Summary:

- The main attraction at Tesla’s We, Robot event was supposed to be the Cybercab, a two-seat, fully autonomous vehicle that’s long been central to justifying Tesla’s gravity-defying valuation.

- Musk believes the Cybercab is going to usher in a “glorious future.” Maybe his claim that entrepreneurs will manage a Cybercab fleet “like a shepherd tends their flock” will become a reality.

- My take: despite Musk insisting that they will build it, the Robovan is a concept car that has almost no chance of ever being street legal.

baileystock

The most impressive, and unimpressive, product displays of 2024 occurred last week – from companies headed by the same person. The largest booster rocket ever assembled was called back to terra by gravity; then, as it approached the Earth’s surface, engines ignited that navigated the projectile into a metal cradle.

SpaceX’s 20-story booster rocket catch was nothing short of remarkable. But four days before, analysts were summoned to a product launch that (essentially) didn’t happen.

I know a woman who was engaged to a celebrity chef who, after 300 guests had assembled at a Caribbean resort, was a no-show (no joke) at their wedding. Tesla’s (NASDAQ:TSLA) Cybercab was a no-show at its premiere. Specifically, there were no details that gave any analyst or onlooker much insight into the product or any idea when the rubber will meet the road.

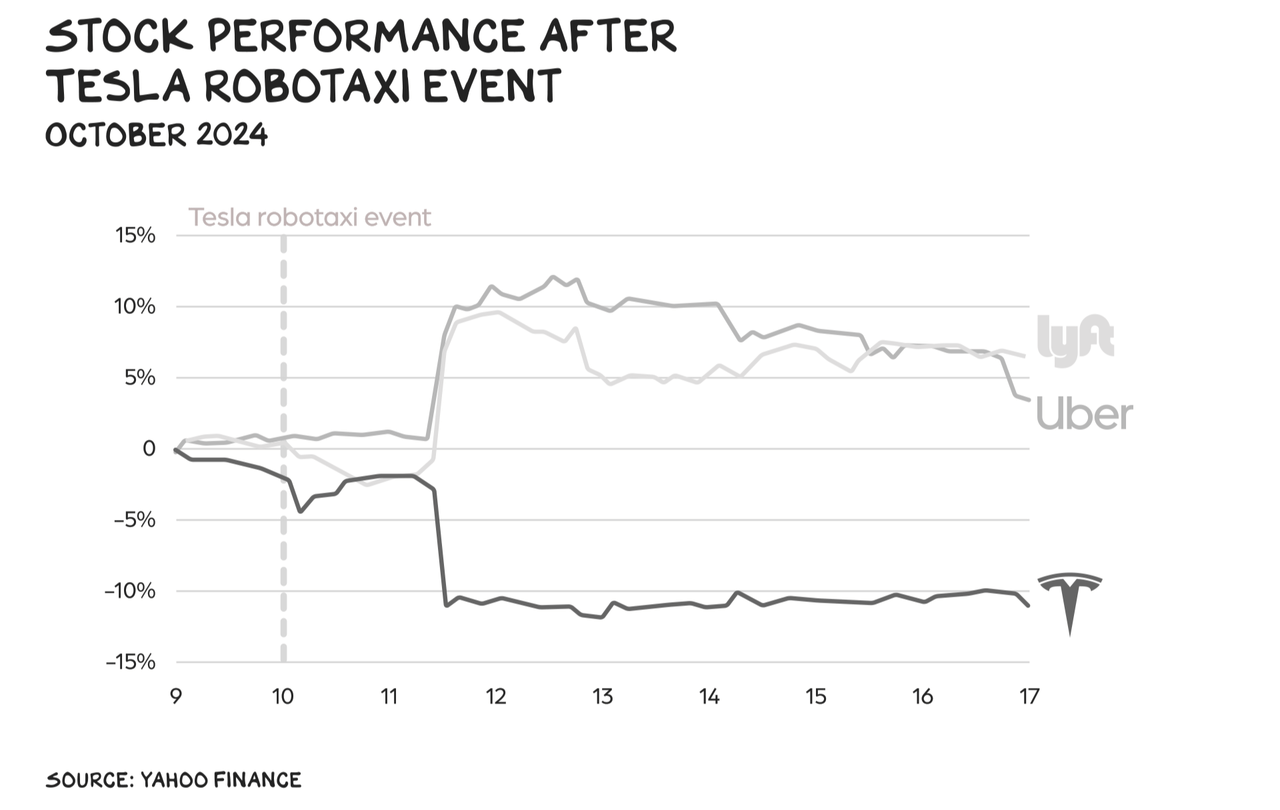

Why was the Cybercab a no-show? In the past two years, CEOs have added trillions to their businesses’ valuations with two letters: AI. Over the last decade, Tesla has sustained its position as the world’s most valuable car company with a one-word claim: autonomous. Tesla’s We, Robot event was a head fake that didn’t fool the market, which promptly trimmed $60 billion from the company’s market cap.

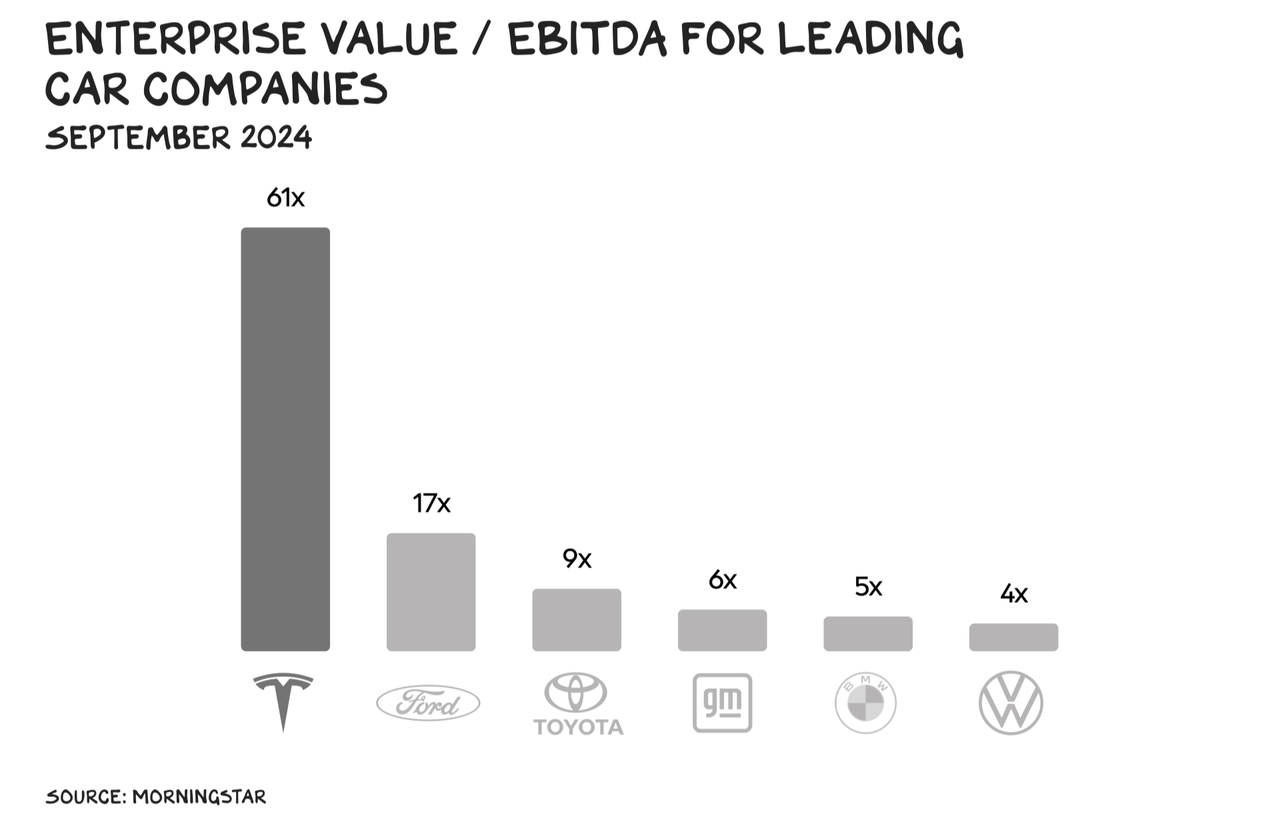

Overvalued

At its peak in 2019, WeWork was valued at $47 billion. Four years later, the co-working company was worth $44 million. In between those two valuations, investors rejected Adam Neumann’s narrative that the business was a tech company and came to see WeWork for what it was — a poorly run real estate play. Tesla is a great company with positive cash flows. However, like Adam Neuman, Musk keeps spewing adjectives and embellishments that have worn thin.

