Summary:

- Competitive pressures from OEM partners may have forced a shift in Roku’s strategy.

- Hardware initiatives are unlikely to create value by themselves and should be viewed as a customer acquisition strategy.

- Continued weakness in the digital ad market along with reduced consumer spending on electronics means Roku may face a difficult 2023.

imaginima

Roku (NASDAQ:ROKU) could be a large beneficiary from the shift to streaming, but the company has to find a way to secure distribution of their operating system without giving unduly large incentives to customers and partners. While the platform side of the business is performing well, Roku’s shift into hardware (smart home devices and smart TVs) indicates the company is facing difficulties maintaining their share in the smart TV operating system market and expanding internationally. Hardware margins are likely to be low / negative and investments in this part of the business will undermine Roku’s profitability in the near term. Roku’s stock may therefore remain under pressure until the digital ad market improves and Roku’s platform business drives the company towards profitability.

Market

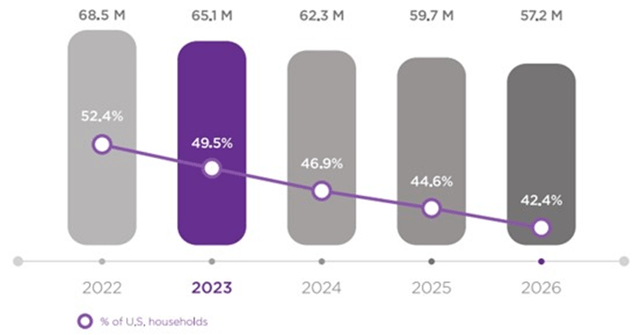

The shift away from linear TV is continuing at a fairly robust pace, which is supportive of the video streaming market. Ultimately, streaming is likely to dominate TV viewing globally, and if the streaming market continues to fragment, a significant portion of this is likely to be supported by advertising.

Figure 1: Legacy Pay TV Households in the US (Roku)

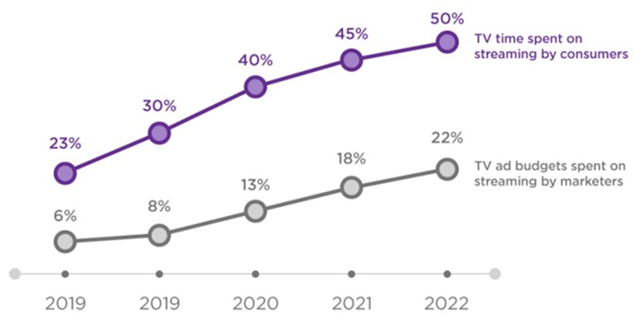

Ad spend continues to trail viewing time significantly though, which may represent an opportunity for streaming advertisers, or could indicate that the TV advertising market is set to decline as streaming takes over. Given the attributes of digital advertising, it would seem reasonable that advertising on a streaming service would offer advertisers a better return on ad spend, but if this is the case, it is not attracting advertising dollars as quickly as might be expected.

For example, Roku has introduced shoppable ads, where viewers can use their Roku remote to proceed to checkout with their shipping and payment details pre-populated from Roku Pay (Roku’s proprietary payments platform).

Figure 2: Viewership versus Ad Budgets on TV Streaming (Roku)

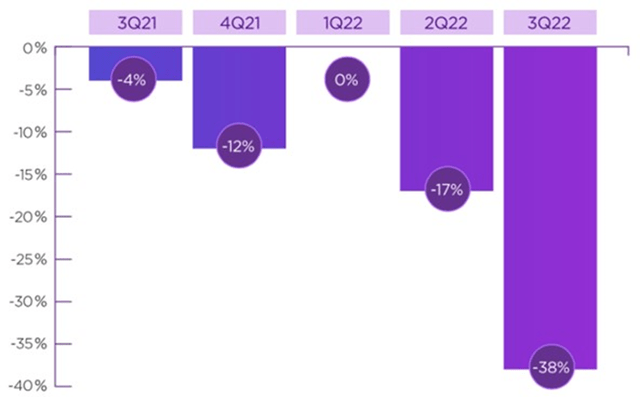

Despite the long term potential of the video streaming market, the near term performance of the market is likely to be dominated by macroeconomic uncertainty. Advertisers are curtailing spend in the ad scatter market (TV ads bought during the quarter). According to a survey, 47% of advertisers in the US made in-quarter pauses on ad spending on TV streaming, 44% on digital video, and 42% on legacy pay TV.

