Summary:

- Broadcom’s AI-driven growth remains robust, with recent strategic moves solidifying its position in the AI and cloud technology sectors.

- The company’s strong revenue mix from software, services, and hardware, combined with exceptional FCF conversion, makes AVGO a Strong Buy.

- Despite potential risks like CEO transition and economic cycles, Broadcom’s fundamentals and valuation are highly attractive.

G0d4ather

My thesis

This article is an update of my initial Broadcom (NASDAQ:AVGO) thesis. The stock delivered a total 13.3% return to investors since the previous call was published.

There are a few powerful indications that AI tailwinds are not getting weaker. As a vital company for the digital age, Broadcom is well-positioned to benefit. Despite its already firm strategic positioning, Broadcom finds new opportunities to cement its position as one of the most essential companies for the AI revolution. This is vital for investors because Broadcom’s ability to convert revenue into value for shareholders is unparalleled. The valuation is still very attractive, and the RSI indicator is moderate, which means that AVGO is still a Strong Buy.

AVGO stock analysis

In my previous analysis I shared several solid reasons why Broadcom is a very important company for the global AI transformation. Therefore, I am starting my new analysis with the information related to what the company did recently to cement its strategic strengths.

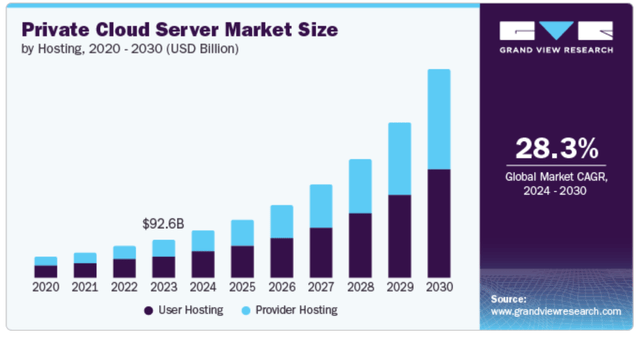

From this perspective, the key recent event was the introduction of VMWare Cloud Foundation 9. According to the release, “VMware Cloud Foundation is the industry’s first private cloud platform to deliver public cloud scale and agility with private cloud security, resilience and performance, and low overall total cost of ownership”. This is crucial because Grand View Research forecasts a strong 28.3% CAGR for the private cloud server market by 2030.

Grand View Research

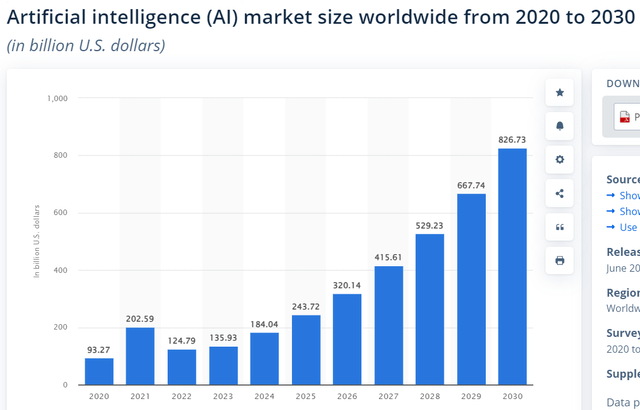

An additional data point that confirms Broadcom’s push to solidify its AI leader position is the introduction of VMware Tanzu Platform 10. This service provides rapid development and deployment of AI applications in private clouds for companies. Automating complex workflows, Tanzu Platform 10 lets users develop intelligent applications with minimal knowledge in artificial intelligence. This approach not only closes the AI skills gap but also allows businesses to be innovative at a faster and cheaper pace. With such innovations, Broadcom is ideally placed to tap into the increasing demand for AI solutions. Statista expects the global AI market to be worth $827 billion by 2030, around 4.5 times higher compared to 2024 levels.

Statista

Broadcom’s role in Achmea’s adoption of Azure VMware Solution is another indication of the company’s strong impact on driving the AI shift across various industries. A hybrid cloud strategy executed through VMware Cloud Foundation helped Achmea to become more agile and data-driven, which eventually results in reacting to changing customer needs by leveraging AI for deeper data insights.

