Summary:

- Mastercard’s upcoming Q3 results are crucial for validating its premium over Visa and assessing my three-pillar growth thesis.

- Key differences: Visa is larger, more U.S.-focused, and more profitable, while Mastercard aggressively pursues customer acquisition.

- Mastercard’s value-added services and new flows are growing faster than consumer payments, reflective of the future drivers of the business.

- Despite Mastercard’s premium valuation, I maintain a ‘Buy’ rating, expecting ~15% annual returns driven by robust EPS growth.

Ekaterina79

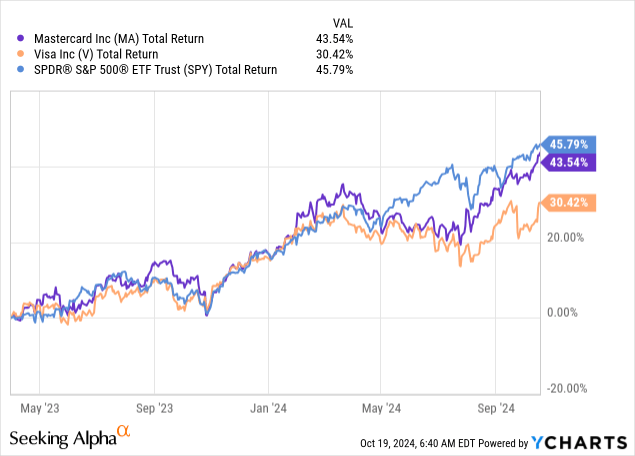

Mastercard (NYSE:MA) is set to report its third-quarter results in less than two weeks, amid a year of slight underperformance for the payments giant.

The upcoming quarter will be key in determining whether the premium over Visa (V) remains justified, and could mark a turning point for my three-pillar growth thesis.

Let’s dive in.

Introduction

I’ve been covering both Mastercard and Visa across a series of articles in the past two years.

Throughout the period, I maintained a ‘Buy’ rating for both companies, and preferred Visa over Mastercard.

So far, I’m sad to say I was wrong, as both Mastercard and Visa lagged the market during this time, and Mastercard significantly outperformed Visa. The DoJ’s lawsuit against Visa’s debit business played a big role here, but it’s not entirely to blame.

Still, I might sound stubborn, but I think it’s one of those situations where I can say my analysis was correct, while the outcome was not.

This is where we should go back to my three-pillar thesis, but first we should go over the key differences between the companies.

Key Differences Between Visa And Mastercard

Let’s make it clear, Mastercard and Visa have nearly identical businesses. Even in this new era, they structured their companies somewhat similarly, across consumer payments, value-added services, and new flows.

That said, there are several key differences between them which make a big difference, in my view, when looking at their next growth phase, which should be primarily driven by the non-consumer pillars.

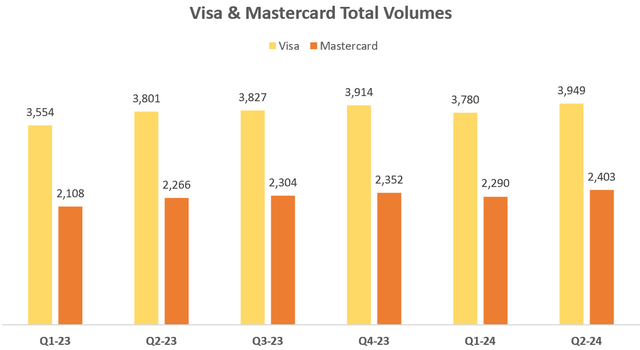

The first major difference is their size. Even after years of market share gains, Mastercard is still significantly smaller than Visa, with the latter generating ~30% more revenues, and facilitating 65% more volume.

Created by the author using data from the companies’ financial reports.

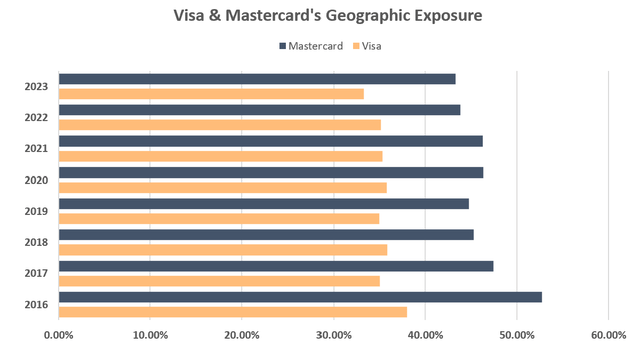

The second difference is their geographic exposure. Last quarter, Mastercard generated around 45% of its revenues in the Americas region (primarily U.S.), whereas Visa was at 41%, for the U.S. alone. However, on volumes, Mastercard is at 67% outside the U.S., whereas Visa is at 54%. Historically, Mastercard is materially more exposed to international markets compared to Visa.

Created by the author using data from the companies’ financial reports.

