Summary:

- The company’s balance sheet remains leveraged due to 5G CAPEX, but net debt improved, and the 6.2% forward dividend yield is sustainable.

- Historical seasonality and potential positive market reactions to earnings, alongside Fed interest rate cuts, present bullish catalysts for Verizon’s stock.

- Risks include underperformance against growth stocks driven by the AI revolution and potential reputational damage from service outages.

JHVEPhoto

Investment thesis

My previous bullish thesis about Verizon’s stock (NYSE:VZ) aged well as the stock outperformed the broader U.S. market since June 20, delivering a 12.5% total return to investors.

I remain bullish from the long-term perspective and today want to focus mostly on the Q3 earnings preview since the earnings release is scheduled for Tuesday, October 22. Verizon has quite a strong earnings surprise record, which is obviously a positive sign. Moreover, this time consensus expectations seem to be quite conservative. Seasonality trends suggest that November and December are historically the most successful months for VZ, which is also quite bullish. Moreover, given VZ’s high reliance on leverage, I expect the management to be more positive with their outlook given the Fed’s recent interest rate cut. The above 6% dividend yield is still safe and there is a 40% upside potential. All in all, I reiterate my “Strong Buy” rating for VZ.

Recent developments

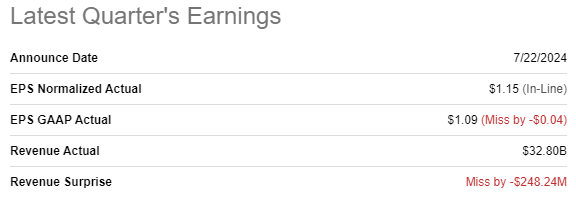

VZ released its latest quarterly earnings on July 22, missing consensus revenue and EPS estimates. Revenue grew YoY by 0.6% YoY, which was the best performance over the last six quarters. Operating income was almost flat YoY, but higher finance costs weighed on the EPS, which decreased from $1.21 to $1.15. That said, the EPS decline is explained by a non-operating factor, which means that the pullback is highly likely temporary.

Seeking Alpha

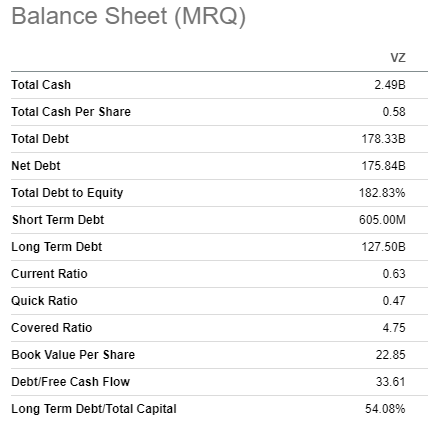

Verizon’s balance sheet is still highly leveraged as the company had aggressive CAPEX spending over the last few years as part of the 5G network build-out. On the other hand, the situation with the net debt improved sequentially by decreasing from $178.3 billion to $175.8 billion. I do not consider substantial leverage as a significant risk since debt maturity schedule looks quite comfortable for the company, and VZ’ credit ratings from the world’s leading agencies are decent.

Verizon demonstrates stable and strong profitability, which ensures a robust covered ratio. Moreover, the peak 5G build-out is in the rearview mirror and CAPEX is expected to moderate. To sum up, I still consider that the stock’s 6.2% forward dividend yield is sustainable and safe.

Seeking Alpha

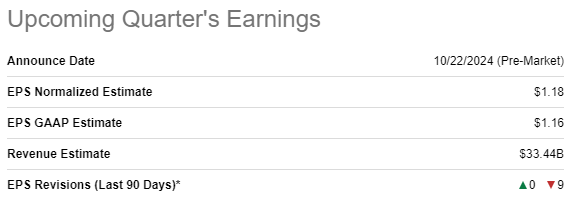

The upcoming earnings release is scheduled for October 22, which is very soon from now. Wall Street analysts expect Q3 2024 revenue to be $33.44 billion, which will be 0.2% higher on a YoY basis. High finance costs will likely weigh on the bottom line once again as the adjusted EPS is expected to decline from $1.22 to $1.18. However, the positive sign is that the adjusted EPS is expected to improve sequentially, from $1.15 to $1.18. Wall Street analysts appear to be quite cautious regarding the upcoming earnings release as there were nine downward EPS revisions over the last 90 days.

Seeking Alpha

The good part is that Verizon quite rarely disappoints against EPS consensus estimates. According to the history, there were only two negative EPS surprises over the last sixteen quarters, which is quite a robust record. On the other hand, VZ’s negative revenue surprises occur frequently, but these misses look quite insignificant in relative terms.

