AscentXmedia

As we head into a packed earnings week, the spotlight turns to major industry players spanning diverse sectors from technology and aerospace to energy and consumer goods. Key earnings reports include Tesla (TSLA), AT&T (T), Verizon (VZ), Coca-Cola (KO), General Electric (GE), and IBM (IBM) alongside tobacco giants Philip Morris International (PM), which are set to reveal their financial performance amidst a backdrop of economic uncertainty and evolving consumer demand.

The technology sector will be particularly active with heavyweights like Texas Instruments (TXN), ServiceNow (NOW), Lam Research (LRCX), and Western Digital (WDC) set to announce their results, providing insight into the broader tech landscape. Aerospace and Defense giants Boeing (BA), Lockheed Martin (LMT), and RTX Corporation (RTX) will also report, shedding light on the state of global defense spending.

The energy sector will be represented by names such as NextEra Energy (NEE), Valero Energy (VLO), and Freeport-McMoRan (FCX), offering clues about the ongoing trends in renewable and traditional energy markets. Meanwhile, the consumer goods sector will be represented by companies such as General Motors (GM), Kimberly-Clark (KMB), and Colgate-Palmolive offering a glimpse into consumer spending and demand.

The airline sector will also be in focus, with companies like American Airlines Group (AAL) and Southwest Airlines (LUV) announcing their earnings, providing insights into the performance of the travel industry. Package delivery giant United Parcel Service (UPS) is also on the docket, giving a key insight into the economy from its vantage point as a critical logistics provider.

Investors will also be keen to hear from financial institutions like Capital One (COF) as well as major real estate and industrial firms including Annaly Capital (NLY) and Agree Realty (ADC).

Below is a rundown of major quarterly updates anticipated in the week of October 21– 25:

Monday, October 21

AGNC Investment (AGNC)

AGNC Investment (AGNC) is set to release its Q3 results on Monday after the market close, with analysts forecasting a 22% Y/Y decline in profits.

SA contributor Robin Hannoun notes that AGNC’s dividends remain stable and outperform its peers, bolstered by effective portfolio rebalancing and hedging strategies, which help maintain sustainability amid interest rate fluctuations. With potential Federal Reserve rate cuts and global uncertainties, AGNC presents a compelling buy opportunity for income-focused investors, although reinvestment is constrained by REIT payout requirements.

- Consensus EPS Estimates: $0.50

- Earnings Insight: AGNC has exceeded EPS expectations in 6 of the past 8 quarters.

Also reporting: Nucor Corporation (NUE), SAP SE (SAP), Dynex Capital (DX), Alexandria Real Estate Equities (ARE), Equity LifeStyle Properties (ELS), Empire State Realty Trust (ESRT), Hexcel Corporation (HXL), and more.

Tuesday, October 22

3M (MMM)

Minnesota-based 3M (MMM) is set to announce its Q3 financial results on Tuesday before the market opens, with analysts projecting a decline of over 25% in both the top and bottom lines.

Following the resignation of finance chief Monish Patolawala, who took a CFO role at Archer Daniels Midland (ADM), the company appointed Anurag Maheshwari as executive vice president and chief financial officer, effective September 1. Maheshwari previously held the same titles at Otis Worldwide (OTIS), known for its elevators and escalators.

Seeking Alpha’s Quant Rating system maintains a Hold rating on the stock, while sell-side analysts have shifted to a more positive outlook with a Buy rating.

SA contributor Shariq Khan, who also rates the stock as Hold, notes that despite a high trailing twelve-month (TTM) P/E ratio, 3M’s diversified portfolio and favorable EV/EBITDA ratios suggest it may be undervalued. However, stagnant revenue and high debt are significant concerns. Addressing PFAS litigation and restructuring operations will be crucial for 3M’s long-term success and its ability to maintain shareholder value through dividends and stock buybacks.

