Summary:

- I am rating McDonald’s stock a “hold” with a price target of $284 due to valuation concerns and macroeconomic headwinds despite recent sales initiatives.

- The $5 Meal Deal and core menu innovations like The Big Arch and Chicken Big Mac aim to restore value perception and drive comparable sales growth.

- Growing loyalty membership, which currently stands at 166M, is expected to increase order values and purchase frequency, enhancing customer engagement.

- Despite projected revenue and earnings growth, McDonald’s trades at a premium compared to faster-growing competitors, limiting the stock’s risk-reward attractiveness.

Bjoern Wylezich/iStock Editorial via Getty Images

Introduction & Investment Thesis

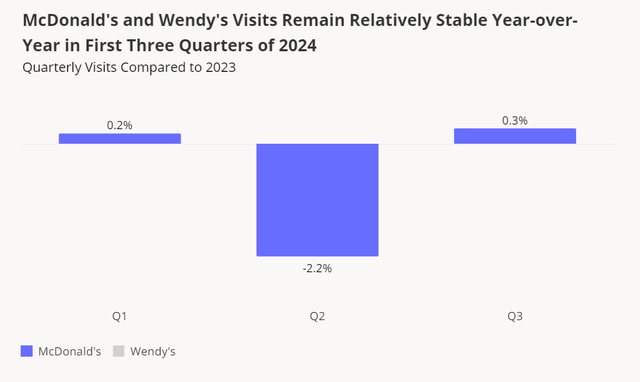

McDonald’s (NYSE:MCD) reported its Q2 FY24 earnings in July, where it saw its global comparable sales declining 1.0% YoY, missing analyst estimates. The underperformance was driven by negative comparable guest counts in the US and International markets, while its International Developmental Licenses Markets were impacted by the war in the Middle East and weakness in China. At the same time, consolidated operating income also decreased 6% YoY, with diluting earnings per share decreasing 11% YoY to $2.80, which also missed analyst estimates as a result of lower sales performance.

While the management attributed the weakness to the highly discerning customer, particularly among lower-income households whose budgets have been stretched from an elongated period of high inflation and interest rates, they emphasized that they are taking meaningful actions to assert their value perception and core menu innovation to gain back market share.

What is interesting to note is that despite a grim Q2 earnings report, the stock has been steadily climbing since then and has outperformed the S&P 500 during the last 3 months.

In this post, we will discuss some of those initiatives that McDonald’s has taken to revive comparable sales growth in its store with its $5 Meal Deal, attracting lower-income households, while simultaneously innovating its core menu to capture market share from competitors in categories such as chicken and beef and grow its loyalty membership.

However, I believe that its rally will soon run out of gas as its stock is priced to perfection, given future growth estimates, where both revenue and earnings are expected to recover into FY25. At the same time, McDonald’s is also trading at a premium relative to many of its competitors, which I believe is not justified given the projected growth rates. Finally, macroeconomic headwinds continue to persist as the monetary easing cycle is uncertain, which can dampen consumer sentiment, profitability, and sales performance in the coming quarters.

Therefore, assessing both the “good” and the “bad”, I have rated the stock a “hold”, with a price target of $284.

The good: $5 Meal Deal, Menu Innovations & Loyalty Membership growth

Restoring value perception with $5 Meal Deal

After losing its value perception with higher prices and declining prices, its $5 Meal Deal, which launched in late June with a 4-piece Chicken McNuggets selection, fries, a drink, and the customer’s choice of either a McChicken or McDouble, is attracting consumers and is profitable for 96% of restaurants.

It is important to note that the timing of the meal deal was not fully reflected in the company’s Q2 sales, but Chris Kempczinski, CEO of McDonald’s, noted that the average check has been over $10 for the $5 Meal Deal, which indicates strong add-ons as part of the program as it restores traffic to the chain.

What I believe is quite optimistic is that same store sales trends have turned positive since the back half of August with growing visits as highlighted by analysts at Evercore ISI and BTIG. This could translate into positive comparable sales growth for Q3 and Q4 as the company’s service metrics improve alongside marketing and value.

