Summary:

- Lumen Technologies is up 400% after securing fiber deals for its conduit network.

- LUMN has executed a masterful turnaround with more work left to do.

- A leveraged balance sheet and high valuation remain pertinent risks.

kynny

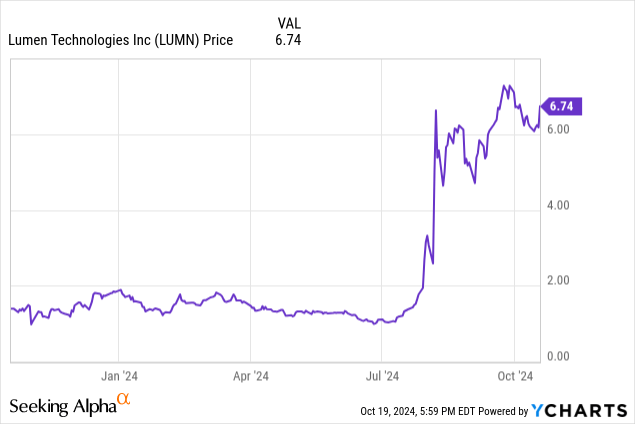

Lumen Technologies (NYSE:LUMN) shareholders have had an eventful few months as the stock has gone from being priced at high risk for bankruptcy due to declining revenues in core segments and a large debt burden, to a valuation explosion on the back of improved cash flow from being part of the AI growth wave and increasingly optimistic hopes for a successful turnaround. While the company is certainly in a better position now than a few months ago, many risks remain and investors should tread carefully.

If You Build It …

Just a few months ago, LUMN was worth about $1.5 billion, had an over-leveraged balance sheet, a major liquidity gap to cover interest expenses and principal payments, and had gradually declining cash flows and core revenues. Now the stock is worth $6.8 billion, cash flow is improving, and the company is gearing up for a growth phase. What the heck happened?

It’s a really fascinating example of how investing in infrastructure can pay dividends in unexpected ways in the future beyond the initial intended uses. Much of Lumen’s current communications network was built over the last quarter-century during a time when AI was more science fiction antagonist than realistic technology of the future, and yet, when the company’s future was looking increasingly grim, those investments seem to have paid off. CFO Chris Stansbury had this to say at a Goldman Sachs conference on communications technology:

So much of it really rides on the fact that over the years and really many, many years ago, 25 years ago, in fact, this large intra and intercity network of conduit was built. And the beautiful thing about conduit is you can quickly deploy fiber through those tubes. And speed is the resource that these large companies don’t have right now time, right?

I don’t mean to discount the foresight of whoever originally had the idea to greenlight this investment, but its monetization certainly came at the perfect time. Now hyperscalers chasing the AI revolution need a way to connect their data centers across distances vast and small, and Lumen is prepared to lease them the data highways to do it. That’s how a stock gains 400% in a couple months’ time!

… They Will Come

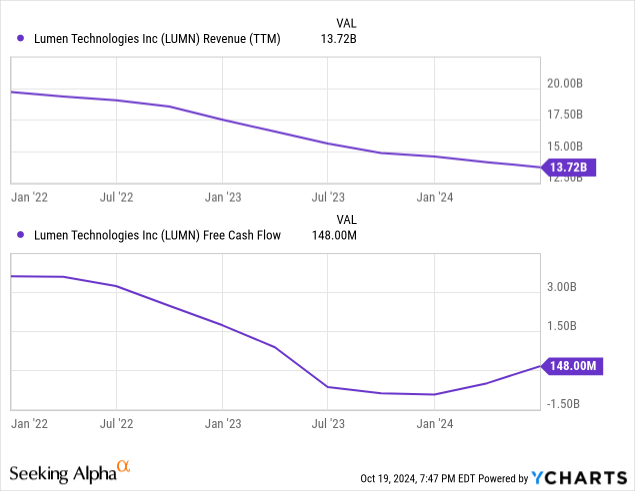

The major drivers of recent gains have been an agreement with Corning (GLW) to use 10% of its fiber capacity in Lumen’s conduit network to interconnect AI-enabled data centers, the securing of $5 billion in fiber service capacity deals for these data centers, and an additional $7 billion in potential deals that are still in “active discussion”. These have caused the stock to rally, not only because other companies serving the AI wave have seen their share prices appreciate considerably, but because Lumen had been in a bit of a death spiral in regards to its balance sheet for a few years now before these most recent developments. Revenue and cash flow have been in a gradual decline even as the company’s $18.4 billion in long-term debt and 7.74% interest rate as of the most recent quarter loom large and weigh on results.

