when you factor in share buyback yield. Morningstar calculates this at 1.0% for UNH and 1.96% for ELV, resulting in total yields of approximately 2.5% and 3.5% respectively. For income-focused investors, this may be a meaningful difference.

The Bull Case for Elevance

With this as a backdrop, my investment thesis for ELV is built upon its long-term earnings growth, expansion into healthcare services, and an attractive valuation for investors versus its peers.

- Earnings Growth – ELV has achieved a nearly 15% CAGR in EPS over the past decade. This growth has come both from premium increases in its core insurance business and the rapid expansion of Carelon Services. Carelon, still in earlier stages compared to UNH’s operations, offers significant long-term growth potential, especially with the recent acquisitions of Paragon Healthcare and Mosaic Health Platforms (both this year).

- Market Position and Tailwinds – ELV’s strong presence in Medicare and Medicaid, coupled with its extensive reach under the BCBS brand, positions it to benefit from favorable demographic trends (read: America’s aging population). The company is also well-positioned to capitalize on government healthcare spending.

- Valuation and Shareholder Returns – ELV trades at lower P/E and P/S multiples compared to UNH, presenting a potential value opportunity for investors. Additionally, the company’s 14.5% dividend CAGR over the past decade, supported by a low payout ratio, demonstrates its commitment to growing shareholder distributions.

Valuation and Price Target

Management provided revised guidance for FY24, estimating full-year adjusted EPS of $33 with 2025 adjusted EPS growth projected to be “at least in the mid-single-digit percent range.” Based on this, we might anticipate earnings growth as follows through FY26:

|

ELV’S Revised Guidance |

||

|

2024 |

$33.00 |

|

|

2025 |

$35.31 |

+7.0% (est.) |

|

2026 |

$37.78 |

+7.0% (est.) |

Based on these projections, ELV currently trades at 12.6x the FY25 estimate of $35.31 and 11.8x the FY26 estimate of $37.78. Both multiples are well below current valuations for UNH (20.5x and 18.7x) and HUM (16.5x and 13.3x). CI is the cheapest of the group, trading at 12.4x and 11.1x.

But what if ELV’s earnings grow at half the projected rate? This would imply earnings of $34.16 in 2025 and $35.35 in 2026:

|

Conservative Model |

||

|

2024 |

$33.00 |

-0.4% |

|

2025 |

$34.16 |

+3.5% |

|

2026 |

$35.35 |

+3.5% |

At the current share price, this would correspond to multiples of 13.0x for FY25 and 12.6x for FY26, both still well below its five-year historical average P/E of 15.6x.

A reasonable approach might be to split the difference between the historical average and the conservative growth model. Doing so, I calculate a potential price target of $481 for FY25 and $498 for FY26. These are well below the current Wall Street consensus estimate of $578.28, though that figure will surely trend lower in the coming weeks.

Given that the conservative price targets of $481 (FY25) and $498 (FY26) represent potential upsides of around 8.3% and 12.2% respectively, I rate ELV a Hold and will look for a further pullback before considering adding more shares. That said, ELV remains more attractively valued than UNH at this time.

Risks

I see four primary risks to the investment thesis outlined above:

- Regulatory Risks – Pharmacy benefit managers are facing increased scrutiny from both political parties. Regulatory changes could significantly reduce ELV’s profit margins and force a realignment of pricing, which would directly impact the CarelonRx segment.

- Rising Medical Costs – In the recent Q3 report, management highlighted a rising benefit expense ratio and increasing costs for their Medicare Advantage and Medicaid plans. This is compounded by the government’s refusal to raise reimbursement rates, and if costs continue to outpace premium increases, ELV’s margins would likely compress further.

- Medicare Advantage Profitability – Given #2 above, Medicare Advantage has become less lucrative for insurers. While ELV has lower exposure to this market than UNH and HUM, it still faces cost challenges associated with this part of the business.

- The “Reset Period” – The Q3 earnings report described 2024 as a “reset” year, with management not expecting margin recovery until at least 2025. With the uncertainty around rising costs and utilization rates, there’s no assurance that margins will fully recover in the near term.

Summary

I consider ELV a compelling investment option due to its historically strong earnings growth, expanding presence in healthcare services, and attractive valuation compared to its peers. The company’s increasingly diversified business model positions it for long-term growth. Although UNH has delivered stronger returns in the past, ELV appears well-positioned to benefit from its expanding footprint in the Medicare and Medicaid markets. Additionally, ELV’s lower valuation multiples compared to UNH present a potential opportunity for capital appreciation.

While 2024 is expected to be a “reset” year, management’s outlook for 2025 and beyond suggests a strong margin recovery. Given these factors, I view ELV as a top-tier option for long-term investors seeking exposure to the healthcare sector.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ELV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.