Summary:

- American Airlines has shown a 12.65% gain since May, outperforming the S&P 500.

- Q3 guidance indicates stable revenues with capacity expansion, but TRASM and adjusted CASM suggest low margins in Q3.

- The company has a strong EPS beat history but a weak track record on revenue estimates, missing expectations frequently.

- Despite debt concerns and reduced price targets, American Airlines remains a buy due to its current undervaluation and potential upside.

Boarding1Now/iStock Editorial via Getty Images

In May, I covered American Airlines and attached a buy rating to the name despite the stock tumbling 14%. Since then, the stock has gained 12.65% which surprisingly a outperformed the 11.35% return of the S&P 500. Which I think is remarkable for a stock that was among the most shorted S&P 500 stocks last month. In this report, I will be discussing the expectations for the third quarter earnings, which the company will announce before the market open on the 24th of October.

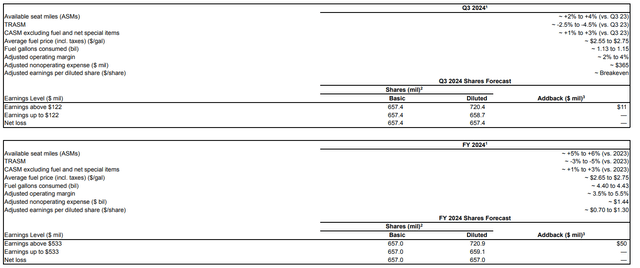

American Airlines Guidance Suggests Stable Revenues

For the third quarter, American Airlines has guided for capacity expansion of 2 to 4 percent with TRASM being down 2.5 to 4.5 percent. Essentially this points at revenues being stable year-on-year, and we also see that in the revenue estimates from analysts which currently is around $13.57 billion which is a 0.67% increase year-on-year. Adjusted CASM (cost per available seat-mile) excluding fuel, is expected to be up 1 to 3 percent with adjusted margins of 2 to 4 percent. Overall, analysts expect earnings per share to be $0.17 while American Airlines has guided for break-even.

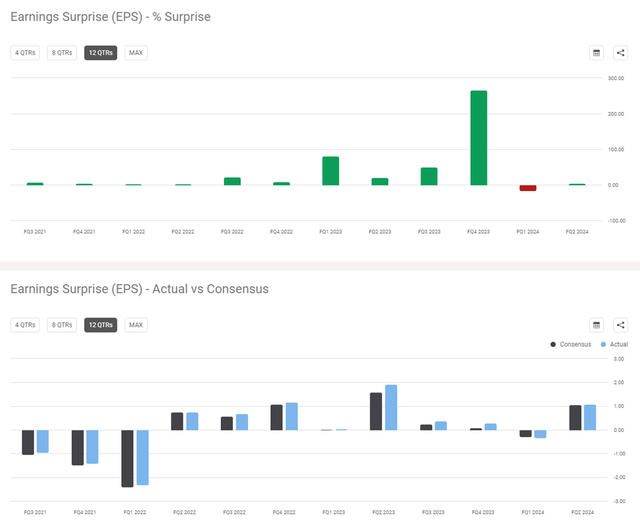

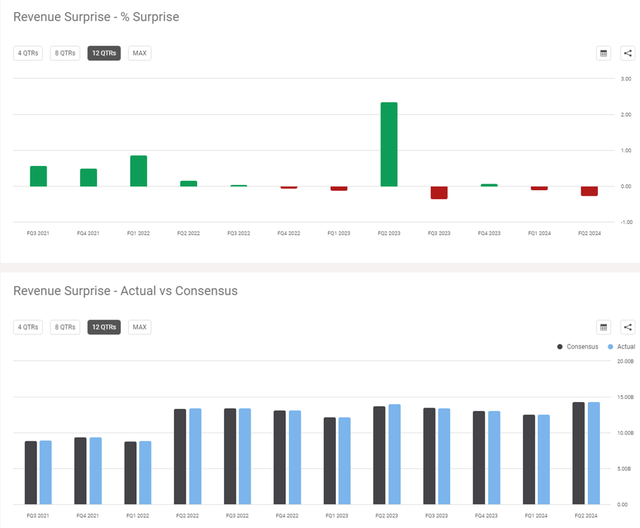

American Airlines Has A Strong Beat History On EPS, Less So On Revenues

When we look at analyst estimates, we also have to look at the track record of American Airlines beating or missing expectations for the simple reason that analysts can also be wrong by either being too optimistic or too conservative with their estimates. On earnings per share, American Airlines has missed estimates once in the past twelve quarters which is a stellar track record.

