Summary:

- The company is rolling out new products, such as Augmented Reality glasses and Apple Intelligence, which should become significant growth drivers.

- Apple Bulls hopes the recently released iPhone 16 with AI intelligence will spur upgrades and rejuvenate iPhone revenue growth.

- Competition from Android is rising, especially in China.

- Apple’s forward PEG ratio suggests the stock is potentially overvalued.

Media Lens King

As I write this article on October 16, 2024, Apple Inc. (NASDAQ:AAPL) is the world’s largest company by market cap, at $3.555 trillion. It’s probably one of the most popular consumer electronic companies ever, but is it worth investing in this mature company at current prices? Let’s investigate.

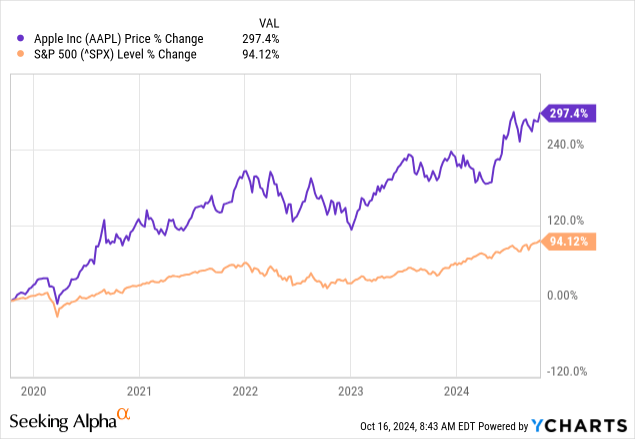

Apple Bears have questioned how much growth it has left in the tank for over a decade, yet the company has continued to defy naysayers. Its stock has risen 297.4% over the last five years compared to the S&P 500’s (SPX) 94.12% rise.

The company has built a substantial ecosystem around the iPhone. Apple Bulls believes that as long as it continues to innovate and add meaningful new products and services to the iPhone ecosystem, the company may maintain or even accelerate long-term growth rates. Apple has produced several products recently that are sizeable enough potential opportunities to believe the company is still a worthwhile long-term investment. For instance, Apple released its Vision Pro Augmented Reality (“AR”) headset in the United States on February 2, 2024. Precedence Research estimates the global AR market will reach $108 billion by the end of 2024 and grow at a 38.5% compound annual growth rate (“CAGR”) to reach approximately $2.804 trillion by 2034. The company is also releasing its take on AI, Apple Intelligence, in the fall of 2024.

The market, aware of Apple’s potential upside from its revenue growth initiatives and excellent profitability numbers displayed in its second-and third-quarter FY 2024 earnings-has accounted for the stock’s approximately 34% rise since May 2. However, the stock’s current valuation reflects much optimism about the company’s future revenue and earnings prospects, to the point that the market may overvalue the stock.

This article will discuss another of Apple’s potential revenue growth drivers, Apple Intelligence. It will also review its fundamentals from its third quarter 2024 earnings report, valuation, risks, and why I recommend a hold.

Apple Intelligence

Apple will roll out its take on AI with a few features this fall. Some of the features that it highlighted on its website include creation and editing tools for writing and images and a more powerful Siri. The one edge that Apple may have over competitors is its emphasis on privacy. Instead of processing AI in some faraway public cloud, Apple will perform most AI functions on-device. In cases where a cloud is necessary, customers will use a private cloud that maintains a user’s privacy. The company described these functions on its website:

Apple Intelligence is designed to protect your privacy at every step. It’s integrated into the core of your iPhone, iPad, and Mac through on-device processing. So it’s aware of your personal information without collecting your personal information. And with groundbreaking Private Cloud Compute, Apple Intelligence can draw on larger server-based models, running on Apple silicon, to handle more complex requests for you while protecting your privacy.

Apple’s strategy of using privacy, which has become a concern over the years due to some large companies abusing personal information, is brilliant. Performing AI functions on the device may give long-time customers an additional reason to upgrade to newer Apple devices. Although other smartphone manufacturers have developed competing AI-powered phones and computers, few have a private cloud resource tied into their hardware devices. Chief Executive Officer (“CEO”) Tim Cook discussed the development of Apple Intelligence on the third quarter earnings call:

We started with some features of Apple Intelligence, not the complete suite. There are other features like languages beyond US English that will happen over the course of the year, and there are other features that will happen over the course of the year. And ChatGPT will be integrated by the end of the calendar year. And so yes, so it’s a staggered launch.