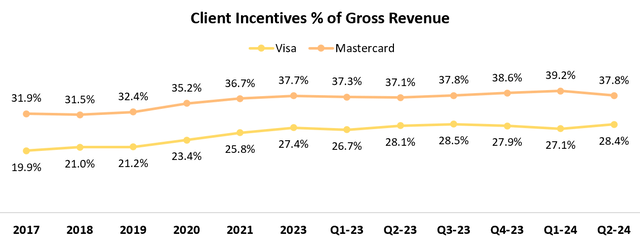

The last difference comes down to client incentives, and profitability. In an effort to continuously take market share from Visa, Mastercard is sacrificing profitability in order to acquire customers. Its client incentives as a percentage of gross revenues are typically 10 points higher than Visa’s, and as a result, its operating margins are about 10 points lower.

Created by the author using data from the companies’ financial reports.

So, summing up this section, Visa is larger, more exposed to the U.S., and less aggressive on customer acquisition, making it more profitable.

The Three-Pillar Thesis

Mastercard and Visa are still viewed by many as pure plays on digital consumer payments. However, this is not really the case anymore.

Last quarter, Mastercard generated nearly 40% of its revenues from what it defines as value-added services, while for Visa this figure stood at around 25%.

For both companies, this portion of the business is growing much faster than consumer payments. In Mastercard’s case, VAS grew 18% last quarter, compared to the consolidated 13%, and in Visa’s case, it was 23% and 10%.

When it comes to New Flows, they don’t disclose the size of the business and Mastercard doesn’t constantly share its growth, but for Visa, it grew 18% last quarter.

What I’m trying to emphasize here is that in the midterm, those non-consumer pillars will become increasingly important. Actually, I argue they will become the focus points for investors, and it won’t take too long before they generate more revenues than the consumer payments segment.

This should become even more apparent when the conversions of Citizens and Fifth Third Banks are complete. These conversions are the primary drivers for Mastercard’s higher volume growth, which is currently the main topic in Wall Street analysts’ reports.

Under such scenario, I find Mastercard a bit worse positioned. Those new pillars rely heavily on existing relationships (which Visa has more of), and like many innovative services and products, they are more likely to first be adopted in the U.S. (where Visa has more exposure).

As I wrote in the past, I believe the market is missing the size of this opportunity (when it comes to both companies’ valuations), but also its significance (when it comes to Mastercard’s premium valuation over Visa).

In the upcoming quarter, I expect the market to remain focused on the legacy businesses and the growth gap there, but I will be on the other side of that, closely monitoring the relative performance in value-added services and new flows. I’ll also focus on the client incentives gap, which the market seems to be ignoring.

Valuation & Outlook

Mastercard is expected to outgrow Visa for the foreseeable future, with consensus estimates at 15%-17% EPS growth and 10%-12% revenue growth for the upcoming years (Visa is at 12%-14% and 9%-11%, respectively).

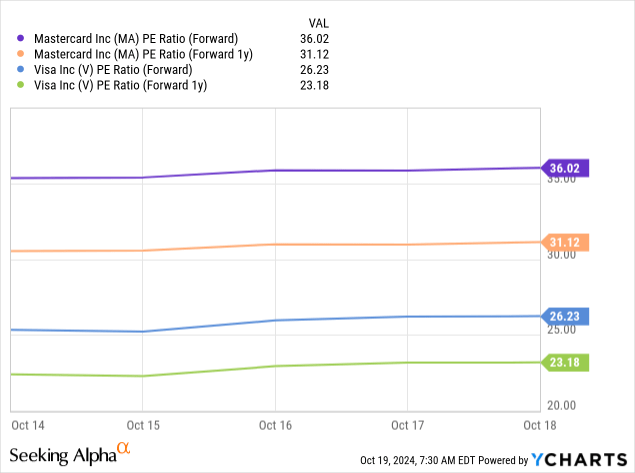

Mastercard is currently trading at roughly a 20% premium on 2025 estimates, while being expected to grow about 2 percentage points faster. To me, such high premium could only be justified by the lower regulatory risk.

Further, at 31 times ’25 estimates, Mastercard is close to being fully valued in my view, trading only 5% below its historical average.

Although I’m very bullish on the new growth pillars, the legacy consumer payments business demands a higher multiple in my view. It has a wider moat, and its underlying secular tailwinds (global GDP per capita and digitalization) are more resilient as well.

That’s why I don’t think Mastercard is expected to see its multiple expand materially, which means returns will be driven by EPS growth (still great).

Conclusion

Mastercard is an extraordinary business with a long runway for mid-teens EPS growth.

Because of the key differences between Mastercard and Visa, I believe the latter is slightly better positioned to capitalize on the growth opportunities outside of consumer payments.

Although Mastercard’s premium can be justified by lower regulatory risk and faster growth, I think its 31x multiple on 2025 earnings is close to peak.

This means that investors should expect shares to follow earnings growth, which is still great, as it means ~15% annual returns in the foreseeable future.

Therefore, I reiterate Mastercard at a ‘Buy’.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.