Summary:

- J&J’s Q3 2024 earnings beat expectations with $22.5B in revenue, driven by strong performances from Darzalex, STELARA, and MedTech, despite ongoing challenges.

- The company updated its full-year guidance, showing optimism despite headwinds like talc litigation and STELARA generic competition, maintaining strong cash flow and dividend payouts.

- New growth opportunities in oncology and MedTech segments, along with strategic acquisitions, are expected to offset potential declines in STELARA sales due to generics.

- I plan to add to my JNJ position if the stock drops below $163, considering technical indicators and potential resistance levels in the near term.

yuelan

It has been nearly a year since my last Johnson & Johnson (NYSE:JNJ) “J&J” article, where I highlighted their Q3 2023 earnings that beat the Street’s projections with $21.4B in revenue, which was up 6.8% year-over-year. At that time, it looked as if the company’s MedTech division was going to be a primary growth driver, along with Darzalex and Abiomed. That quarter was a critical time for J&J following their strategic spin-off of Kenuve consumer health business while still dealing with the ongoing Talc litigation. In addition, J&J was facing the looming threat of STELARA biosimilar competition for one their blockbuster drugs. Despite the murky outlook, I remained optimistic thanks to J&J’s pipeline and their track record of excellence. Now, we are here a year later looking at their Q3 earnings report that revealed a beat on EPS and revenue that was once again fueled by the company’s blockbusters Darzalex, Invega Sustenna, and STELARA. That being said, the company has adjusted their full-year earnings guidance following their V-Wave acquisition for $1.7B amongst other headwinds. After a brief sell-off, JNJ was able to recover in the trading session and is now trading above my Buy Threshold of $163 per share. Although I am still apprehensive about the impact of STELARA generics in the coming quarters, I believe their Q3 earnings showed the company’s resilience and some new growth opportunities. As a result, I am looking to add to my JNJ position in the near term.

I intend to review the company’s Q3 earnings and will provide my views on the quarter. Then, I will highlight some of J&J’s new growth opportunities. In addition, I will point out some notable risks investors need to be aware of. Finally, I reveal my plans for managing my JNJ in the coming days and weeks.

Q3 Earnings Review

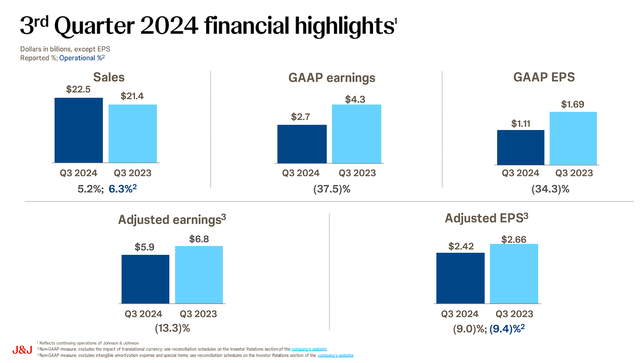

Taking a look at J&J’s Q3 earnings their total revenue came in at $22.5B, which was up 5.4% year-over-year. In terms of EPS, J&J publicized that their non-GAAP EPS came in at $2.42. The company attributed their growth to the Innovative Medicine segment, which pulled in $14.58B, up 0.8% quarter-over-quarter and 4.9% year-over-year. I will highlight that once again, STELARA was able to beat analyst expectations and was the primary contributor throwing $2.68B into the coffers.

Johnson & Johnson Q3 Financial Highlights (Johnson & Johnson)

Again, J&J’s Darzalex was a heavy hitter posting $3.02B for Q3, which beat the Street’s forecast of $2.94B. In addition, other oncology drugs such as ARVYKTI, TECVAYLI, and TALVEY are showing growth. ARVYKTI hit $286M in sales, which was up 87.6% year-over-year and 53.2% quarter-over-quarter. In addition, TECVAYLI has made strong gains in the multiple myeloma market with sales growing 21.4% year-over-year to hit $135M. J&J also highlighted ERLEADA’s growth, up 26.3% year-over-year, as it continues to claim more of the metastatic castrate-sensitive prostate cancer market.

