Summary:

- Tesla, Inc.’s 6.4% YoY increase in EV deliveries lags revenue growth projections, with ASP likely remaining a headwind due to high interest rates and competition.

- The stock’s valuation remains sky-high, with only an unrealistic 8.5% perpetual growth rate and aggressive free cash flow margin improvements justifying the current market cap.

- The absence of insider stock purchases during the significant drawdown in Spring 2024 signals a lack of confidence in TSLA’s short-term prospects.

Richard Drury

My thesis

This is my investment thesis update for Tesla, Inc. (NASDAQ:TSLA). The first one was bearish, a Strong Sell. TSLA is currently around 5% cheaper than it was since my first call was published.

The company will release its Q3 2024 earnings soon, on October 23. With today’s thesis update, I want to warn readers that there are a few indications that the earnings release might be disappointing. Based on the recent Q3 delivery numbers and highly likely no significant changes in the average selling prices, I think that Tesla is likely to miss revenue growth expectations. Since Tesla gained a massive market capitalization that is multiple times higher compared to the largest legacy automotive makers due to its unmatched revenue growth, I think that missing Q3 revenue estimates can be a significant bearish catalyst. The recent robotaxi event was met with unusual market pessimism, a rare occurrence for Tesla’s major announcements. This shift in investor sentiment might indicate that Tesla has reached a stage where tangible products and concrete profits are becoming more crucial to investors than futuristic concepts and promises.

Finally, the valuation is still very high, looking both at the discounted cash flow, or DCF, and multiples. TSLA remains a Strong Sell, in my opinion.

TSLA stock analysis

We have the company’s upcoming earnings call scheduled for October 23, which is quite soon. Therefore, today’s thesis will be focused on my expectations around TSLA’s Q3 earnings. According to quarterly consensus estimates, Wall Street expects the company to deliver a 10% YoY revenue growth, but the non-GAAP EPS to decline by around 9%.

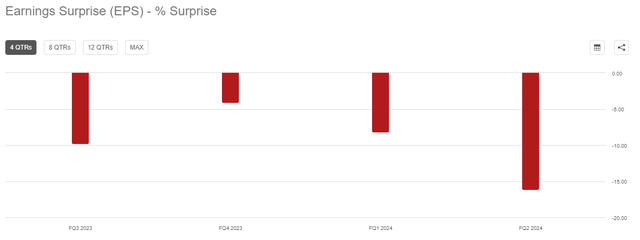

The good part is that revenue growth is expected to continue accelerating after three previous quite challenging quarters. On the other hand, the EPS is expected to shrink, which is never good for shareholders’ wealth. Moreover, Tesla has underperformed against consensus EPS estimates over the last four quarters with quite wide misses.

Since automotive sales account for approximately 81% of the company’s total revenue, examining the number of EV units delivered in Q3 will likely provide strong evidence of TSLA’s revenue dynamics. According to the official release, Tesla delivered 462,890 units in Q3 2024. This is around 6.4% higher on a YoY basis as the company delivered 435,059 units during the same quarter last year.

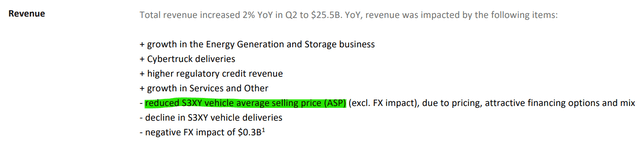

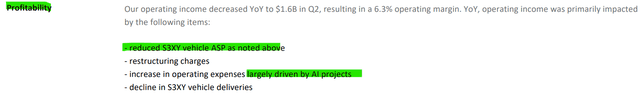

A 6.4% increase in physical volumes delivered is notably slower than the projected 10% revenue growth. We do not have details about the average selling price (ASP) in Q3, but decreased ASP was the number one headwind for TSLA’s Q2 revenue, according to the presentation.

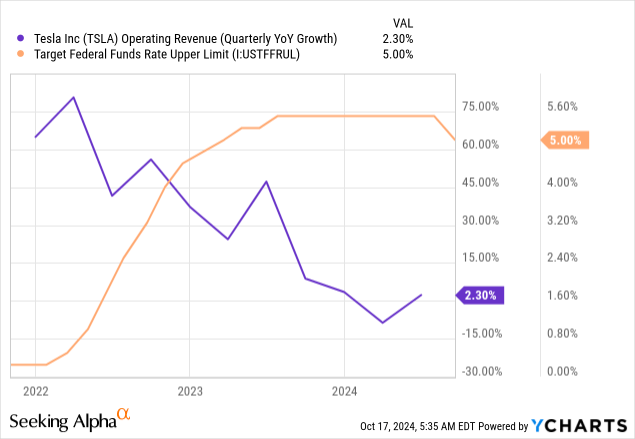

There are two reasons why it is quite unlikely that the situation with the ASP improved during Q3 2024. Let me remind you that there were two primary reasons why Tesla started offering aggressive discounts: high interest rates and intensifying competition in the EV space.

