Summary:

- United Airlines’ Q3 earnings report and guidance led to a new 52-week high, nearing pre-pandemic stock prices.

- Passenger revenue growth is slowing, but cargo revenues surged 25.2% due to Middle East freight challenges and Asia Pacific capacity expansion.

- Operating income dropped 10% due to higher non-fuel costs, but Q4 EPS guidance shows strong year-on-year growth, boosting investor confidence.

- A $1.5 billion share repurchase program and increased free cash flow projections signal strong future confidence, maintaining a buy rating.

Boarding1Now

United Airlines (NASDAQ:UAL) posted its third quarter earnings on the 16th of October and investors seem to have liked the results, sending the stock to a new 52-week high. In fact, at the current prices, United Airlines stock is closing in on pre-pandemic stock prices. In July, I covered United Airlines and attached a $65.90 price target based on half of the upside materializing and an $84.86 price target if all upside would materialize. The first price target has now been reached and with the third quarter earnings in, it is a good moment to analyze the earnings, risks and opportunities and assess whether there is additional upside for United Airlines stock.

United Airlines Unit Revenues Normalize

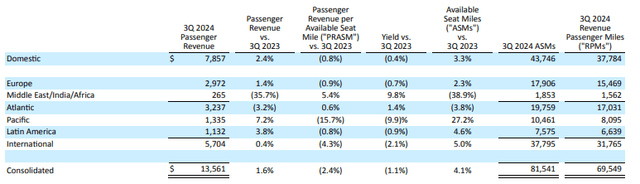

United Airlines

United Airlines passenger revenues increased 1.6% on a 4.1% increase in capacity, pointing at some further reduction in the unit revenues. That’s not extremely alarming, as unit revenues are actually following a trend of normalization after the pandemic surge in unit revenues.

On the domestic market, the capacity increased by 3.3% while unit revenues declined by less than a percent, so that is something I view as measured capacity expansion. The same is observed in the European market, and those markets combined saw modest capacity growth as United Airlines is trying to stabilize the unit revenues. The Middle East/India and Africa markets saw a significant decline in capacity due to the turmoil in the Middle East and that led to a 35.7% decrease in passenger revenues, partially offset by higher unit revenues as many airlines have reduced their flight offering to the Middle East.

The opposite is happening in the Asia Pacific market where airlines, including United Airlines, continue expanding capacity as unit revenues stabilize while on the Latin American market, we see a similar trend as on the domestic and European market but with higher revenue growth partially driven by some airlines facing financial challenges in Latin America. So, overall, we see some erosion to the unit revenues and United Airlines has been able to squeeze out a modest growth in revenues, which seems to be something that many airlines are targeting at this point.

United Airlines Profit Falls

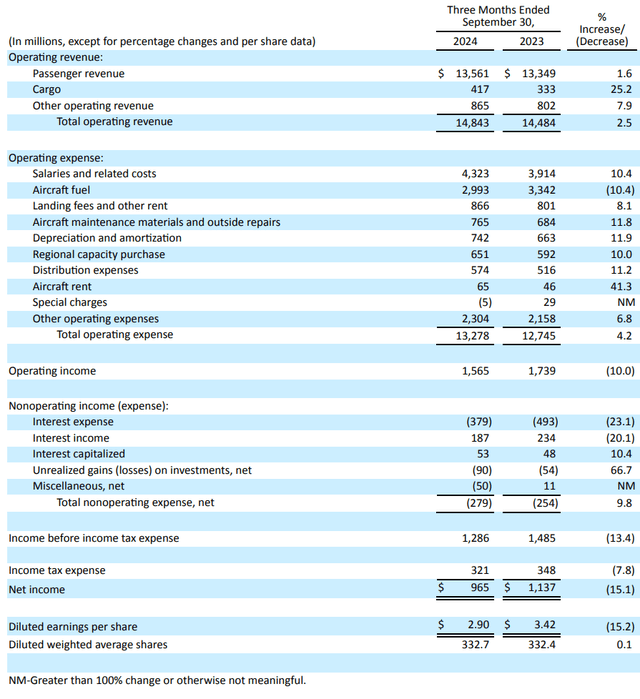

United Airlines

United reported total revenues of $14.83 billion, which beat analyst estimates by $70 million. Interesting to note is that the cargo revenues increased by 25.2%, which, I believe, is driven by the challenges faced for ocean freight in the Middle East and the expansion of capacity in the Asia Pacific region. Both factors boost the revenue potential of cargo. Other operating revenues, primarily driven by redemption of miles, increased by 7.9%. So, the passenger revenues, while it is obviously the biggest contributor to revenues, saw the smallest growth rate driven by normalization of unit revenues and Boeing and Airbus being unable to meet delivery schedules.