Apple partnered with OpenAI in June to integrate ChatGPT into its devices. When Apple users need capabilities beyond Apple Intelligence’s current ability, they can use a privacy-enhanced ChatGPT for those functions. OpenAI’s website states:

Privacy protections are built in when accessing ChatGPT within Siri and Writing Tools-requests are not stored by OpenAI, and users’ IP addresses are obscured. Users can also choose to connect their ChatGPT account, which means their data preferences will apply under ChatGPT’s policies.

CEO Tim Cook said the following about ChatGPT on the earnings call:

I think the way that I look at it is that Apple Intelligence is the on-device processing and the Private Cloud Compute. And a lot of that will be things with a personal context. And then for world knowledge, we are integrating with ChatGPT initially, and that will be focused on world knowledge as I said.

The current relationship with OpenAI appears not to preclude Apple from forming commercial relationships with companies offering other foundational models or Apple eventually creating and substituting a homegrown foundational model. If its Apple Intelligence product is successful, it could potentially boost revenue growth beyond analysts’ long-term forecasts.

Company Fundamentals

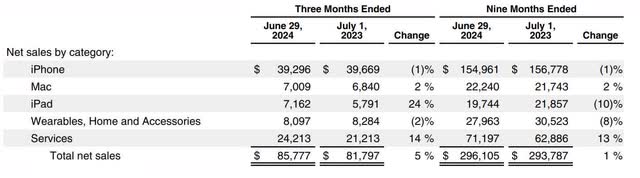

The first thing to note is that the iPhone accounted for around 46% of Apple’s total sales in the June quarter, and iPhone sales declined 1% year-over-year. Since the iPhone sits at the center of its ecosystem, the market hopes the recently released iPhone 16 with AI intelligence would spur upgrades and rejuvenate growth. However, the initial news about the new smartphone was disappointing. Seeking Alpha published an article on October 1 that stated the following from Barclay’s analysts, ‘”Based on our recent supply chain channel checks, we believe AAPL may just have cut roughly 3 [million] units at a key semiconductor component in iPhones for the Dec-Q, which if confirmed would be the earliest build cut in recent history,” said Barclays analysts Tim Long and George Wang, in a Tuesday note.’

Apple Bulls hope Barclays’ assessment is wrong and that the holiday season and AI-powered iPhones will encourage users to upgrade and produce robust sales. Monitoring iPhone sales is a must if you are an Apple investor because although the company is developing new revenue streams, the primary growth driver in the company’s ecosystem in the near-and medium-term centers around the iPhone. Although its Services sales grew 14% year-over-year, some of that growth depends on iPhone sales. Chief Financial Officer (“CFO”) Luca Maestri said on the third quarter FY 2024 earnings call (emphasis added):

In services, total revenue reached an all-time record of $24.2 billion, growing 14% year-over-year. We continue to have great momentum in services, as the growth of our installed base of active devices, sets a strong foundation for the future expansion of our ecosystem.

Part of the issue of slowing iPhone sales is due to global smartphone sales growth grinding to a halt in 2017 after nine years of growth since the first iPhone appeared on the scene in June 2007. Some suggested that the world had hit peak smartphones in 2016 at 1,472 million units shipped. Market research company Statista stated the following: “According to estimates from IDC, smartphone vendors shipped 1.17 billion devices last year [2023], down more than 20 percent from 2016, when smartphone shipments peaked at 1.47 billion units.”

Before 2016, the smartphone market was a rising tide that lifted all boats. After 2016, people began thinking that the global smartphone market may have reached a saturation point, where everyone who wanted a smartphone already had one. Between 2016 and 2023, investors became less optimistic about the long-term growth prospects of all smartphone companies, including Apple.

Analyst CounterPoint stated the following about the situation, “Consumers are holding on to their smartphones for longer periods because upgrades are offering limited differentiation in features. This leads consumers to opt for high-end smartphones to ensure their devices remain technologically relevant for a longer duration.” Essentially, consumers are upgrading at a slower pace because, until recently, newer models have offered less differentiation from older models.