Roku has suggested that this is due to consumers cutting back on discretionary spending, but this is not really clear from the data. Certainly, retailers like Target (TGT) have suggested that discretionary spending has weakened, and a number of digital advertisers have pointed to weaknesses in verticals like CPG, but at an aggregate level consumer spending remains strong. Consumers still have excess savings and debt levels are manageable, but savings are declining and debt levels rising rapidly.

Figure 3: US Traditional TV Ad Scatter Spend (YoY Change) (Roku)

Roku

Smart TVs

Roku believe that the three main licensed operating systems competing in the smart TV market are Roku OS, Android TV and Fire TV. These operating systems are reportedly gaining accounts at the expense of proprietary operating systems.

Roku has the number 1 selling smart TV OS in the US and the number 2 selling smart TV OS in Mexico (approximately 25% market share). Roku’s international expansion efforts are also continuing, with the expansion of their global Roku TV program to Germany with TCL and Metz, and to Australia with TCL. It is unknown to what extent Roku’s success in the US can be replicated internationally though, as they are giving up a significant head start in some markets which may be difficult to overcome.

Roku has to compete both with operating systems from Google (GOOG) and Amazon (AMZN) who likely view the market as part of a broader strategy, and with OEMs who are trying to utilize proprietary operating systems to capture more value. This is a potentially difficult situation, which Roku has so far managed well, but rising sales and marketing expenses, along with Roku’s recent expansion of their hardware business, suggest the competitive environment is becoming more difficult.

Roku’s management has suggested that the market will naturally gravitate towards a handful of operating systems, but this may not be the case. Part of the reason that most operating system markets coalesce around a small number of solutions is because the OS is generally a developer platform. Developers will only want to work with a small number of operating systems and as a result only a small number of operating systems will have an adequate supply of applications. This is not really the case at the moment with smart TV operating systems though. If users interact with the OS a lot, it also creates familiarity and raises switching costs. SmartTV operating systems do not have the advantage that Microsoft (MSFT) Windows has with the Office suite.

This would be less of an issue if Roku controlled distribution or the customer relationship, and this is likely the reason that Roku are launching their own line of TVs. Roku recently announced the launch of their Roku Select and Plus Series TVs. These are Roku-branded HD and 4K TVs which are both designed and made by Roku. These TVs will be available in the US beginning spring of 2023, with retail prices ranging from 119 USD to 999 USD for the full lineup of 24″ – 75″ models. Given the services that Roku has been providing their OEM partners, this initiative likely requires minimal additional investment, but there are questions around how successful Roku TVs will be, whether this will sour relationships with partners and what the margin profile of the business will look like. Roku also recently made a OLED TV reference design available to all Roku TV partners, which could help Roku to compete at the high-end of the market.

Advertising

Roku’s advertising business continues to expand, but has faced headwinds due to difficult comparable periods in 2021 and an uncertain macro environment. Roku closed Upfront deals for the 2022-2023 TV season with all seven major agency holding companies and surpassed 1 billion USD in total commitments.

The M&E business has faced tough comparable periods to 2021, where some services had launched in the second half. But the M&E business continues to grow and provide high margins. M&E revenue depends on active account growth and streaming hour growth and as a result has likely faced headwinds from the normalization of user viewing behavior post-pandemic. Roku’s M&E business helps drive subscriptions, engagement and viewership on the platform. As a result, Disney and Netflix’s launches of ad businesses should be supportive of M&E spend as these services need engagement to drive advertising revenue.

Smart Home Product Expansion

Roku are also entering the smart home market, but the strategic rationale is not clear. While Roku can leverage their hardware and OS expertise in the development of smart home devices, from a user perspective the smart phone is the natural hub for a smart home.

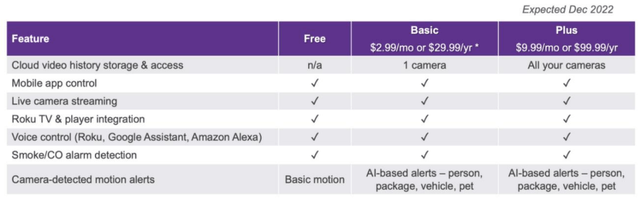

The market has potential, with approximately 20% of US households having cameras, but it may end up being a loss leader that is used to drive service revenue. Roku believe that the existing smart home experience is fragmented and difficult to use, but it is not clear they can add value in this area compared to companies like Apple (AAPL), Google and Amazon who all have their own ambitions.