Both of these two unfavorable factors are still there. The Fed introduced its interest rate cut on September 18, meaning that interest rates were still at their peak during almost the entire quarter. The competition also becomes more intense as new EV models are entering the market. According to insideevs.com, Tesla Model Y (the company’s by far most popular model) deliveries in the USA decreased by 9.1% YoY. This is a clear indication that competition is intensifying rapidly.

Therefore, with the restrictive monetary policy and intensifying competition, it is highly unlikely that the ASP YoY dynamic will be strong. Therefore, with a notable gap between the expected Q3 YoY revenue growth and actual growth in deliveries, there is a very high risk of TSLA delivering a negative revenue surprise. Due to Tesla’s historically aggressive R&D spending and an inherently high proportion of fixed costs for an automotive company, it is highly likely that a potential revenue miss will also lead to an EPS miss.

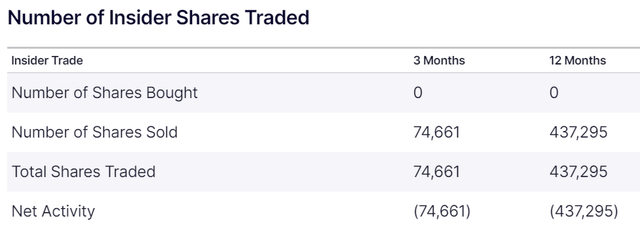

Insiders bought zero TSLA shares over the last twelve months, which says a lot. I consider this information as a red flag because the stock saw a big drawdown in 2024. The stock dropped closer to $140 in April, which was a 42% drawdown compared to the stock price at the beginning of 2024. Even despite such a dip drawdown, none of the insiders bought the stock, which means that those with the most insight into the company’s operations and potential challenges are still not optimistic about TSLA’s short-term prospects.

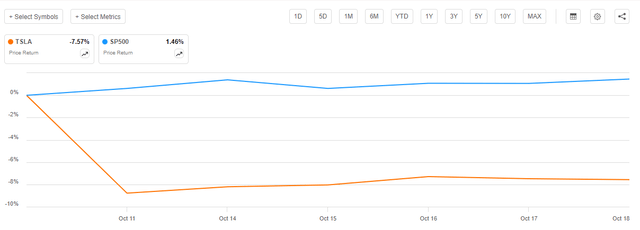

Finally, TSLA bulls might argue that there have been quarters when, despite missing revenue or EPS estimates, the stock rallied after the earnings call. This, they might say, was due to CEO Elon Musk’s ability to persuade investors that there are still numerous ambitious plans to conquer new blue oceans. This could have been the case, but the robotaxi event on October 10 suggests that the paradigm has shifted. Despite the impressive presentation with traditionally beautiful and futuristic prototypes, investors were likely not impressed. The fact that the stock declined by more than 7% since October 10, while the S&P 500 held up quite well, suggests that TSLA is currently at a stage in its business life cycle where investors prefer tangible results over futuristic promises. Therefore, I do not expect Elon Musk to charm investors during the earnings call, which might overshadow missing earnings estimates.

Intrinsic value calculation

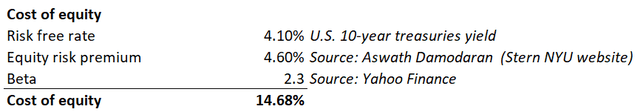

Tesla became by far the world’s largest automaker by market capitalization thanks to its aggressive revenue growth, especially during the pandemic. Therefore, the discounted cash flow (DCF) approach is the best fit to value this stock. Tesla’s total $12 billion debt is insignificant compared to the above $700 billion market cap, making the cost of equity the most suitable to be used as a discount rate. The discount rate is calculated below using the CAPM formula.