Some Apple investors have hoped that global smartphone growth will resume because AI-powered smartphones will provide enough differentiation to encourage consumers to upgrade their smartphones. IDC forecasts global 2024 smartphone shipments to grow 5.8% over 2023. The problem for Apple is that much of that growth will come from Android. Nabila Popal, senior research director with IDC’s Worldwide Quarterly Mobile Phone Tracker, stated the following (emphasis added):

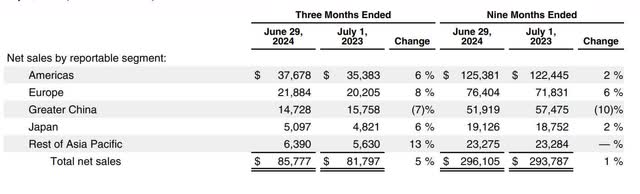

The resulting growth for Android this year will be nine times faster at 7.1% than iOS at 0.8%. Apple’s softer growth is a result of increasing competition in China but also a higher comparison base year. However, there is a potential upside to the iOS forecast with a lot depending on how well the demonstrated GenAI use cases play out in the upcoming iPhone 16 launch and how soon Apple can establish local AI partnerships in China.

The market will likely watch consumers’ reactions to the iPhone 16’s generative AI features. Analysts could revise revenue growth estimates and price targets upwards if generative AI proves helpful and demand grows for Apple’s newest smartphone. On the other hand, if consumers show a lackluster response to generative AI, the company could miss future analysts’ consensus estimates.

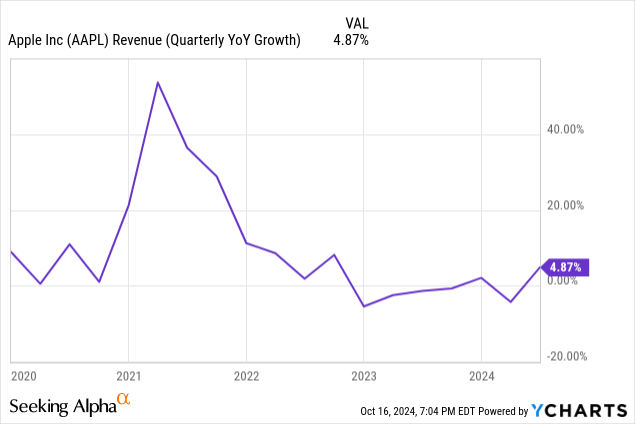

Apple’s third-quarter 2024 total net sales only grew 5% year-over-year, dropping precipitously since 2021.

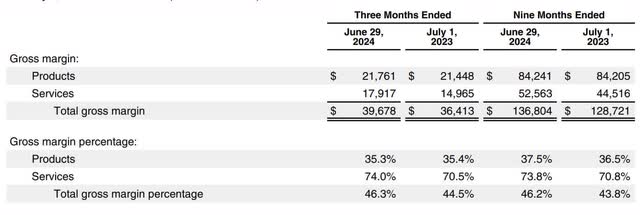

Next, let’s look at the company’s profitability. The table below shows that Apple’s third-quarter FY 2024 product gross margins were 35.3%, which is excellent for a device manufacturer. Its use of contract manufacturers like Foxconn likely allows it to keep product gross margins relatively high. The company’s third-quarter FY 2024 Services gross margins were 74%.

Apple’s third-quarter FY 2024 10-Q

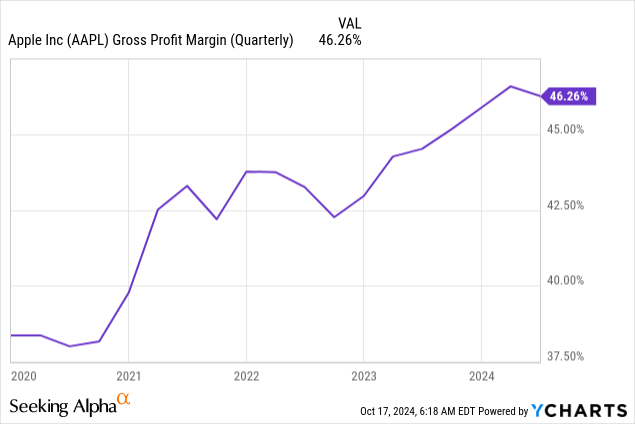

Apple’s third-quarter FY 2024 gross margin rose 180 basis points (“bps”) to 46.26%. Its gross margins have shown a significant improvement over the last five years. Among the reasons for its total gross margin expansion is higher margin Service revenue becoming a more substantial percentage of total revenue. In the third quarter of 2023, Service revenue was 25.93% of total revenue. In this year’s third quarter, Service revenue grew to 28.22% of total revenue.

