Summary:

- The market has over-reacted to UNH’s cautious FY2025 guidance, since the lower bottom-line is attributed to “CMS payment cuts, the IRA, and a mismatch between Medicaid rates and medical program.”

- Given the recently released Star rating for 2025, we believe that the redeterminations and higher medical costs may be a new normal across the health care provider industry.

- For now, UNH has attempted to optimize its operations while managing the Optum therapy/ drug costs, resulting in the segment’s growing profit margins and decent FY2024 guidance.

- With the recent correction already triggering improved entry points as the bulls also defend the $550s bottom, we believe that UNH remains a compelling buy here.

frankpeters/iStock via Getty Images

We previously covered UnitedHealth Group (NYSE:UNH) in June 2024, discussing why we had maintained our Buy rating then, with the company reporting a double beat on the FQ1’24 earnings call while offering an optimistic FY2024 guidance, despite the slight impact from the cyberattack.

With the stock still reasonably valued while offering great upside potential and expanded forward dividend yields, we had believed that the health care provider might emerge much stronger by 2025, aided by the Brazil divestiture.

The Medicare Star Rating/ Bottom-Line Headwinds Trigger UNH’s Undervaluation To Historical Levels

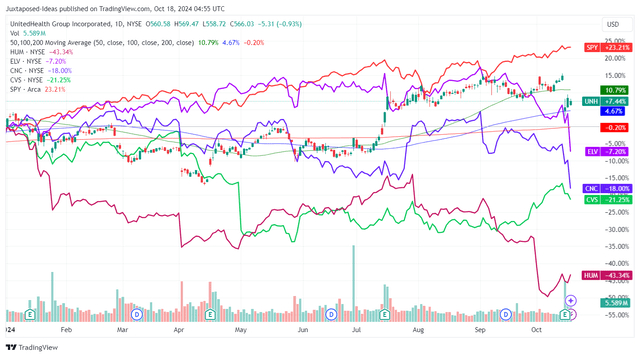

UNH YTD Stock Price

Since then, UNH has had a robust stock price return of +24.9%, with it well outperforming the wider market at +11.3%, prior to the great correction by -9.7% at its worst after the FQ3’24 earnings call.

For reference, the health care company reported double beats with revenues of $100.82B (+1.9% QoQ/ +9.1% YoY) and adj EPS of $7.15 (+5.1% QoQ/ +8.9% YoY).

This is while offering a relatively robust FY2024 adj EPS guidance of $27.62 (+9.9% YoY), despite the $0.75 per share impact from the cyberattack, compared to the original guidance of $27.75 offered in the FQ4’23 earnings call (+10.4% YoY).

Much of UNH’s robust bottom-line performance is attributed to the management’s stellar operating cost efficiency, attributed to the moderating operating cost ratio of 13.2% in the latest quarter (-0.1 points/ -2.8 YoY) – thanks the ongoing optimization in its vertically integrated healthcare offerings.

If anything, the Optum health segment has already recorded higher operating margins of 7.4% (+0.6 points QoQ/ +0.5 YoY), thanks to the ongoing efforts to manage cost of drugs/ therapies through the use of biosimilars and wraparound weight loss programs.

On the other hand, UNH has delivered an underwhelming FY2025 adj EPS outlook at $30 (+8.6% YoY), with it attributed to the “impact of payment cuts to the Medicare program, the Inflation Reduction Act, and a mismatch between the Medicaid rates and medical benefits.”

This is compared to the healthcare provider’s historical bottom-line growth at a CAGR of +17.7% between FY2016 and FY2023, and the long-term growth target at between +13% and +16%.

Most notably, while UNH has highlighted that its “2025 Medicare Advantage plans may reach 96% of eligible Medicare beneficiaries,” with the initial 2026 scores seemingly “consistent with initial levels for plan year 2025 and company expectations,” it is uncertain how its near-term prospects may be impacted.