In April, Tesla’s operating profit dropped 50%. This should’ve sent the stock down, but Musk pulled off another mid-air catch. On the earnings call, he said, “We should be thought of as an AI robotics company. If you value Tesla as just an auto company, it’s just the wrong framework.”

Then he added, “If somebody doesn’t believe that Tesla is going to solve autonomy, I think they should not be an investor in the company.” The stock rose 14%. Spoiler alert: Tesla is a car company.

Automotive is Tesla’s core business, accounting for 94% of last year’s revenue. There is a dangerous belief in the U.S. that if you repeat a lie long enough, it will become less of a lie. The election wasn’t stolen, and Tesla is not a software/energy/AI/autonomous firm, but a great car company that is wildly overvalued. (Note: Not financial advice — I consistently get it wrong on Tesla.)

Hybrids

I used to own a Tesla Falcon Model X. It’s a great car from a great brand. Early adopters signaled to the world that they cared about the environment and were rich. Which is a feature that commands margin: being more desirable to potential mates… or less undesirable.

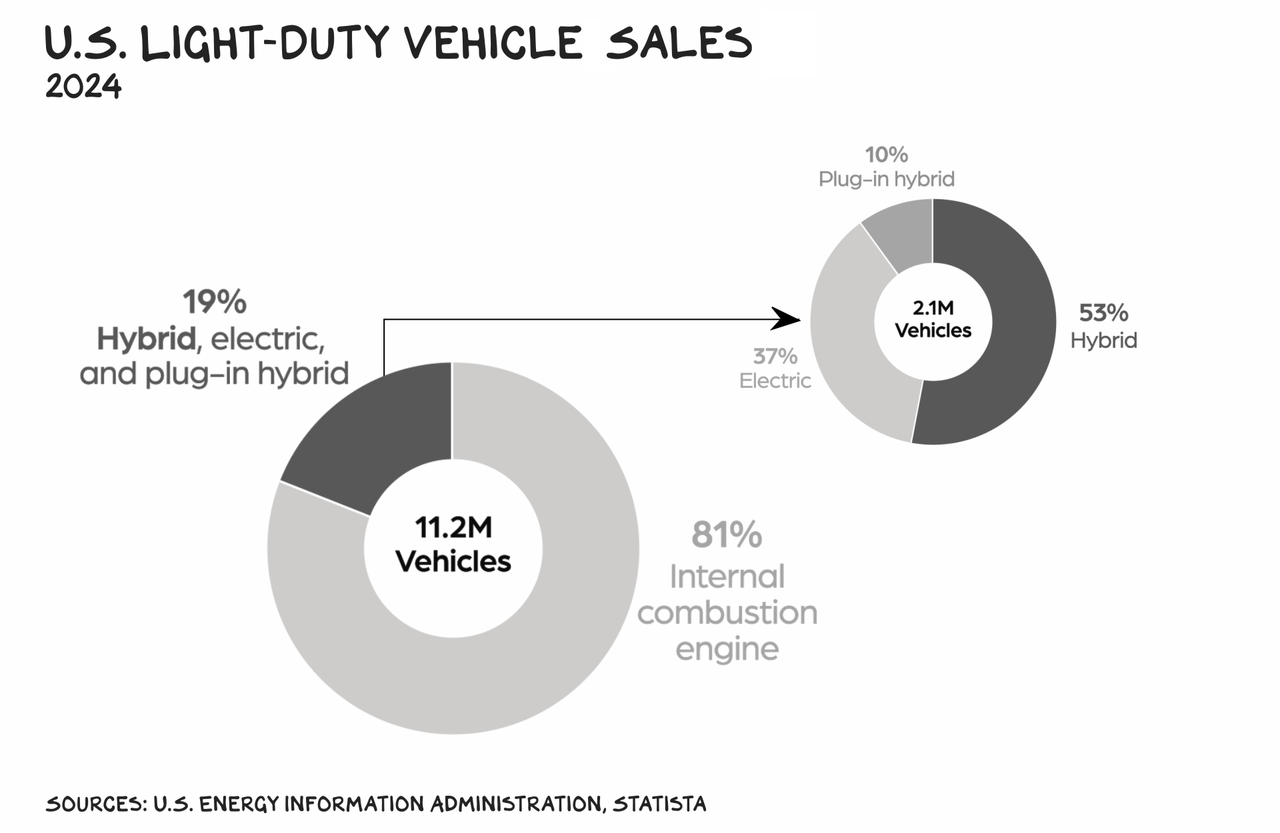

At the moment, however, hybrids appear to be the bridge to a future thought to be electric. Internal combustion autos still account for 81% of new car sales in the U.S., and hybrids are selling 5X faster than EVs in 2024.

Range anxiety and charging concerns are limiting EV sales. One consumer survey found that 80% of those considering an EV for their next car believe the current charging availability is insufficient, while 70% of current EV owners say they’re dissatisfied with the current infrastructure.

That’s bad news for the EV brand, but potentially good news for Tesla, as its charging infrastructure is excellent. However, Musk’s plan to make Tesla charging the industry standard and open its charging stations to all EVs have not materialized.

Another significant factor is price, as hybrids in the U.S., on average, cost $14,884 less than EVs. As EVs attempt to expand beyond early adopters to the mass market, price becomes more important — as the middle of the pyramid is much more price conscious.

For the first time since the pandemic, Tesla saw its sales drop 13% in the first quarter and 9% in the second. Sales rebounded 9% in the third quarter, but the news across the EV sector suggests the category is slowing. Ford (F) is scaling back its EV rollout.