Roku’s product portfolio includes cameras and video doorbells with subscription plans that offer users the ability to view cloud recordings of the videos, along with AI-based alerts (e.g., person, package, vehicle, pet).

Figure 4: Roku Smart Home Subscriptions (Roku)

Even if smart home devices were to end up being a viable market, it is not clear whether Roku has the resources to successfully compete in this market. The company is still relatively small and yet is trying to build an advertising platform, develop a range of devices and produce its own content. While these efforts are likely trying to offset the fact Roku largely relies on OEMs for distribution, Roku’s efforts appear increasingly unfocused.

Financial Analysis

While the advertising business is growing more slowly than Roku had forecast at the beginning of the year, they continue to win advertising share and grow active accounts. Q3 2021 was also a tough comp due to the launch of new streaming services, which drove significant growth of higher-margin M&E and content distribution. Roku expects ad scatter declines for both traditional TV and connected TV to continue through at least 2023. Going forward, Roku also expects lower Player sales YoY and significantly lower margins sequentially due to promotional pricing over the holiday period.

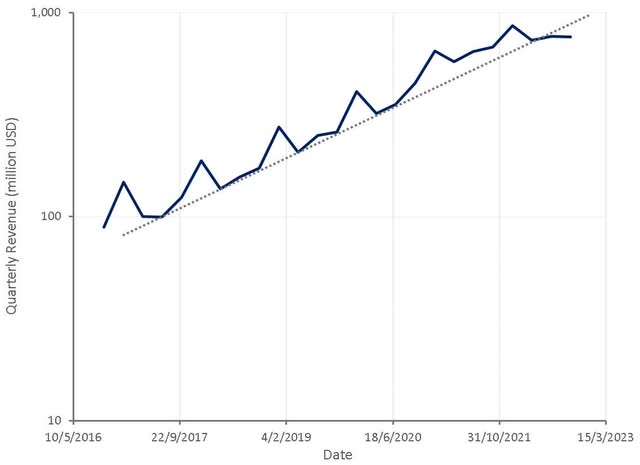

Figure 5: Roku Revenue (Created by author using data from Roku)

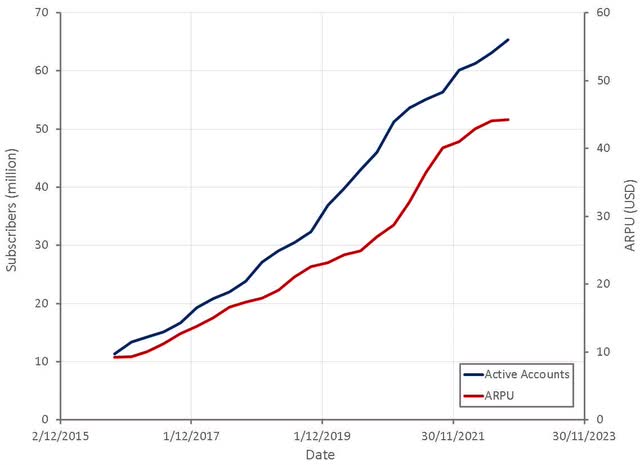

The number of active accounts continues to increase at a reasonable pace but ARPU has begun to stall over the past 12 months. This appears to be in part due to Roku approaching saturation in terms of streaming hours per account and a weak macro environment limiting growth in revenue per streaming hour. As Roku expands internationally they are also likely to face ARPU headwinds due to the addition of lower value accounts.

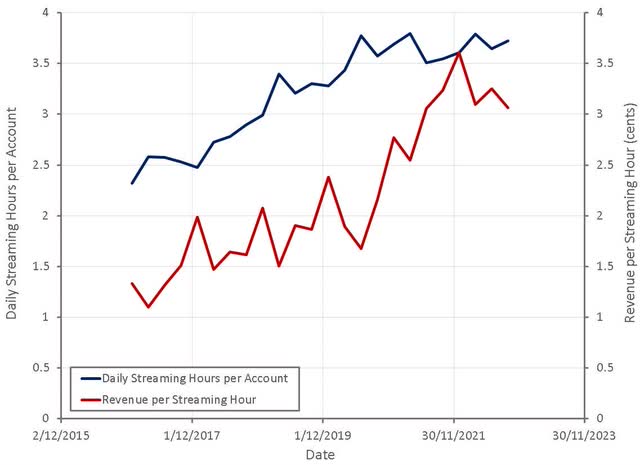

Figure 6: Roku Accounts (Created by author using data from Roku) Figure 7: Roku Streaming Hours (Created by author using data from Roku)