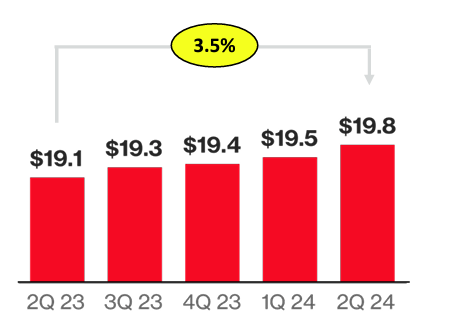

I am optimistic about the upcoming earnings release based on the company’s recent operational performance as well. The company has been demonstrating consistent growth in its wireless service revenue over the last several quarters. This strength is backed by the company’s aggressive rollout of its 5G Ultra Wideband network, which aims to enhance service quality.

Verizon’s Q2 earnings presentation

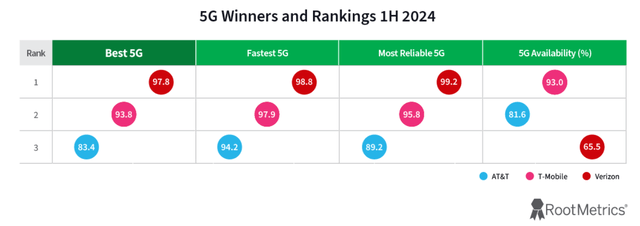

Verizon has been quite successful in building its competitive edge in 5G, as evidenced by the recognition of its service quality by industry experts. For instance, Verizon is notably ahead of its main rivals in terms of 5G speed and reliability, providing the best 5G experience for users, according to RootMetrics.

Verizon’s commitment to delivering the best 5G experience is likely to enhance its competitive position, leading to improved customer acquisition. Moreover, we saw quite strong performance in Q2 when Verizon delivered a 2.5 million wireless retail postpaid phone gross adds [9.3% YoY growth], and 1.8 million consumer wireless retail postpaid phone gross adds [12.0% YoY growth]. Furthermore, in the previous earnings presentation, the management emphasized that improving customer experience through C-band deployment was the top priority for the second half of 2024. This focus suggests that Verizon is likely to report strong customer growth metrics in Q3 as well.

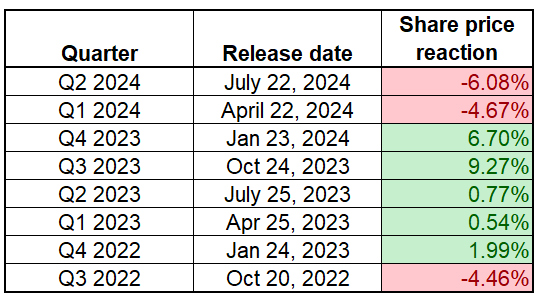

The stock more frequently reacted positively to earnings releases over the last eight quarters, according to my below compilation. On the other hand, the last two quarterly earnings releases were absorbed quite negatively by the market by notable after-earnings sell-offs. Given the several downward EPS revisions from consensus over the last 90 days, I believe expectations are already quite conservative. Therefore, there is a probability that the market could react positively to the upcoming earnings release if the company delivers positive revenue and EPS surprises.

Compiled by the author

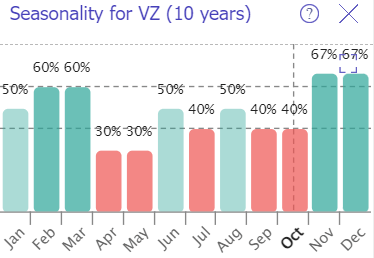

Historical seasonality patterns also look quite bullish for the remainder of the year. November and December were historically the strongest months for VZ over the last decade with a 67% success rate. Since the company usually reports Q3 earnings closer to the end of October, such a historically strong performance in November suggests that investors more frequently have positive reactions to the company’s Q3 earnings releases.

TrendSpider

Recent interest rates cut by the Fed look quite positive for VZ. As we saw above, the balance sheet is highly leveraged, which weighs on the bottom line. Therefore, expected further interest rate cuts through 2025 appears to be a solid tailwind for the bottom line. The management might share a more positive outlook due to decreasing interest rates during the upcoming earnings call, which could also be a positive catalyst for the stock price.