Meanwhile, immunology had mixed results, with TREMFYA posting 14.3% growth as it makes inroads into the psoriasis and psoriatic arthritis markets. The company’s neuroscience products are also contributing with SPRAVATO recording 55.3% growth. J&J’s OPSUMIT and UPTRAVI posted solid growth of 17.4% and 15.2%, respectively.

In addition, the company’s MedTech segment recorded a solid performance as the number of procedures increased and they rolled out new products. MedTech hit $7.89B in sales, growing 0.8% quarter-over-quarter increase and 5.2% year-over-year. The company reported a recovery in the number of surgical procedures driving demand for their medical devices. Although the segment did miss the Street’s mark of $8.03B, the growing demand does bode well for J&J’s MedTech business going forward. In addition, J&J pointed to their acquisitions of Shockwave and Abiomed helped drive double-digit growth.

Turning to the company’s vision products, ACUVUE OASYS’s price adjustments led to 4.7% growth, and their TECNIS products saw some growth.

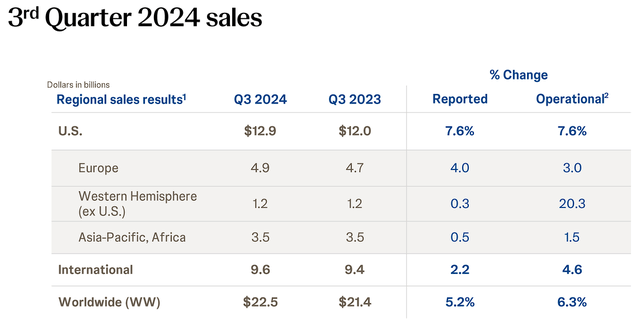

Looking at J&J’s regional sales figures, their U.S. sales were scribed in at $12.57B, which was up 2.7% from Q2 and 7.6% year-over-year. On the other hand, the company pulled in $9.88B from international markets, which was down 1.2% from last quarter, but up 2.2% year-over-year. Notably, the company believes the drop from Q2 was mostly due to currency and weaker sales in Europe. However, the company did point out that the year-over-year growth came from emerging markets grabbing Innovative Medicine and MedTech products.

Johnson & Johnson Q3 Sales (Johnson & Johnson)

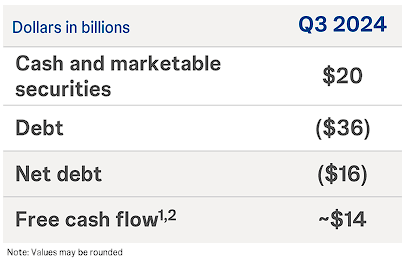

The company’s Q3 earnings encouraged them to update their full-year 2024 guidance with sales coming in between $89.4B-$89.8B, which is up from $89.2B-$89.6B. J&J also updated their adjusted operational EPS guidance to $9.86-$9.96, which is down from $10.00-$10.10. I must point out that the company said they revised their EPS due to the V-Wave acquisition, and talc litigation costs.

Johnson & Johnson Q3 Financials (Johnson & Johnson)

In terms of their finances, J&J closed out Q3 with ~$20B in cash and marketable securities thanks to $14B in free cash flow. In addition, the company has about $36B in debt, leading to a net debt of about $16B.

My Take

For me, J&J’s Q3 results highlighted their ability to frequently outperform the Street’s expectations, despite some of the looming concerns and operating in a challenging environment. Beating the Street’s EPS estimates by $0.21 and surpassing revenue forecasts by $330M shows just how their leading products are in control of their markets, helping the company log $22.5B in total revenue for the quarter. STELARA and Darzalex are the company’s big hitters who are still capable of carrying the company forward. However, I’m also encouraged by their MedTech segment, which posted a solid 5.2% year-over-year growth. I am also encouraged about the company’s outlook on how their Shockwave and Abiomed acquisitions could have a strong impact in the near future.

