Summary:

- Intel’s Q2 FY2024 results were disappointing, with revenue and margins falling short of expectations, highlighting ongoing struggles against competitors like AMD and TSMC.

- Despite recent negative sentiment and downgrades, I believe Intel has a favorable environment to beat Q3 expectations, potentially leading to a stock price recovery.

- Intel’s long-term initiatives, including AI and foundry expansions, are promising but slow-moving, with significant competition and execution risks.

- I remain neutral on Intel stock due to valuation concerns and high competitive pressures, despite potential short-term positive surprises in the upcoming Q3 report.

JHVEPhoto/iStock Editorial via Getty Images

Into & Thesis

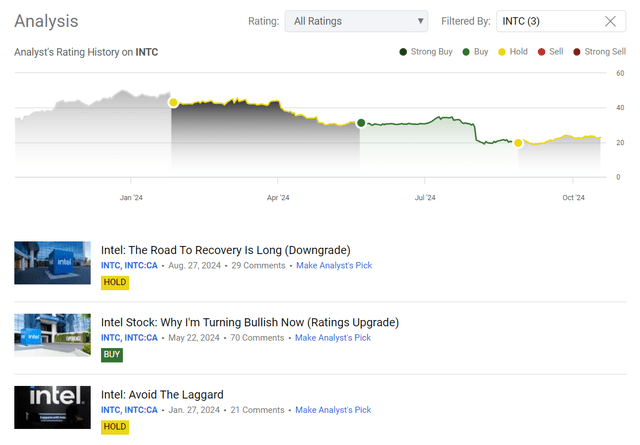

In late January 2024, I initiated coverage of Intel Corporation (NASDAQ:INTC) with a “Hold” rating and recommended avoiding the stock, as Intel’s business appeared to be an obvious laggard compared to other peers in the technology sense. After the stock price fell by 28% – this happened in late May 2024 – I decided to upgrade the stock to “Buy” as I believed that INTC’s Gaudi 3 would have a long-term competitive advantage, especially in enterprise AI applications where efficiency and cost-effectiveness are critical. Unfortunately for my bullish call, the stock collapsed on poor Q2 FY2024 earnings and I had to downgrade INTC to “Hold” once I saw the stock lose its sufficient margin of safety. I noted at the time that Intel seemed to have enough internal problems that could potentially lead to a continuation of the prolonged correction. Since the publication of my last article, however, the stock has moved sideways and has even gained ~14% (the S&P 500 (SP500) has risen by 4.3% in the same period).

Seeking Alpha, my coverage of INTC

Although we don’t yet have any new financial data from the company, we can try to estimate the chances of an earnings beat based on current expectations and recent corporate events. In my opinion, the market sentiment and WS analysts’ attitude towards Intel’s ability to recover has become too negative lately, as earnings estimates have been going down recently. I believe when no one expects anything good, it’s time to take a contrarian stance and expect positives when the report is released. However, due to the high competitive risks and still insufficient evidence of undervaluation, I leave my rating at “Hold”.

Why Do I Think So?

Since I’ve already outlined the firm’s Q2 FY2024 results in my previous article, now I’d just like to briefly walk you through what I find the key highlights from that report (and some analytical notes dedicated to it).

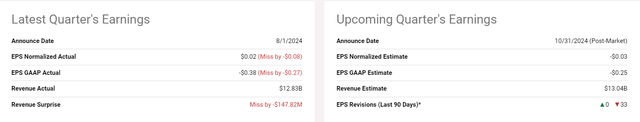

Intel’s Q2 FY2024 performance was a relative disappointment with revenues of $12.83 billion, a sequential growth of 1% but a 1% decline year-on-year. It was below the management’s $12.5-$13.5 billion estimate and the consensus estimate of about $12.98 billion. Intel’s gross margin dropped to 38.7% in Q2 from 45.1% in Q1 and 39.8% in Q1 last year. Likewise, the operating margin declined to 1.0% versus 5.7% Q1 and 3.5% last year. So the non-GAAP EPS came in at $0.02, significantly down from $0.13 the year prior and below the consensus of $0.10. This was one of the worst earnings misses in recent history and is another reminder that Intel struggles to stay profitable in a world of aggressive competition and investing. The CEO Pat Gelsinger conceded that profitability has been shaky (even with improvements to product and process roadmaps), and noted that more must be done quickly to boost profits and capital efficiency by over $10 billion by 2025.