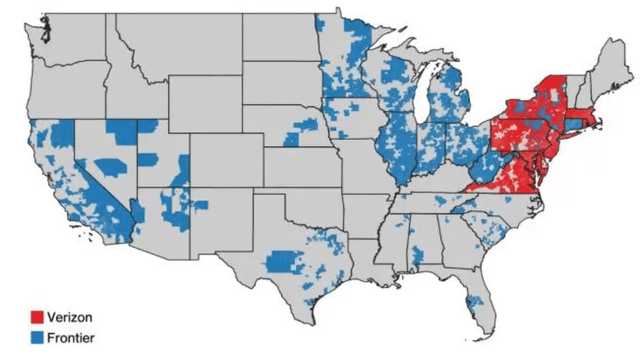

Last but not least, I expect the management to share more details about the Frontier acquisition. At first glance, the deal looks quite promising for Verizon’s shareholders. The deal will significantly help VZ to expand its broadband footprint across 25 U.S. states, which is significant. The management expects the merger to bring synergies of $500 million by enhancing operational efficiency. I think that VZ will be able to realize these synergies because we saw that it offers premium quality to customers, and it means that Frontier’s clients will highly likely enjoy Verizon’s premium offerings.

Valuation update

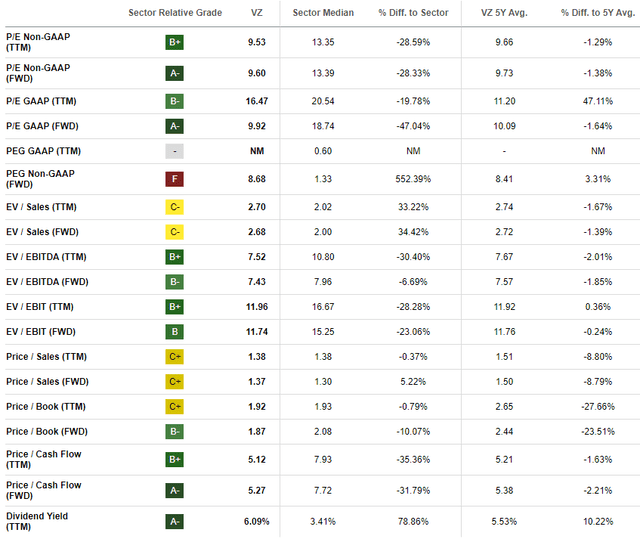

VZ’s performance has been solid over the last 12 months with a 42% rally, and a 17% YTD share price appreciation. Most of the valuation ratios look quite attractive, mostly in line or lower than the sector median.

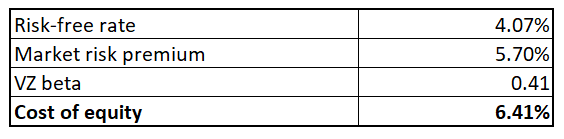

For a dividend stock like Verizon, the best way to proceed with my valuation analysis is the dividend discount model [DDM]. Cost of equity is the discount rate for the DDM approach, which I figure out below using the CAPM formula. All variables are easily available on the Internet.

Author’s calculations

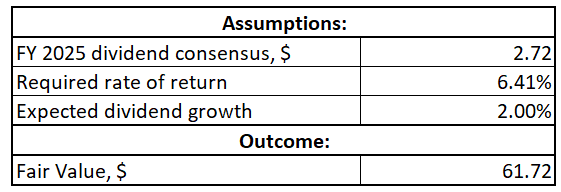

Verizon’s cost of equity is 6.41%, which will be used as a required rate of return for my DDM. The stock’s next year dividend provided by consensus is $2.72, which is a reliable assumption given historical stability in payouts. A 2% dividend growth is in line with long-term inflation levels and Verizon’s last five years’ dividend CAGR.

Author’s calculations

The fair share price according to my DDM simulation is $61.72. This is 40% higher than the last close, meaning that Verizon is currently very attractively valued.

Risks update

Soaring revenues and EPS delivered by technological giants supported by the AI revolution made growth stocks extremely attractive for investors, while value stocks have been significantly lagging behind over the last few years. Since around a third of the S&P 500 index is represented by the Technological sector, VZ has been lagging the broader U.S. stock market over the last three years. There was only a relatively short period when VZ outperformed during the panic caused by accelerating inflation in the U.S. in early 2022.

With its above 6% forward dividend yield and deep discount, VZ represents a safe investment choice paying generous dividends. However, if the AI-fueled mania in growth continues for longer, the stock is poised to further underperform compared to the S&P 500.

Verizon’s customers experienced two outages in one week, but the stock market did not react with any deep drawdowns. However, if outages occur again soon, this might raise doubts about Verizon’s ability to provide stable services, potentially leading to significant reputational damage and eventually resulting in a stock selloff.

Bottom line

To conclude, VZ is still a “Strong Buy” before the Q3 earnings release. The company is likely to deliver solid performance against consensus estimates, which look quite conservative after multiple downward revisions. Verizon’s above 6% dividend yield is still safe, and there is a 40% upside potential left.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.