Summary:

- Apple remains a high-quality company with strong cash flow and long-term growth potential, but shares are currently pricey, justifying a ‘hold’ rating.

- Recent financial results show revenue growth, particularly in services, but weaknesses in iPhone and wearables sales, and challenges in China persist.

- Despite significant share buybacks and reduced debt, the stock’s valuation remains high, making it less attractive for new investment at this time.

- Upcoming financial results on October 31st could impact the stock’s performance, but without significant changes, maintaining a ‘hold’ rating is prudent.

Images By Tang Ming Tung

With a market capitalization of nearly $3.6 trillion, Apple (NASDAQ:AAPL) is the largest publicly traded company on the planet at this moment. It truly is a testament to the power of creative thought and the application of that creativity to technology. In the long run, I would imagine that further growth for the business is likely, even though financial results in recent years have not been terribly impressive. The most recent figures provided by management, which involve the third quarter of the 2024 fiscal year, do show that most parts of the company are growing at this moment. However, this doesn’t mean that the company makes sense to buy into at this point in time.

In my last article published about the company in July of this year, I mentioned that shares were getting quite pricey. I also pointed to both positive and negative catalysts for the company. In particular, there seems to be a lot of optimism revolving around the power of AI and how it can be applied to the firm’s products and services. On the other hand, the business is facing competition in global markets, specifically competition from other smartphone manufacturers. Even though the stock was expensive, I made the case that it would be a better ‘hold’ than a ‘sell’ because of how high quality it is and because of its minimal amount of debt. Since then, the stock has pulled back somewhat, dipping by 1% at a time when the S&P 500 is up by 3.1%.

This spread is not terribly significant, especially over a three-month window of time. However, there is an opportunity for this spread to change rather meaningfully in the coming days. You see, after the market closes on October 31st, management will be announcing financial results covering the final quarter of the company’s 2024 fiscal year. Analysts are forecasting growth on both the top and bottom lines. If things can come in better than anticipated, shares might narrow that gap or even achieve upside greater than the broader market. But as somebody who does not like to speculate and after taking into consideration how the stock is priced, I believe that maintaining my ‘hold’ rating is logical right now.

Shares still don’t make sense to buy

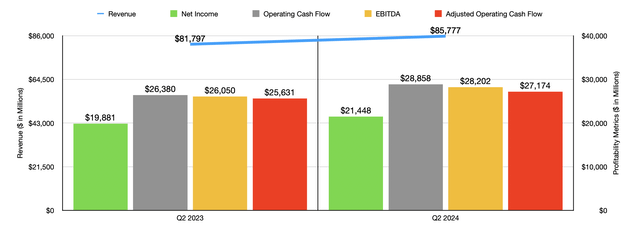

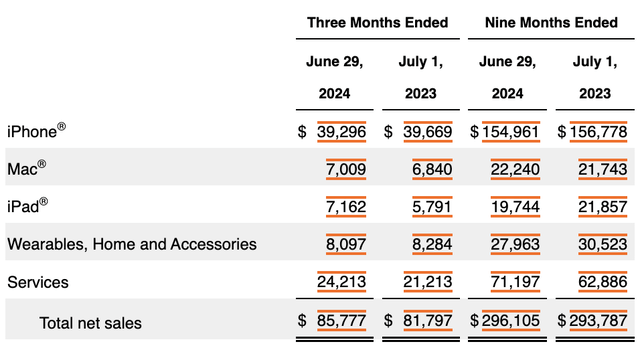

When I last wrote about Apple a little over three months ago, investors had access to data covering through the second quarter of the 2024 fiscal year. But results now extend through the third quarter. During that most recent quarter, management achieved some rather impressive results. Revenue hit $85.78 billion. This is 4.9% above the $81.80 billion that the company reported one year earlier. For the most part, the company saw expansion on a product-by-product basis. As an example, Mac sales popped up by 2.5% from $6.84 billion to $7.01 billion. Even more impressive was the iPad, which saw an increase in revenue of 23.7% from $5.79 billion to $7.16 billion.

But to me, the most interesting part of the company would not be the products that it sells, but instead its services. This includes advertising revenue from its platforms, revenue associated with AppleCare, cloud services that it provides to customers, digital content sales, and certain payment services like Apple Card and Apple Pay. Speaking of digital content sales, this includes revenue associated with the firm’s App Store, as well as things like Apple Arcade, Apple Fitness+, Apple Music, Apple News+, and Apple TV+. I have always been a fan of service-oriented businesses. Their potential for recurring revenue, combined with their high margins, seem to be attractive in my book. And in the most recent quarter, this part of the company performed exceptionally well, with revenue of $24.21 billion. That’s up 14.1% compared to the $21.21 billion the company reported one year earlier.

This is not to say that everything about the company is going well. It did see some weakness involving its wearables, home products, and accessories. These sales dropped by 2.3% from $8.28 billion to $8.10 billion. In addition to this, the company reported a decline in revenue involving its iPhone. This is, by far, the company’s most significant product. Year over year, revenue dipped by 0.9% from $39.67 billion to $39.30 billion.