The market obviously didn’t like what it saw and heard, so the Wall Street consensus for the third quarter fell sharply due to massive downgrades:

Q2 numbers showed how hard Intel is finding the cashflow, as it looks to ramp up production of its Core Ultra AI CPUs, among other moves to position the company for a growth potential. Production moved from a cheap plant in Oregon to a cheaper one in Ireland also affected gross margins, thanks to the high level of competition from Advanced Micro Devices (AMD), Nvidia (NVDA), and even Apple (AAPL).

As I noted last time, the reasons for Intel’s struggles could be multiple, including that it hasn’t been keeping up with technology developed by its rivals such as TSMC (TSM). TSMC’s aggressive pricing programs with equipment manufacturers have enabled it to have a huge price lead, and its early implementation of FinFET has allowed it to outcompete Intel. Also, Intel’s traditional lead – its execution of Moore’s Law and the x86 instruction set – has been eroded by AMD’s alliance with TSMC, and by the shift by companies such as Apple to ARM-based CPUs. These changes have led competitors to take market share in PC/server CPUs versus Intel’s position.

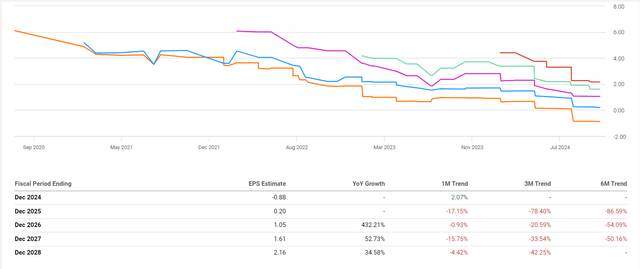

Therefore, the poor Q2 FY2024 was by no means the main reason for the reduction in sales and EPS estimates for the coming years – they have been falling steadily since at least 2020:

On the other, Intel is taking a calculated step to make its way back. As Argus Research analysts noted in their September note (proprietary source), the company is now nearing the completion of its “five nodes in four years” initiative, with the Intel 20A product slated for release in the second half of 2024. But I think the viability of this project remains to be seen, as competitive pressures remain. Also, Intel is growing its IFS offering to become the second-largest external foundry by 2030 – this expansion comes with an important alliance with Amazon’s (AMZN) AWS for the development of custom AI Fabric Chips and Xeon 6 servers, which should improve Intel’s share of the AI space. However, there is a very high risk that the train has already left the station without Intel if you look at the financial figures for 2023-2024 and compare them with those of its competitors.

Let’s get back to what drove the stock lower on the Q2 release – one of those things was bad guidance. Intel’s management issued slightly negative guidance for Q3 2024, a 5%-12% decrease in revenue and non-GAAP loss. Intel forecasts Q3 revenue between $12.5 and $13.5 billion in FY2024, a midpoint that is 8% below historical averages. The firm also projects a non-GAAP gross margin of 38.0% and a non-GAAP loss of $0.03 per share. This forecasts a very tough 2nd half of the year and continues to challenge margins and profitability. As Intel will still continue to focus on long-term growth and competitiveness initiatives, such as the AI plan and its foundry expansion, the doesn’t market anything good for its bottom line dynamics for the next few quarters at least. According to data from Seeking Alpha Premium, Wall Street analysts view the new management’s third-quarter earnings per share guidance as consensus, but at the same time expect significantly lower numbers compared to what was priced 3-6 months ago:

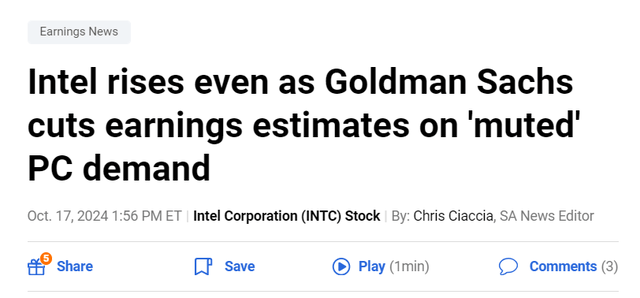

In my opinion, the massive consensus estimates cut has created a very favorable environment for INTC to finally beat Q3 expectations – a loss of 2 cents per share is in itself a positive 33% beat, so this seems to me to be a perfectly achievable target for the company. Over the last 3 quarters, we have seen ugly price action following Intel’s quarterly reports, but last year the Q3 FY2024 results stood out in that INTC surprised everyone positively and the stock responded with solid growth. This was superimposed on favorable seasonality – November is the strongest month for INTC (as the company reports Q3 results on the last day of October, the main reaction occurs in November).