- Consensus EPS Estimates: $1.90

- Consensus Revenue Estimates: $6.06B

- Earnings Insight: 3M has exceeded EPS and revenue expectations in 6 of the past 8 quarters.

Also reporting: General Electric Company (GE), Verizon Communications (VZ), General Motors Company (GM), Lockheed Martin Corporation (LMT), RTX Corporation (RTX), Freeport-McMoRan (FCX), Philip Morris International (PM), Texas Instruments Incorporated (TXN), Enphase Energy (ENPH), Kimberly-Clark Corporation (KMB), Danaher Corporation (DHR), Seagate Technology Holdings (STX), Baker Hughes Company (BKR), The Sherwin-Williams Company (SHW), Genuine Parts Company (GPC), Range Resources Corporation (RRC), Norfolk Southern Corporation (NSC), and more.

Wednesday, October 23

Tesla (TSLA)

Elon Musk’s electric vehicle giant Tesla (TSLA) is scheduled to release its Q3 financial results on Wednesday after the market closes, with analysts anticipating a 9% decline in profits despite expected top-line growth of about 10%.

Tesla delivered 462,890 electric vehicles in Q3, falling short of the consensus estimate of 463,897 but showing a significant increase from the previous quarter’s 443,956 vehicles and 435,059 vehicles in Q3 of last year.

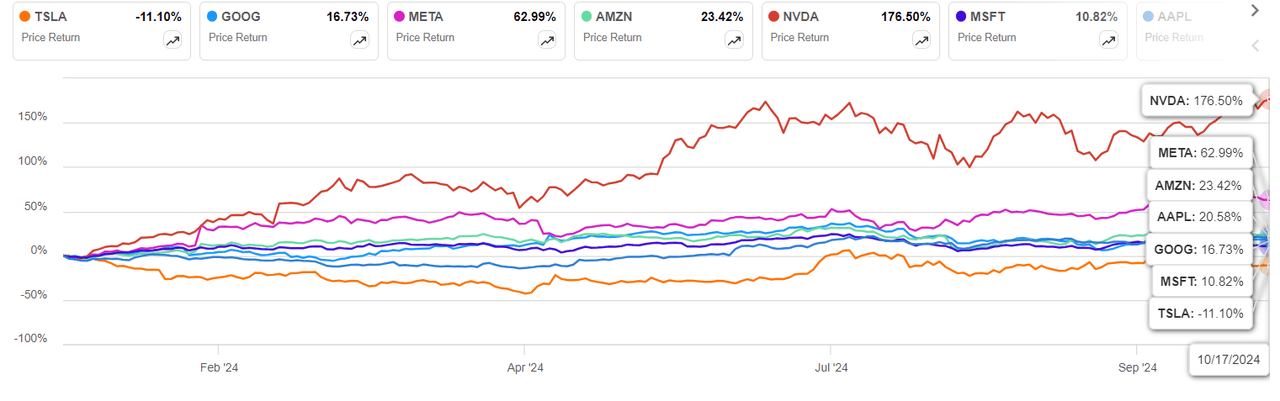

Once boasting a market cap of over $1 trillion, Tesla has emerged as the weakest performer among the “Magnificent 7” tech and growth stocks. While the share price is down 13% YTD, it has surged over 42% in the past six months, increasing its market cap to $705B from below $500B in Q1.

SA Investing Group leader Danil Sereda remains skeptical about Tesla’s potential recovery, particularly in the near term, arguing that the market is overestimating the impact of innovative technologies like the Robotaxi and Optimus robot, which were presented without clear growth drivers. Sereda highlights Tesla’s high valuation, with PEG ratios exceeding 1x through 2027, indicating significant overvaluation. Tesla’s Q2 2024 results revealed a sharp decline in profitability, with EPS dropping to $0.52, below estimates due to lower average selling prices (ASPs) and rising expenses. As a result, he maintains a Sell rating, citing ongoing pressures on the stock.

Both Seeking Alpha’s Quant Rating system and sell-side analysts share a cautious outlook, assigning Hold ratings.