In an article that I published back in November of 2023, I talked about the market share that Apple has in the phone operating system space. When it comes to the US, it is the big giant out there. But outside of the US, focused on the global market, it is considerably smaller. Back then, for 2023, I calculated that it had a roughly 29% share of the global operating system industry. That did represent an increase over what it had been over the prior five years. However, it is becoming increasingly clear that the enterprise is facing continued pressure in key markets.

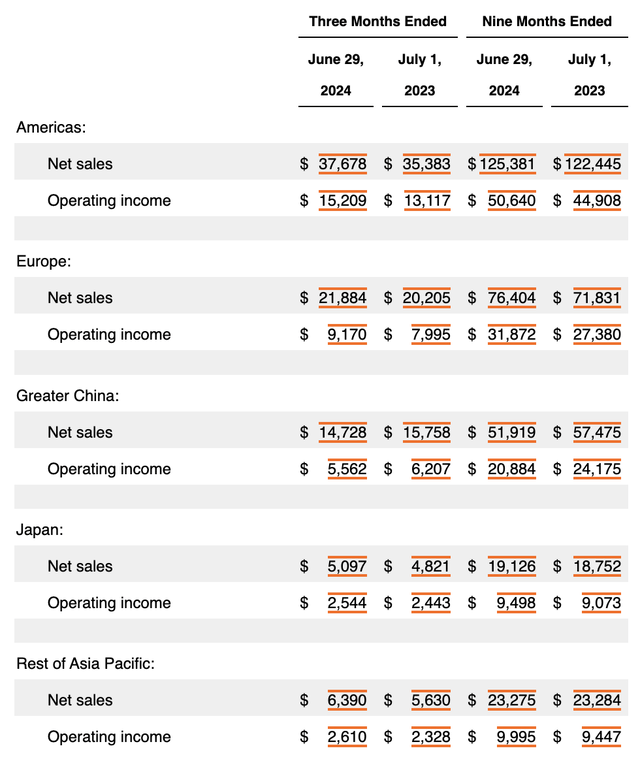

Unfortunately, management does not provide product by product revenue data on a geographic basis. But they do provide total revenue on a geographic basis. If you look at the image above, you can see financial performance for all of the major regions in which the firm operates. In every single one of these, with the exception of Greater China, the business experienced growth in the third quarter of 2024 compared to the same time last year. The same held true for the most part for the first nine months of 2024 compared to the same time of 2023. The one exception to this was the ‘Rest of Asia Pacific’ region where sales dipped by $9 million year over year. But while that might be a good chunk of money for you or I, it truly is a rounding error for Apple.

In Greater China, the company continues to struggle. In the most recent quarter, revenue of $14.73 billion was 6.5% below the $15.76 billion reported one year earlier. And for the first nine months of this year, revenue of $51.92 billion was 9.7% lower than the $57.48 billion the company reported the same time of 2023. Back in an article that I published about the behemoth in April of this year, I discussed the challenges that it was facing in China. There were regulatory issues, plus homegrown competition in the form of Huawei, that were causing the business issues.

As disappointing as all of this was, I did mention that the company still has plenty of growth opportunities elsewhere even if things don’t go right in China. Specifically, I singled out India, which is expected to continue expanding from a population perspective even as China is destined to decline in the coming decades. With other parts of the world, including the US, expected to continue growing, I felt as though even the worst-case scenario would be little more than a slight pain for the company in the long run. I still feel that way today. Now obviously, this small problem could become a big one if it ever results in Apple losing its ability to manufacture its iPhones in China. After all, around 90% of these devices are produced there.

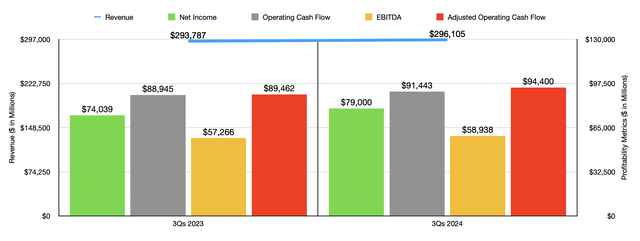

With revenue for the company increasing as of late, profits also improved. Net income grew from $19.88 billion to $21.45 billion. Operating cash flow popped from $26.38 billion to $28.86 billion. If we adjust for changes in working capital, we get an increase from $25.63 billion to $27.17 billion. And finally, EBITDA for the business expanded from $26.05 billion to $28.20 billion. In the chart above, you can see financial results for the first nine months of the 2024 fiscal year compared to the same time of 2023. Across the board, revenue, profits, and cash flows, are up. So even though the company is seeing weakness in one of its largest markets, it is still doing well enough elsewhere to more than compensate for this. It is worth noting that year over year results for the first nine months of this year compared to the same time last year would actually be higher had it not been for the fact that the company had an extra operating week last year. So on a comparable basis, things are even better than they appear.