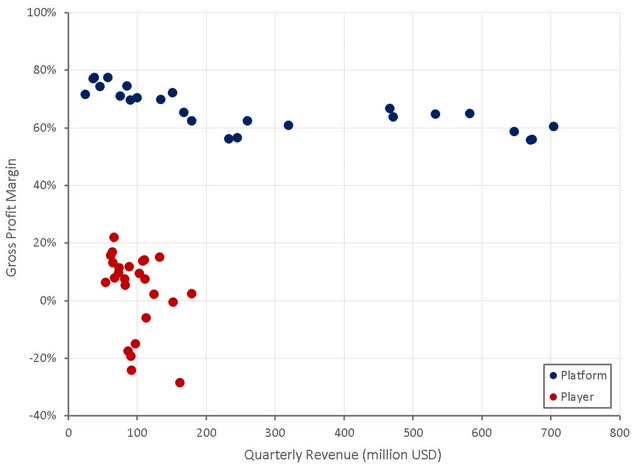

Gross profit margins for the platform business have been fairly stable, but player margins have deteriorated due to supply chain issues. While player gross margins are likely to improve from current levels, this business will remain a drag on margins as it is a customer acquisition tool.

Figure 8: Roku Segment Gross Profit Margins (Created by author using data from Roku)

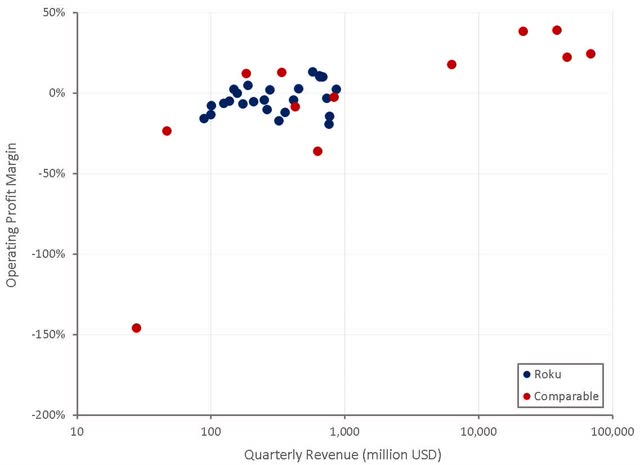

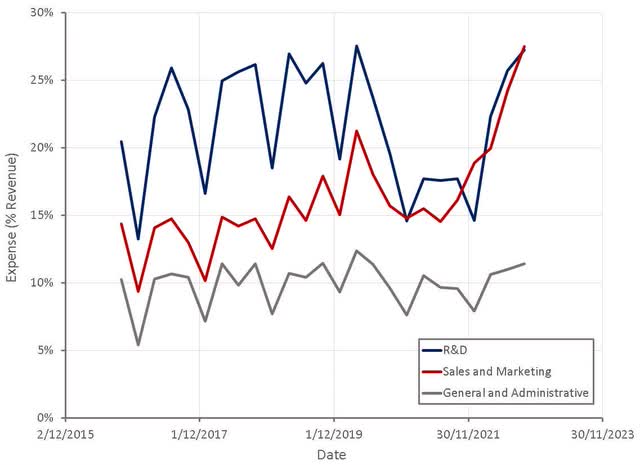

Roku has so far demonstrated limited operating leverage, which is largely due to R&D investments required to support new business initiatives and an increasing sales and marketing burden.

Figure 9: Roku Operating Profit Margins (Created by author using data from company reports)

Roku took steps in the second quarter to slow both operating expense and headcount growth, in response to weaker than expected market conditions. Roku’s current cost base is high though and absent layoffs, the company will still need to grow into these costs.