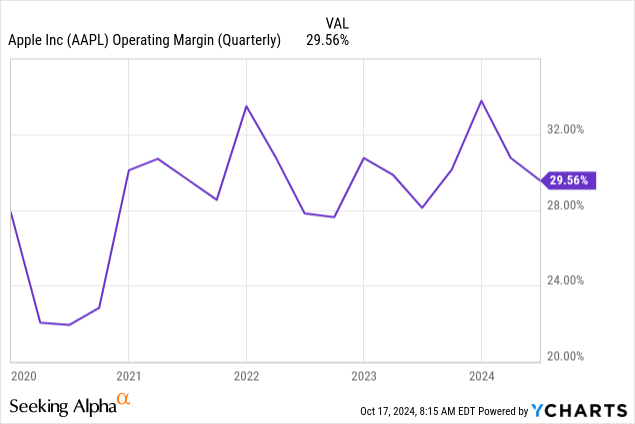

Apple’s third-quarter operating margins grew 145 bps to 29.56%.

The company reported a third-quarter FY 2024 diluted earnings-per-share (“EPS”) of $1.40, showing 10% growth year-over-year and beating analysts’ estimates by $0.06.

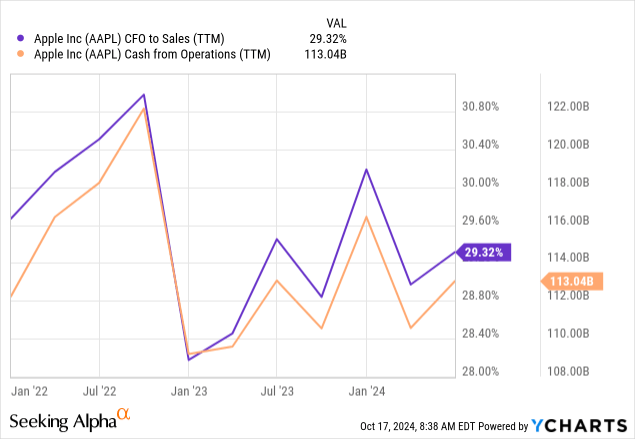

The company produced trailing 12-month (“TTM”) cash from operations (“CFO”) to sales of 29.32%, which means for every $1 in sales, Apple generates $0.29 in CFO. Its third-quarter TTM CFO was $113.04 billion.

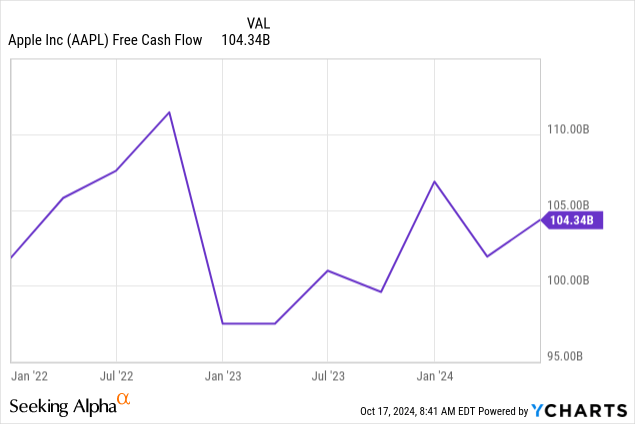

Apple produced a TTM free cash flow (“FCF”) of $104.34, which it can use to reinvest in growth, pay down debt, buy back stock, or pay dividends to provide value for shareholders.

CFO Maestri said the following on the third quarter FY 2024 earnings call:

We ended the quarter with $153 billion in cash and marketable securities. We repaid $4.3 billion in maturing debt and increased commercial paper by $1 billion, leaving us with a total debt of $101 billion. As a result, net cash was $52 billion at the end of the quarter. During the quarter, we returned over $32 billion to shareholders, including $3.9 billion in dividends and equivalents and $26 billion through open market repurchases of 139 million Apple shares.