Total operating expenses grew 4.2%, slightly higher than capacity expansion. Almost all expense items saw growth in excess of capacity expansion, but this was partially offset by lower fuel costs despite higher fuel consumption. So, overall, we do see the non-fuel cost continue to experience inflated growth and one of the biggest drivers is the increase in headcount and salaries, driving the line item up by 10.4%. The result is that operating income dropped 10% to $1.565 billion, indicating a margin decrease from 12% to 10.5%.

In terms of unit revenues, there was a 1.6% decrease while cost per available seat-mile remained stable, but that was mostly driven by the reduction in fuel costs. Excluding fuel costs, there was a 6.5% increase in costs which actually reflects the reality that while unit revenues are normalizing further, the costs have been inflated due to wage increases. The company reported core earnings per share of $3.33, which exceeded analyst estimates by $0.16.

What Does United Airlines Expect For Q4 Earnings?

For the fourth quarter, United Airlines expected adjusted diluted earnings per share between $2.50 and $3.00 with analysts expecting $2.90 in earnings per share marking a 44.8% year-on-year growth.

What Are The Risks And Opportunities For United Airlines?

I don’t believe that the third quarter results were the reason why United Airlines stock took off. The reasons why I believe that the market has been satisfied with United Airlines is because the fourth quarter earnings per share guidance points at significant year-on-year growth. Furthermore, United Airlines announced a $1.5 billion buyback that is separate from the share repurchase in the third quarter to offset the exercise of 6.4 million warrants issued to the US Treasury under the Payroll Support Program and CAREST Act. The share repurchase authorization, which will see $500 million worth of shares being repurchased this year, is the strongest sign of confidence in the company’s trajectory and that the pandemic is now a rearview mirror event.

Is United Airlines Stock Still A Buy?

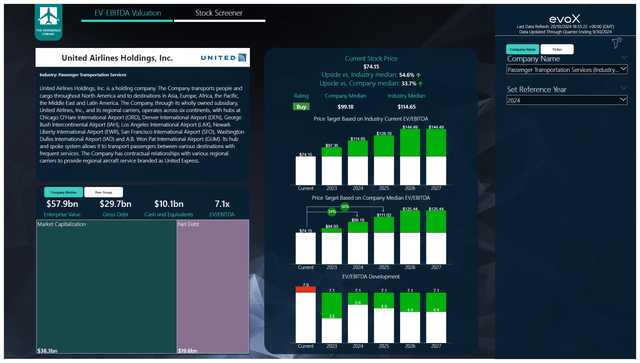

The Aerospace Forum

To determine multi-year price targets The Aerospace Forum has developed a stock screener which uses a combination of analyst consensus on EBITDA, cash flows and the most recent balance sheet data. Each quarter, we revisit those assumptions, and the stock price targets accordingly. In a separate blog I have detailed our analysis methodology.

Between 2023 and 2025, the EBITDA is expected to have a CAGR of 5.2%. Overall, the EBITDA generation between 2024 and 2026 has barely changed but the expectations for 2024 have increased by 2.7% or $210 million, partially offset by around $165 million downward adjustments for 2025 and 2026. The free cash flow has been revised up significantly by around $575 million, which, I believe, is primarily driven by delivery delays of new airplanes which drive down capital expenditures. As a result, the price target for 2024 using the company median EV/EBITDA has been increased to $99.18 which is an increase of $15 per share. Interestingly, Wall Street analysts have a consensus target of $81.81 which is lower than the previous target I had.

Conclusion: United Airlines Shows Confidence In The Future

The third quarter results were not great in the sense that we see that passenger revenue growth is becoming harder and harder to realize while the cost have ticked up significantly. Lower fuel costs kept the margin contraction low, but if we strip that, we do see that there is a high cost basis with a lack of strong top-line growth. The good news is that United Airlines is expecting a strong fourth quarter, and the share repurchase program of $1.5 billion shows a lot of confidence in the future. As a result, I am maintaining my buy rating for the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.