Summary:

- Most analysts covering NVDA are currently focused on GPU demand from data centers as signals for future stock price performance.

- The truth is, Nvidia is also strongly positioned to capitalize on the next leg of this AI revolution, to which savvy long-term investors grant greater importance over the short-term noise.

- We discuss Nvidia’s massive hardware and software revenue potential as AI powers another extraordinarily exciting market.

Justin Sullivan/Getty Images News

Most analysts covering NVIDIA (NASDAQ:NVDA) (NEOE:NVDA:CA) are currently focused on GPU demand from data centers as signals for future stock price performance.

In fact, in the previous article, NVDA stock was downgraded to a ‘hold’ as signs of Nvidia losing pricing power and profit margin compression raise the risk of a massive pullback in the share price. We also covered how the rise of open-source software threatens Nvidia’s competitive moat, as per historical analogies from previous tech cycles.

Though Nvidia CEO Jensen Huang did come out recently to proclaim that “demand for Blackwell is insane”, sending the stock rallying to reach new all-time highs, and admittedly subduing the chances of a major pullback any time soon.

Although, selling AI chips to data center customers to power increasingly versatile Large Language Models (LLMs) is only a fraction of the growth story.

The truth is, Nvidia is also strongly positioned to capitalize on the next leg of this AI revolution, and that is the robotics phase. Beyond the hardware opportunities, it is the beautifully recurring software revenue potential that makes one wish they had bought more shares.

The robotics revolution

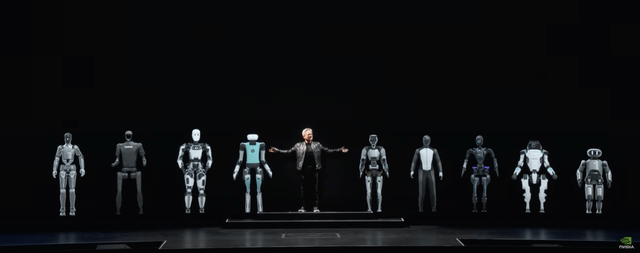

By now, most people will have seen CEO Jensen Huang show off a fleet of robots at various Nvidia events, all of various different sizes, shapes and dexterities, fit for a variety of different jobs.

Over time, robots are expected to fill jobs in numerous sectors and industries, including retail, hospitality, and healthcare. Although for now, industries like warehousing and manufacturing remain the most prominent fields of deployment.

Base case is for more than 250,000 humanoid robot shipments in 2030, almost all of which would be for industrial use.

At the COMPUTEX event back in June 2024, CEO Jensen Huang highlighted the essential hardware solutions that Nvidia offers to help companies build and operate their robotic devices:

Building robots with generative physical AI requires three computers: NVIDIA AI supercomputers to train the models; NVIDIA Jetson Orin and next generation Jetson Thor Robotics supercomputer to run the models; and NVIDIA Omniverse, where robots can learn and refine their skills in simulated worlds. We build the platforms, acceleration libraries and AI models needed by developers and companies and allow them to use any or all of the stacks that suit them best.

One very advantageous trend working in Nvidia’s favor is the growing use of demonstrative videos to train robots, as opposed to developers having to code for every single task and circumstance that the robot may face.

We have this technology called Teleoperation. The person does the thing 200 times, we record all that data, and then we use that data to train these models. And the AI models are very similar to the GPT style generative AI models. You feed in the 200 trajectories and the system learns how the task is being done, and then the robot will do the task autonomously.

– Geordie Rose, Co-founder and CEO of Sanctuary AI in an interview with CNBC

The reason this is such a favorable trend is because video-based training requires a lot more computing power, conducive to greater demand for more proficient chips and powerful NVIDIA AI supercomputers.

Automation software layer

The sale of increasingly powerful hardware computing solutions is just one component of the growth opportunity, as the greater value resides in recurring software revenue. This is where Nvidia’s Omniverse comes in.

One of the integral technologies for advancing robotics is reinforcement learning. Just as LLMs need RLHF or reinforcement learning from human feedback. To learn particular skills, generative physical AI can learn skills using reinforcement learning from physics feedback in a simulated world. These simulation environments are where robots learn to make decisions by performing actions in a virtual world that obeys the laws of physics.