Placer.ai: Recovering visits to McDonald’s

At the same time, McDonald’s announced last month that it will extend its $5 Meal Deal at the majority of its restaurants through the end of December, with McDonald’s US President Joe Erlinger reiterating their commitment to keeping prices as affordable as possible. At the same time, McDonald’s is also offering a $2 McCrispy sandwich in honor of National Fried Chicken Sandwich Day on November 9 and will continue to celebrate Free Fries Fridays along with local deals as they innovate on ways to offer meals at fair prices.

Innovating its core menu with the Big Arch, Chicken Big Mac & Expanding Breakfast Options

Meanwhile, McDonald’s continues to innovate across their core menu to address unmet customer needs with the introduction of The Big Arch, which they piloted across three international markets to satisfy larger appetites with its enhanced flavors and sizes. The Big Arch features two 100% Canadian beef quarter-pound patties and three slices of white processed cheese, which are topped with crispy onions, slivered onions, pickles, lettuce, and a new tangy sauce served on a sesame and poppy seed bun.

During the Q2 earnings call, Chris Kempczinski called the Big Arch the chain’s “quintessential” new item, with a twist on the chain’s iconic familiar flavors. So far, reviews of the Big Arch sandwich on social media sites Instagram, TikTok, Facebook, and X have been generally positive.

Looking ahead, McDonald’s is planning a large rollout of The Big Arch in the US, which could further boost comparable sales in its US markets while adding incremental competition for other burger chains such as Wendy’s (NASDAQ:WEN), Burger King (NYSE:QSR), Jack in the Box (NASDAQ:JACK), Shake Shack (NYSE:SHAK), and more.

Simultaneously, the management has repeatedly noted that they see a significant growth opportunity in chicken, which is a category that is twice the size of beef globally and growing at a faster rate. In early October, the company launched the Chicken Big Mac for a limited time, which is priced at $5.49 in most markets to attract both loyal fans and newcomers.

Although the reviews have been mixed, McDonald’s saw visits jump by 7.9% compared to the chain’s YTD Thursday visit average, which showcases the power of limited-time items to generate excitement and urgency among consumers.

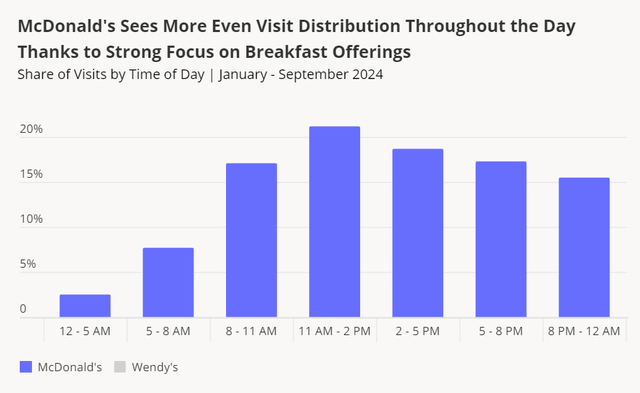

Finally, in addition to new menu items, McDonald’s is placing a strong emphasis on its breakfast offerings as it expands its breakfast menu, offering healthier alternatives and promoting limited time deals. This has successfully translated into higher morning traffic, with 24.8% of daily visits occurring between 5:00 am and 11:00 am.

Placer.ai: Traffic during the day at McDonald’s

Steadily growing loyalty membership will lead to higher order values and purchase frequency

As McDonald’s works to restore its value perception with its $5 Meal Plan, while innovating on its core menu to gain market share from its competitors in categories such as chicken and beef, its third growth lever is tied to its loyalty membership, which surpassed expectations at 166M members, representing 25% of system-wide sales. The company has a target of reaching 250M members as they aim to scale their number of restaurant locations to 50,000 by 2027 with a digital-forward, values-driven, and culture-led strategy.

The reason why growing loyalty members is a priority is because loyalty customers tend to spend more and visit more often. Therefore, as McDonald’s invests in unlocking deeper customer insights, they will be able to drive relevant, timely, and more personalized offers, which should translate to a higher frequency of orders and size of order value per customer, along with elevated customer satisfaction levels.