Figure 10: Roku Operating Expenses (Created by author using data from Roku)

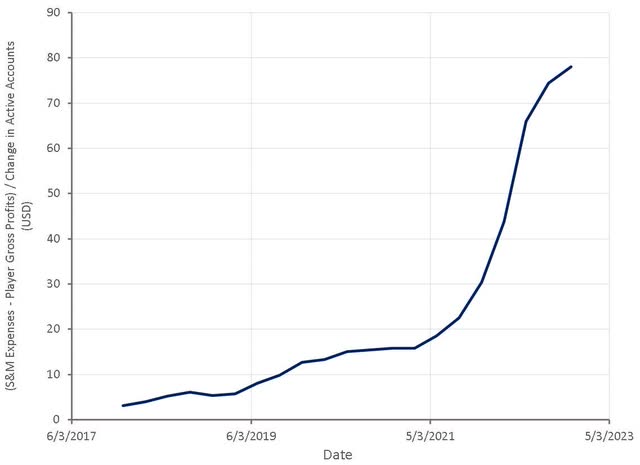

Comparing sales and marketing expenses and player gross profits to the number of active accounts added indicates that Roku’s acquisition costs have increased dramatically. How much of this is due to a deterioration in Roku’s competitive position, or due to international expansion, versus overstaffing and supply chain issues remains to be seen. Sales and marketing expenses are primarily related to personnel, but also include marketing, retail and merchandising costs, and allocated facilities and overhead expenses.

Figure 11: Sales and Marketing Expenses Minus Player Gross Profits per Additional Active Account (Created by author using data from Roku)

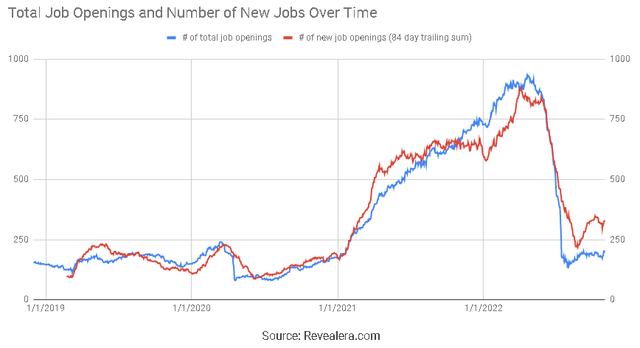

Roku has not only dramatically reduced hiring to control expenses. According to a filing from the company, Roku will lay off a total of 200 employees. That represents roughly 7% of its workforce. The company cites the current economy as the reason behind the job cuts. With these cuts, Roku will suffer between 28 million and 31 million USD in related charges.

Figure 12: Roku Job Openings (Revealera.com)

Valuation

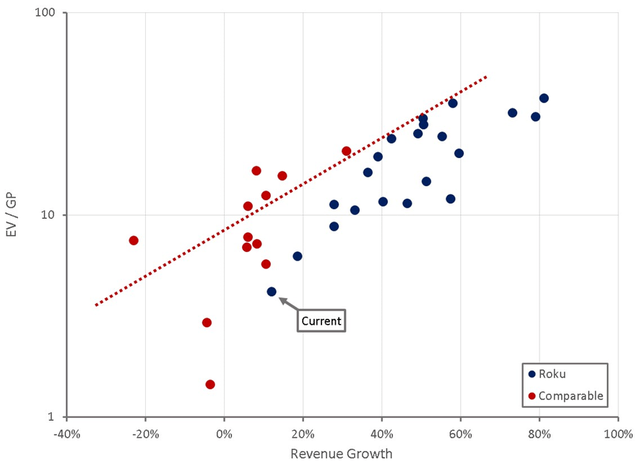

Roku’s stock is currently trading on record low revenue multiples, despite the business transitioning from low margin hardware revenue to relatively high margin ad revenue over the past few years. As a result, if Roku can achieve even modest levels of growth and profitability over the next 5 years, the stock should appreciate significantly from current levels. Based on a discounted cash flow analysis I estimate that Roku’s intrinsic value is approximately 115 USD per share, but there is considerable uncertainty about how much of a drag the hardware business will be on margins and what level of success Roku will achieve internationally.

Figure 13: Roku Relative Valuation (Created by author using data from Seeking Alpha)

Conclusion

Roku has faced significant multiple compression over the past 2 years as growth has slowed and rising interest rates and macro uncertainty have caused investors to shun unprofitable growth stocks. Roku’s growth is likely to reaccelerate at some point in the next few years and looser financial conditions are likely to cause investors to shift back into tech.

In the short term, Roku is facing a weak ad market and decreased consumer spending on electronics. As a result, revenue growth is likely to be weak for at least the next 12 months. Longer-term, Roku must find a way to distribute their TV OS without providing excessive incentives to partners and consumers. If Roku can replicate their US success internationally, the stock could provide substantial upside given the current valuation.

Disclosure: I/we have a beneficial long position in the shares of ROKU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.