We built NVIDIA Omniverse as the operating system where physical AIs can be created. Omniverse is a development platform for virtual world simulation, combining real time, physically based rendering from physics simulation and generative AI technologies.

– Nvidia CEO Jensen Huang, COMPUTEX 2024 (emphasis added)

Now, this concept of the NVIDIA Omniverse as an operating system is key to the recurring software revenue prospects through automation and robotics. In a previous article, we had extensively delved into Nvidia’s other ‘operating system’ offering, known as ‘NVIDIA AI Enterprise’, in which we explained the software revenue opportunities using current examples from the ongoing AI revolution in the LLM space.

NVIDIA AI Enterprise is $4,500 per GPU per year, that’s our business model. Our business model is basically a license. Our customers then with that basic license can build their monetization model on top of.

In a lot of ways we’re wholesale, they become retail. They could have a per — they could have subscription license base, they could per instance or they could do per usage, there is a lot of different ways that they could take a — create their own business model, but ours is basically like a software license, like an operating system.

– Nvidia CEO Jensen Huang, Q3 2024 Nvidia Earnings Call

More specifically, Software-as-a-Service (SaaS) companies like ServiceNow (NOW) are already paying $4,500 per GPU per year to access NVIDIA AI Enterprise, on which they run their generative AI-powered, subscription-based, enterprise software applications in this new era.

Now as the robotics revolution gets going, Nvidia is also setting itself up to earn a similar stream of recurring software revenue through ‘NVIDIA Omniverse Enterprise,’ for which it also charges $4,500 per GPU/per year.

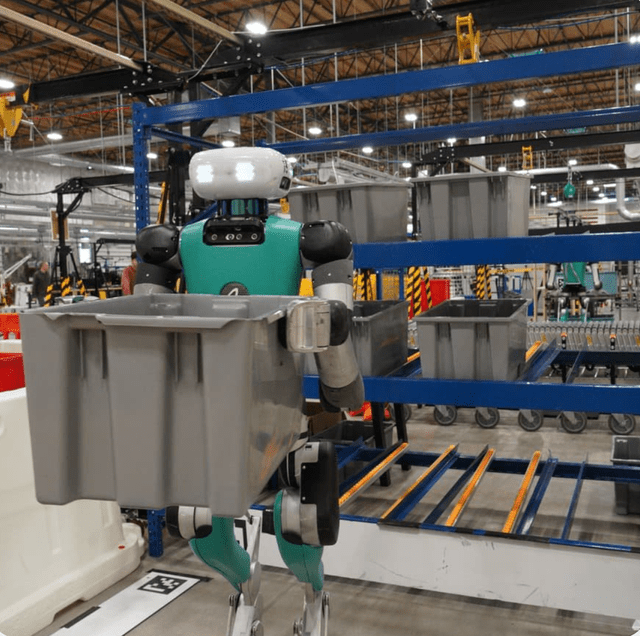

In fact, key Nvidia customer Agility Robotics, which is the maker of the ‘Digit’ humanoid robots, is already offering insights into what a “Robots-as-a-Service (RaaS)” world could look like going forward.

We envision an app store for robots out in the future where if for example you need a recycling app, you can go into the App Store and download that onto your robot.

As long as they have the robot, we help maintain it, take care of it, keep the software updated and they just pay on a monthly basis. – Peggy Johnson, CEO of Agility Robotics in an interview with CNBC

Akin to how software developers are able to build and monetize apps that run on PCs and smartphones, third-party developers will also be able to extend the capabilities of a robot by building software applications that enable various new functionalities beyond what the initial robot manufacturer may have envisioned.

So just like how SaaS vendors like ServiceNow are earning subscription revenue from enterprises at the front-end, while paying $4,500 per GPU/per year for the ‘NVIDIA AI Enterprise’ operating system at the back-end, RaaS vendors of the future are likely to charge monthly subscription fees to customers at the front-end, while paying a licensing fee of $4,500 per GPU/per year for the ‘NVIDIA Omniverse Enterprise’ operating system at the back-end.