Since AVGO makes new solid moves to improve its moat in the global AI transformation, let me also highlight that the industry is still very hot. The latest big evidence of it is Taiwan Semiconductor Company’s (TSM) Q3 earnings release. TSM’s Q3 net revenue grew by 36% YoY, and High Performance Computing (HPC) represented 51% of net revenue, up from 42% during the same quarter of 2023. Another piece of information suggesting that tailwinds for semiconductors are still strong is that the Semiconductor Industry Association reported that semiconductor sales in August rose nearly 21%

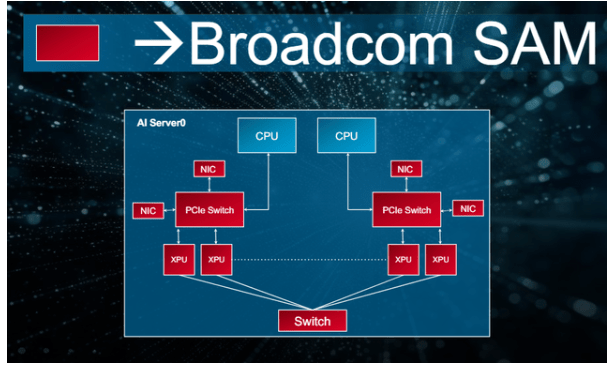

Therefore, we see that the momentum in data centers is still very strong. It is also crucial because AVGO is not only a software company but also has a strong hardware revenue mix. While CPUs and GPUs are the brains of data centers, in the below picture it is shown that Broadcom’s products are vital in connecting these “brains”.

Broadcom

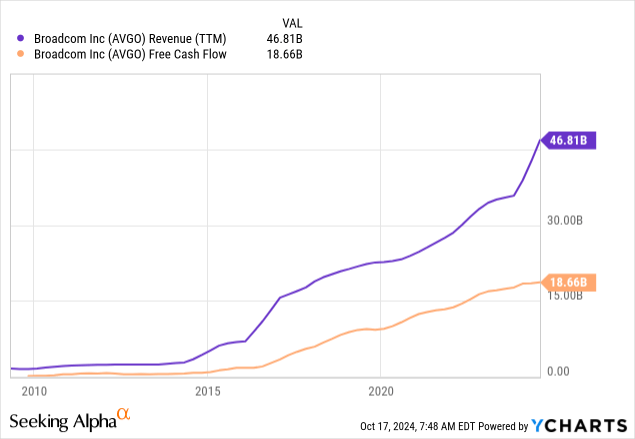

I firmly believe that reasons describe above are robust enough to explain why I am very bullish about Broadcom’s prospects to drive strong revenue growth for longer. What I also want to emphasize is that the management is very strong in converting revenue growth into value for shareholders, i.e. free cash flow (FCF). The company’s levered TTM FCF margin looks unbelievable at 55.5%, which is more than ten percentage points higher than the last five years’ average. It will not be an exaggeration to call Broadcom a cash printing machine.

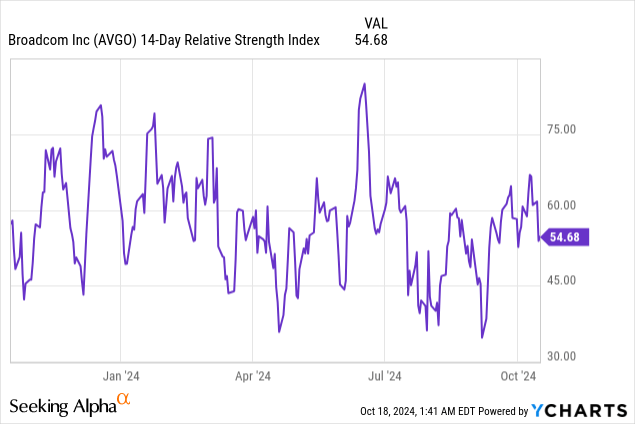

The stock looks interesting from the technical setup perspective as well. The current RSI indicator is quite moderate at around 55, which is far from peak levels.

In summary, AVGO did several strong strategic steps recently to fortify its positioning as one of the most important companies for the AI revolution. It boasts a strong revenue mix with AI exposure, consisting of software, services, and hardware. AI tailwinds are still very strong, and Broadcom demonstrates exceptional ability to convert tailwinds into value for shareholders.

Intrinsic value calculation

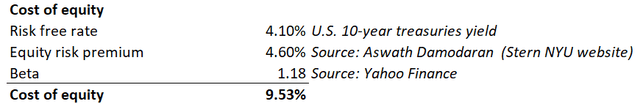

The discounted cash flow (DCF) model is the proper approach to value a company like Broadcom, that is firmly committed to drive growth. Since I usually look at the levered free cash flow, my discount rate is cost of equity calculated under the CAPM approach. According to the below working, AVGO’s cost of equity is 9.53%