The bad: Valuation Concerns, Competitive Pressures and Persisting Macroeconomic Headwinds

McDonald’s stock seems fully priced.

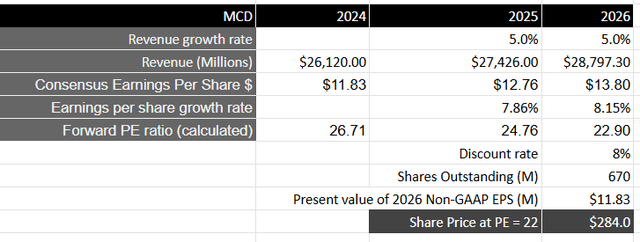

If I take the consensus estimates for its revenue and earnings projections for the next 3 years into account, where revenue is estimated to grow roughly 2.5% YoY in FY24 before turning to growth in the mid single digits after that, it should generate close to $28.8B by FY26. I believe this will be achievable as McDonald’s restores its value perception to attract lower-income households with programs like the $5 Meal Plan, while simultaneously innovating on its core menu to convert its new and existing users into loyalty members, where it can leverage user insights to deepen engagement and purchase size and frequency.

Meanwhile, from a profitability standpoint, taking the consensus estimates for non-GAAP EPS of $13.80 in FY26, we see that it will be growing at a slightly faster rate than overall revenue growth. This will be equivalent to a present value of $11.83 in EPS when discounted at 8%.

Taking the S&P 500 as a proxy, where its companies their earnings increase on average by 8% over a 10-year period, with a price-to-earnings ratio of 15-18 and a current forward price-to-earnings ratio of 22, I believe McDonald’s should trade at par with the index, which will translate to a price target of $260, which represents a downside of 10% from its current levels.

Therefore, even though McDonald’s revenue and earnings are projected to improve from next year onwards, I believe its stock price has fully priced in the upside and is not trading at an attractive level from a risk-reward perspective.

Its competitors are growing faster and are priced more attractively.

Meanwhile, McDonald’s stock also carries a higher premium relative to its competitors, which include Wendy’s, Burger King, Jack in the Box, Shake Shack, Yum Brands, and more. With the exception of Wendy’s and Jack in the Box, the remaining competitors are growing their revenues at a faster rate than McDonald’s over the next few years and are trading at a more attractive twelve-month forward price-to-earnings ratio. Plus, with the exception of Shake Shack, McDonald’s and its competitors have been underperforming the index year-to-date.

Macroeconomic uncertainty can threaten sales performance in domestic and international markets.

While McDonald’s is working hard to restore its value perception as it tries to gain market share among lower income households while innovating on its core menu to build loyalty, the US consumer continues to be highly discerning as an elevated period of high inflation and interest rates has squeezed consumer budgets. Although the Fed recently cut rates by 50 basis points in its last meeting, inflation can spike once again, which will derail the Fed’s monetary easing cycle plans. This will not only hurt consumer sentiment but also affect the profitability of McDonald’s with increased cost of goods as well as wage inflation. At the same time, a higher dollar could also threaten performance in its international markets, which will hurt overall sales performance.

My final verdict and conclusions

Assessing both the “good” and the “bad,” I believe that the recent rally in McDonald’s stock price will likely run out of legs soon. While its initiatives to restore its value perception with the $5 Meal Value, along with innovations to its core menu with The Big Arch, Chicken Big Mac and more, should result in positive comparable sales growth in Q3 and possibly into Q4, I believe that the stock has fully priced in the upside with limited risk-reward to initiate a new position at its current levels. Furthermore, McDonald’s stock is also trading at a steeper premium despite slower revenue growth rates when compared to its competitors, along with persisting macroeconomic headwinds that can derail progress in its domestic and international markets. Therefore, I will rate the stock a “hold” at its current levels with a price target of $284.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I am Amrita and I write primarily about growth software stocks.

I recently joined The REIT Forum and if you are looking for more investment ideas like this one, get them exclusively at The REIT Forum with access to our subscriber only portfolios.