General Motors (GM) is delaying its electric truck and reducing investments in EV battery mining. Volvo (OTCPK:VLVLY) is walking back its 2030 all-electric target. The EV revolution isn’t over, but Toyota (TM) CEO Akio Toyoda was right about its pace. Toyota bet on hybrids, and this year that paid off with a 66% jump in U.S. hybrid sales.

China

In China, though, EVs will account for 45% of new car sales this year. A growing EV pie is good news for a pure-play EV company. But BYD (OTCPK:BYDDF), the No. 1 Chinese EV manufacturer, offers cars at considerably lower prices than Tesla.

The BYD Seagull sells for $9,700 and the Yuan Plus costs $16,600; a Tesla Model 3 starts at $34,000, and the Model Y costs $37,000. China also has 200 domestic EV manufacturers fighting for the EV Iron Throne. The CCP has made clear that it intends to win the EV future via competition.

Mass Distraction

The main attraction at Tesla’s We, Robot event was supposed to be the Cybercab, a two-seat, fully autonomous vehicle that’s long been central to justifying Tesla’s gravity-defying valuation. Unlike the Cybertruck, the Cybercab actually looks cool.

Supposedly, it’ll enter production by 2026, or, as Musk jokes, “before 2027.” The Cybercab will sell for under $30,000, but Musk didn’t offer any details, as financials are a buzzkill. Also, we have no idea whether the self-driving technology will meet regulatory safety standards.

Today, there was news that the main U.S. auto safety regulator said it was investigating Tesla’s self-driving system. Latin for, this tech is not ready for prime-time. But don’t worry. For the past decade, Musk has been predicting that autonomous driving is just around the corner.

Meanwhile, back on Earth, Tesla has only achieved Level 2 autonomy (a driver is still required). The Waymo self-driving taxi, which looks like a science fair project, has Level 4 autonomy (no driver needed), and is already providing 100,000 paid rides per week in Austin, Los Angeles, Phoenix, and San Francisco.

Unlike Tesla, which is trying to go vertical, Waymo wants to be the OS for autonomous driving. The company is working with multiple auto manufacturers, including Fiat Chrysler, Hyundai, and Volvo. My prediction: Waymo’s tech coupled with several brands at different price points will bring autonomous to the masses, not Tesla.