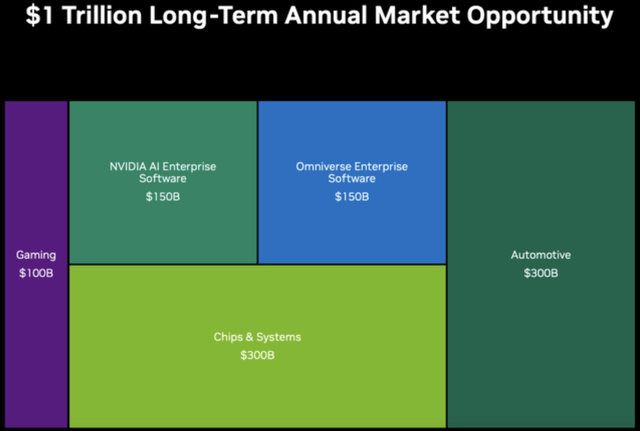

Therefore, the software revenue scope through the robotics form factor could be massive. Late last year, Nvidia projected that the long-term annual market opportunity for both its operating systems, ‘NVIDIA AI Enterprise’ and ‘NVIDIA Omniverse Enterprise,’ to be $150 billion each.

Essentially, at least 30% of Nvidia’s total revenue is expected to derive from software licensing fees over the long term.

Risks and counterarguments

Safety & Regulations: One of the biggest obstacles to deployment of robots in the industrial space is safety, while increased government regulations and scrutiny is expected to protect workers from potential accidents due to robots malfunctioning.

Now, the ‘glass half empty’ viewpoint here would be that the drafting of legislature and the time lag until the rollout of updated safety regulations for industrial workplaces could slow the adoption of robotics. The ultimate stringency of such new laws could also potentially undermine the rate at which corporations adopt robots in the workplace.

That being said, the ‘glass half full’ perspective would argue that building robots, both at the hardware and software layers, that comply with constantly evolving regulations, should further boost demand for Nvidia’s omniverse technology to be able to test robots in safe environments before they are deployed in real work environments.

In Omniverse, robots can learn how to be robots. They learn how to autonomously manipulate objects with precision, such as grasping and handling objects, or navigate environments autonomously, finding optimal paths while avoiding obstacles and hazards. Learning in Omniverse minimizes the sim-to-real gap and maximizes the transfer of learned behavior.

– Nvidia CEO Jensen Huang, COMPUTEX 2024

For the most part, up till now, industrial robots have been designed to “operate away from human workers for safety reasons”, but this could be changing.

So right now Digit is non-collaborative and we’re working to what’s called collaborative safety, which is being able to formally verify, according to international standards, that Digit is safe to be in close proximity to a person.

– Pras Velagapudi, CTO of Agility Robotics in an interview with CNBC

This trend of machines and humans working alongside each other in the industrial sector can be favorable for Nvidia, as it would support the need for more human-like interaction capabilities being built into these robots so that they can follow instructions from their fellow human colleagues. Comprehension of natural language instructions is more compute-intensive than pushing buttons to get a robot to complete various tasks, amplifying the need for more powerful robotics chips and software extensions from Nvidia.

Cost of adoption: At Tesla’s ‘We, Robot’ event last week, CEO Elon Musk suggested that its ‘Optimus’ robot would cost between $20,000 and $30,000. In the past, he had suggested that humanoid robots would need to cost less than $20,000 to induce wider-scale adoption. Any additional software applications with monthly subscription fees would further add to the total cost of owning/ running these robots.

Although it is worth noting that the cost of manufacturing is certainly improving, augmenting the prospects of mass-scale deployment.

There are signs that robot components, from high-precision gears to actuators, could also cost less than previously expected, leading to faster commercialization. The manufacturing cost of humanoid robots has dropped — from a range that ran between an estimated $50,000 (for lower-end models) and $250,000 (for state-of-the art versions) per unit last year, to a range of between $30,000 and $150,000 now. Where our analysts had expected a decline of 15-20% per annum, the cost declined 40%.