Indeed, J&J still has plenty of challenges including generics, currency headwinds, and ongoing litigation, but I see J&J’s decision to adjust their guidance and maintain strong cash flow as strong signals that they are optimistic about their near-term performance. Furthermore, the fact that they’re still paying out $8.8B in dividends year-to-date reassures me they’re committed to shareholders while not stunting growth.

Overall, I don’t see any major red flags coming out this earnings, and the company’s beat should tell you that the lingering concerns are not hindering their performance.

Looking For Growth

J&J’s Darzalex and STELARA, have set a solid foundation for the company to continue to grow in the near term. However, I have to recognize that the upcoming generic competition for STELARA could deteriorate branded sales, faster than Darzalex can grow. Thankfully, I believe that J&J’s overall pharmaceutical portfolio still has pending growth. The company’s CARVYKTI and TECVALYI have reported strong double-digit year-over-year growth and are positioned to grab more of the oncology market. I’m also excited about some of J&J’s new products and their ability to be immediate contributors. I must also acknowledge that RYBREVANT and TREMFYA are now approved and could bulk up their oncology and immunology revenues. I’m also champing at the bit to see the sales disclosures for TALVEY, as well as the anticipated sales for RYBREVANT.

Although J&J’s MedTech segment slightly underperformed in Q3, it still holds a lot of promise with their surgical systems and cardiovascular devices, which should deliver significant sales in the future. The ongoing integration of V-Wave’s cardiac device technologies should start to show traction after adding some short-term pressure to earnings. The company should also see some revenue growth from REMICADE and SIMPONI in Europe as distribution rights are set to return to J&J in Q4 of this year.

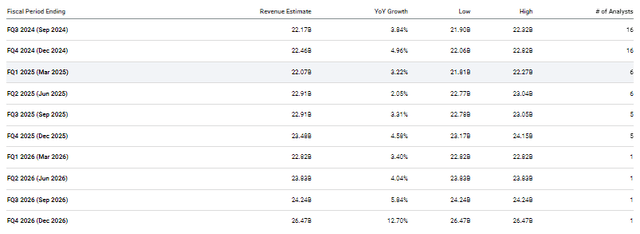

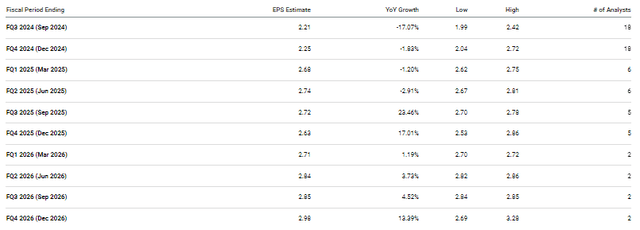

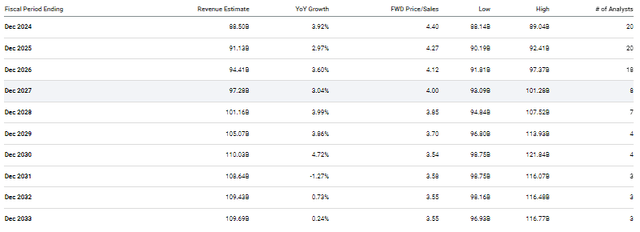

I am not the only one expecting growth from J&J… the Street is expecting the company to report growth in the coming quarters with a solid single-digit to low double-digit revenue growth from Q4 2024 to Q4 2026.

Johnson & Johnson EPS Revenue Estimates (Seeking Alpha)

Admittedly, the quarterly EPS estimates are expected to stagnate for a few quarters, but analysts are projecting the numbers to improve in Q3 of next year and will continue to grow through 2026.

Johnson & Johnson Quarterly EPS Estimates (Seeking Alpha)

Zooming out, we can see that analysts are expecting J&J to report single-digit growth for the remainder of the decade for both EPS and revenue.