For now, CMS has already released their 2025 star ratings, with none of UNH’s plans making the 5 star list, compared to six for 2024. This development is unsurprising indeed, with only seven plans industrywide receiving 5 stars for 2025, compared to 38 plans in 2024.

Part of the headwinds may be attributed to the reduced industrywide bonus payments of $11.8B in 2024 (-7.8% YoY), with a similar downtrend likely in 2025.

The reduced CMS Medicare funding has already partly contributed to UNH’s higher FQ3’24 Medical Care Ratio of 85.2% (+0.1 point QoQ/ +2.9 YoY/ +2.7 from FY2019 levels of 82.5%) and UnitedHealthcare segment’s impacted operating margins of 5.6% (+0.2 points QoQ/ -1 YoY), with it similarly impacting the FY2025 bottom-line outlook, as guided by the management.

At the same time, UNH has yet to provide official updates on its lawsuit against CMS, with readers recommended to monitor the developing situation – since the reduced stars may impact healthcare provider’s upcoming enrollment and consequently, top/ bottom-line performance.

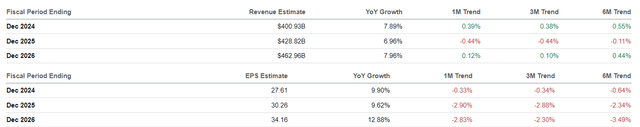

The Consensus Forward Estimates

This may also be why the consensus have lowered their forward estimates, with UNH expected to generate a decelerating top/ bottom-line growth at a CAGR of +7.5%/ +10.8% through FY2026, compared to the previous estimates of +8%/ +12.1%, respectively.

UNH Valuations

Nonetheless, we believe that the steep correction has triggered UNH’s reasonable valuations at FWD P/E non-GAAP valuations of 20.70x, near to its 5Y mean of 20.51x, 10Y mean of 18.63x, and the sector median of 21.48x.

Despite the lowered estimates, the stock continues to boast a relatively reasonable FWD PEG non-GAAP ratio of 1.54x, compared to the 5Y mean of 1.54x and 10Y mean of 1.05x – with it triggering a decent margin of safety for those looking to add.

The same may be observed when comparing to the sector median FWD PEG non-GAAP ratio of 2.01x and its direct peers, including CVS Health (CVS) at 2.67x, Centene (CNC) at 1.28x, Elevance Health (ELV) at 1.10x, and Humana (HUM) at 3.27x.

If anything, the CMS redeterminations, higher medical costs, and bottom-line impacts appear to be an industry wide phenomenon, with UNH’s situation not an outlier.

As a result, investors may simply want to view these developments as the new normal as CMS “seeks to strengthen and modernize the Nation’s health care system, to provide access to high quality care and improved health at lower costs,” while saving “money for the customers and taxpayers who fund care.”

So, Is UNH Stock A Buy, Sell, or Hold?

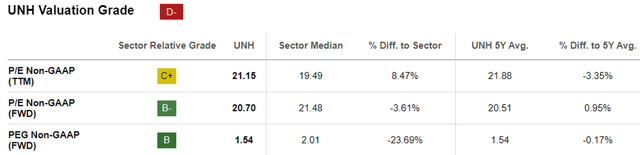

UNH 3Y Stock Price

For now, UNH has lost most of its Q3’24 gains as the stock drastically pulls back below its 50/ 100 day moving averages, thanks to the management’s cautious FY2025 commentary.

Even so, based on the management’s updated FY2024 adj EPS guidance of $27.62 at the midpoint (+9.9% YoY) and the 5Y mean of 20.50x, it appears that the stock continues to trade close to our updated fair value estimate of $566.20.

Based on the consensus FY2026 adj EPS estimates of $34.21, there remains an excellent upside potential of +23.8% to our long-term price target of $701.30 as well, thanks to the recent pullback.

If anything, the bulls have quickly swooped in to defend UNH’s recent pullback at the Q3’24 bottom of $550s, with it signaling that the worst may already be over.

As a result of the still attractive risk/ reward ratio at current levels, we are maintaining our Buy rating here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.