In L.A. last week, I experienced my first Waymo ride. It drives just how I’m hoping my 17-year-old drives, overly cautious. However, when we encountered an accident, with flares, cones, and a cop with a luminant baton, redirecting traffic into the wrong side of the road to pass the damaged vehicle, Waymo was intimidated. But it figured it out, which I found remarkable. The millions of (unexpected) data points collected, digested, and then acted on is staggering.

Glorious Future

Musk believes the Cybercab is going to usher in a “glorious future.” Maybe his claim that entrepreneurs will manage a Cybercab fleet “like a shepherd tends their flock” will become a reality. Maybe a future where Cybercabs are constantly on the move will enable city planners to turn parking lots into parks.

If that day comes, maybe Cathie Wood, who believes Tesla will create $8 trillion in enterprise value by 2029 as a robotaxi business, will look like Warren Buffett. But at the moment she appears to be the Tesla of hedge fund managers, overpromising and underdelivering with inane hyperbole.

Robovan

My Pivot co-host Kara Swisher called the Tesla Robovan a “toaster on wheels.” But Kara also drives a Kia Sorento, which puts an asterisk next to any view she might have on cars.

My take: despite Musk insisting that they will build it, the Robovan is a concept car that has almost no chance of ever being street legal. And Tesla knows this, but autonomous was a no-show at the wedding, and the bride (Musk) needed something to get everyone to look away from the embarrassing situation in front of them.

Peter Drucker advised business leaders to focus on your opportunities, not your problems. And Musk is doing this. SpaceX is ascending, Tesla is falling to Earth. This was obvious at the event, as Musk seemed unrehearsed, confused, and stumbled over his words. BTW, the most impressive person in tech you’ve likely never heard of is Gwynne Shotwell, COO of SpaceX.

Optimus

Musk pitched the Optimus robot as a personal R2-D2 or C-3PO that can be a teacher, babysitter, dog walker, gardener, or companion. “Whatever you can think of, it will do,” Well, I can think of it actually being a robot that has autonomous capabilities. At the event, Optimus robots served as bartenders and chatted with the crowd, which sounds amazing, until you realize that they were controlled by human operators.

Supposedly, the robots will cost somewhere between $20,000 and $30,000 (human operator not included). That’s $12,000 less than a new Tesla Model 3. But a Tesla is a product that solves a real problem — offering personal transportation without burning fossil fuel.

Even if Optimus could do half the things Musk claims it can, who’s going to buy one? Tesla can’t answer that question, but neither can Boston Dynamics. Their Atlas robot requires human oversight, just like Optimus. But after more than a decade of R&D and support from the Defense Department’s DARPA program, Boston Dynamics still doesn’t have a commercial strategy for Atlas, though it has produced some great YouTube videos.

This entire category defines the concept of a technology in search of a use case. However, while it may never be able to watch your kids, Optimus did provide a purposeful distraction from the introduction of a product that is not ready and (once ready) will be inferior to products already in the market.

Pants-on-Fire Mode

Entrepreneur is a synonym for salesperson, and salesperson is the pedestrian term for storyteller. Pro tip: No startup makes sense. We (entrepreneurs) are all impostors who must deploy a fiction (a story) that captures the imagination and attracts capital to pull the future forward and turn rhyme into reason. No business I have started, at the moment of inception, made any sense… until it did. Or didn’t. The only way to predict the future is to make it.

This is not the same as lying. There’s a real distinction between an entrepreneur and a liar: Entrepreneurs believe their story will come true, as they are laser-focused on making it true. A liar, well, they know they’re misleading people with false data. Usually for money (i.e., fraud). This is where Tesla turns gray. Here’s what I see:

- In 2015, Tesla was two years away from a 1,000-kilometer range… a decade later it’s closer to 600 km.

- In 2016, coast-to-coast autonomous driving was two years away.

- In 2019, Tesla said it would have 1 million self-driving cars (that wouldn’t require any human oversight) on the road by mid-2020.

- Also in 2019, robotaxis were one year away… until last week, when we were told robotaxis were two years away.

I believe this is the year the market looks at Tesla and sees what I see: a great car company that is a car company.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.