On revenues, the company has disappointed the 5 out of the past twelve quarters and so far this year, the company has missed estimates every time. So, if American Airlines misses the consensus that would fall into a sequential pattern observed this year. In fact, over the past four quarters the company has missed expectations 3 out of 4 times. So, it suffices to say that the company’s track record on revenues is weak.

American Airlines: No Longer Part Of The S&P 500 But Share Float Also Dropped

On the 23rd of September, American Airlines was removed from the S&P 500 in the quarterly rebalancing. Perhaps that caused the short float to actually drop, and I do expect that short interest has dropped further in October on the back of strong Q3 readings from United Airlines and Delta Air Lines. Short interest dropped to 12.9% by the end of September compared to 14.8% in August.

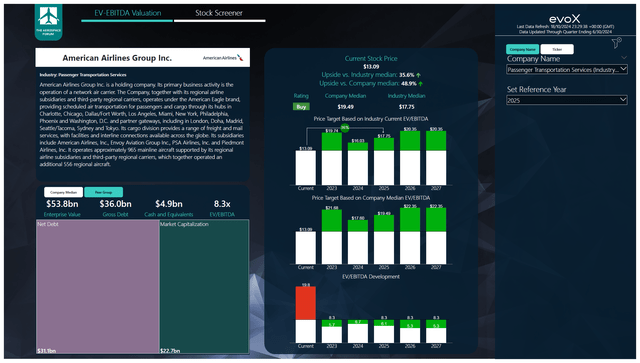

To determine multi-year price targets The Aerospace Forum has developed a stock screener which uses a combination of analyst consensus on EBITDA, cash flows and the most recent balance sheet data. Each quarter, we revisit those assumptions, and the stock price targets accordingly. In a separate blog I have detailed our analysis methodology.

On EBITDA level, the estimates from analysts have come down significantly with a 13.8% reduction to the estimate for 2024, 15.7% for 2025 and 16.7% for 2026. That’s already not a great look and the free cash flow estimates have come down significantly as well. For 2025 and 2026, the expected free cash flow is around 25% lower and even 80% lower for 2024. The result is that my price target for 2024 has reduced from $21.89 to $16.03 and from $25.07 to $17.75 for 2026. While those are big price target reductions, that still provides upside of 36%. While my model still prints a buy rating for American Airlines, a watch item is the net debt which exceeds the market cap which can be seen as the market seeing financial risk in American Airlines. I believe that in some way that is also the case. In our modelling, we assumed around $5 billion in cash on hands to be required in each year and that would mean that American Airlines has to refinance some of its debt. In 2025, that would be around $4 billion and $3 billion in 2026. In other words, the company is not expected to service its debt from cash flow.

At the same time, it should be noted that with interest rates dropping the cost of debt which currently stands at 8.65% for American Airlines could also drop. I also have to admit that the free cash flow estimate dropping from $2 billion to around $400 million is a steep drop. It implies that the company would burn around $1.45 billion in the balance of the year as the company generated $1.83 billion in the first half of the year. For the balance of the year, analysts expect around $1.33 billion in CapEx which would indicate that the operating cash burn in the balance of the year would be around $500 million. With the summer season being the strongest for cash generation, the cash generation in the balance of the year is definitely a watch item but we do note that Delta and United both had near break-even cash flow during the quarter. With the guidance for the third quarter of 2 to 4 percent margins, there indeed could be a cash burn in the balance of the year for the airline, so I would not say that the steep drop in cash flow estimates from analysts is incorrect.

Conclusion: American Airlines Faces Some Risks But Has Upside

American Airlines definitely faces a serious risk on its debt servicing and I do believe that the company requires to refinance at least $7 billion in debt. Important to note is that the net debt has hovered around $20 billion between 2018 and 2020. So, its current net debt of $23.3 billion is not awful. It certainly is not great but also not bad and even with net debt being higher than the market capitalization by 2025, there still remains upside to the stock. So, I do view American Airlines as a buy… perhaps a buy with some clear risks but at current prices, the stock is too cheap even when considering the risks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.