These declines are mostly due to a deterioration in the company’s legacy businesses, evidenced by a 10.7% YoY decline in revenues for Q2 2024 even as Fiber Broadband, Lumen’s only real growth driver, grew 14.6% YoY. The number is poised to grow significantly in light of these new deals, but at $181 million in total revenue this segment still only represents around 5% of total sales. Further, while these deals have big headline values like $5 billion and $7 billion, the timeframes can be quite long, some of them up to 20 years, so the actual revenue and earnings recognition will be spread out.

That said, perhaps the most important aspect of these wins for Lumen is that they will provide much-needed cash to cover the liquidity gap that had formed due to the erosion of legacy cash flow. Stansbury said as much on the Q2 2024 conference call:

So the key thing here is that, in one set of deals in those $5 billion deals that the net after-tax cash generated from that fully fund the liquidity gap that we’ve talked about for so long on these calls. It’s over, it’s behind us.

While revenue recognition is dispersed over the course of the contract, Lumen does receive cash upfront to facilitate the fiber build-out, which, in addition to inflows from continuing to divest non-core assets, will provide a lifeline as the company tries to de-leverage. As evidence of this, for the second quarter, Lumen reported FCF of -$156 million, but provided outlook for between $1 billion and $1.2 billion in FCF for FY2024, which is primarily because an overwhelming majority of the cash flows from these fiber contracts, around 90%, is delivered in the first 3-4 years. Of course, while capital expenditures and operating expenses will increase as well to enable these fiber build-outs, the cash infusion is massive for Lumen and alleviates some of the market concerns over liquidity risks.

While there are many tailwinds for Lumen at the moment, the stock’s prospects are where I think things get a little bit murky. On the one hand, I think the AI wave represents a very real growth opportunity for Lumen over the next few years: data centers are becoming increasingly power hungry and will likely be built in more remote and rural places going forward, making interconnects like the ones Lumen offers essential, the demand from hyperscalers for Nvidia (NVDA) GPUs shows no signs of slowing, and creating new conduit networks is exceedingly difficult and cost-intensive.

On the other hand, Lumen doesn’t yet possess any competitive advantage in building these networks other than that they already have the existing infrastructure in place. This is valuable, but does put a ceiling on the kind of growth we can expect since the only sure thing is that the company will be able to monetize existing conduits.

My bull case for LUMN is that the company utilizes the upfront cash and recurring inflows from these fiber contracts to de-leverage its balance sheet to the point where organic operating cash flows cover interest payments and CapEx without the need for new deals to cover expenses and that non-core assets continue to be divested to create a lean, primarily fiber network operator that benefits from steady ongoing demand for AI data center interconnects. I think, if this comes to fruition, LUMN will see a significant stock price appreciation, even on top of recent gains. However, there are still significant risks before that vision is achieved.

Risks

First, the margins on these fiber build-outs are fairly slim over the first few years of the contract. Much of the cash received will need to go towards the expenses of the projects themselves and cannot be used to pay down big chunks of debt. The long tails will be extremely high margin, but it will be many years before Lumen can coast and rake in the EBITDA and cash.

Second, while the company’s financial position is much improved from these deals, the balance sheet is still a mess.

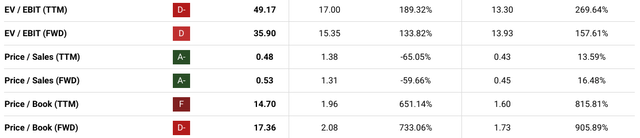

Seeking Alpha

Price/book ratio is in the dumps for obvious reasons, and while I’ve seen some clamor over the low price/sales ratio, if those sales aren’t generating cash then they’re not of much use to Lumen. There is some macroeconomic relief coming in the form of lower interest rates from the Fed, which should allow the company to refinance some of its debt in addition to the refinancing it already completed last quarter, but the sheer magnitude of liabilities compared to cash inflows means risk to investors remains.

Third, with the share price rocketing higher, there have been, as there usually are, detractors. Kerrisdale Capital and Hedgeye have both weighed in on the short side in recent weeks, despite a significant reduction in short interest, likely due to the major short squeeze that followed the announcement of Lumen’s fiber contract wins. With short interest now at around 6%, it represents less of a risk but is still something of which investors should be aware.

Investor Takeaway

Alright, so what’s the bottom line? In my opinion, there is significant upside here for those willing to jump in, but the risks are significant as well. Lumen has secured substantial deals for the use of its existing conduit network in fiber interconnects for AI-enabled data centers, representing an inflection point for a company that looked headed for bankruptcy just a few months ago. The company’s significant long-term debt position, the burden of its legacy businesses, and a valuation that has baked in a lot of assumed execution offset some of these tailwinds and are the main reason I’m not recommending a Buy at this time.

I would classify LUMN as a high-risk, high-reward opportunity that speculative investors could benefit from nibbling at, though I’d likely wait for a better entry point considering the current valuation. For now, I rate LUMN a Hold for most investors and a Speculative Buy for the risk-takers among you.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.