Last, the company expects fourth-quarter revenue to grow at a rate similar to the third quarter and gross margins between 45.5% and 46.5%.

What to expect in upcoming earnings

The coming is due to report fourth-quarter FY 2024 earnings on October 31, 2024. Analysts’ consensus revenue estimates are $94.23 billion, in line with management’s guidance for a similar growth rate in the third quarter of FY 2024.

Typically, Apple’s September quarter is seasonally strong. It benefits from the back-to-school season, which drives demand for Apple’s products, particularly laptops and tablets. Additionally, management hopes that the boost from Apple Intelligence will restore the iPhone to growth. The wildcard is China, which has been highly competitive, forcing Apple to discount its iPhones to compete with cheaper smartphones from competitors like Huawei in a weak Chinese spending environment.

If the company’s generative AI features produce much higher sales by pushing users to upgrade to the iPhone 16 series and Apple can bring China closer to making positive revenue growth, it could exceed analysts’ revenue estimates, and the stock may rise in the short term. Investors also want to pay attention to gross margins because the costs of running generative AI applications can push cloud costs higher. Suppose Apple beats on revenue, but gross margins come in lower than 45.5%; depending on how much lower, the market may not take it well.

Investors should pay particular attention to commentary on Apple Intelligence’s adoption and whether consumers find it useful. You should also consider what the company says about the Chinese competitive environment. The company may beat analysts’ revenue and earnings expectations, but the stock could drop if management gives negative commentary on Apple Intelligence, iPhone 16, or China.

Valuation

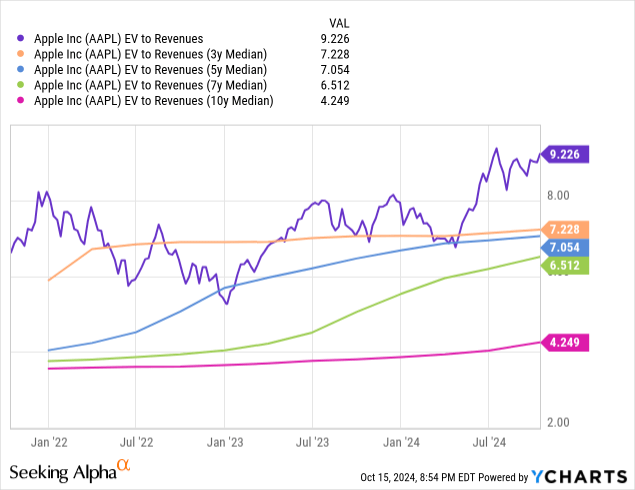

Apple’s Enterprise Value (“EV”) to revenue is 9.226, well above its three-, five-, seven-, and ten-year median. Consequently, some may consider the stock overvalued.

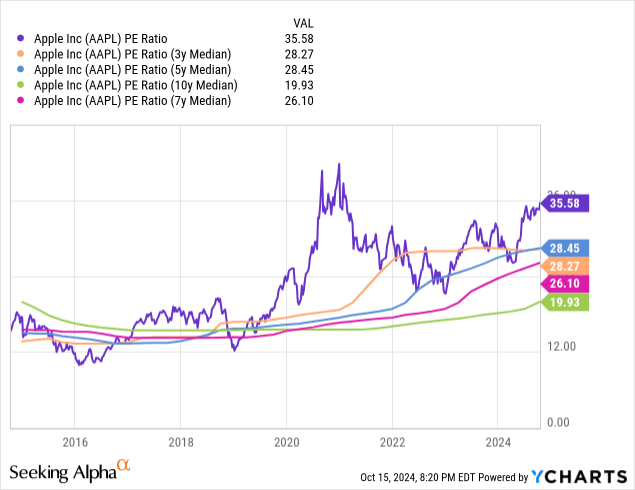

Apple’s price-to-earnings (P/E) ratio is 35.58, well above the three-, five-, seven-, and ten-year median. Given that it’s currently trading above its median, some might call the company overvalued.

