Summary:

- Netflix delivered strong 3Q FY2024 earnings, beating revenue and non-GAAP EPS estimates, achieving a record high operating margin.

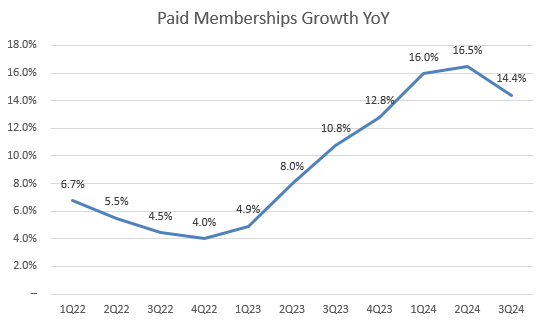

- The company’s paid membership growth peaked in 2Q and began to normalize in 3Q as year-over-year growth decelerated, with the LATAM region showing negative net adds during that quarter.

- Its 4Q and FY2025 outlook exceeds market consensus; however, it indicates a normalization in growth, while operating margin is expected to increase modestly.

- Management noted that its ads business will not contribute to revenue growth in FY2025, as they are prioritizing audience growth over monetization.

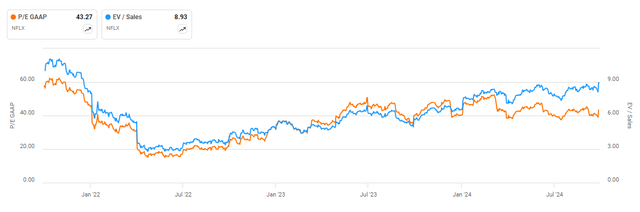

- NFLX stock’s valuation multiples remain high, trading near 40x forward P/E, consistent with levels seen over the past few years.

Robert Way

3Q FY2024 Earnings Takeaway

Netflix (NEOE:NFLX:CA) (NASDAQ:NFLX) delivered another solid earnings report in 3Q FY2024, driven by robust growth in paid net adds, beating both revenue and non-GAAP EPS consensus. In my 2Q earnings analysis, I maintained a buy rating on the stock, supported by accelerating growth in paid memberships. NFLX is well-positioned to maintain its current industry leadership. Since my last rating, the stock has rallied 15%, beating the S&P 500 index by 10%.

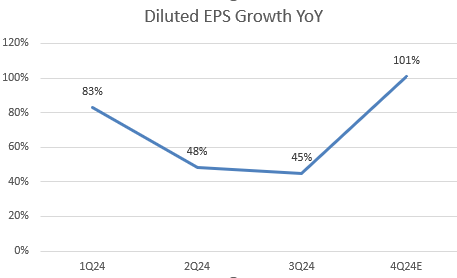

However, NFLX’s current valuation is not cheap, reflecting an expected 60% YoY EPS growth in FY2024, driven by record operating margin and mid-teens revenue growth. While the company guided a better-than-expected revenue outlook and indicated that margin expansion will continue into FY2025, I believe the paid memberships growth has peaked in 2Q FY2024, and the operating margin will normalize in FY2025 to balance future growth.

Moreover, the management also noted that ads will not be a primary driver of revenue in FY2025 as the company is currently focusing on scaling audiences other than monetization. Therefore, I believe the stock is pricing for perfection in the near term, and therefore a hold rating on NFLX is warranted. However, I acknowledge there may be some near-term consolidation, which could create an attractive entry point.

Paid Memberships Growth Has Peaked

The company model

NFLX’s 3Q total paid memberships continued to show resilience, growing 14.4% YoY. As shown in the chart, the growth trajectory is starting to normalize as paid net adds decelerated in 3Q. It’s important to note that a slowdown in paid net adds doesn’t mean the company has stopped growing its paid memberships base. 3Q paid net adds were largely driven by EMEA and APAC regions, while the UCAN region saw some sequential softness, and LATAM experienced negative paid net adds for the first time since 1Q FY2023.

During the 3Q earnings call, management attributed the paid net loss in LATAM to “recent price changes in some of our larger LATAM markets.” However, in the Regional Breakdown section, we notice that the average revenue per membership in 3Q FY2024 was even lower than in 3Q FY2023, suggesting that the lower demand wasn’t driven by price hikes as seen in UCAN. They also mentioned that LATAM’s paid net adds would have been positive if the quarter had lasted one more day. I believe this “channel stuffing” explanation is not convincing, and any potential rebound in 4Q should be discounted accordingly.

