Summary:

- Lumen Technologies, Inc.’s stock surged on AI network deals, but the excitement is overblown due to limited long-term recurring revenues from these contracts.

- The company receives significant upfront cash but lacks substantial future revenue growth, with reported financial benefits delayed until 2027 or 2028.

- Despite AI market growth, Lumen’s revenue and EBITDA are expected to decline, with minimal free cash flow and high debt levels.

- Investors should cash out near the peak as the stock faces a double top and ongoing weak revenue trends.

Devrimb/iStock via Getty Images

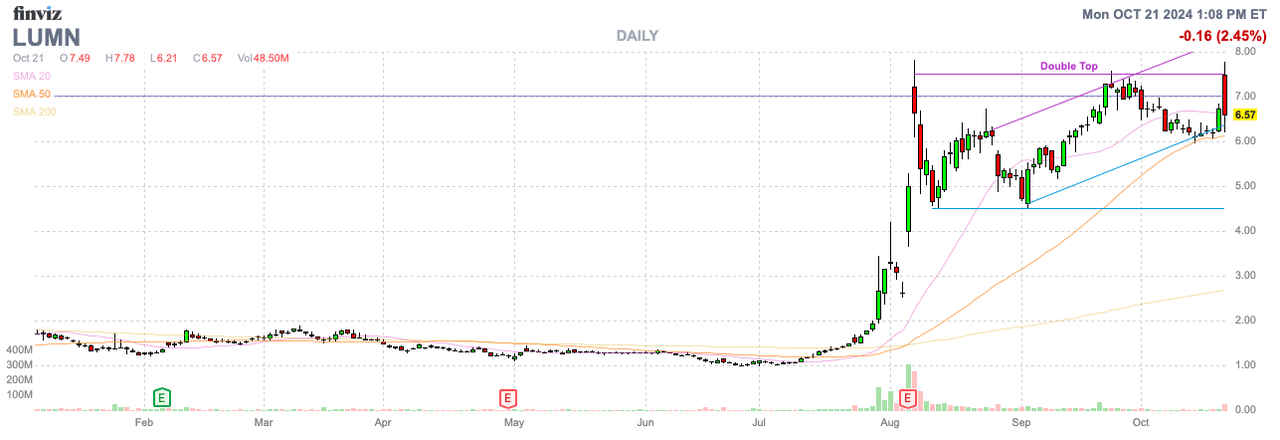

Lumen Technologies, Inc. (NYSE:LUMN) has seen a massive rally off the recent lows due to excitement over AI network deals. With the main contracts being glorified network construction contracts, the stock has run too far. My investment thesis remains Bearish on the stock, with a potential double top set in place on the latest AI fluff.

Limited Recurring Revenues

Lumen initially soared above $7 on a press release with Meta Platforms (META) on a partnership to significantly increase their network capacity. The announcement lacked any specific details and Raymond James suggests the news is all related to the prior $5 billion network deals for Private Connectivity Fabric.

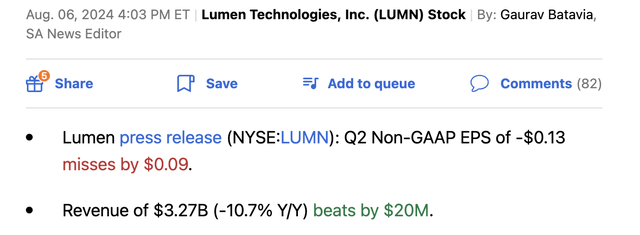

The stock has surged from only $1 to start July to nearly $8 on a couple of occasions in the last few moneys due to the announcement of $5 billion in AI networking deals. The reality of the investment story remains the weak financials as reported in the Q2 ’24 report back in early August as follows:

Of course, the excitement regards the future due to the AI deals with Microsoft (MSFT) originally and now Meta. The issue is that the majority of revenue is one-time in nature to construct the network.

Lumen gets a nice cash infusion upfront, but the telecom company doesn’t get a lot of new long term recurring revenue. At the Goldman Sachs Communacopia conference, CFO Chris Stansbury highlighted how the connectivity isn’t the big AI part and the financials are as follows:

So really over a 3-year to 4-year period is the construction phase where we’re deploying fiber through the conduit. We’re building huts along the way, 400 to 500 per network build where there’s equipment that repowers the signal. There may be compute power in there. It’s very complex. And the cash received and the CapEx for that is in those first 3 or 4 years. That’s about 90% of the total cash flows from the project.