The improving affordability of humanoid robots certainly benefits Nvidia in the form of higher demand for supercomputing chips, as well as growing streams of recurring software revenue through ‘NVIDIA Omniverse Enterprise.’

However, there are more impediments arising that may considerably slow down the adoption of industrial robots.

The rapidly developing automation technology can help speed up operations and lift some of the burden off human workers, but the tools have a new set of requirements such as access to far more electrical power and a strong internet signal.

Building that capability can be particularly difficult for industrial operators that are located in rural areas far from existing infrastructure, or those in urban areas where there are heavy demands on the power grid. – The Wall Street Journal

Upgrading public infrastructure to accommodate for a new industrial revolution could take years, delaying robotic deployments and abating the pace of revenue growth for Nvidia’s ‘Professional Visualization’ segment, which houses the Omniverse, and the ‘Automotive’ segment, which includes its robotics business line.

The investment case for Nvidia

On the Q2 2025 Nvidia earnings call, CFO Colette Kress offered the following remarks on the segments serving the industrial digitalization wave:

Moving to Pro visualization. Revenue of $454 million was up 6% sequentially and 20% year-on-year. Demand is being driven by AI and graphic use cases, including model fine-tuning and Omniverse-related workloads. Automotive and manufacturing were among the key industry verticals driving growth this quarter.

…

Moving to automotive and robotics, revenue was $346 million, up 5% sequentially and up 37% year-on-year. Year-on-year growth was driven by the new customer ramps in self-driving platforms

Now revenue of a few hundred million dollars dwarfs in comparison to the $26 billion in ‘Data Center’ revenue last quarter, still boasting year-on-year growth rates of 100%+.

So the ‘Professional Visualization’ and ‘Automotive’ segments are certainly not the key growth drivers for NVDA at the moment. Although that does not mean that these segments can never achieve the kind of growth rates that the ‘Data Center’ unit is currently delivering.

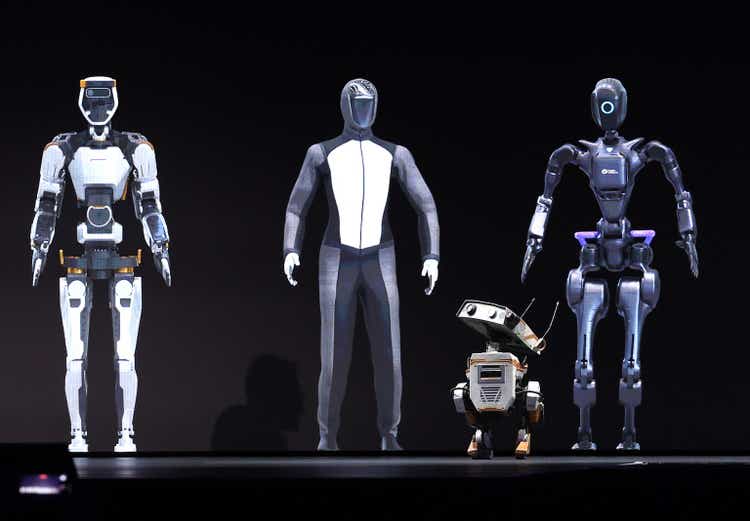

It ultimately comes down to the presence of a ‘killer application’. Similar to how the launch of ChatGPT spurred corporate attention to the power of generative AI and subsequently triggered the triple-digit growth rates for Nvidia’s ‘Data Center’ segment, it is simply a matter of time until a revolutionary app arises for the robotics world that would accelerate industrial adoption and stimulate faster revenue growth for Nvidia’s ‘Professional Visualization’ and ‘Automotive’ segments.

For instance, a key selling point of robots is that they can be deployed for tasks that would be considered dangerous for human laborers. Now as the industry evolves, the innovation of new robotic form factors and the simultaneous development of creative software apps should cultivate into completely new ways of working, such as in the fields of manufacturing or warehousing. Such innovations could give rise to new processes that companies could have never imagined in human-dominated work environments, or even new products and services for that matter.

As the current generative AI revolution has proven, it only takes one ‘killer application’ to spark wide-scale adoption of the underlying technology.