DT Invest

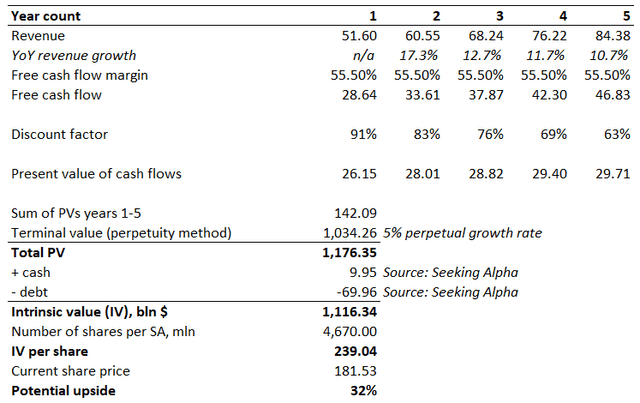

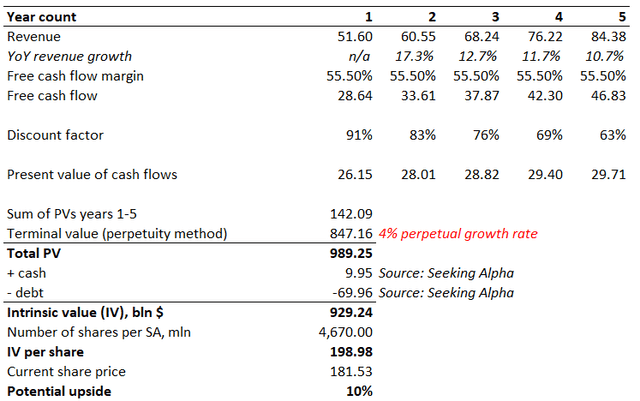

As I mentioned earlier, AVGO’s levered TTM FCF margin is 55.5%. The level is already strong, so it is difficult to expect any further substantial expansion. Therefore, my revenue growth projections will be multiplied by this coefficient. Revenue growth projections for years 1-3 are based on consensus, as these figures represent the average opinions of over 20 Wall Street analysts, which appears reliable. For years 4 and 5 I incorporated a 100bps yearly revenue growth deceleration. Due to AVGO’s strong positioning in the AI shift, I reiterate the same 5% perpetual growth rate that I used before.

DT Invest

AVGO’s intrinsic value (IV) per share is $239. The potential upside is solid, because the IV is 32% higher than the last close. Perpetual growth rate is always a controversial assumption, but even with a 4% growth rate AVGO still looks around 10% undervalued.

DT Invest

To wrap up, even with a conservative perpetual growth rate, AVGO’s intrinsic value per share is nearly $200. Even a 10% discount seems like an extremely attractive bargain for a stock like AVGO.

What can go wrong with my thesis?

I believe that Broadcom’s strong business and financial performance was achieved thanks to high-quality leadership from Hock Tan, the CEO. He has been in charge for several years, and under his leadership the stock price increased by more than 100 times since 2009. But even super-CEOs like Hock Tan cannot escape the effects of aging. Mr. Tan is now 73 years old, which suggests that Broadcom will likely undergo a leadership transition within the next few years. This is always risky, as a CEO transition could disrupt the efficiencies and strategic direction established under Tan’s leadership.

Seeking Alpha

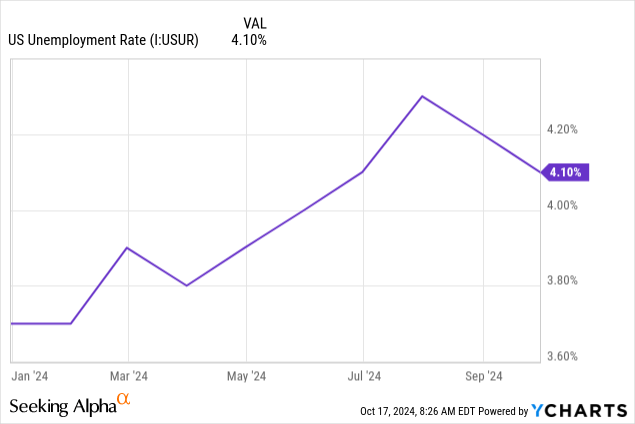

Semiconductor industry is cyclical, which also poses risks for investors. The U.S. economy is still quite resilient, but there are a few warning signs. Despite a recent pullback, the U.S. unemployment rate is currently much higher compared to January 2024. This is especially warning considering that the Fed’s monetary policy is still restrictive, even after the recent interest rates cut. Furthermore, OECD expects the U.S. GDP growth to slow down notably in 2025.

Summary

Broadcom’s fundamentals are bulletproof thanks to expanding revenue growth potential and the management’s non-stop master class of converting revenue growth into FCF expansion. Still attractive valuation and a favorable technical setup makes AVGO a Strong Buy again.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.