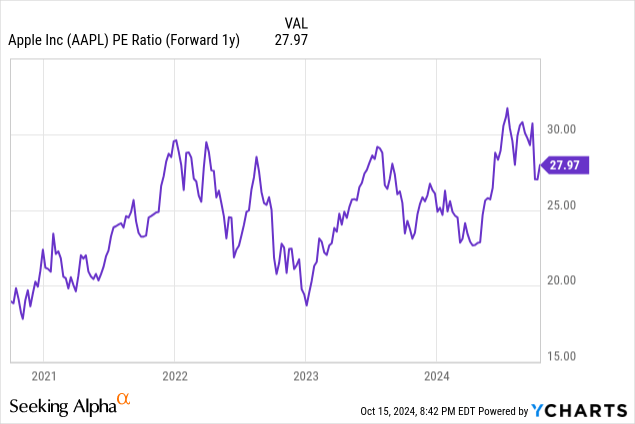

Apple’s one-year forward P/E ratio is 31.24, near the upper end of its trading range over the last five years. Some might consider it overvalued based on its one-year forward ratio. The following chart from YCharts shows the incorrect forward P/E ratio of 27.97. However, I included the chart to show that a one-year forward P/E ratio is historically on the higher end of its trading range. The time to buy Apple was at the beginning of 2023 when the one-year forward P/E was below 20 and at the lower end of its trading range.

Apple’s one-year forward price/earnings-to-growth (“PEG”) ratio is 2.93 (One-year forward P/E of 31.24 divided by analysts’ estimated FY 2025 EPS of 10.66%). Investors may currently overvalue the stock, using the standard that PEG ratios above 2.0 are excessive for a growth stock.

If Apple traded at a one-year forward PEG ratio of 2.0, the stock price would be $157.77, down 48.22% from its October 15 closing price of $233.85. Let’s perform a reverse discount cash flow (“DCF”) on Apple to determine what the October 15, 2024, closing price implies about the stock’s cash flow growth rate over the next ten years.

This reverse DCF uses a terminal growth rate of 2.5% because the company should grow cash flow around the GDP (Gross Domestic Product) long-term growth average once it exceeds the forecast period. I use a discount rate of 8.5%, the opportunity cost of investing in Apple, reflecting a low-risk level. This reverse DCF uses a levered FCF for the following analysis.

Apple Reverse DCF

|

The third quarter of FY 2024 reported Free Cash Flow TTM (Trailing 12 months in millions) |

$104,339 |

| Terminal growth rate | 2.5% |

| Discount Rate | 8.5% |

| Years 1 -10 growth rate | 11.5% |

| Current Stock Price (October 8, 2024, closing price) | $233.85 |

| Terminal FCF value | $428.915 billion |

| Discounted Terminal value | $2,204.865 billion |

| FCF margin | 26.81% |

Suppose Apple can maintain an FCF margin of 26.81% over the next ten years; Apple would need to maintain annual revenue growth of 11.5% to justify the October 15 closing price. Although AI may boost its revenue growth, an annual growth rate in the double-digits seems a stretch as the company only grew revenue at an 8.41% compound annual growth rate (“CAGR”) over the last ten years. Fortune Business Insights forecasts the consumer electronics industry to grow at a CAGR of 7.63% between 2024 and 2032. Despite Tim Cook’s disbelieving in the law of large numbers, the company may find it difficult to grow much faster than the consumer electronics industry.

Also, considering that its median FCF margin was 25.7% over the last ten years, the company may be unable to maintain an FCF margin of 26.81% over the next ten years. If it maintains the slightly lower 25.7% FCF margin over the next ten years, it must grow revenue by 12.1% annually to justify the October 15 closing price. Considering that its primary end market of smartphones may be saturated, it’s hard to see Apple growing revenue by double digits. My base case assumption assumes Apple can increase annual revenue by 9% each year over the next ten years at a 25.7% FCF margin, giving it an estimated intrinsic value of $183.52. At a 7% CAGR, the intrinsic estimated value would be $157.37. If revenue grows at an 11% CAGR, the estimated intrinsic value would be $213.96.