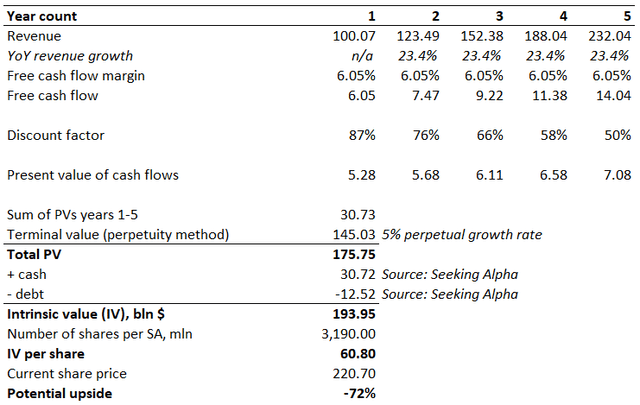

Based on the above working, the discount rate is 14.68%. The base year $100.07 billion revenue projection is based on consensus estimates. According to Precedence Research, the global EV market is expected to observe a 23.4% long-term CAGR. This growth rate is incorporated for years 2-5, an aggressive assumption. Tesla’s past five years’ average FCF margin is 6.05%. I use this level flat because, with the intensifying competition, it will be extremely difficult for Tesla to drive a free cash flow margin. Since EV is a thriving industry, I give Tesla an optimistic 5% perpetual growth rate.

The first scenario suggests that Tesla’s intrinsic value (IV) per share is around $61, significantly lower compared to the last close. The gap is large, and I might be too pessimistic.

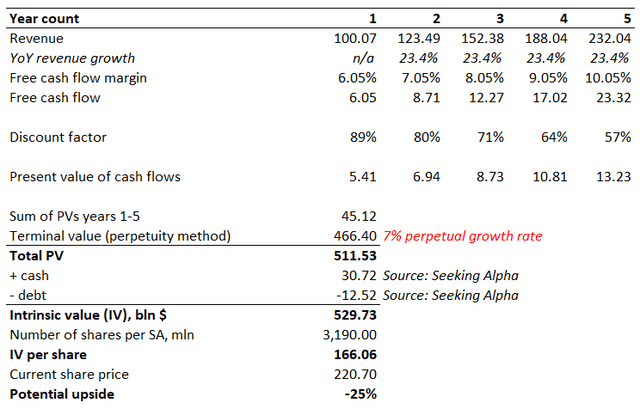

Therefore, let me simulate another scenario with more aggressive assumptions. I think that a 23.4% revenue CAGR for the next five years is already very aggressive, so I prefer not to change it. For the second scenario, I am using a softer 12% discount rate and a much more aggressive 7% perpetual growth rate. I also incorporate a 100 bps FCF margin expansion annually.

Even with all these aggressive assumptions, TSLA is still around 25% overvalued. To justify its current valuation, an 8.5% perpetual growth rate must be incorporated. I find this growth rate unrealistic because of the intensifying competition in the EV industry.

What can go wrong with my thesis?

Some examples we’re always able to hear about from optimists: are full-self driving, the energy segment, or the humanoid robot Optimus. Though I have no idea where these initiatives are going to go, there’s no doubt that Elon Musk is a great CEO, and he has founded several innovative companies. Maybe I’m not a genius like Musk, and perhaps I’m missing something in my slow-motion judgment. If the trillion-dollar humanoid robot market grows to take off, Tesla might reap the rewards as a leading innovator. So, there is a lot of doubt regarding these new initiatives, but that doesn’t have to translate only into negatives.

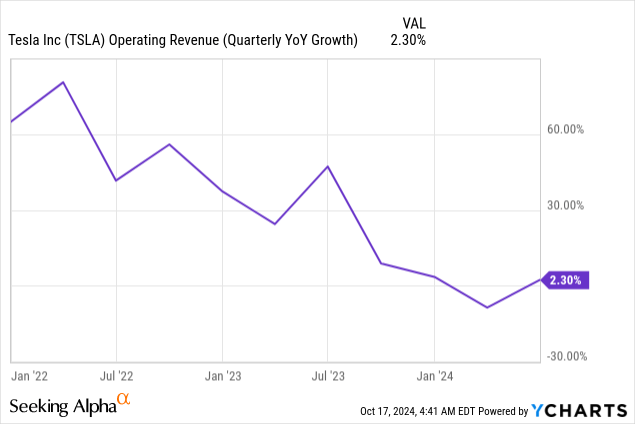

The last three years showed us that Tesla’s revenue growth is significantly dependent on the monetary policy. Just look at the above chart – the company’s revenue growth started deteriorating rapidly when the Fed started increasing interest rates. As I mentioned earlier, the Fed recently started cutting interest rates, which is positive for TSLA. While interest rates are still very high compared to levels we saw during the pandemic, the Fed’s pivot occurred. Therefore, any information that the Fed is moving to a less restrictive monetary policy faster than expected can lead to substantial rallies for TSLA.

Summary

Tesla remains a Strong Sell before Q3 earnings due to a highly likely revenue miss against consensus forecasts and massive overvaluation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.