TrendSpider Software, INTC daily, notes added

I think the negative sentiment for INTC stock is now at one of its highest levels in years. But as the saying goes, you buy when everyone is scared. I’m not saying that’s the case with INTC right now, but we already see that bad news is becoming “no news” for Intel – even the Goldman expectations cuts aren’t disrupting the stock price, which, I think, is a sign that a significant amount of the risk is already priced in.

So when Intel reports for Q3, I expect even minor out-of-consensus positive moves to lead to a strong recovery in the stock price in the medium term.

However, I’m in no hurry to upgrade INTC to “Buy” this time around. First of all, as I noted already, Intel is particularly vulnerable to strong competition – in particular AMD, which has steadily expanded its share of the PC and data center CPU markets.

Again, this pressure is amplified by AMD’s strategic relationship with TSMC, enabling it to capitalize on advanced manufacturing platforms that are far superior to Intel. Intel’s legacy in microprocessors is at risk. Therefore, the company will need to successfully deliver on its multiple-year product and solutions roadmaps to reposition itself in the market. I have doubts about Intel’s potential to reclaim the lead, and whether the physical standards by which the firm sets itself will define its viability or not. Also, Intel’s past acquisitions, including Altera and Mobileye, have integration risk and Mobileye’s high price adds pressure to deliver its offering in reaching larger TAM for autonomous and assisted driving.

In addition to competition, Intel’s strategy, including the IDM 2.0 model and internal spin-off of its Foundry operation, is a long-term bet that will take years to play out. These steps and some new initiatives under the CHIPS & Science Act are great moves, but they don’t provide immediate relief from Intel’s rivalry challenges.

I’m still not satisfied with the valuation level of the company we see today. After the disappointing second quarter results and subsequent guidance cuts, I think INTC’s fair value has dropped significantly – something I wrote about in a previous article. Considering that INTC stock is up 14% since then, I think it’s even less favorably valued for those looking for some margin of safety.

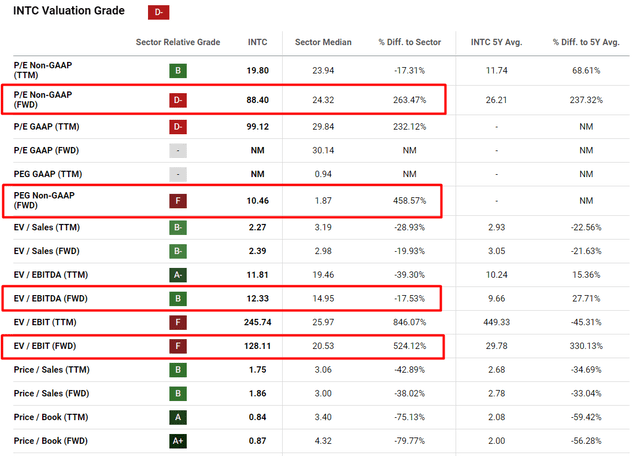

Yes, INTC may indeed appear undervalued on some valuation metrics. But when it comes to earnings-related multiples, we see a strong overvaluation – the declining margins play a role here. And the PEG of 10.46x – times more than the industry median – doesn’t promise sufficient long-term returns for those buying Intel at current levels.

Seeking Alpha, INTC, notes added

So based on all that, I decided to remain neutral on INTC today, less than 2 weeks before its Q3 print.

The Bottom Line

Overall, Intel’s market share is a nightmare right now, because of the fierce rivalry with AMD and the rest of the market. On the other hand, I see some indications that Intel should beat market expectations for Q3 FY2024 – or at least we may see a relief rally driven by less pessimistic comments from the management team.

Unfortunately, Intel’s more forward-looking plans, like the “five nodes in four years” initiative or extending into AI and foundry offerings, seem potentially slow-moving long-term investments. The earnings-related multiples (both on TTM and FWD basis) are also an issue for the company’s valuation, while the PEG ratio for the next year suggests poor long-term returns. So even if we see a surprise in the Q3 report which might be positive with low expectations, competition, and execution risk remain high. So being neutral on Intel seems safe, as the company works to rebalance itself in an uncertain industry.

Thank you for reading!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!