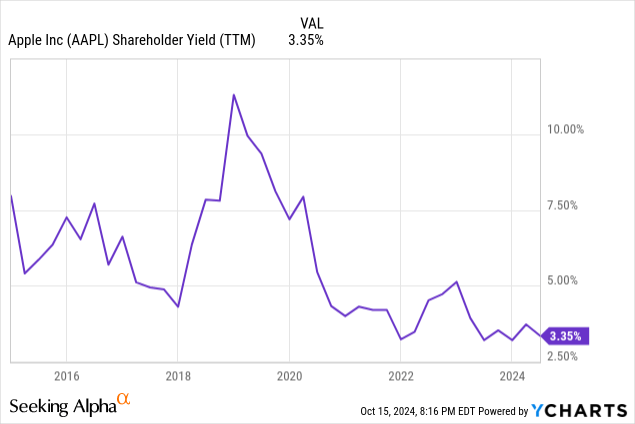

Apple’s TTM shareholder yield is 3.35%, on the lower end of its range over the last ten years, suggesting the market overvalues the stock.

Seeking Alpha’s quant gives Apple’s valuation a D rating. The market has likely driven the stock up to unsustainable valuations.

Risks

The following table confirms the main culprit for slowing iPhone sales in the third quarter: Greater China.

Although the renminbi currency exchange rate was partially responsible for lower Chinese sales, competition from companies such as Xiaomi, Vivo, and Oppo (All Android companies) also had a part to play. Smartphones may, at best, be a slow-growing business moving forward, and competition could intensify. Although Apple has solid brand loyalty, its hold on teenagers may be slightly slipping, as indicated by Piper Sandler’s Taking Stock with Teens Fall 2024 survey. Apple investors hope that teens value the company’s generative AI features.

Apple isn’t the only smartphone company manufacturing AI-powered smartphones. Samsung already has Galaxy AI-powered phones on the market, and Alphabet released its Google AI-powered phones in August. Unlike the first iPhone, where Apple had a substantial lead over competitors, Apple may not have the upper hand in developing new features before competitors. I view AI-powered devices as an area that will become quickly commoditized, with smartphone manufacturers developing features that competitors may match or exceed in only months. Apple’s most significant competitive advantage may be its privacy features and interlocking ecosystem, which may or may not hold competitors at bay.

Last, global regulators have scrutinized all the large tech companies intensely, either bringing litigation against them or creating rules to impede them. For instance, the European Union started applying the Digital Markets Act (“DMA”) in May 2023. The DMA is a regulation with special rules for companies designated as “Gatekeeper Platforms” to help foster competition in digital markets. One of the actions that Apple had to perform as a Gatekeeper was to adjust the rules and fees for developers on its App Store. Seeking Alpha posted an article in August that stated:

The changes center around how app developers utilizing Apple’s App Store in the EU link to the web to show users alternative payment methods. “Developers can communicate and promote offers for purchases available at a destination of their choice,” Apple explained. “The destination can be an alternative app marketplace, another app, or a website, and it can be accessed outside the app or via a web view that appears in the app.” Under the prior structure, developers were limited in how they could direct users to alternate web pages where they could pay for in-app purchases or pay a fee as high as 17% or more to link out. To comply with the DMA, Apple also adjusted its commission fees, or Store Services Fee. The changes result in lower fees for app developers using Apple’s App Store.

The DMA will likely reduce revenue from its EU App Store over time. Another example of the negative impact of global regulators going after massive tech platforms is the U.S. Department of Justice’s (“DOJ”) antitrust lawsuit against Alphabet, which could negatively impact Apple’s revenue generation over the long term. Seeking Alpha posted an article on October 16, 2024, that stated:

Google’s deals with smartphone makers such as Apple are at the heart of the Department of Justice’s antitrust lawsuit against the search behemoth. If the DOJ ultimately prevails after a series of appeals, the iPhone maker could lose a significant chunk of valuable revenue, investment firm Jefferies said. “The antitrust expert hosted by our US Internet team believes it could take 3 to 8 years to settle,” analyst Edison Lee wrote in a note to clients. “We [estimate] if AAPL loses 1/3 of GOOG [revenue] (US only) as of FY28, our DCF will be ~8% (US$19) lower.”

The above are only two examples of regulators in different regions taking actions that could limit Apple’s long-term revenue growth opportunities.

Apple is a long-term hold

Although Apple has decent upside potential from areas like generative AI and AR, the market appears to have already factored that potential into its valuation. I believe the market overvalues this stock, and there’s a high possibility it could stagnate or even go down from current prices. If you already own Apple, continue to hold it. However, if you are looking to invest new money, there are better options in the market with more reasonable valuations and more potential growth.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.