My counterargument to the bullish thesis for NFLX is that its paid net adds will begin to normalize in FY2025, signaling a significant slowdown in total paid memberships (anticipate mid-single digit), as seen in the post-pandemic era, which could impact its revenue growth.

Balanced Margin Expansion In FY2025

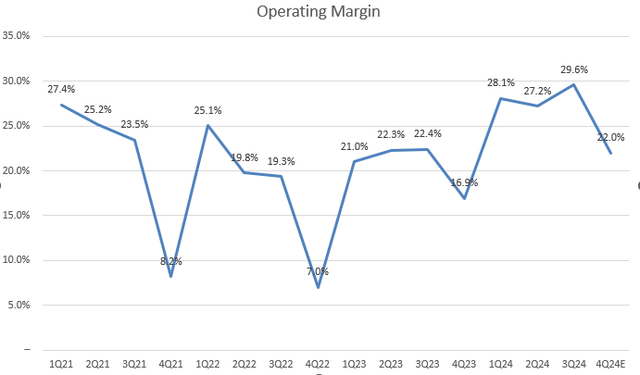

NFLX has been steadily improving its operational efficiency and is expected to continue expanding its operating margin in FY2025. In my last analysis, I highlighted that the company achieved a record operating margin of 28.1% in 1Q FY2024. In 3Q FY2024, the company set a new record, reaching 29.6%.

Management has guided an operating margin of 22% for 4Q, with the sequential drop reflecting typical seasonality, as seen in previous fourth quarters. However, the 4Q margin still shows significant improvement compared to the same period over the past two fiscal years. It’s impressive how the company is navigating rising costs while expanding into new areas such as live-streaming, ads, and gaming. I believe most of these businesses are still unprofitable. Despite an anticipated 6.4% increase in operating margin in FY2024, the company is also expected to improve operating margin by another 1% in FY2025. During the earnings call, NFLX indicated that as its growth normalizes in FY2025, the company plans to balance near-term margin expansion with reinvestments in new growth opportunities.

Strong Earnings Growth Boosts FCF

The company model

NFLX’s earnings growth has been strong throughout FY2024. The company reported a 45% YoY increase in diluted EPS in 3Q, driven by solid revenue growth and a record-high operating margin. For 4Q, as mentioned, its operating margin is expected to be 5% higher than the same period last fiscal year, which will significantly improve its earnings outlook, though specific guidance was not provided. According to Seeking Alpha’s earnings consensus, the company is expected to generate $19.80 in EPS for FY2024, implying a 4Q EPS of $4.24 and 101% YoY growth. FY2024 EPS is projected to grow 60.6% YoY, marking a significant acceleration from 20.4% YoY growth in FY2023.

Due to strong earnings growth, NFLX’s FCF increased by 19.4% YoY in 3Q FY2024. Despite more than tripling its FCF in FY2023, I believe the company’s FCF could be even higher in FY2024, even with rising capex. Lastly, the management has no intention of increasing leverage to fund stock buybacks or issue dividends in the near term.

Valuation

I previously noted that NFLX could be trading at higher valuation multiples due to its strong revenue growth acceleration and margin expansion. While its non-GAAP P/E fwd is currently below its 5-year average, the stock had been trading at over 40x on average during that period. This indicated that the stock might have been ahead of itself and could normalize as earnings grow. Its current multiple is around 38.6x, which makes me cautious, especially as its growth on paid memberships growth begins to decelerate.

Moreover, its EV/sales TTM has been trending higher despite strong revenue TTM growth, and the multiple is now 30% above its 5-year average. In my previous analysis, I noted that its non-GAAP PEG fwd was 21.5% below the sector average, according to Seeking Alpha. Currently, this multiple is trading at 1.46x, which is 8.2% above the sector average. Therefore, I’m lowering my rating on the stock from buy to hold for now.

Conclusion

In summary, NFLX has demonstrated its industry leadership as indicated by its strong revenue growth, margin expansion, and robust FCF generation in FY2024. However, its paid membership growth peaked in 2Q FY2024 and started to decelerate in 3Q, as growth is expected to normalize while the margin will increase modestly in FY2025. We noticed that some region locations have shown negative net adds in the last quarter, even though it might prove to be short-lived. Other parts of the growth driver like ads and live-streaming may not significantly contribute to revenue growth in the near term. Therefore, its valuation multiples are becoming a point of concern as growth normalizes. The forward P/E trading near 40x adds to valuation risks, increasing the potential for multiple contractions when the economy slows. Therefore, I downgraded the rating to hold to reflect my cautious outlook.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.