Likewise, it could only take one “killer application” to induce mass-scale robotics adoption and set off the next leg of Nvidia’s growth story.

Now, while the Forward PE multiple is commonly used to assess stock valuations, the Forward PEG ratio is actually a more valuable metric, as it adjusts the Forward PE multiple by the projected earnings growth rates.

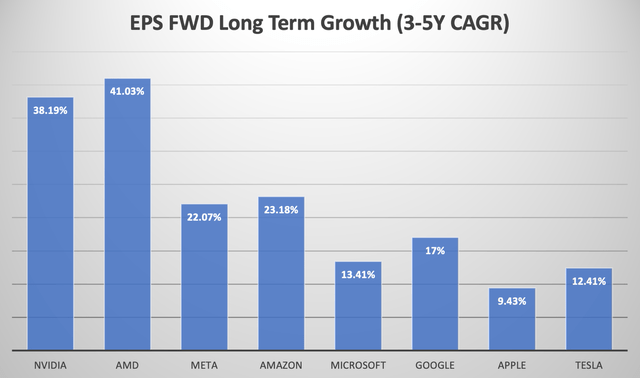

The expected EPS FWD Long-Term Growth (3-5Y CAGR) for NVDA is 38.19%, which is higher than the growth rates of most large-cap tech stocks that are also anticipated to benefit from the AI revolution.

Nexus Research, data compiled from Seeking Alpha

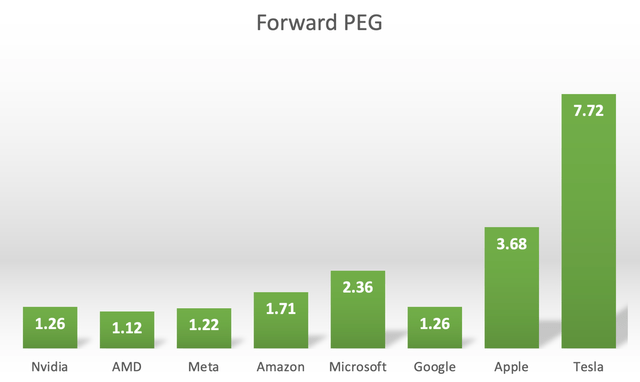

Based on these anticipated EPS growth rates, we derive the following Forward PEG ratios for each AI stock.

Nexus Research, data compiled from Seeking Alpha

For context, a ratio of 1x would mean that a stock is trading close to its fair value.

At a Forward PEG multiple of 1.26x, NVDA is currently one of the cheapest AI stocks.

Keep in mind that the projected EPS growth rate for Nvidia is also predominantly based on data center revenue prospects amid the current generative AI revolution. In the event that we get a “killer application” for the robotics revolution, it would spur the market to raise their projected EPS growth rates even higher, as the growth opportunities for ‘Professional Visualization’ and ‘Automotive’ segments are augmented.

So NVDA may be even cheaper than the current valuation metrics reflect if we indeed get this ‘killer application’ in the next 3-5 years.

At present, Tesla seems to be getting most of the attention when it comes to the growth opportunities around robotics. Though with the stock trading at a lofty Forward PEG multiple of 7.72x, and its recent ‘We, Robot’ event underwhelming investors, you may be better off buying NVDA at this appealing valuation, as the Jensen Huang-led company is also aptly positioned to benefit from multiple iterations of robotic evolutions until they are perfected for official public launch.

Now given my bullish stance on NVDA, one may be confused by my ‘hold’ rating on the stock. Quite frankly, my rating is simply reflective of the fact that I would not add more to my position at these levels following such a staggering rally. Particularly as speculative behavior around the stock through leveraged ETFs like GraniteShares 2x Long NVDA Daily ETF (NVDL) becomes concerningly prevalent, as this can worsen stock volatility and the probability of a major pullback as these weak hands sell out of the stock on the slightest bad news.

That being said, for those that have been on the sidelines and eager to buy the stock right now, just stay ready to deploy a ‘dollar-cost averaging’ purchasing strategy in the event of a correction creating lower price-entry points.

For the long-term, Nvidia remains a solid stock to hold on to.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.