However, if an investor wants to conceptualize these network connectivity deals, Lumen is in essence getting paid $4.5 billion upfront to build their network out. Since the deals are for 20 years, the revenue works out to ~$250 million per year in revenues reported in the financials after the fiber is installed and working.

Lumen has nearly $13 billion in annual sales and this revenue won’t start hitting the financials for 3 to 4 years, while AI is booming now. Even the additional $7 billion in potential deals will only double the future revenue potential, though the telecom will receive the vast majority of cash upfront for the construction phase, so the future benefits are very limited.

Investors need to understand that the hyperscalers and large cloud companies are estimated to be spending upwards of $200 billion on capex by 2025 with the vast majority going to Nvidia (NVDA) for AI GPUs. Citi estimates these companies to boost data center capital spending by 40% or more in 2025, providing a massive boost to data center interconnect demand.

Limited Financial Impact

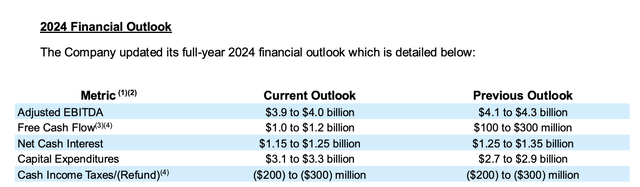

While the AI market is seeing booming demand, Lumen isn’t discussing any deals that impact near-term revenues. The telecom is forecasting an ~$1 billion boost in 2024 cash flows to at least $1 billion, but the company isn’t expected to see any boost in revenues while adjusted EBITDA actually takes a $200 million hit.

Source: Lumen Q2’24 earnings release

If Lumen had come out and said, Microsoft and others had signed deals generating $250 million in annual revenues in 3 to 4 years, the stock likely doesn’t rally. The deals are good for Lumen due to the upfront cash flow boost, but the network connectivity value of the equation still signals the company controls the “dumb pipes” of the AI race.

At the conference, the CFO appears to guide towards revenue growth not returning until 2027 or 2028. The current consensus analyst estimates are for minimal revenue growth and for 2028 revenues to actually dip $0.5 billion from the 2024 level despite these AI network deals that excited the market.

Investors need to understand these revenues likely only offset ongoing declines in legacy business units. For a long time now, Lumen has consistently released next-gen products that hardly offset declining revenues, and AI appears no different.

While AI has more excitement, the path to higher revenues doesn’t actually appear to exist. Lumen won’t see the actual financial benefits to revenues and EBITDA for years. Cash flows get an initial boost, which could be a massive negative in the future when cash flows won’t match revenues due to the upfront payments and only 10% in recurring cash, amounting to just ~$50 million annually.

Even the remark about competition isn’t a good sign when the CFO makes the following statement suggesting investing in network connectivity isn’t even a top return for Verizon (VZ) and AT&T (T).

Our 2 major competitors, their next best dollar is spent on wireless and the consumer and Fiber to the Home.

Lumen isn’t exactly winning these deals due to the best network. The telecom is apparently winning the deals due to the 2 larger competitors focused on projects with better returns.

At this point, Lumen produces about $4 billion in adjusted EBITDA. The investment profile suggests declines next year, while the company has $17 billion in net debt and an enterprise value of ~$24 billion.

More importantly, the telecom has limited free cash flow from the current business. The 2024 target was for $100 to $300 million due to a tax refund for a company with $18.5 billion in debt. The AI networking deal boosts the FCF short term, but even $1 billion in FCF from the deal over 20 years only amounts to $50 million annually, which doesn’t warrant investor excitement for a company struggling to generate positive FCF.

The current consensus estimates are for revenues to trend down. Lumen reported $3.27 billion in revenues for Q2 ’24 and the current forecast is for the telecoms to end 2025 with revenues of $3.07 billion.

Takeaway

The key investor takeaway is that Lumen Technologies, Inc. stock is likely to follow the revenue trends. The stock rallied due to misunderstanding of the value of these AI network deals, and ongoing weak revenues are likely to highlight these issues.

The stock just hit a double top. Investors should clearly cash out here near the peak.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start Q4, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.