- Consensus EPS Estimates: $0.60

- Consensus Revenue Estimates: $25.67B

- Earnings Insight: Tesla has exceeded EPS estimates in 3 of the past 8 quarters, and revenue estimates only twice in that span.

Also reporting: AT&T (T), The Boeing Company (BA), International Business Machines (IBM), The Coca-Cola Company (KO), Annaly Capital Management (NLY), Newmont Corporation (NEM), NextEra Energy (NEE), QuantumScape Corporation (QS), Lam Research Corporation (LRCX), ServiceNow (NOW), Rio Tinto Group (RIO), General Dynamics Corporation (GD), Thermo Fisher Scientific (TMO), T-Mobile US (TMUS), Las Vegas Sands (LVS), and more.

Thursday, October 24

American Airlines (AAL) and Southwest Airlines (LUV)

Following Delta Air Lines’ (DAL) disappointing results and United Airlines’ (UAL) outperformance, American Airlines (AAL) and Southwest Airlines (LUV) are set to report Q3 earnings on Thursday. AAL is expected to see a 56% Y/Y profit decline, while LUV anticipates an 88% drop due to macroeconomic uncertainties and high oil prices.

Stone Fox Capital maintains a bullish outlook on American Airlines (AAL) and Southwest Airlines (LUV), noting that AAL’s removal from the S&P 500, despite a profit rebound forecast, presents a buying opportunity near COVID lows. Historical data suggests stocks often rally after exiting major indexes, as seen with Comerica (CMA) and Illumina (ILMN). Meanwhile, Southwest Airlines’ (LUV) strategy of assigned seating and premium options is viewed as incremental but lacking compared to legacy carriers.

Wall Street analysts maintain a Hold rating on both American Airlines (AAL) and Southwest Airlines (LUV), while Seeking Alpha’s Quant Rating system assigns a Buy rating to AAL and a Hold rating to LUV

- Consensus EPS Estimates: AAL – $0.17; LUV – $0.04

- Consensus Revenue Estimates: AAL – $13.57B; LUV – $6.79B

- Earnings Insight: AAL has topped EPS expectations in 7 of the past 8 quarters, and revenue estimates in 3 of those reports. LUV has topped EPS expectations in 3 of the past 8 quarters, and revenue estimates in 4 of those reports.

Also reporting: Dow (DOW), United Parcel Service (UPS), Honeywell International (HON), Vale S.A. (VALE), Valero Energy Corporation (VLO), Digital Realty Trust (DLR), Western Digital Corporation (WDC), Union Pacific Corporation (UNP), Carrier Global Corporation (CARR), Northrop Grumman Corporation (NOC), Weyerhaeuser Company (WY), S&P Global (SPGI), and more.

Friday, October 25

Colgate-Palmolive Company (CL)

Colgate-Palmolive Company (CL) is scheduled to release its FQ3 results on Friday before the market opens.

The stock has risen 26% YTD, earning a Buy rating from Wall Street analysts, while Seeking Alpha’s Quant Rating System remains cautious with a Hold rating.

SA columnist Dividend Yield Theorist highlights Colgate-Palmolive as a high-quality company with consistent revenue growth, stable profit margins, and strong returns on invested capital, making it a reliable dividend stock. With a 61-year streak of dividend growth and a healthy payout ratio of ~60%, future increases seem likely. While recent dividend growth has slowed, it is aligned with inflation and business growth. Following a recent pullback, the stock is near fair value.

- Consensus EPS Estimates: $0.88

- Consensus Revenue Estimates: $5.01B

- Earnings Insight: Colgate has topped EPS expectations in 7 of the past 8 quarters, and revenue estimates in 3 of those reports.

Also reporting: Sanofi (SNY), Aon (AON), Booz Allen Hamilton Holding Corporation (BAH), AutoNation (AN), NatWest Group (NWG), Barnes Group (B), Avantor (AVTR), and more.