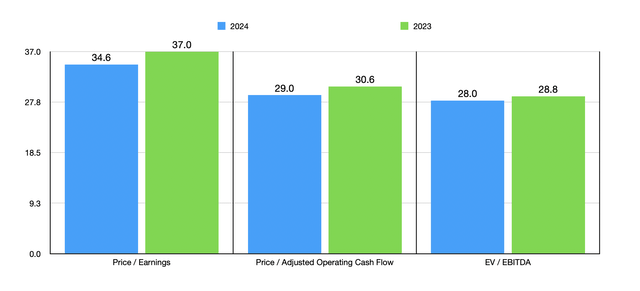

Throughout this article, you might get the impression that I am optimistic about the company. Operationally speaking, I certainly am. I firmly believe that Apple will be a larger business in 10 years than it is today. But this doesn’t mean that I think the stock is worth buying into. If we annualize financial results that we have achieved so far this year, we would expect net profits for 2024 in its entirety to be $103.49 billion. Following the same approach with the other profitability metrics would result in adjusted operating cash flow of $123.59 billion and EBITDA of $129.49 billion.

In the chart above, you can see what this means for the valuation of the company. That chart also includes valuation figures using results from 2023. Normally, these are the kinds of trading multiples that would convince me to rate a business a ‘sell’. But because we are talking about an industry leader, I believe that considering the company fairly valued would make more sense. Of course, others might disagree with me. After all, there are some things that the business has going for it that are appealing to investors.

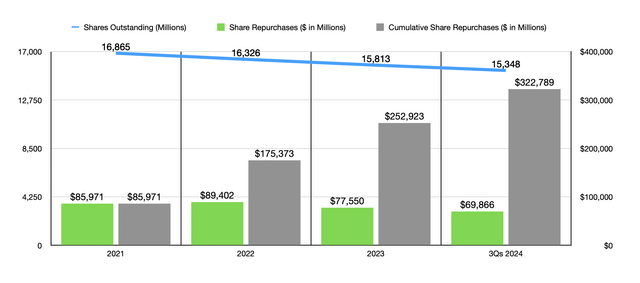

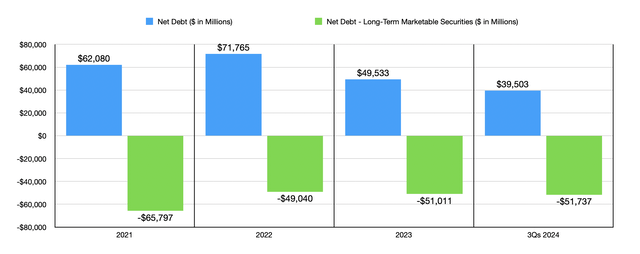

For starters, over the last few years now, management has invested significant amounts of capital toward buying back stock. From the start of 2021 through the end of the third quarter of this year, Apple $322.79 billion toward share buybacks. This allowed the company to reduce its total share count by roughly 9%. Considering how the company is valued, I would personally prefer this capital be allocated toward growth. But considering also how large the business is, meaningful expansion might not be possible. I would also like to point out that the company has achieved this without increasing its overall debt. Net debt for the company actually dropped from $62.08 billion in 2021 to $39.50 billion in the most recent quarter. If we strip out long term marketable securities that are also on its books, then we actually go from having a slightly different situation of a net cash position of $65.80 billion in 2021 to $51.74 billion this year. So in that case, the situation did worsen some. But when you talk about exactly how large Apple truly is, I don’t consider that to be a meaningful difference.

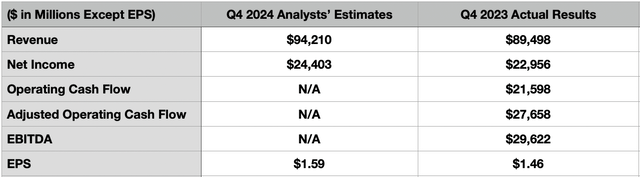

As always, I try to be open minded about situations changing. But those changes need to occur in response to legitimate changes to the fundamental health of the business in question. The next opportunity for that to arise will be on October 31st when, after the market closes, management will report financial results covering the final quarter of the 2024 fiscal year. The current expectation is for the company to report sales of $94.21 billion. Should this prove correct, it would imply a 5.3% increase in revenue over the $89.50 billion the company reported one year earlier. Earnings per share are also forecasted increase, rising from $1.46 to $1.59. Assuming we don’t see a change in share count, this would translate to an improvement in net profits from $22.96 billion to $24.40 billion. In the table below, you can also see other profitability metrics for the final quarter of the 2023 fiscal year. If revenue and profits increase year over year, I can only imagine that these cash flow metrics will likely improve as well.

Takeaway

Believe me when I say that I that Apple is one of the best companies on the planet. It might not be growing at a rapid pace, but it is incredibly healthy. It generates a ton of cash flow and I believe in its long-term potential to continue expanding. Having said that, shares are pricey at this point in time and, even though its troubles in China won’t make or break the business, those still do weigh on the company in the near term. Unless something changes when management reports results later this month, I do believe that keeping the firm rated a ‘hold’ makes sense right now

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!