Johnson & Johnson Annual EPS Estimates (Seeking Alpha)

Johnson & Johnson Annual Revenue Estimates (Seeking Alpha)

Certainly, single-digit growth is not going to justify a premium valuation, however, I think it does repudiate the narrative that STELARA generics and the talc litigation are going derail J&J’s growth. Yes, both of those issues have most likely hurt the company’s growth trajectory, but the company can still leverage their pharmaceutical strengths, innovative therapies, and strategic acquisitions to drive growth for the remainder of the decade.

Risks To Consider

Despite my bullish outlook for J&J, I still have to acknowledge a few risks that could hurt the company’s long-term outlook. First, I must acknowledge their talc litigation, which will most likely continue to weigh on the ticker as investors remain apprehensive about the fallout from potential settlements.

Furthermore, the costs of integrating V-Wave are going to be a concern. While this acquisition helped contribute to the top line, it has also increased expenses. The company is still expecting an impact in 2025, but any setbacks in rollouts and R&D could hurt profitability. As a result, J&J needs to show that they can quickly and seamlessly integrate V-Wave into their existing operations in order to start hitting the Street’s expectations for their MedTech segment.

Last but not least, the impending generic competition for STELARA is a serious concern. In fact, the drug’s Q3 sales experienced a decline of 5.7% due to biosimilar competition in Europe, and investors should expect a similar challenge in the U.S. in 2025. Investors should be prepared for STELARA sales numbers to dip, which will require the company to rely heavily on their newer therapies to fill the gap and maintain the growth trajectory.

Despite these risks, I maintain my conviction level for J&J at a strong 5 out of 5. I believe the company has the resilience and strategic vision to navigate these challenges effectively. Furthermore, I still view J&J as a “Healthy Dividend” stock, reflecting its commitment to returning capital to shareholders even amidst these headwinds.

My Plan

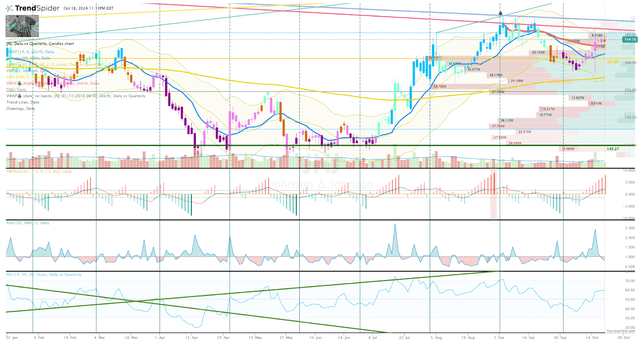

Indeed, the launch of STELARA generics is inevitable and will be a major blow to the company’s portfolio. In addition, the dark cloud from the talc litigation will likely prevent the ticker from outperforming its peers. It is possible that STELARA is able to fend off generics longer than Street believes, and maybe the talc litigation will finally come to an end sooner than expected. Moreover, the company’s next batch of growth drivers might be able to help offset some of the projected drop in revenue from STELARA. Plus, it looks as if Darzalex will continue to be the main driver in the near term with projected peak sales of $13B to roughly $16B by 2029. As a result, I will be looking to add to my JNJ position in the near term if the ticker is able to drop below my “Buy Threshold” of $163 per share.

JNJ Daily Chart (Trendspider)

Looking at the Daily Chart, we can see JNJ has rebounded from support around $161 and is approaching resistance near $165. The chart shows several indicators are pointing to a potential move higher now that the share price has climbed above the anchored-VWAP and the “Go-No-Go” is now neutral. On the other hand, the TW Pivot is suggesting a potential bearish reversal is on the horizon, so I am going to wait to see if the ticker can break above the downtrend ray and will retest support before clicking the buy button. If that occurs, I will make an upsized addition and then will revisit the ticker at the end of the month to see if I have to update my Buy and Sell Targets.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JNJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my research on Seeking Alpha. If you want to learn even more about my method and how I discover these investment opportunities, please check out my subscription marketplace service, Compounding Healthcare, and sign up for a free trial.